What are differences between Deriv Multipliers and Margin Trading (Leverage) Table of Contents

- What are Deriv Multipliers?

- Why trade with Multipliers on Deriv?

- How do multiplier contracts work?

- Step by Step of multipliers on DTrader

- Important points when using Deriv multipliers

- What is margin (leverage) trading on Deriv?

- The relationship between Margin and Leverage

- Why margin trading (leverage) on Deriv?

- How to calculate the margin on Deriv?

- Important margin policies on Deriv

- Useful information when trading on margin with Deriv

What are Deriv Multipliers?

Deriv multipliers have the advantages of trading on margin with the limited risk of options.

This means that when the market moves in your favor, the potential profits will multiply; if instead the market moves against you, the losses will be limited to the stake amount.

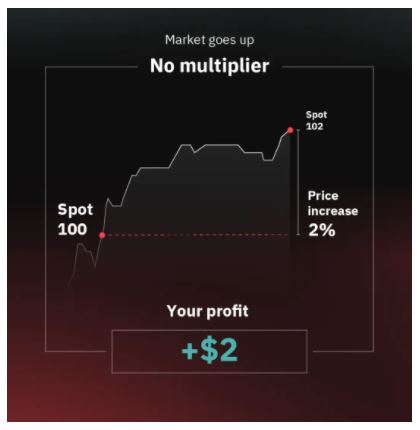

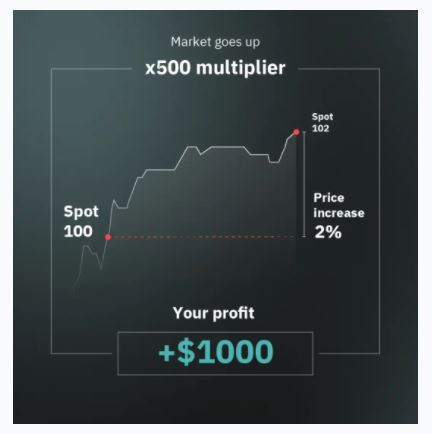

Let’s assume your forecast is for a rising market.

With a multiplier, if the market rises by 2%, the profit will be 2% * $ 100 = $ 2.

With a multiplier of x500, if the market rises by 2%, the profit will be 2% * $ 100 * 500 = $ 1,000.

With a trade equivalent of $ 100 and leverage of 1: 500, the risk is 2% * $ 50,000 = $ 1,000 of loss.

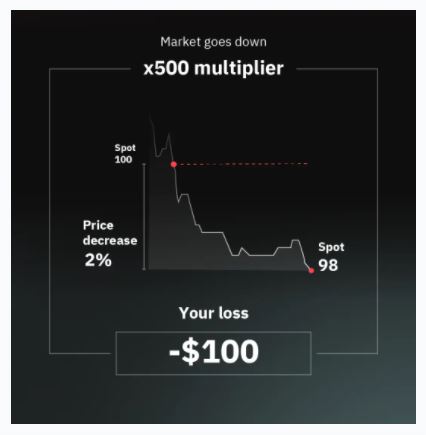

With a x500 multiplier, if the market drops by 2%, you will only lose $ 100.

If the loss reaches the stake amount, the stop-out automatically takes place.

Why trade with Multipliers on Deriv?

- Better risk management

- Customize contracts based on your style and risk appetite using innovative features such as stop loss, take profit and cancellation.

- Greater market exposure

- Gain greater exposure to the market by limiting the risk to the stake amount.

- A versatile and safe platform

- Trade on safe and intuitive platforms, designed for traders with all levels of experience.

- Expert assistance always available

- You can count on the experience and availability of Deriv’s professionals whenever you need them.

- Trade 24/7, 365 days a year

- You can trade with multipliers on Forex and synthetic indices all year round, 24/7.

- Crash / Boom indices

- Earn money by forecasting sudden market spikes and crashes with Deriv’s Crash / Boom indices.

How do multiplier contracts work?

- Define your location

Select the market to trade on and set other fundamental parameters such as trade type, stake amount, and multiplier value. - Establish optional parameters

Define optional parameters that give you more control over trading, including stop loss, take profit, and cancellation. - Buy the contract

Buy the contract if the position you define suits you.

Go to Deriv’s Official Website

Step by Step of multipliers on DTrader

- Market

Choose an asset from the list of markets available on Deriv. - Type of trade

Choose a “Multiplier” from the list of trade types. - Stake

Enter the amount you wish to trade with. - Value of the multiplier

Please enter a valid multiplier value. The profit or loss will be multiplied by this value. - Take profit

This feature allows you to set the level of profit you prefer when the market moves in your favor. Once the desired amount is reached, the position will automatically close and your earnings will be deposited into the Deriv account. - Stop loss

This function allows you to determine the amount of any loss if the market trend is unfavorable to your position. Once the amount is reached, the contract will be automatically closed. - Cancellation

This function allows you to cancel a contract within one hour of purchase without losing the stake amount. The service requires a small non-refundable fee.

Important points when using Deriv multipliers

- Stop-out.

- Deriv will close the position if the market moves against your forecast and the loss reaches the stop-out price, whether in the absence or in the presence of a stop loss. The stop-out price is the price at which the net loss coincides with the stake.

- Multipliers on Crash and Boom.

- Erasing is not available for the Crash and Boom indexes. The stop-out feature will automatically close the contract when the loss reaches or exceeds a percentage of the stake. The stop-out percentage is indicated under the bet on DTrader and varies according to the multiplier chosen.

- You cannot use the stop-loss and cancel functions at the same time.

- This is to protect you from losing money when you resort to cancellation. The cancellation function allows you to claim the full stake amount if you cancel the contract within one hour of opening the position. With the Stop-loss function, on the other hand, you can close the contract at a loss if the market trend turns against you. However, when the cancellation function reaches its deadline, it is possible to set a stop-loss level on the open contract.

- You cannot use the take-profit and write-off options at the same time.

- It is not possible to set a take-profit level when purchasing a contract with multipliers and cancellation possibilities. However, when the cancellation function reaches its deadline, a take-profit level can be set on the open contract.

- The delete and close options are not allowed simultaneously.

- If you purchase a contract with cancellation, the “Cancel” button allows you to conclude the contract and return to the total stake. If, on the other hand, you press the “Close” button, you can close the position at the current price, with the risk of losing if you close a trade at a loss.

Trade Forex and CFDs with Deriv Multipliers

What is margin (leverage) trading on Deriv?

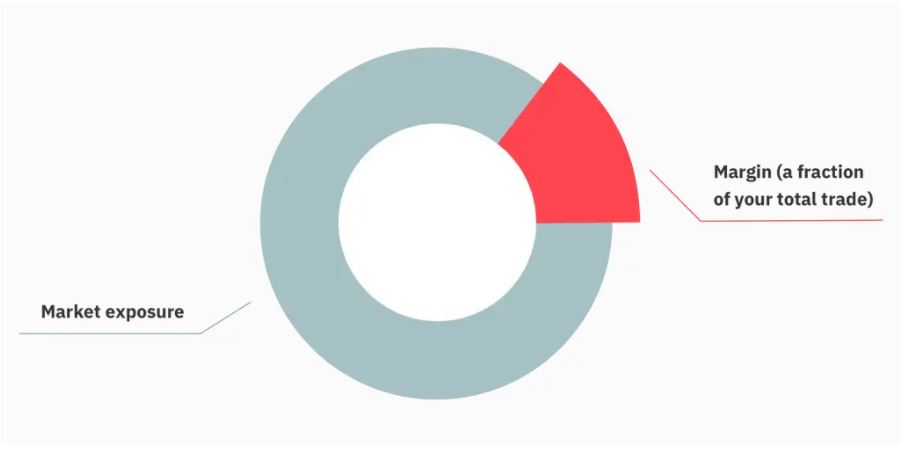

Margin is first and foremost a deposit required to open a leveraged position, i.e. a position with a greater value than the capital invested.

Therefore, trading on margin allows you to buy larger units of assets at a lower cost price, in order to increase your exposure to the market even if you are trading with limited capital.

This means that you can buy more than one asset with the same capital.

The result translates into greater profits in the event of a positive trade and, consequently, in greater losses in the event of a negative trade.

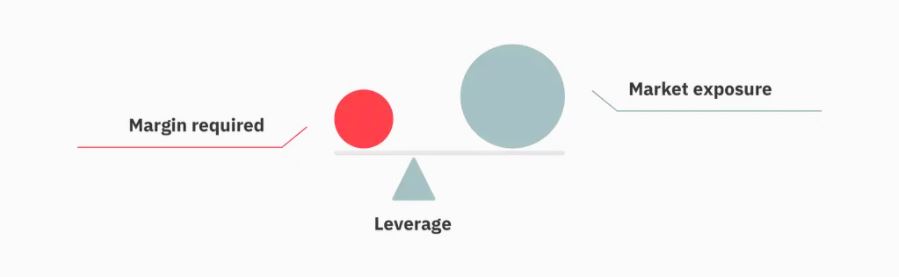

The relationship between Margin and Leverage

These terms, often used interchangeably in online trading, actually have a different meaning: just like margin, leverage allows you to control a trading position that is larger than your capital.

However, while leverage is expressed in ratios such as 50: 1, 100: 1, 400: 1, the margin is expressed as the percentage of the amount needed to open a position, for example, 2%, 1%, and 0.25%.

Based on the margin allowed, you will be able to determine the maximum leverage you can use for your trades.

Why margin trading (leverage) on Deriv?

- High leverage and low spreads

- Take advantage of the high leverage and tight spreads on Deriv MT5 (DMT5).

- All your favorite markets available

- Trade on major markets and Deriv’s synthetic corporate indices available 24/7.

- Open long and short positions

- Open long or short positions, based on your preferred trading strategy.

- Expert assistance always available

- You can count on the experience and availability of Deriv’s professionals whenever you need them.

- Instant access

- Open an account and start trading in minutes.

How do Margin Contracts work?

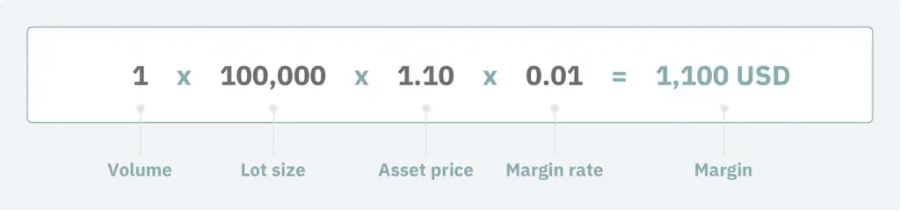

For example, one lot (100,000 EUR) of the EUR / USD pair with a unit price of 1.10 USD will cost 110,000 USD. However, a margin of 1% allows you to open a position worth USD 110,000 by paying only USD 1,100.

Even leverage of 100: 1 will offer the same level of exposure to the trading market with a margin of 1%.

Go to Deriv’s Official Website

How to calculate the margin on Deriv?

When trading on Deriv, you can calculate the allowable margin for a contract using one of the following formulas:

The leverage formula calculates margin as follows: volume in lots x lot size x asset price/leverage = margin.

This formula is used to determine the margin for currency pairs on Forex and commodities.

Margin Rate Formula: Calculates Margin as Batch Volume x Batch Volume x Asset Price x Margin Rate = Margin.

This formula is used to determine the margin in cryptocurrency contracts.

Find out more about Leveraged Trading on Deriv

Important margin policies on Deriv

While trading on Deriv, they may apply stop-out and forced liquidation measures to protect your account from losses potentially in excess of equity.

Equity, in this case, is the sum of balance and floating profit and loss (PnL).

These measures are implemented when the margin level (i.e., the ratio of equity to margin) falls below the stop-out level, typically 50%.

When this occurs, Deriv initiates a forced liquidation process to close the positions in the following order:

- First, Deriv will cancel an order with the highest reserved margin.

- If the margin level is lower than the stop-out level, the position with the second-highest reserved margin will be eliminated, while orders without margin requirements will not be affected.

- If your margin level is still below the stop-out level, Deriv will close the open position with the largest loss.

Deriv will execute the trade until the margin level exceeds the stop-out level.

Useful information when trading on margin with Deriv

Margin increases both potential profit and loss

Trading on margin increases market exposure, thereby increasing profit, but also potential loss.

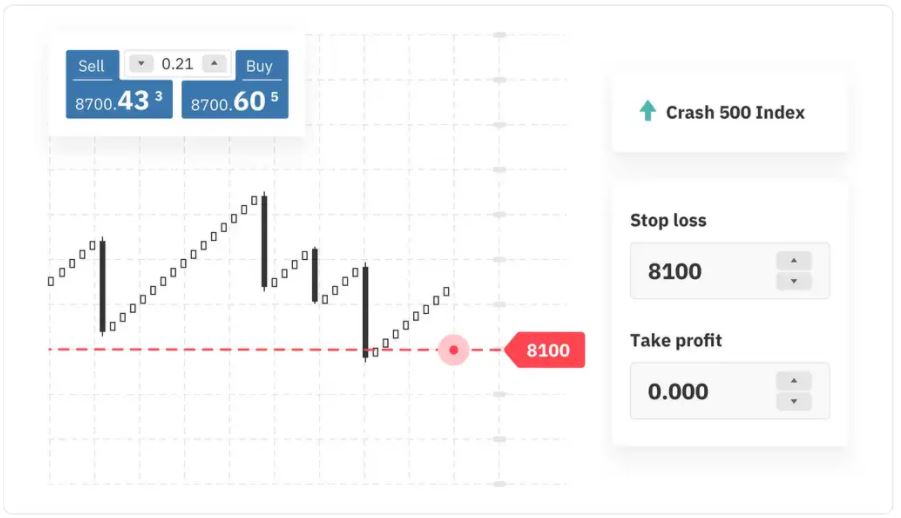

Stop-loss

You can set the stop loss level to minimize potential losses and reduce the likelihood of a margin call: in this way, the trade will be closed automatically when the losses coincide with the stop loss amount.

Stop-loss with Crash / Boom / Range break indices

The stop loss works a little differently with the Crash / Boom / Rang break indices.

When trading with these indices and a stop loss level, the trade will be closed automatically if the loss exceeds the stop loss amount.

The reason is that in the break Crash / Boom / Range indices, the sudden price fluctuation between ticks can exceed the established potential loss (stop loss).

In this case, the trade will close at the closest market price, and not exactly at the stop loss level.

For example, you expect the market to move higher and buy a Crash 500 index contract at 8,000

When the market price reaches 8,700, you decide to set the stop loss level at 8,200.

After a few ticks, the price drops to 8,100 and surpasses the stop loss level.

Your trade will automatically close at 8,100 which is the closest applicable market price to the stop loss level.

Margin call

You can still open positions when there is a margin call: in this case, Deriv recommends adding funds to your account to keep them active.

Margin requirements

Margin requirements may differ based on factors such as the asset you trade with, account equity, account type and market conditions.

Swap rates (overnight financing rate)

If you hold a position open overnight, an interest adjustment (or swap rate) will be made on your trading account to offset its cost.

Different swap rates and conditions apply to the instruments traded on Deriv’s platforms.

Forex and commodities

The swap rate is based on interbank lending rates, plus a 2% fee that is charged every day (overnight) for holding the position.

The swap rate also depends on the time and days on which the positions are held.

- Positions opened after 23:59:59 GMT will be subject to the base swap rate.

- As Forex trades take two days to complete, a fee of three times the swap rate will be charged for positions that are still open on Wednesday at 23:59:59 GMT to account for the weekend.

- Deriv’s swap rate may also be adjusted to take into account holidays.

Synthetic indices

There is an interest adjustment on the trading account to balance the cost of holding the position overnight, calculated on an annual low for short and long positions.

You can use the swap calculator to estimate the swap tax required to keep positions open overnight on DMT5.

Go to Deriv’s Official Website

Please check Deriv official website or contact the customer support with regard to the latest information and more accurate details.

Please click "Introduction of Deriv", if you want to know the details and the company information of Deriv.

Deriv

Deriv  AdroFX

AdroFX