Partial Close is a standard MT4 function that allows the client to close part of an open position by dividing the initial position volume into smaller parts.

This function allows the client to close a part of the volume of an open position at the currently desired price.

The Partial Close function is usually used by the client to minimize losses and increase profits.

Consider an example of partial closure of a position:

Let’s say a client has placed an order, 0.50 standard lots of EUR / USD at 1.44754 (# 9578517).

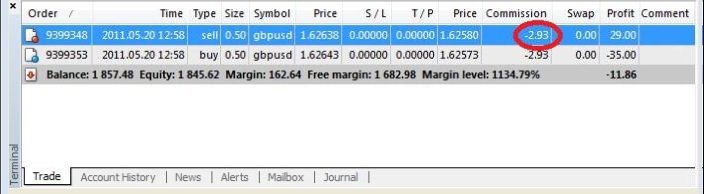

When opening a deal in the MetaTrader 4 terminal, the client immediately sees a commission charge for a full circle (opening + closing a deal) in the “Trade” tab.

For some reason, the client decides to close 0.30 standard lots of this order.

In order to partially close a position, the client must right-click on the order he wants to close, in the Trade tab and select the Close order option in the pop-up window.

A new order window will pop up.

In this window, the client must enter the volume he wants to close and then press the yellow Close button.

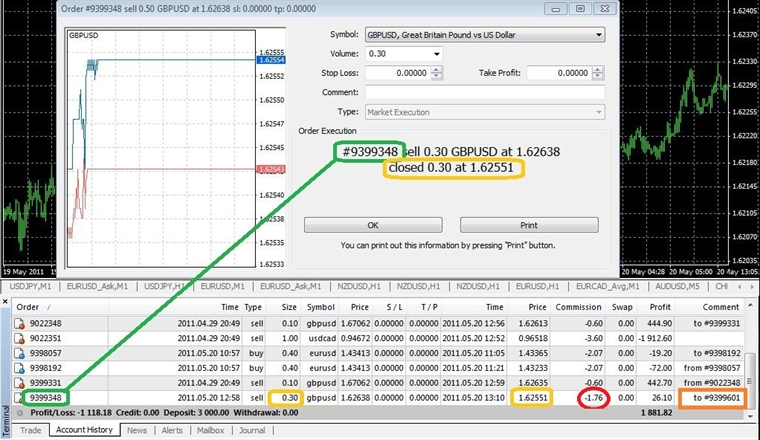

After clicking the Close button, a window will pop up with a message about which order was partially closed, in what volume, and at what price.

The closed order is displayed in the Account History tab.

The commission for closed 0.30 lots is debited from the balance and is also displayed in the Account History tab.

The rest of order # 9578517 (0.20 standard lots) was reopened at 10.10 am (server time), at a price of 1.44754 (order opening price # 9578517) with a new ID number # 9583199.

The order is displayed in the Trade tab with a corresponding comment.

The commission charged for 0.20 reopened lots are displayed in the Commission tab.

The commission is debited from the account balance in proportion to the volume of the closed position.

The above example shows how a partial close works if the client partially closes the position manually.

A position can also be partially closed during a period of low liquidity.

For example, if the TP level is reached, and there is not enough liquidity to close the position completely, the order will be partially closed.

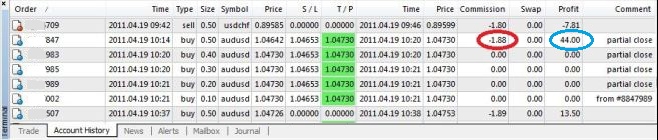

Consider an example: Example: The client placed a buy order (# **** 847), 0.50 standard lots AUD / USD at 1.04642, SL 1.04653 and TP 1.04730.

When the best BID price reached TP, there was no counter-order in the ECN market of the corresponding volume.

In fact, when the TP level (1.04730) was reached, there was a counter order with a volume of 0.10 lot on ECN, instead of the required 0.50.

Due to the peculiarities of the trading platform, the order was closed in full, and the profit for 0.50 closed lots was added to the account.

The remaining 0.40 lots were reopened at 1.4730 (closing price for # **** 847) with a new ID number (# **** 983).

When the TP level was reached again, order # **** 983 was closed in the volume of 0.10 lots.

The remaining 0.30 lots were reopened with a new ID number.

The following 3 orders: # **** 985, # **** 989, # **** 002 were reopened / closed in the same way.

Thus, one order with a volume of 0.

When opening a deal in the MetaTrader 4 terminal, the client will immediately see the commission charged for a full circle (opening + closing a deal).

The commission for 0.50 standard lots was deducted from the balance immediately after the order was completely closed.

The reopened order # **** 983 will remain open until the closing price of 1.04730 is reached.

If the price moves in a direction that is unfavorable for the client, the client will incur losses.

Contact XM’s support team for more

Please check XM official website or contact the customer support with regard to the latest information and more accurate details.

XM official website is here.

Please click "Introduction of XM", if you want to know the details and the company information of XM.

IronFX

IronFX

FXGT Broker Review: A Leader in High Leverage Forex and Cryptocurrency Trading

Comment by whatisgoingonTRUMP

February 17, 2025

Trump’s team holds 80% of the $TRUMP token supply, giving them the power to influence prices and put investors at risk. A crypto controlled by one group? Doesn’t seem very decen...