ZuluTrade Copy Trade Guide. Table of Contents

- How to Become a Trader of ZuluTrade?

- What is Strategy provider of ZuluTrade?

- How to open a strategy provider account?

- Trading platforms of ZuluTrade

- Performance, statistics and indicators on ZuluTrade's Platform

- Condition of Fund Deposit and Withdrawal ZuluTrade

- Automatic payment function for real account traders

- Trading Rules

How to Become a Trader of ZuluTrade?

Traders can earn a monthly amount ranging from US$100 to US$1 million, depending on their performance and popularity.

Use your favorite trading method to provide your trading signals to all ZuluTrade Demo and real accounts!

Trader refers to any user who shares trading signals on the ZuluTrade platform.

Traders attract copy users through their competitive trading performance, allowing investor users to accept their trading signals.

The more profit a trader makes, the more investors and users you will attract.

Earn 0.5 point commission from the real investment account, that is, the client trades every standard hand strategist earns $5 commission!

Start Copy Trading with ZuluTrade

What is Strategy provider of ZuluTrade?

“Strategy providers” are also users of ZuluTrade. They use demo accounts or real accounts for trading, and their trading results are counted by ZuluTrade and published on the website. Each transaction in the strategy account is sent to all ZuluTrade demo accounts or in the form of signals. In the real account,

customers who choose to follow the trader (“investor”) will automatically perform trading operations in their account, and the account belongs to or their own dealer. Since simple trader signals are executed by various trading platforms with different trading interfaces and configurations, some problems cannot be avoided in trading. One possible example is the orphan transaction. Orphan trading refers to the closing of positions in the strategist’s account due to various reasons, but it may continue to hold positions in one or more real accounts of investors. This problem may lead to differences in trading results between strategists and investors-for example, although the strategist makes a profit by closing the position, the investor will eventually close the position and lose money because the transaction is not closed in time in the investor’s account. However, strategists have the ability to monitor and close positions that appear to be orphaned transactions.

Investors can adjust or reset strategists by configuring their settings in the ZuluTrade account portfolio or conduct manual trading.

For risk management purposes, ZuluTrade may restrict traders from being copied by investors to prevent them from not complying with the transaction rule.

Find out more in AAAFX Official Website

How to open a strategy provider account?

Anyone can register as a policy provider by just registering here. One email can register 10 policy provider accounts. The competition is fierce.

The ZuluTrade community and ranking formula continue to rank according to the trading performance of the strategy providers, so only the best strategy providers can appear at the top of the ranking list.

For the European version of the “Traders” page, the competition is even more intense! According to EU regulations, only when the following conditions are met can they display and provide trading signals to investors residing in the EU:

- Their minimum transaction time is at least 8 weeks.

- Their maximum loss in points is less than 30% (calculated in points or account equity)

- The average points are higher than the average return of 3:00 or greater than 0.015%.

For ZuluTrade’s US traders page, traders must comply with the FIFO and no-hedging policies specified by the NFA.

If you want to know how ZuluTrade ranking is calculated, please click here.

Trading platforms of ZuluTrade

Strategists will choose one of the following trading platforms to trade:

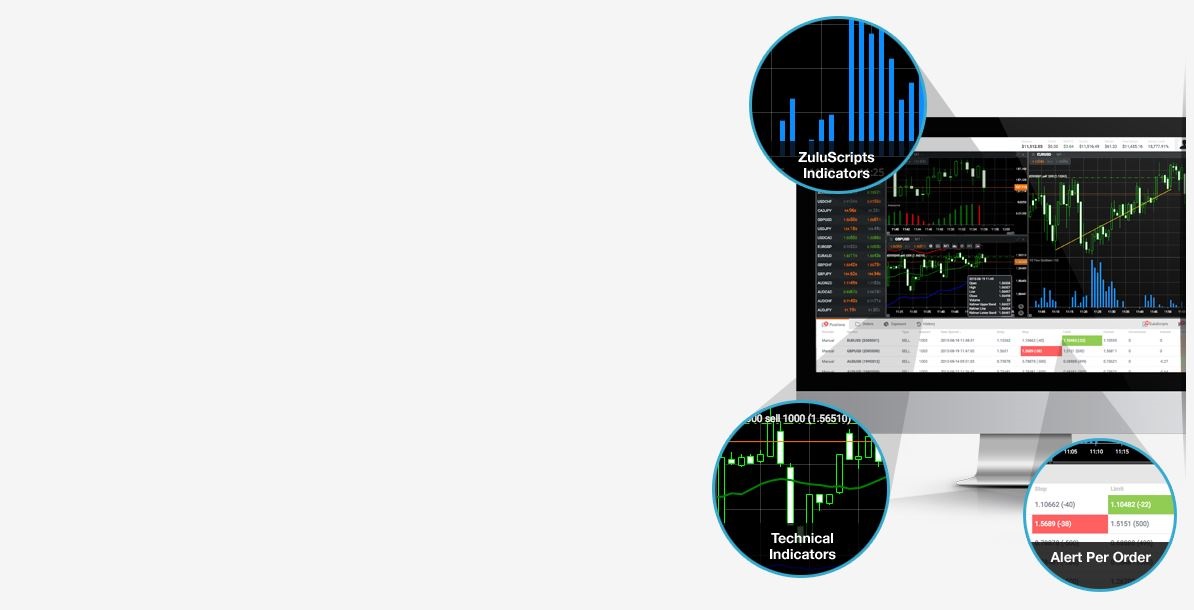

1. ZuluTrade+

On the ZuluTrade+ platform, all real and demo traders have a mature trading platform interface, which contains technical charts and indicators; at the same time, traders can create automated trading programs using ZuluScripts. Built-in a variety of trading charts (wax eclipse chart, OHLC, line), various indicators (trend, oscillator, volatility, trading volume, Bill Williams, etc.), customizable lines/texts/objects, etc., these functions All in one account, no external platform is required. The platform is completely browser-based, free from connection problems, and can run EA without interruption without a VPS. To learn how to create and run ZuluScripts, please see here.

Find out more about ZuluTrade+

2. ZuluTrading API

ZuluTrade+ can use ZuluTrading API. ZuluTrade provides its own REST API, which allows strategy providers to directly submit trading requests to ZuluTrade accounts through their own custom programs. In other words, there is no need to manually open, close, and manage transactions by logging into the strategy provider account; only the strategy provider needs to set up their trading program to perform the above operations. Although certain programming skills are required, a comprehensive detailed guide will guide you through setting up the ZuluTrading API.

Find out more about ZuluTrade API

3. MetaTrader 4 (MT4) platform

It is possible to connect an external real or demo MT4 platform in the account of the strategy provider. In this case, the strategy provider account becomes read-only, and trading activities in MT4 will be copied to the ZuluTrade account. The list of compatible brokers can be found under the settings column in the account of the strategy provider or obtained by contacting customer service.

Find out more about AAAFX’s MT4

4. ZuluTrade VPS

Strategy providers using MT4 have the opportunity to use ZuluTrade’s free VPS service to host trading strategies. ZuluTrade supports more than 60 brokers, there is no need to download any platform-the MT4 you choose will be pre-installed in your VPS account, and you can use a browser to access the VPS. ZuluTrade VPS is only for strategy providers who trade via MT4; the number of VPS is limited, strategy providers need to pay attention to the connect to my virtual private server’ button under the settings bar. This button will appear when a VPS is available. ZuluTrade VPS is an additional service that needs to be used reasonably; if ZuluTrade detects any form of abuse of the VPS service, the VPS service may be canceled in your account. Typical examples of unreasonable use are as follows:

- Malicious use;

- Under or overuse;

- Use third-party executable programs in virtual systems;

- Multiple MT4 program windows or EA;

- Mount the account used in a non-ZuluTrade environment, etc.

Please note that each customer can only have one ZuluTrade free VPS.

Find out more about ZuluTrade VPS

Performance, statistics and indicators on ZuluTrade’s Platform

When strategy providers trade, their performance and trading status will gradually evolve on ZuluTrade’s return performance page, and the ranking will move up or down. All data and information of the strategy provider are used to calculate the ranking. Some of the decisive factors for Zulu ranking are (please note, here is a brief introduction):

- Maturity: How long the strategy provider has traded, reflected in the “week” value.

- Exposure: At most a few transactions can be opened at a time, reflected in the “maximum number of open positions” and “the minimum required net asset value”, etc.

- Loss: The ups and downs experienced by the strategy provider in historical transactions.

- Performance: overall profit points, average profit points per order, and other return indicators.

Regarding the EU return performance page, the following points will also affect the order of the top 2000 traders:

- Their minimum transaction time is at least 8 weeks.

- Their maximum loss in points is less than 30% (calculated in points or account equity).

- The average points are higher than the average return of 3:00 or greater than 0.015%.

For ZuluTrade’s US traders page, traders must comply with the FIFO and no-hedging policies specified by the NFA.

If you want to know how ZuluTrade ranking is calculated, please click here.

The return performance follows the strategist’s sending of transactions and its data statistics are updated several times a day. The return performance also includes graphic indicators to help investors identify the strategist.

A strategy provider needs to close 1 transaction and the transaction time is at least 12 weeks before it can appear on the return performance page of the European website!

2. Condition of Fund Deposit and Withdrawal ZuluTrade

Traders’ remuneration varies according to their real investors’ account types and the country where the trader is located to meet local regulations.

- Commission based on transaction volume-classic account;

- Profit-Sharing Commission-Profit Sharing Account;

- Commissions to U.S. investors and/or U.S. traders;

- Use Japanese broker’s investor account to reverse commission.

i. Commission plan based on transaction volume

In the classic account mode, for each hand transaction completed in the real investor’s account, your trader can get 0.5 pips, which varies according to the currency pair being traded, the investor’s account type, etc.

ii. Profit sharing commission plan

Traders are compensated monthly based on the profits earned by real investors under the profit-sharing account model

Whenever you create a profitable monthly profit and loss for profit-sharing investors, you will be charged a 20% performance fee. This fee only applies to the amount above the high water mark (“HWM”). HWM is the maximum profit created by the trader, and it is calculated from the first calendar day of each month since the investor adds the trader to your portfolio.

For each profitable monthly PnL, traders will be compensated according to the 50% payment-reserve model. details:

- 50% of the performance fee charged will be directly credited to the trader’s account;

- The same amount (50%) will be drawn from the reserve fund. The amount to be issued and credited is limited to the reserves generated in the previous period;

- 50% of the performance fee will be added to the trader’s reserve bucket for the next period.

Each trader holds a reserve bucket for all your profit-sharing account investors. The reserve amount is updated on the first calendar day of each month based on the profit/loss generated by the trader in the real investor account of the previous month.

Scenario 1: Profitable monthly PnL-profit is higher than HWM

Investor’s monthly performance fee (higher than 25% of HWM’s profit) is divided as follows:

- 50% deposited into the trader’s account

- 50% deposited in reserve (if applicable-see example below)

- 50% is deposited into the trader’s reserve for future use.

Scenario 2: Loss of monthly PnL

If the performance is poor, the reserve amount will be deducted 25% of the loss incurred.

Scenario 3: Recovery period-profit is lower than HWM

If there is a recovery period, the performance fee will not apply, but the trader’s reserves will increase by 25% of the profit.

E.g:

In June, traders made a profit of $1000-this will be HWM. Investors will be deducted 25% ($1000) from accumulated profits: $1000 x 25% = $250

Based on the payment-reserve plan, traders

- 50% of the performance fee paid by the investor will be immediately credited to the trader’s account: $200 x 50% = $100.

- 50% of the performance fee paid by the investor will be credited to the trader’s account from the reserve fund (if there is an available amount). In this example, there is no reserve.

- 50% of the performance fee paid by investors will be kept in the trader’s reserve: $200 x 50% = $100.

Monthly Reserve Amount = $100

Total Reserve Amount = $100

In July, the trader has a loss month (-$100)-HWM is still $1000.

- Performance fees do not apply to investors.

- The trader’s reserve will be deducted 25% of the loss amount:-$100×25% =-$25.

Monthly reserve amount = -$25

New total reserve amount = $75 (=$100-$25)

In August, traders made a profit of $500-the new HWM $1400

- The first $100 is considered to be the recovery loss amount (loss incurred in July), and investors will not be charged any performance fees. However, the trader’s reserve will be refilled again with an amount of $25 (25% x $100).

- The performance fee will only be $400 applicable to investors (amount higher than the new HWM): $400 x 25% = $100.

Traders will now receive

- 50% of the investor performance fee will be credited immediately: $80 x 50% = $40.

- 50% of the investor performance fee will be credited to the total reserve fund: $80 x 50% = $40.

- 50% of the investor performance fee will be added to the reserve: $80 x 50% = $40.

Monthly reserve amount = +$20 (from the recovery period) + $40 (deposited into reserve) = $60

New total reserve amount = $100 (=$75 + $25 + $40-$40)

Start Copy Trading with AAAFX’s ZuluTrade

iii. Commission for US users

US Investors

Traders will receive a $21 monthly commission for each US Investor copying their strategies.

The monthly amount will be calculated on a pro-rata mode based on the Investor’s Subscription date, which is the date that the Investor added the Trader to his/her portfolio.

More specifically:

Example 1:

Investor A purchases a monthly recurring subscription to the Trader on September 1.

For September, the Trader will receive the full commission amount of $21.

Example 2:

Investor B purchases a monthly recurring subscription to the same Trader on September 15.

In this case, the Trader will be compensated in proportion to the Investor’s subscription date, thus, he/she will receive $10,50.

American Trader

ZuluTrade compensates US Traders by a variable monthly Subscription Fee. Monthly compensations for Traders can vary depending on the date they were added to the Investor’s accounts. The monthly Subscription Fee has been fixed to $21 per Investor. Example 1: Investor adds the Trader on September 1. For this month, the Trader will be credited the full amount of the Subscription Fee, which by default is $21. Example 2: Investor adds the Trader on September 15. For this month, the Trader will receive the Subscription Fee in proportion to the Investor’s registration date, which in this case is $10.5.

Please note that ZuluTrade has established a monitoring mechanism to detect violations. I regret to inform you that if your strategy does not comply with the above rules, any commissions from US investors will be rejected.

iv. Investors of Japanese dealers

Due to different trading conditions, the real account commission of Japanese dealers is 0.3 pips per lot.

According to local regulations, Japanese residents can register a trader account with ZuluTrade, but they will not earn commissions from trading activities.

Start Investing with ZuluTrade

Automatic payment function for real account traders

Real account traders can choose to automatically receive payable commissions in the broker’s trading account on the first working day of each month.

In order to be able to use the automatic payment function, traders need to:

- Use real trading accounts of brokers participating in this project.

- The account identity and address verification has been completed.

Traders can activate the automatic payment service under the account income column. On the first working day of each natural month, they can automatically receive the previous month’s payable commission in their trading account. The automatic payment service has no minimum amount limit and no processing fees.

Please also consider the following points:

- Before issuing the commission, the strategy provider needs to provide sufficient documents to ZuluTrade-generally ZuluTrade needs a valid photo ID (passport, ID card or voter card) and a recent official billing document showing your full name and address.

- Before sending the remittance, all positions need to be checked in accordance with the trading rules, and the commission takes time to collect from the cooperating broker; after submitting the withdrawal request from ZuluTrade’s website, the estimated time for processing the application is about 60 days.

- If the commission in the active account reaches 100 U.S. dollars, you can apply for withdrawal.

- Please make sure to set up your bank account details, PayPal account or ZuluTrade MasterCard correctly to avoid any problems when making payments. The following are related fees for different payment methods. Bank transfer (handling fee of USD 45), PayPal (handling fee of USD 20 for remittance of USD 0-500, a handling fee of 3.9% for remittances above USD 500), MasterCard (handling fee of USD 25).

- Large deposit accounts may be recognized as institutional accounts by brokers, and such accounts enjoy preferential spreads. Therefore, in this type of real account transaction, the commission is 0.1 pips per lot.

- Traders use the Social page and ZuluTrade Traders community service desk to communicate with real account investors who copy their strategies in a timely, full, and transparent manner.

- ZuluTrade regards the protection of funds in investor accounts as ZuluTrade’s most important principle. For this reason, ZuluTrade will closely monitor the high-risk illegal trading behaviors caused by the strategy provider on the copy account. If the strategy provider conducts malicious operations, their rebates will be rejected.

- If the trader expresses the profit and loss in USD for each specific calendar month, the trader’s commission for that month will not be paid. The total monthly profit and loss include the floating profit and loss valuation of the trader’s open positions at the end of the month.

- Please note that a withdrawal application must be made within 30 days after receiving the account disabling notice. The withdrawal application submitted after 30 days will be rejected. If the account is disabled or terminated, any accrued commissions that do not reach the $100 threshold will be automatically rejected.

3. Trading Rules

Transaction

When using a demo account to trade, please make sure that your trading strategy meets the following requirements:

- Strategists can send up to 50 market transactions (and 50 pending orders) to users every 24 hours, and at the same time send up to 5,000 transaction update instructions to investor accounts every 24 hours.

- There must be a minimum of 5 seconds between any open signals or pending orders before these signals will be sent to the investor’s account.

- The maximum number of open and pending orders allowed is 50, and other signals will not be sent to investors.

Please note that strategists who use real account transactions are not restricted by the above terms.

Find out more about Copy Trading

Use the MT4 terminal to trade

In addition to the above-mentioned strategy providers using MT4 or other terminal platform trading rules, the following requirements must also be met:

- Partial liquidation is not supported.

- Deleting the stop loss/take profit value through the EA (change the stop loss/take profit from a non-zero value to zero through the EA) will not pass, and the relevant trading signals will not be uploaded to the investor account.

- ZuluTrade supports trading foreign exchange, CFDs, indices, gold and silver.

- Any changes to MT4 transaction records or statistical data are strictly prohibited.

- Closing trades using “Close position with” is not supported.

Violating the rules of trading

ZuluTrade regards the protection of funds in the documentary account as ZuluTrade’s most important principle. For this reason, ZuluTrade will closely monitor the high-risk illegal trading behaviors caused by the strategy provider to the investor’s account. If the strategy provider conducts malicious operations, their rebate will be rejected and the ZuluTrade service may be permanently disabled. Similarly, any attempt to use its status, blackmail or even disrupt communication channels with the community or company will be considered malicious.

In order to reduce trading risks, the trading rules that strategists must follow include:

- The maximum floating loss points of the strategist should not be greater than the total profit points of the account. This requirement applies to strategists who have sufficient trading records. For example, the strategist’s total profit and loss points exceed 1,000 points.

- The maximum loss of any single transaction on the account shall not be greater than 700 points. Setting a reasonable stop loss is a mandatory requirement to protect the copy account. Reasonable and effective trading stop loss is also a way to promote the ranking of strategists. Failure to set a stop loss or setting a stop loss that is too large will be considered a violation of trading rules.

- ZuluTrade does not agree that the winning transaction rate is close to 100%. This is a potentially dangerous strategy because it may produce unusual points of loss.

Note that the above standards only apply to ordinary foreign exchange trading currencies. Special types such as gold, silver or CFDs bear the standards relative to this type.

Transaction hour

No transactions can be performed outside the trading hours of the ZuluTrade foreign exchange market. The foreign exchange market closes at 22:00 UTC on Friday and opens at 22:00 UTC on Sunday. When the US Eastern Time uses daylight saving time, the foreign exchange market is closed at 21:00 UTC on Friday and opened at 21:00 UTC on Sunday.

Please see here for the trading hours of CFDs.

Check Out the Trading Hours on AAAFX

4. Recommended trading strategies

- Ultra-short-term transactions are not recommended.

- Due to the different trading policies of various foreign exchange merchants, and the quotations of users registered on different foreign exchange platforms are different, ZuluTrade does not recommend traders to send ultra-short-term transactions to the documentary account. Ultra-short-term transactions often result in very different transaction results at different foreign exchange merchants.

- Trading News

- Many Forex Chambers will refuse to execute transactions when the market releases news that causes currency market price fluctuations. This will also cause differences between strategists and real account investors.

- Trading with virtual funds

- In addition to the trading results in the virtual account, if your trading funds are extremely high or the number of transactions is extremely high, it will be difficult for users to follow your strategy.

- Accurate strategy description

- Trading strategies need accurate and clear descriptions so that traders can participate in copying according to this description.

Since your ZuluTrade investors do not like unexpected trading behavior, any strategy that does not match your actual trading behavior will be rejected, which will affect your rebate or ranking accordingly. - Up to the current state

- The current state needs to be kept in the latest updated state. Investors can request a status update from the strategist. In this case, you will receive an email notification and update the status in the shortest possible time. Awkward silence is not a friendly way to treat the follower, so please ensure that you provide timely updates on the transaction status.

5. Suspend use

There are two ways for the strategy account to be stopped: as a temporary warning, or permanently suspended due to violation of website regulations. The responsibility and consequences of the strategy account being deactivated are the responsibility of the strategy provider.

Not in service

If the strategist’s account is connected to MT4, once it violates ZuluTrade’s relevant regulations, the account will be automatically terminated from the connection with MT4. The strategist can try to reconnect the account to MT4 when adjusting the trading strategy.

Permanently discontinue use

Stop using the account. The strategy account will be stopped if there is no trading operation within a certain period of time.

All strategy accounts that have not conducted any transactions for more than 3 months will be automatically stopped by the system.

The account of the strategy provider connected to MT4 will be stopped if there is no transaction for 1 month.

The strategy account has been temporarily suspended many times.

Find out more about AAAFX’s ZuluTrade

Please click "Introduction of AAAFX", if you want to know the details and the company information of AAAFX.

IronFX

IronFX

FXGT Broker Review: A Leader in High Leverage Forex and Cryptocurrency Trading

Comment by whatisgoingonTRUMP

February 17, 2025

Trump’s team holds 80% of the $TRUMP token supply, giving them the power to influence prices and put investors at risk. A crypto controlled by one group? Doesn’t seem very decen...