XM MetaTrader4 Platform. Table of Contents

- XM offers both MT4 and MT5 platforms

- Why is XM's MT4 better for Forex trading?

- How to install MT4 from XM?

- XM MT4 System Requirements

- How to uninstall MXM MT4 from PC?

- What's the server name of XM MT4?

- What is MT4 (MetaTrader4)?

- How was MT4 developed?

- Who uses the MT4?

- How does MT4 automated trading work?

- MQL4 automated program of MT4

- XM MT4 Mobile App for iPhone and Android

XM offers both MT4 and MT5 platforms

Start trading the instrument of your choice on XM’s MT4 and MT5, available on PC and more, or on a variety of mobile devices.

Alternatively, you may want to try XM’s WebTrader, accessible immediately from your web browser.

In addition, XM’s wide range of platforms for Apple and Android mobile devices will allow you to easily access and operate your account from your smartphone or from your tablet with full functionality.

Sign up with XM to get access to the MT4

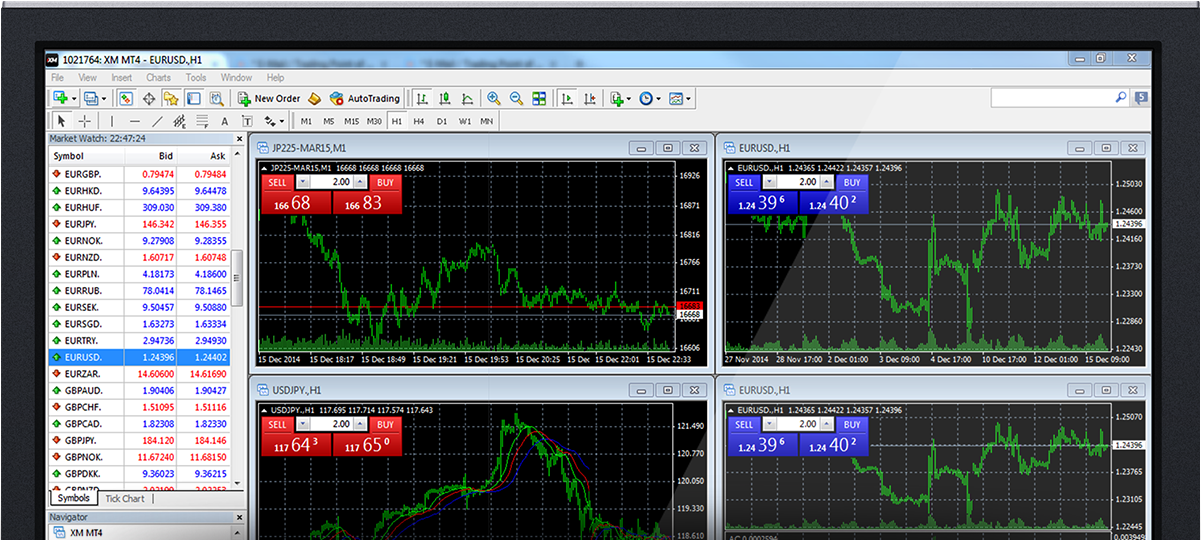

Why is XM’s MT4 better for Forex trading?

XM pioneered offering an MT4 platform with execution quality in mind.

Trade MT4 with no requotes, no reject orders, and with leverage up to 888: 1.

XM MT4 Features include:

- More than 1000 instruments, including forex, CFD, and futures;

- 1 single user to access 8 platforms;

- Spreads from just 0.6 pip;

- Full Expert Advisor functionality;

- 1-click trading;

- Technical analysis tools with 50 indicators and charting tools;

- 3 types of charts;

- Micro lot accounts (Optional)

- Hedging allowed;

- VPS functionality.

On the MT4 platform, you can trade all the instruments available on XM, including stock indices, forex, precious metals, and energies.

Individual stocks are available only on MT5.

How to install MT4 from XM?

- Go to XM Official Website;

- Download the terminal by clicking here (.exe file);

- Run the XM.exe file once it has been downloaded;

- When you run the program for the first time, you will see the login window;

- Enter the access data of your real or demo account.

To start trading on the MT4 platform, you need to have an XM MT4 trading account.

It is not possible to trade on an MT4 platform if you have an XM MT5 account.

To download XM’s MT4 platform, click here.

XM MT4 System Requirements

| Operating system: | Microsoft Windows 7 SP1 or higher |

|---|---|

| Processor: | Intel Celeron-based processor, clocked at 1.7 GHz or higher |

| RAM: | 256 Mb of RAM or more |

| Storage: | 50 Mb of free disk space |

How to uninstall MXM MT4 from PC?

- Click Start → All Programs → XM MT4 → Uninstall;

- Follow the instructions on the screen until the uninstall process is complete;

- Click on My Computer → click on Drive C or on the root disk, where your operating system is installed → click on Program Files → locate the XM MT4 folder, and delete it;

- Restart your computer.

What’s the server name of XM MT4?

To find my server name on MT4? (PC / Mac), click on ‘File’ -> Click on “Open an account” and a new window will appear, “Trading Servers” -> go down and click the + symbol in “Add new broker” and type ‘XM’ and click on “Scan”.

After the search is complete, close this window by clicking “Cancel”.

Then please try again by clicking “File” -> “Access trading account” to see if your server name is there.

What is MT4 (MetaTrader4)?

MetaTrader 4, commonly referred to as MT4, is a widely used electronic trading platform for currency exchange; It has been developed by the Russian software company MetaQuotes Software Corp., which currently offers the MT4 license to almost 500 brokers and banks around the world.

Launched in 2005, the MT4 trading platform became very popular with forex traders, especially for its ease of use and its ability to facilitate automated trading by allowing users to write their own trading robots and scripts (known as expert advisors).

Today, for most online traders and investors, whether they are trading forex or CFDs (contracts for difference on various financial instruments), MetaTrader 4 is undoubtedly a well-known brand.

MT4 is not only considered one of the most popular trading platforms for accessing global markets, but it is also one of the most efficient programs for currency trading (developed especially for individual traders online).

Online (or electronic) trading platforms are computer programs used to place trading orders for various financial instruments through a network of financial institutions (for example, investment companies) that operate as financial intermediaries (for example, facilitating transactions online between buyers and sellers when executing their trades).

Online investors can trade live market prices that are broadcast through the trading platforms, as well as enhance their profit potential with some additional trading tools offered by these platforms, such as trading account management, live newsletters, chart packages, and they can even use trading robots, also called expert advisors.

When compared to current trading platforms used to trade various financial instruments, such as currencies, stocks, bonds, futures, and options, the first versions of the software were dedicated almost exclusively to the stock market.

Until the 1970s of the last century, financial transactions between operators and their counterparts were processed manually, and operators did not have the possibility of directly accessing global financial markets but through an intermediary.

Also at that time, electronic trading platforms began to be used to carry out at least a part of these transactions.

The first platforms were used primarily for the stock market and were known as RFQ (Request for Quotation) systems, in which clients and brokers placed orders that were later confirmed.

During the 1970s, electronic trading platforms that did not offer real-time price transmission were replaced by better-developed programs, with almost instantaneous order execution, as well as real-time price transmission and an interface.

Which is better? XM MT4 or MT5 trading platforms?

How was MT4 developed?

The first generation of foreign exchange (forex) trading platforms on the Internet emerged in 1996, making it possible for the exchange to take place at a better pace and allowing the expansion of markets for clients.

As a result, online retail currency trading enabled customers to access global markets directly from their computers.

Although the first generation of such electronic platforms was very basic downloadable software and lacked user-friendly interfaces, new features such as technical analysis and graphing tools were gradually added, bringing improved attributes, as well as the ability to to use these platforms on mobile devices (such as smartphones and tablets) compatible with automated tools such as trading robots.

At the same time that online trading platforms appeared, a rapidly growing sector of the forex market also appeared, allowing users to access global markets and trade online through traders and banks: retail forex.

This segment of the market allowed even small investors to access the markets and trade with smaller amounts.

Demand for more sophisticated trading platforms continued to grow, particularly for forex trading, and so did the need for users to trade directly in global markets.

Launched in 2005, the MetaTrader 4 online trading platform was the type of software that made it possible for more retail forex traders to speculate and invest in forex markets and other financial instruments from anywhere in the world.

How to start trading FX on XM MT4 and MT5 platforms?

Who uses the MT4?

Currently, more than half a million retail traders are using the MT4 platform in their daily trading practices, benefiting from its wide range of options that facilitate investment decisions, such as automated trading, mobile trading, one-click trading, live newsletters, built-in customizable indicators, the ability to handle a large number of orders, an impressive number of indicators and charting tools.

MT4 is suitable for both beginner and more experienced traders who have versatile trading skills and practices.

The MT4 platform can be considered as the ultimate trading software for trading from anywhere in the world.

MT4 and MT5 – Which is better?

How does MT4 automated trading work?

Automated trading is well known to online investors as a useful tool to automatically process orders with an incredibly fast reaction time and according to a series of predetermined trading rules (such as entries and exits) that traders can set using the MQL programming language of MetaTrader 4.

Also known as a trading system, automated trading has another great advantage: while conducting trades mechanically and based on traders’ settings, it excludes the emotional factor from trading, which often affects negatively investment decisions.

Thus, it has the ability to handle trades on behalf of the investor, while also performing the analytical processes related to trading.

The cutting-edge technology of the MT4 platform offers automated trading as its fully integrated feature, executing repetitive trading orders at a speed that would be impossible with manual trading.

For many investors, this saves a considerable amount of time, from routine watching the market to executing the trade.

Backtesting (for example, testing trading strategies on previous periods of time) is another advantage of automated trading, in which trading rules are applied on historical market data and this helps investors to evaluate the efficiency of various investment ideas.

By applying appropriate backtesting, traders can easily evaluate and improve their trading ideas, which they can then apply in their trading practices for better results.

Automated trading is not only effective, but it is also a sophisticated method of trading the markets and because of this, it is advisable to start with small amounts during the learning process, especially for novice traders.

Additionally, potential mechanical failures can affect the outcome of operations performed by the automated system, and many traders with slow Internet connections are required to manually monitor the operations managed by automated trading.

In order to exclude negative factors such as slow connections, computer failures, or unexpected power outages, MT4’s free VPS (Virtual Private Server) service with fiber optic connectivity from XM ensures automated trading operations and experts advisors at all times, allowing clients to connect to MT4 VPS and enjoy seamless trading.

FAQs – For Beginners of MT4 and Forex Trading

MQL4 automated program of MT4

Automated trading is undoubtedly one of the most popular options in MetaTrader 4.

Its impressive data shows that since 2014, more than 75% of US stock trades, including the NASDAQ and the New York Stock Exchange.

The fact that automated trading via MT4 software is now also available to retail traders and investors is a huge advantage, allowing you to trade not only stocks but also currencies (forex), futures, and options.

The MT4 platform uses MQL4, a proprietary programming language to implement trading strategies, which helps traders develop their own Expert Advisors (e.g. trading robots), custom indicators, and scripts, as well as test and optimize their EAs.

MQL4 encompasses a large number of functions that allow traders to analyze current and previously received prices, follow price changes by means of integrated technical indicators, and not only manage but also continuously monitor trading orders.

More than 30 custom technical indicators are available to traders in the MT4 software and are available in various financial instruments in addition to forex, which helps traders identify dynamic price patterns, market trends and also determine market trends, possible entry and exit points, as well as managing trading signals.

Trading programs written in the MQL4 programming language serve different purposes and offer traders various options.

Expert Advisors, which are linked to specific charts, offer online traders valuable information about potential trades and can also trade on your behalf, sending orders directly to the trading server.

In addition to this, by using MQL4, traders can program their own indicators and use them alongside those already available in the MT4 client terminal.

MQL4 also includes scripts, but unlike Expert Advisors, they do not execute any default actions on behalf of traders and are designed to manage the execution of certain trading activities.

XM MT4 Mobile App for iPhone and Android

MetaTrader 4 was designed to take into account all the requirements of 21st-century technology and therefore ensures its flexibility and mobility.

This is exactly the reason why the mobile trading option allows investors to access the trading platform, not only from their Windows or Mac operating systems but also from their smartphones and tablets.

The trading portfolio, as well as multiple account management and monitoring options, can be accessed on the go.

Having the ability to manage multiple accounts from a single interface and from portable devices such as smartphones and tablets gives traders a definite advantage for trading, while compatibility with the iOS operating system allows Mac users to stay in the loop, from market changes 24 hours a day and place orders directly from your iPhone, iPad, or iPod Touch.

MT4 mobile trading makes it easy for online traders to easily follow global markets at all times, and from anywhere they can instantly place and execute orders and, of course, manage their accounts even when they are away from their computers.

In addition, mobile trading also offers a wide spectrum of analysis options and the graphical display of quotes for proper account management.

Since MT4’s mobile trading options are exactly the same for smartphones, tablets, and computers, online investors can carry out their trading activities at the same speed and with the same trading tools for better results.

Please check XM official website or contact the customer support with regard to the latest information and more accurate details.

XM official website is here.

Please click "Introduction of XM", if you want to know the details and the company information of XM.

IronFX

IronFX

FXGT Broker Review: A Leader in High Leverage Forex and Cryptocurrency Trading

Comment by whatisgoingonTRUMP

February 17, 2025

Trump’s team holds 80% of the $TRUMP token supply, giving them the power to influence prices and put investors at risk. A crypto controlled by one group? Doesn’t seem very decen...