Crude Oil and Natural Gas. Table of Contents

Crude Oil and Natural Gas Prices

Crude oil and natural gas, both of which are commodities, are two important components of the global energy structure.

The price relationship between them has a profound impact on transaction decisions, energy policies, and portfolio optimization in financial markets.

Many economists and Industry analysts have conducted detailed research on this.

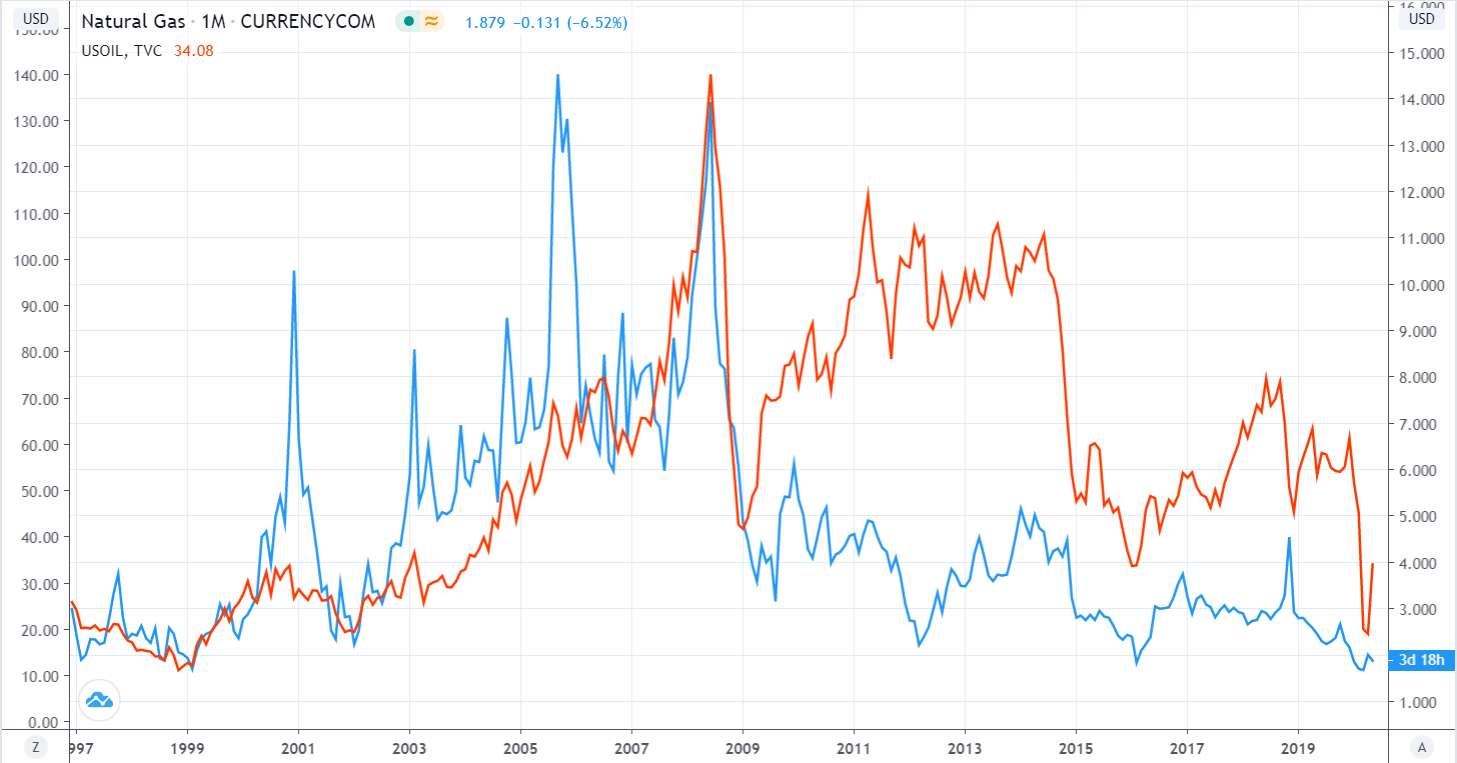

In general, before 2008, the supply and demand relationship between the two commodities made the price changes of the two occur simultaneously and in the same direction most of the time.

However, after 2008, due to the weakening of the link between them as substitutes, the price trends of the two have gradually diverged (see the figure below).

The relationship between natural gas price and oil price (blue natural gas price corresponds to the right coordinate, red oil price corresponds to the left coordinate).

The reasons for the decrease in the price correlation between the two are: the discovery of a large number of shale gas resources in the United States, Power plants abandoned residual fuel oil, and oil prices dropped sharply.

But this does not mean that the relationship between crude oil and natural gas prices has no research value.

People often use the Oil Price to Natural Gas Ratio, which is the unit price of crude oil divided by the unit price of natural gas, to measure the price relationship between the two.

When the oil-gas price ratio increases, it means that the demand for crude oil relative to the demand for natural gas increases; when the price ratio of oil-gas decreases, it means that the demand for crude oil decreases relative to the demand for natural gas.

The oil and gas price ratio also measure the Inter-market Spread between crude oil and natural gas, that is, the price difference between crude oil and natural gas.

By observing the historical trend of the oil and gas price ratio, people can look for the law of change in the price difference between crude oil and natural gas, so as to carry out cross-market arbitrage in the futures market.

Start Investing in Gold and Oil on FBS’s platforms

How geopolitical risks affect Oil prices

Among the many factors that affect oil prices, geopolitical risks occupy a very important position.

Broadly speaking, geopolitics is a discipline that studies the influence of geographic elements and political patterns on national strategies, while geopolitical risk refers to all risk factors in geopolitics, such as wars, political changes, financial crises, and natural disasters.

These factors often affect oil prices along with the supply and demand in the crude oil market.

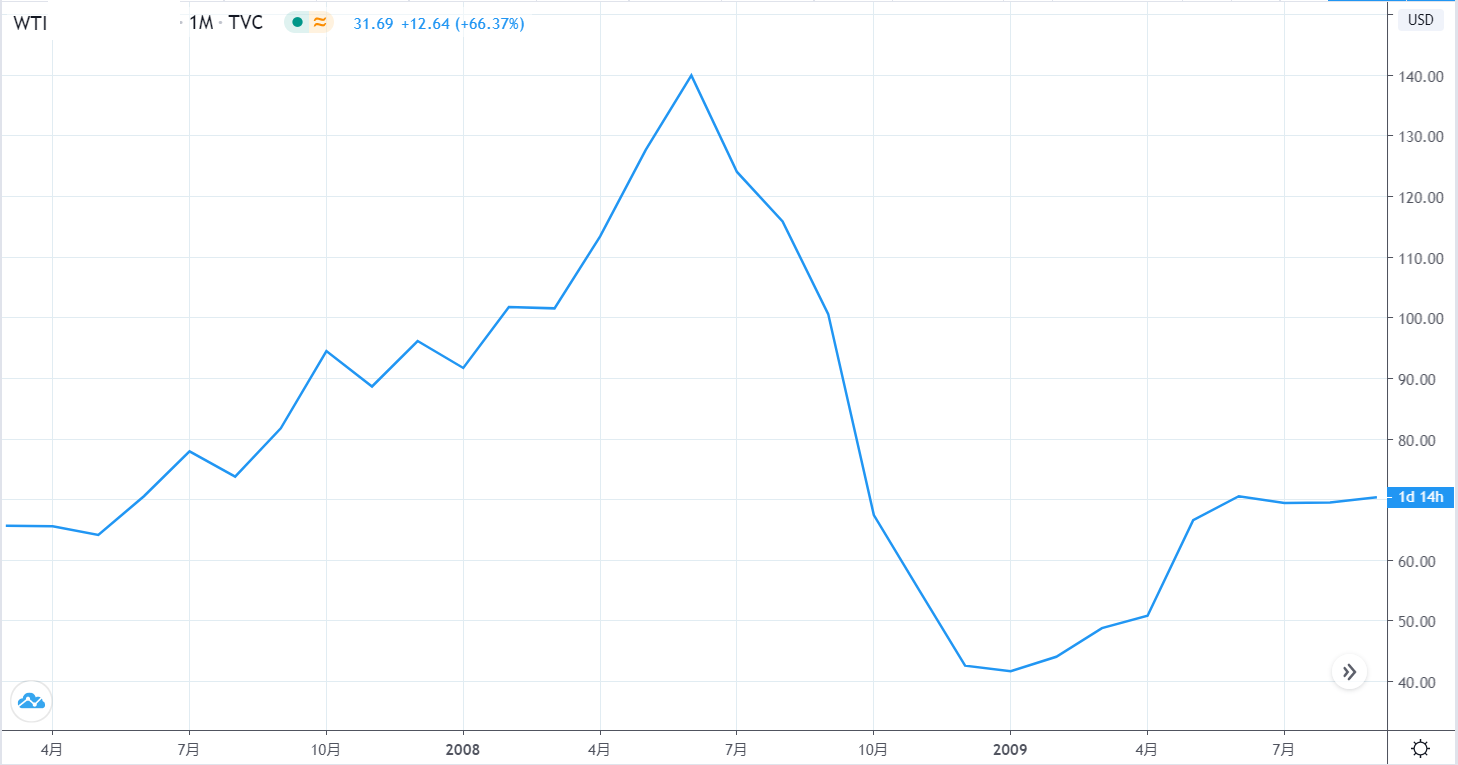

For example, in 2008, the global financial crisis triggered by the US subprime mortgage crisis led to a sharp contraction in global economic activities, which in turn led to a sharp drop in crude oil demand.

This caused a nearly 80% plunge in oil prices in the second half of 2008 (see the figure below).

For example, in 2020, under the influence of the COVID-19 epidemic, countries have restricted air travel and stopped most industrial production.

As a result, global crude oil demand has shrunk sharply, coupled with insufficient production cuts by oil producers, which has led to the exhaustion of oil storage space, which ultimately caused crude oil prices to plummet (see the figure below), West Texas Intermediate Crude Oil (WTI) May futures contract The price fell to -37.63 dollars per barrel before delivery.

Other geopolitical risk factors such as hurricanes in the Gulf of Mexico and military conflicts in the Middle East will cause the supply of crude oil to be tight, thereby pushing up oil prices.

Crude oil price chart (January 2020 to May 2020)

War is also an important factor affecting oil prices.

The war mentioned here is not limited to a full-scale war like the Iraq War, but can also be Iran uses rockets to attack neighboring countries in local military conflicts.

When a war breaks out or the risk of a war breaks out in the region of the oil-producing country, oil prices generally go up.

But after the war broke out, the trend of oil prices is more difficult to predict.

In general, when local political risks increase, oil prices tend to rise/decrease sharply and fluctuate sharply.

When these geopolitical risks ease, oil prices generally fall/rebound and become stable.

Geopolitical risks acting on the supply side will drive oil prices up, and geopolitical risks acting on the demand side will drive oil prices down.

Start Trading oil/USD on Deriv’s MT5 and DTrader platforms

How crude oil reserves reports affect oil prices

If you pay attention to the crude oil market, you may often notice the words “crude oil inventories exceed expectations”, “EIA report shows rising crude oil reserves”, “API report shows decreasing US gasoline inventories” etc.

These are all related to crude oil and its derivatives. Among them, the weekly reports released by EIA and API have attracted the most attention.

The full name of EIA is “US Energy Information Administration”, and the Chinese name is “US Energy Information Administration”.

It is an official agency under the US Department of Energy.

The agency will publish a report on oil conditions as of the previous Friday every Wednesday.

Although the name is “Petroleum Condition Report”, it actually includes the changes in national and regional inventory, imports, and exports of crude oil, distillate fuel oil, gasoline, residual oil, and other crude oil-related products.

For most crude oil traders, the more important data is the weekly changes in US crude oil inventories, that is, how many barrels of US crude oil inventories increased/decreased last Friday compared to last Friday.

The full name of API is “American Petroleum Institute” and the Chinese name is “American Petroleum Institute”.

It is a trade association of the American energy industry.

Under normal circumstances, the organization will publish weekly statistical announcements as of the previous Friday on Tuesdays (sometimes Wednesdays).

Similar to EIA’s oil status report, API’s report also contains inventory and import and export data of a variety of crude oil products.

The most concerning data in the report is also the data on changes in crude oil inventories.

Since most of the time, API releases reports earlier than EIA, API reports are often used as pilot data as a reference.

If crude oil inventories rise, it means that in the past week, the supply of crude oil in the United States has exceeded demand, which will have a bearish effect on crude oil prices.

And if the report shows a decline in crude oil inventories, it means that demand exceeds supply, which will have a bullish effect on crude oil prices.

Of course, for investors, it is not enough to pay attention to changes in crude oil inventories.

They also need to analyze gasoline inventories, crude oil imports and exports, and the current geopolitical environment to make a better prediction of oil price trends.

IronFX

IronFX

FXGT Broker Review: A Leader in High Leverage Forex and Cryptocurrency Trading

Comment by whatisgoingonTRUMP

February 17, 2025

Trump’s team holds 80% of the $TRUMP token supply, giving them the power to influence prices and put investors at risk. A crypto controlled by one group? Doesn’t seem very decen...