OANDA's Depth of Market. Table of Contents

What is board information? Depth of Market (DoM)?

DOM is a function that allows you to know the size of the market. Specifically, both buying and selling show multiple prices and the trading volume that can be traded for each price, showing how many orders can be processed in the market. This is a useful feature when placing large orders or checking market liquidity, as you can instantly see how many orders can be processed at what price.

In OANDA’s CFD, DoM can be displayed in OANDA MiniTerminal (hereinafter referred to as MiniTerminal) of MT5 or MT4. In MiniTerminal, you can view DoM information by clicking on the spread part. In MT5, you can also check on the board information order screen.

DoM applies to all order types. Specifically, it applies to new (market, limit / stop / stop) and settlement (market, limit / stop / trailing stop).

Start Using OANDA’s Depth of Market

How to access Depth of Market on OANDA?

In MiniTerminal, you can view the DoM by clicking on the spread part.

If you enter a trading lot in the “Lot” part, the prices and spreads of both buys and sells that can be ordered at that time will be displayed according to the trade volume entered.

If the number of lots entered exceeds the quantity that can be ordered at the first-rank price, this price will be calculated together with the price and quantity of the second and subsequent ranks.

Also, if a lot number is entered that is larger than the first-ranked tradeable quantity, the part of the rank below the price that reaches that lot number will be highlighted.

DoM displays a list of prices and the volume of transactions that can be executed for each price at that time. If the quantity ordered is larger than the number in the first rank, the price in the second and subsequent ranks will be applied to the portion exceeding the tradeable quantity (the quantity that can be traded in the first rank is the price in the first rank).

For example, if the quantity that can be traded at the 1st place price is 1000 and the quantity at the 2nd place price is 2000, when 1500 orders are placed, 1000 orders at the 1st place and 500 orders at the 2nd place will be processed. Will be done. If the quantity of the order cannot be processed even with the quantity of the second rank, it will be processed at the lower price in order such as the third rank.

And if the order exceeds the total quantity of all ranks displayed in the DOM, the order will be rejected.

The price displayed in MiniTerminal is displayed as “Volume Weighted Average Price (VWAP)” calculated by adding the price and quantity of DoM.

Go to OANDA’s Official Website

How to calculate the volume-weighted average price, VWAP?

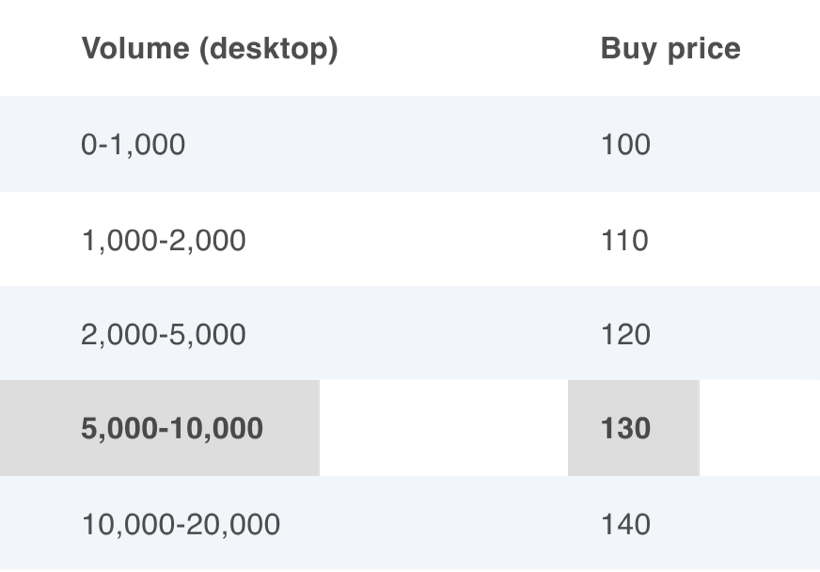

We will show you an example of placing an order with a trading volume of 10,000 when DoM is in the following state.

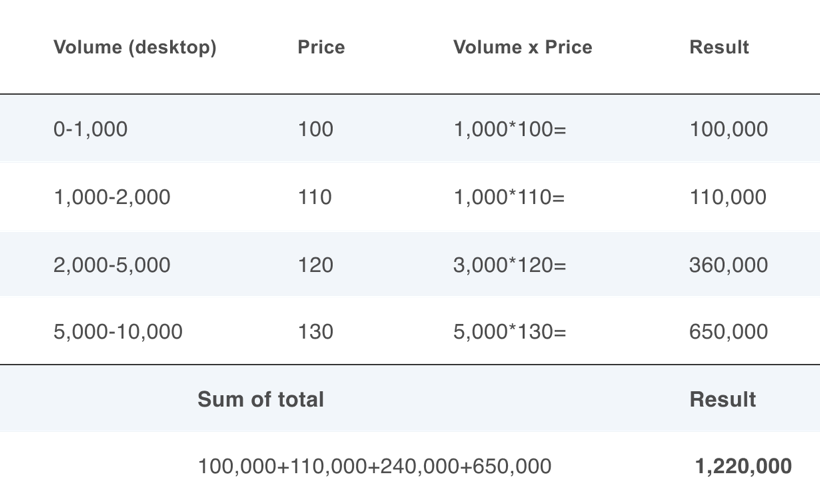

When calculating the VWAP in this case, multiply the price of each rank by the transaction volume to be executed at that price to calculate the contract price for each price. Continue downgrading until all contract amounts have been processed.

In this example, we are not using the 5th rank price (140 in this case) because we were able to process all of the order quantity up to the 4th rank level price.

Finally, add up the contracted amounts. In this example, the total contract amount is 1,220,000.

Finally, divide the total contract amount by the transaction volume. In the case of this example, it is calculated as follows.

1,220,000 ÷ 10,000 = 122

VWAP is 122.

If multiple orders are placed at the same time, the processing is the same as when placing an order for one combined quantity. In other words, one order consumes a part of the first rank, and the second and subsequent orders take over the rest of the trading volume that can be executed.

Start Using OANDA’s Depth of Market

Please click "Introduction of OANDA", if you want to know the details and the company information of OANDA.

IronFX

IronFX

FXGT Broker Review: A Leader in High Leverage Forex and Cryptocurrency Trading

Comment by whatisgoingonTRUMP

February 17, 2025

Trump’s team holds 80% of the $TRUMP token supply, giving them the power to influence prices and put investors at risk. A crypto controlled by one group? Doesn’t seem very decen...