Best Time to trade FX. Table of Contents

Market Hours of Global Foreign Exchanges

Foreign exchange transactions are carried out around the world 24 hours a day, 5 days a week.

The trading market opened in Wellington, New Zealand on Monday morning and remained open until Friday night in New York, USA.

Knowing which trading hours are currently active helps you to choose a trading currency pair and check the relevant financial events before trading starts.

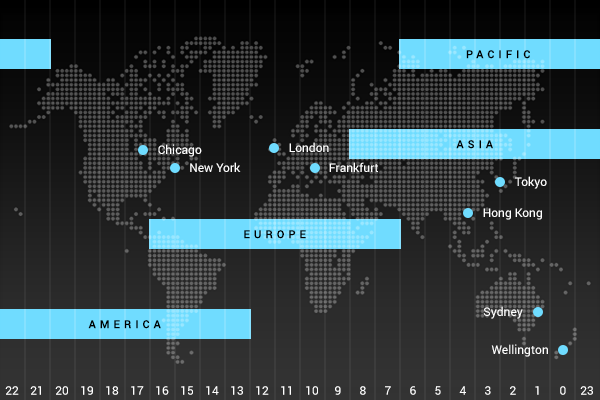

Each trading day can be divided into three trading periods according to the activity of the financial center in a specific time period.

The opening and closing time of each time period is based on the usual local business working hours:

| Time Period | City | Opening Time (EET) | Closing Time (EET) |

|---|---|---|---|

| Asia | Tokyo | 2:00 – 3:00 | 11:00 – 12:00 |

| Europe | London | 10:00 | 19:00 |

| America | New York | 15:00 – 16:00 | 0:00 – 1:00 |

Go to OctaFX’s Official Website

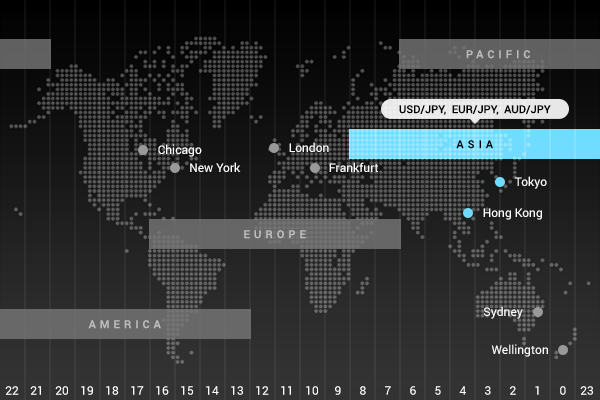

1. Asian (Tokyo, Japan) Session

The main trading center is located in Tokyo, and the Asian session also includes China, Australia, New Zealand, and Russia.

The first financial center to open after the weekend was actually Wellington, New Zealand, and the capital market in Tokyo opened at 2 AM EET (3 AM EST).

The closing time overlaps with the opening time of the European session.

Important economic data in this region that may affect European and American trading hours are released during this time period.

You can expect significant price fluctuations in the US and Japan USDJPY, Europe and Japan EURJPY, and Australia and Japan AUDJPY.

Trade during Asian (Tokyo, Japan) Session

2. European (London) Session

The moment when the Asian financial center is about to close is also the beginning of a new day in the European market.

Due to the overlap between the European time and the Asian and American time periods, the foreign exchange market usually sees increased volatility and market liquidity, but the spreads tend to be smaller during the London time.

The most important financial news is released by the Eurozone, the UK, and Switzerland.

Usually, a trend will continue from the European time to the beginning of the New York time.

The most liquid currency pairs are Europe and the United States against EURUSD, the pound and the United States against GBPUSD, the U.S. dollar and Swiss franc USDCHF, the British pound euro EURGBP and the Euro Swiss franc EURCHF.

Trade during European (London) Session

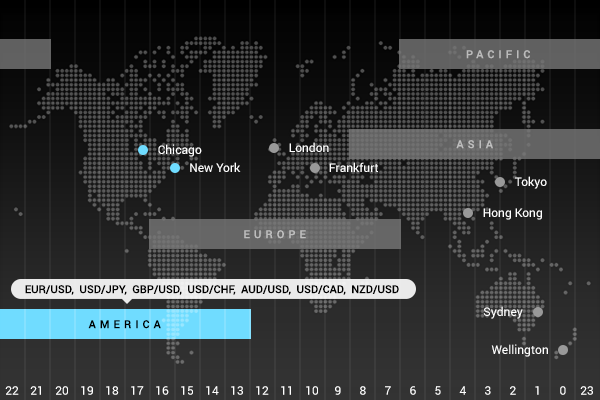

3. US (New York) Session

Dominated by the New York Financial Center, including Canada and South American countries.

Naturally, there is a lot of liquidity in the first half of this period because the European market is still open.

A series of economic indicators that have a profound impact on the market is released by the United States and Canada, so be sure to check the economic calendar in advance to pay attention to upcoming news.

Since most foreign exchange transactions involve the U.S. dollar, all major and cross-exchange rates fluctuate during this period, but the liquidity is also high during this period and basically, any currency pair can be traded.

Trade during US (New York) session

Fundamental analysis and economic indicators

Fundamental analysis is the study of how a country’s economy affects its currency exchange rates, mainly involving the interpretation of statistical reports and economic indicators.

Hundreds of economic news and reports are released every day, to some extent, predict whether the currency will appreciate or depreciate in the future or whether the current trend will reverse.

The release date of a specific report or indicator is scheduled in advance, and the time can be found in the economic calendar.

This is the main tool used to analyze the influence of the news that will release.

It also shows the experts’ prediction of the data to be released.

Check out OctaFX’s Fundamental Analysis

The central banks and interest rates

Since the central bank is usually responsible for dealing with the country’s fiscal problems, the policies it pursues have a profound impact on the exchange rate.

For example, in order to increase the value of the currency, the central bank can buy and store its own currency.

In order to lower the exchange rate, sell the reserves back to the market.

When it is necessary to stimulate consumption, the central bank may lower the interest rate it provides commercial bank loans.

If its purpose is to slow inflation, interest rates will rise to stimulate consumption reduction.

Depending on whether the focus of attention is to control inflation or promote economic growth, the central bank’s policies can be called “hawks” and “doves”.

The former usually leads to higher interest rates and monetary policy tightening, while the latter usually means lower interest rates and loose monetary policy.

Inflation

Inflation assesses the rate of increase in the prices of goods and services in a given economy, which has a direct impact on the supply and demand of the currency.

The main inflation indicators are:

- Gross domestic product (GDP)

- calculates the market value of all final products and services produced by all resident units in a certain period of time. This means an increase in economic growth in the gross domestic product, because of this, it is used to measure inflation. Announcement time: initial value-four weeks after the end of a quarter; final value-three months after the end of the quarter, time: 15.30 Eastern Time (14.30 EST).

- Consumer Price Index (CPI)

- CPI is an indicator of the degree of change in the price of consumer goods and services purchased by urban and rural residents in a certain period of time. Compared to previous results, CPI shows how consumption power changes and how it is affected by inflation. Announcement time: every month, approximately mid-month, time: 15.30 EST (14.30 EST).

- Producer Price Index (PPI)

- This indicator shows that it mainly reflects the price changes of the means of production and can evaluate the changes in consumer-level prices. Announcement time: the second or third week of each month, time: 15.30 Eastern Time (14.30 EST).

Open OctaFX’s Account for free

Employment

The level of employment directly affects the exchange rate because it affects current and future consumption power.

The increase in the unemployment rate is seen as weak economic growth, and thus the demand for money is declining.

On the contrary, strong employment figures are a sign of economic growth and usually mean that the demand for currency will continue to increase.

Below you will find the most important employment reports from different countries:

- Non-agricultural employment in the United States

- An assessment of employment trends, excluding the government, non-profit organizations and agricultural employment population.

- U.S. Unemployment Insurance First Application

- The number of new applicants for unemployment insurance measures the number of new unemployed persons.

- Labour Force Survey

- Measures the current change in employment rates in Canada.

- Wage Price Index

- Shows changes in Australian wages.

- Change in claim count rate

- Measures the change in unemployment insurance claims over a period of time in the UK.

Go to OctaFX’s Official Website

Retail sales

This indicator is important because consumer spending is an important part of the economy.

It is a statistical summary of the amount of retail sales, including the amount of consumption of different goods and services in a certain period of time.

Retail sales growth indicates that consumers have additional income to consume and have confidence in the country’s economy.

Announcement time: every month, approximately mid-month, time: 15.30 EST (14.30 EST).

Open a FX trading account with OctaFX

House sales

The growing housing market is one of the main indicators of economic strength.

Mainly based on consumer confidence and mortgage interest rates, the home sales report shows the total consumer demand for housing consumption.

Release time: the fourth week of each month, time: 15.30 EST (14.30 EST).

Trade Forex and CFDs with OctaFX

Wholesale trade report

The wholesale trade report is based on a survey of monthly sales, inventory, and inventory-to-sales ratio data of 4,500 wholesale merchants.

This shows the dynamics of supply and demand and may help forecast the quarterly GDP report.

However, this indicator does not strongly affect the market.

Release time: Around the 9th of every month, time: 17.00 EET (16.00 EST)

Balance of Payments (BOP)

The balance of payments sums up the flow of income and expenditure of all economic transactions between a country and a foreign country in a certain period of time.

All transactions are subdivided into capital accounts that include goods, services, and income, including financial instrument transactions.

These data are the key to formulating national and international economic policies.

Release time: Around the 19th of each month, Time: 15.30 Eastern Time (14.30 EST)

Open OctaFX’s Account for free

Trade balance

The report shows that the difference between a country’s imports and exports is an important part of the balance of payments.

A trade deficit means that the country imports more than exports, while a trade surplus is an opposite.

A decline in surplus or deficit often means an increase in demand for currency.

Release time: Around the 19th of each month, Time: 15.30 Eastern Time (14.30 EST).

Go to OctaFX’s Official Website

Know the Internation Exchange Markets

The international exchange market usually called the foreign exchange market or FX in short, is the world’s largest financial market.

In this market, the currency is bought, sold, or exchanged for one currency for another.

Unlike the stock market, it does not require centralized exchanges and transactions through the counter, that is to say, all participants conduct transactions through a global network of financial institutions such as banks and brokers.

As a global market, the foreign exchange market is open for trading 24 hours a day, 5 days a week.

The major financial centers are located in almost any time zone-London, New York, Tokyo, Zurich, Frankfurt, Hong Kong, Singapore, Paris, and Sydney.

According to specific active trading periods, global foreign exchange transactions can be divided into three periods: Asia, Europe, and the Americas.

To learn more about trading hours, please click on the link.

In foreign exchange, currency quotations appear in pairs, usually expressed by the exchange ratio between two currencies.

The quotation shows how much of the quoted (second) currency is needed to buy or sell the base (first) currency.

The exchange rate is driven by supply and demand: when the demand for a currency is greater than the supply, the value of the currency usually rises, and if the demand for the currency is less than the supply, its value will fall.

In addition, price fluctuations are also affected by economic, social, and political events and will appear within 24 hours.

The political situation and the economic performance of related countries also have a profound impact on currency prices.

For example, countries with low inflation rates often see the value of their currency increase relative to the currency value of their trading partners.

Inflation is also highly positively correlated with central bank interest rates: lower interest rates promote exchange rate depreciation and vice versa.

Another decisive factor in setting prices is the orders of participants in the foreign exchange market, and the different trading volumes they generate will also have different effects.

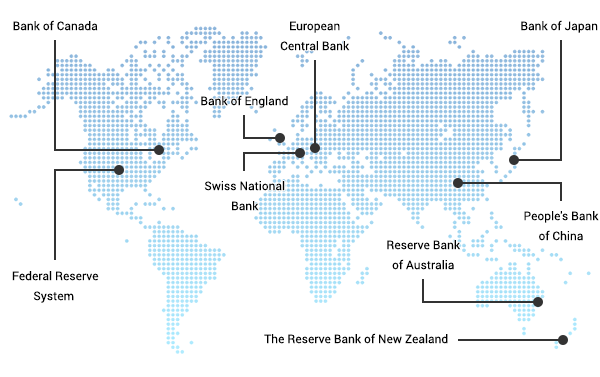

Governments and central banks such as the European Central Bank, the Bank of England, and the US Federal Reserve have the largest currency reserves and therefore have the greatest impact on exchange rates.

The central bank regulates the level of inflation, money supply, interest rates, and supervises the commercial banking system.

They can use foreign exchange reserves to intervene in the market to stabilize exchange rates or achieve specific economic goals.

The second most influential group includes major banks and bank associations forming the so-called inter-bank market.

Through their transactions with each other, they determine the currency prices that individual traders see on the trading platform.

Since foreign exchange trading is a decentralized market, you can often see that the exchange rate of the same currency in different banks is slightly different.

OctaFX customers can get the best buy/sell prices from OctaFX’s huge liquidity pool.

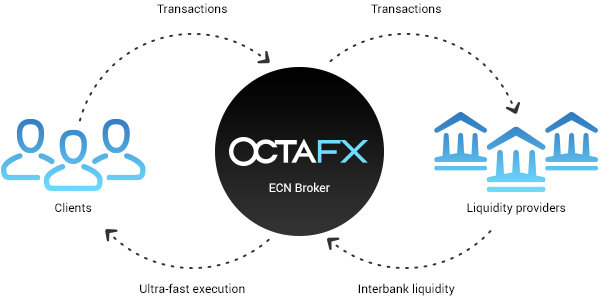

Another group of participants in foreign exchange transactions is brokerage companies that act as intermediaries between individual investors and the market.

They use electronic communication networks (ECN) to offset customer orders, and their liquidity providers include various financial institutions.

When executing orders, this mode of execution eliminates the conflict of interest between the brokerage and the customer.

An ECN broker, different from a market maker, obtains profit through commissions or spreads for each order.

You can learn more about ECN implementation here.

An ECN broker allows individual investors to enter the foreign exchange market, that is, within the scope of the original large financial institutions, to profit from price fluctuations.

Although daily price fluctuations may seem small, usually less than 1%, the use of leverage can increase the value of these movements.

Traders interact with the broker through a trading platform-that is, a piece of software that can buy and sell currencies.

It can be installed on desktop computers, mobile devices, and even accessed through a web browser.

Go to OctaFX’s Official Website

What you should consider when choosing a broker

1. Reliability

Highly recommended that you understand the ratings and reviews of a broker before investing. It is very important.

OctaFX provides the safest and most reliable services to OctaFX’s customers in accordance with major international laws and regulatory actions.

2. Order Execution

OctaFX execution model eliminates the conflict of interest between the client and the agent: as an intermediary between you and the real market, OctaFX can offset orders one by one with competitive prices through the huge liquidity pool.

You can ensure that OctaFX’s execution speed is less than 0.1 seconds, and OctaFX customers will not encounter any requotes.

3. Spreads

In general, spreads can be fixed or floating: the former stays the same when prices change, while the latter changes according to market conditions and are usually smaller than fixed spreads.

What needs to be considered is that the lower the spread, the less you pay for each transaction.

OctaFX’s low floating spreads ensure low transaction costs and accurately reflect the market’s supply and demand relationship.

4. Trading Tools

Every trader expects diversification: a wider range of trading tools allows you to choose the trading you are good at and leaves room for trying other currency pairs.

OctaFX’s great trading tool options allow you to choose the market you are interested in.

The full list can be found here.

5. Minimum Deposit

For novice investors is the transaction threshold, which depends on the minimum deposit amount.

In OctaFX you can start investing with only 25$/€25 as your initial capital.

It can help you try various techniques and apply different trading strategies, and can help you prepare for a truly serious transaction.

The good news is that the maximum deposit is unlimited!

6. Security

Security of Funds Ensuring the security of your funds is the most important when making investments.

OctaFX uses 3D security technology for Visa/Mastercard deposits and SSL encryption to protect personal accounts.

All measures taken to ensure the safety of financial information, will not be obtained by any third party.

7. Negative Balance Protection

A negative balance protection function can protect the trader in the event of sudden market transactions: if the trader’s balance is negative, OctaFX will make it up to zero.

Therefore, your loss will not exceed your deposit.

The negative balance protection function is handy in the ever-changing economic environment: OctaFX compensated customers’ negative equity to zero after the Swiss franc incident occurred in 2015 when some brokerages went bankrupt.

8. Account Type

Account type is very important to choose an account type that suits your level of trading experience.

This can ensure that you can give full play to your trading potential.

The coverage of OctaFX’s trading account allows traders with different experience values and different needs to operate their funds accordingly: OctaFX MT4 account allows new investors to deposit at a minimum of $25 to participate in the practice, while the real OctaFX cTrader account is for experienced trading.

Provides a wider range of trading tools.

You can compare account types here.

9. Leverage

Since daily price fluctuations seem to be small (usually less than 1%), it is important to choose a broker that provides a variety of leverage.

The higher your ratio, the fewer funds you need to hold a position.

OctaFX provides a flexible leverage system up to 1:500.

10. Platform

Choose a trading environment, you need to consider the general availability of the platform, compatibility with your equipment, and the number of trading tools available for technical analysis and trading.

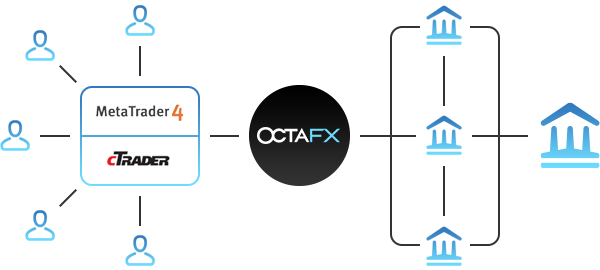

OctaFX provides you with MetaTrader 4 and cTrader platforms supporting desktop, mobile, and web platform versions.

Click here to compare trading platforms.

11. Customer Service

If there are any questions about the transaction, customer support will provide the trader with relevant information to help you solve the problem.

OctaFX’s award-winning customer support is available for you 24 hours/5 days, and it only takes about 5 minutes on average to help you solve your problems, even the most complex problems of your customers.

Due to a large amount of daily trading volume, sufficient liquidity, 24/5 operation time, and low cost, the foreign exchange market stand out compared to other markets.

It allows traders more flexibility in choosing how to trade and when to trade, while also providing considerable leverage and low spreads.

You can learn more about the advantages of the foreign exchange market here.

Start trading Forex with OctaFX

Please check OctaFX official website or contact the customer support with regard to the latest information and more accurate details.

OctaFX official website is here.

Please click "Introduction of OctaFX", if you want to know the details and the company information of OctaFX.

IronFX

IronFX

FXGT Broker Review: A Leader in High Leverage Forex and Cryptocurrency Trading

Comment by whatisgoingonTRUMP

February 17, 2025

Trump’s team holds 80% of the $TRUMP token supply, giving them the power to influence prices and put investors at risk. A crypto controlled by one group? Doesn’t seem very decen...