This order type allows you to control the price at which a buy or sell order will be executed.

Limit Order to buy ( Buy Limit ) can only be executed at the price you specify or below that price, and a limit order to sell ( a Sell Limit ), respectively, can be executed at the price you specify or better.

This means that in any case, the Limit order will be executed at the price you set or at a more favorable price.

When you open a market order, you cannot set the price at which it will be executed.

The peculiarity of the ECN feed quotes is that you see the best ASK and BID prices as soon as they come from other clients and liquidity providers trading in this system.

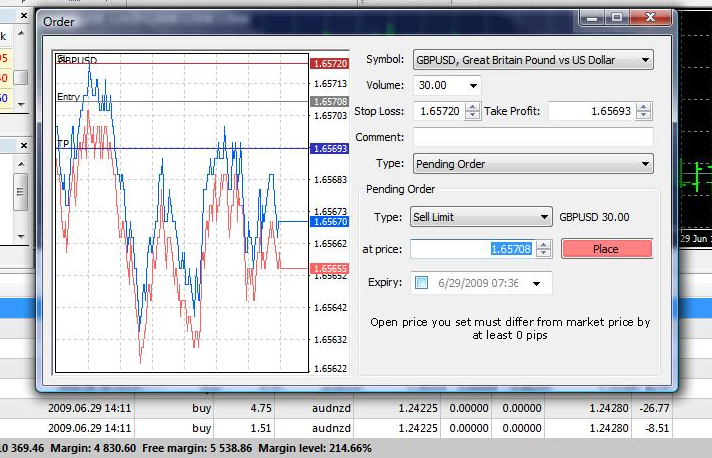

When you open limit orders on the ECN platform lowest price Bid, on which can be set Limit Order to sell ( a Sell Limit Order ), may be lower than the lowest Ask price.

In other words, a Sell Limit order can be placed within the spread, that is, within the difference between the best Ask price and the best Bid price.

Similarly, the highest price Ask, for which can be set Limit Order to buy ( Buy Limit Order ), can be higher than the highest price Bid.

That is, a Buy Limit order can also be placed within the spread (the difference between the best Ask and Bid prices).

In times of strong market volatility, it is likely that Limit and Take Profit orders placed even at the best Ask and Bid prices will not be executed, as the market price changes too quickly.

For example, if a limit order to buy ( Buy Limit ) was put up at the best Ask price, but the price in the market has changed rapidly, this order will not be executed and will be delayed ( pending ) for as long as the market price will not return to the previous level, or the order will not be changed.

ECN brokers transfer their clients’ Limit orders to the market.

Participants of electronic trading networks (ECN) can see all Limit orders and Take Profit orders in the “order book” (order book).

For example, the client wants to open a Limit order to buy AUD / NZD (Buy Limit Order) at a price of 1.24200 with a volume of 7 standard lots (see Fig. 1).

The difference between the Ask and Bid prices at the time the order was placed was as follows: Bid – 1.24170 and Ask – 1.24230 (this can be seen in the “ order book ” in Fig. 1).

After successfully exhibiting Limit orders to buy ( Buy Limit Order ), the price of 1.24200 with a volume of 700000 AUD became the best Bid price level (see. “Glass applications” in Fig. 2).

This means that a limit order to buy ( Buy Limit Order ) was added to the book ECN orders.

Orders Stop Loss and Take Profit can be added to limit order (see. Fig. 3).

After the Limit order is executed, the Stop Loss and Take Profit levels are set to the open Limit order automatically (see Fig. 4).

Limit orders are included in the volumes visible in the “ order book” that are available for buying or selling at a given time.

Limit orders can be partially executed if there is not enough liquidity in the market or the market is very volatile.

This means that the order will be executed immediately, in whole or in part, if there is a suitable opposite order, and the remainder will be visible in the order book until another suitable opposite order is received at the required price.

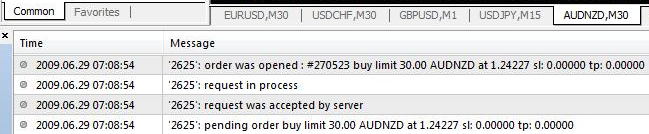

An example, the client opened a Limit Order to buy AUD / NZD ( Buy Limit Order ) at a price of 1.24227 with a volume of 30 standard lots.

See the corresponding log entry in fig. five.

Limit Order to buy ( Buy Limit Order ) has been executed in part because the moment has been reached set price in ECN was no corresponding opposite order on the sale volume of 30 lots.

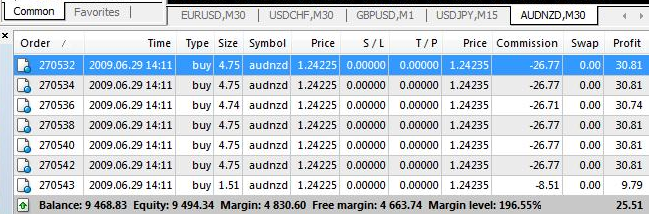

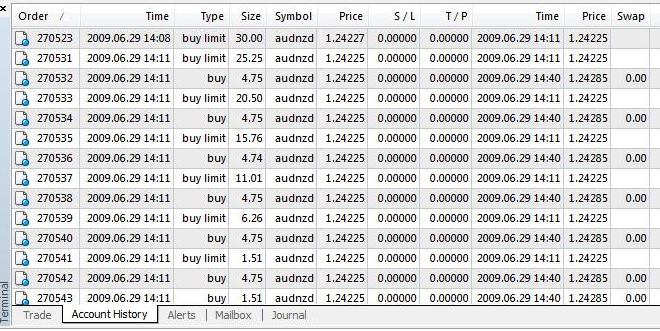

Therefore, a Limit buy order with a volume of 30 standard lots was seen in the market and then combined with seven smaller counter orders to sell at the desired price, as they were placed by other participants (see Fig. 6.1, the “Trade” tab and Fig. 6.2, the “Account history” tab).

Please check XM official website or contact the customer support with regard to the latest information and more accurate details.

XM official website is here.

Please click "Introduction of XM", if you want to know the details and the company information of XM.

IronFX

IronFX

FXGT Broker Review: A Leader in High Leverage Forex and Cryptocurrency Trading

Comment by whatisgoingonTRUMP

February 17, 2025

Trump’s team holds 80% of the $TRUMP token supply, giving them the power to influence prices and put investors at risk. A crypto controlled by one group? Doesn’t seem very decen...