Use Bollinger Bands to determine buy / sell levels

One of the most popular maxims in the world of trading and technical analysis is “trends are friends”.

However, if the trend goes in a different direction than you expected, the transaction will not go well.

Bollinger Bands is a secret tool that can be used to keep track of changing trends when the market is in a buy-and-sell situation.

Developed and introduced by John Bollinger, this concept is one of the most popular technical indicators in any financial market and for traders trading stocks, bonds or forex (FX).

They help investors identify whether prices are relatively high or low compared to recent averages and predict when prices will rise or fall in the future. This allows traders to ultimately make decisions about buying or selling assets.

Start using Bollinger Bands on XM

How the Bollinger Bands work

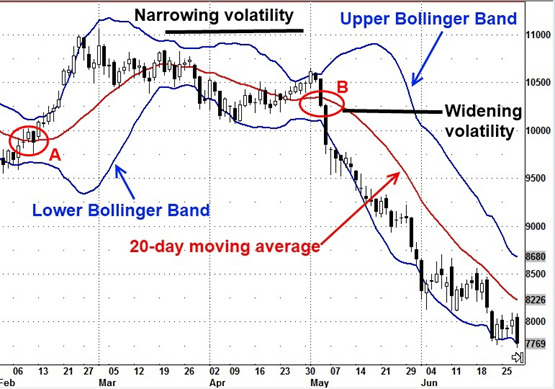

These are volatility bands placed above and below the moving average. Volatility is determined by measuring the standard deviation and therefore changes as the asset value rises and falls.

These bands automatically expand as volatility increases and narrow as volatility decreases. It can also be used for securities with different standard settings due to its dynamic nature. As a signal, the Bollinger Bands can be used to determine M-Tops and W-Bottoms and to identify the strength of the trend.

It usually consists of two bands. The middle band is a simple moving average set to 20 cycles. The simple moving average is used here as it is also used in the standard deviation formula. The retrospective period of the standard deviation is the same as the simple moving average.

The outer band, on the other hand, has two standard deviations above and below the center band. These settings can be changed according to the specific securities or trading style. However, it is advisable to keep the adjustment as low as possible.

How is the buy / sell level determined?

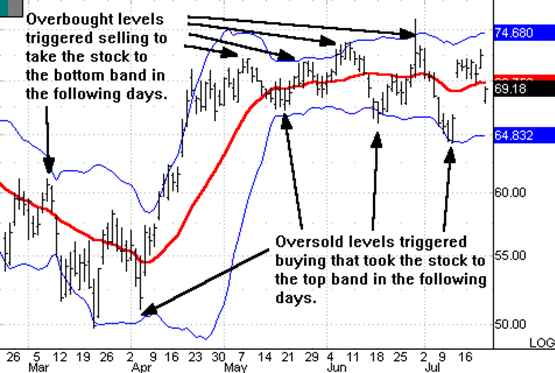

Bollinger Bands are most helpful in determining buy / sell levels.

This is the reason why it is said that way.

1. Buy

Assets that are traded at a relatively high price are considered buy-and-hold. When the price reaches the upper limit, it can be identified using the Bollinger Bands. It is very unlikely that prices will rise further, so traders may try to sell their assets in the hope that prices will fall towards the moving averages.

2. Sell

This is the exact opposite of a buy-and-hold position and can be defined as a situation where the asset price reaches a lower band. In this case, the price of the asset is relatively low and is considered a sell-off. At this point, the trader may buy the asset in the hope of profiting when the value reaches the middle band.

In either situation, there is no guarantee that prices will reverse just because they are too low or too high, and you can get stuck in one wrong move. For further confirmation, it is useful to look at candlestick patterns and other indicators.

Please check XM official website or contact the customer support with regard to the latest information and more accurate details.

XM official website is here.

Please click "Introduction of XM", if you want to know the details and the company information of XM.

IronFX

IronFX

FXGT Broker Review: A Leader in High Leverage Forex and Cryptocurrency Trading

Comment by whatisgoingonTRUMP

February 17, 2025

Trump’s team holds 80% of the $TRUMP token supply, giving them the power to influence prices and put investors at risk. A crypto controlled by one group? Doesn’t seem very decen...