Do you have problems or questions while using MT4 (MetaTrader4) and MT5 (MetaTrader5) trading platforms?

We have about 40 popular questions and answers for online traders.

You may find your answers here, and even if you don’t, you may find many useful information for using MT4 and MT5 platforms.

Here is the list of questions, that will be answered in this page below.

- What are the IP-addresses of LiteForex’s trading servers?

- Which trading platforms are available with LiteForex?

- What is MultiTerminal? How can it be useful?

- What are the most convenient and frequently used keys in MetaTrader?

- Where can I find a complete user guide for the terminal MT4?

- What are “Bid” and “Ask”?

- What are “Stop loss” (S/L) and “Take profit” (T/P)?

- A Stop Loss order has triggered although there was no such price on chart.

- What are “Stop” and “Limit” pending orders? How do they work?

- On what conditions can the orders S/L, T/P, Stop and Limit be placed?

- What is the “Volume” in “New Order” window and which units is it measured in?

- How to solve Inactive “New order” button problem.

- The buttons ‘Sell’ and ‘Buy’ are inactive. Is my account blocked?

- The terminal shows the message “Invalid account”.

- The terminal shows the message “No connection”.

- I followed all the tips above but still cannot log in to my account. What else can I do?

- What is the terminal (trading platform) server time?

- When I try to open an order, I see the message “Trade stream busy”.

- Why has the account history disappeared?

- How to calculate the cost (value) of point?

- How do I calculate the margin required for opening a position?

- What’s the difference between Futures/CFD/Forex profit calculation types?

- Why is a fee charged or credited for overnight positions (Swap)?

- How long can I keep a position opened?

- What are long-term and short-term positions?

- What is “Margin Call” and “Stop Out”?

- What is “Credit Stop Out”?

- Why has a transaction on my account been closed without any notice?

- What is a “trailing stop”?

- How to reverse a position in MetaTrader?

- Why are there only 4 currency pairs in “Market Watch”, although I know that the Company provides far more trading instruments?

- What is a maximum deviation of the price and what is this option used for within the trading platform?

- How to set a maximum deviation from a quoted price when opening an order?

- What are the levels of support and resistance?

- What are the figures of profit or price movement?

- What is “Money Management”, or “Rules of money Management”?

- What is interest rate, % per annum?

- Where can I find MQL language guide for expert advisors and indicators?

Some information maybe outdated. For the latest information or inquiries, please contact the support team from the official website.

1. What are the IP-addresses of LiteForex’s trading servers?

| LiteForex-Demo.com: | 88.85.95.167:552 or 193.124.57.168:552 – for demo accounts; |

|---|---|

| LiteForex-ECN.com: | 78.140.179.222:444 or 193.124.57.168:554 |

| LiteForex-Cent.com: | 88.85.95.167:555 or 193.124.57.168:555 |

| LiteForex-Classic.com: | 78.140.179.143:444 or 193.124.57.168:553 |

2. What kind of trading platforms does the LiteForex Company provide?

Three types of terminal are currently provided for trading in both demo and real accounts: MetaTrader4 (MT4), MetaTrader5 (MT5) and Web Terminal located in Client Profile and allowing you to work with any account type.

Besides a basic terminal for a Windows-based personal computer, we offer terminals for Android, iPhones and iPads.

You can download any version of the terminal.

The Web terminal located in LiteForex’s Client Profile is adapted to any type of device and can be opened in a browser both on the computer and mobile devices.

3. What is MultiTerminal?

MetaTrader4 MultiTerminal is designed to manage several trading accounts which are on the same trading server.

It will be helpful for traders working with many accounts at the same time.

4. What are the most convenient and frequently used keys in MetaTrader?

- F1 – user guide for the terminal

- Ctrl + T – open/close terminal window within Metatrader window,

- Ctrl + O – open a window of terminal settings, where you can enter the data for authorization and set other options of the program,

- Ctrl + N – open navigator window,

- Ctrl + Y – show period dividers on chart,

- Ctrl + L – show volume on charts.

5. Where can I find a complete user guide for the terminal MT4?

You can find the user guide in the terminal itself.

Press F1 in order to review it straight after launching the terminal.

6. What are “Bid” and “Ask”?

This is a buy and sell price which you can see when requesting to open or close a position.

The difference between the Bid and Ask price is called spread.

All charts in the terminal show Bid price.

You can also set the function allowing the display of Ask price as well.

In order to do this, press F8 on the chart window, where in the tab “General” you need to tick “Show Ask Line”.

“Buy” orders are opened under the price “Ask” and closed under the price “Bid”.

“Sell” orders are opened under the price “Bid” and closed under the price “Ask”.

7. What are “Stop loss” (S/L) and “Take profit” (T/P)?

Stop Loss is used for minimizing losses if the security price has started to move in an unprofitable direction.

If the security price reaches this level, the position will be closed automatically.

Such orders are always connected with an open position or a pending order.

The terminal checks long positions with Bid price for meeting this order provisions (the order is always set below the current Bid price), and it does with Ask price for short positions (the order is always set above the current Ask price).

Take Profit order is intended for gaining the profit when the security price has reached a certain level.

Execution of this order results in closing of the position.

It is always connected with an open position or a pending order.

The order can be requested only together with a market or a pending order.

The terminal checks long positions with Bid price for meeting of this order provisions (the order is always set above the current Bid price), and it checks short positions with Ask price (the order is always set below the current Ask price).

For example:

When we open a long position (Buy order) we open it at Ask price and close it at Bid price.

In such cases S/L order can be placed below the Bid price, while T/P can be placed above the Ask price.

When we open a short position (Sell order) we open it at Bid price and close it at Ask price.

In this case S/L order can be placed above the Ask price, while T/P can be placed below the Bid price.

Let us suppose that we want to buy 1.0 lot on EUR/USD.

We request a new order and see a quote Bid/Ask.

We select the relevant currency pair and the number of lots, set S/L and T/P (if required) and click on Buy.

We bought at Ask price 1.2453, respectively, Bid price at that moment was 1.2450 (spread is 3 pips).

S/L can be placed below 1.2450.

Let’s place it at 1.2400, which means that as soon as Bid reaches 1.2400, the position will be automatically closed with 53 pips loss.

T/P can be placed above 1.2453.

If we set it at 1.2500, it will mean that as soon as Bid reaches 1.2500, the position will be automatically closed with a profit of 47 pips.

8. A Stop Loss order has triggered although there was no such price on chart.

This question is often asked by beginners in relation to Sell positions.

It happens because traders do not take spread into consideration.

Sell order is opened at Bid price; the chart shows this price as well.

But order closes at Ask price, which is higher than Bid price by the size of spread.

To enable displaying Ask price, press F8 on the chart window and in the tab “General” tick the “Show Ask line”.

9. What are “Stop” and “Limit” pending orders? How do they work?

These are orders which will trigger when the quote reaches the price, specified in the order.

Limit orders (Buy Limit / Sell Limit) are executed only when the market is traded at the price specified in the order or at a higher price.

Buy Limit is placed below the market price, while Sell Limit is placed above the market price.

Stop orders (Buy Stop / Sell Stop) are executed only when the market is traded at the price specified in the order or at a lower price.

Buy Stop is placed above the market price, while Sell Stop – below market price.

10. On what conditions can the orders S/L, T/P, Stop and Limit be placed?

For all currency pairs the price stated in the order shall differ from the current market price “Bid” or “Ask” at least by the size of spread for this pair depending on the direction of position.

You cannot place pending order S/L or T/P closer to the current market price than it’s stated in the “Trading instruments” in Stop&Limit” column.

11. What is the “Volume” in “New Order” window and which units is it measured in?

“Volume” is a size of order, which is measured in “lots”.

The size of the lot for each trading instrument is indicated in the section “Trading instruments”.

The volume, which you are allowed to use when entering the market, can be calculated with the help of “Trader’s calculator”.

12. Inactive button “New order”.

If the button “New order” is not active, it means that you have connected to the account using investor’s password.

In order to trade on the trading account, use trader’s password.

The trader’s password is used to log in to the trading account and enables you to manage it.

You can open, close or modify positions only if you use the trader’s password.

The investor’s password is used to review the account.

Therefore, you can log in to the trading account and view it, but cannot open, close or modify any positions.

13. The buttons ‘Sell’ and ‘Buy’ are inactive. Have you blocked my account?

If the buttons “Sell” and “Buy” are not active, it means that you indicated a wrong trade volume.

The minimum and maximum volume for CLASSIC and ECN accounts are 0.01 and 100 lots, respectively.

Please, check the page “Account types” for more details.

14. I cannot log in to my account. The terminal shows the message “Invalid account”.

Possible reasons:

- You may have used the wrong login. Note that only the digits of account number can be used as login. For example: if an account number is MT4-R-12345, the login will be 12345.

- You have used the wrong password. Please check your password. If you have forgotten or lost the trader’s password, you can change it in the Client’s Profile. See paragraph 1.15.

- Probably, your trading account is archived as it has been inactive for three months. See paragraph 1.22.

15. I cannot log in to my account. The terminal shows the message “No connection”.

The reasons can be as follows:

- You have used the wrong server to log in to the trading account. Please use the IP address instead of server.

| LiteForex-Demo.com: | 88.85.95.167:552 or 193.124.57.168:552 – for demo accounts; |

|---|---|

| LiteForex-ECN.com: | 78.140.179.222:444 or 193.124.57.168:554 |

| LiteForex-Cent.com: | 88.85.95.167:555 or 193.124.57.168:555 |

| LiteForex-Classic.com: | 78.140.179.143:444 or 193.124.57.168:553 |

- You have no Internet connection;

- It is also possible that port 443 has been blocked in your network or access to Internet is provided through a proxy server. If you use a network of organization this also can be a reason. Ask your IT Manager about proxy server address and then include it in the settings of the terminal (in the menu “Tools”/”Options”/”Server” tick “Allow proxy server”/ click proxy button/ register address, proxy server port, username and password).

- A firewall (anti-virus software) blocks port 443. Windows’ firewall is also a firewall. In this case it is necessary to include “MetaTrader” in the list of the allowed programs or open the 443 port.

16. I followed all the tips above but still cannot log in to my account. What else can I do?

Attention! To perform the actions below, you will need to restart your computer and log on as an administrator.

Since you will need to type commands at a command prompt, you shall follow the instructions strictly.

The instruction is for PC users.

If you are a MAC user, find the information on how to clear DNS cache on Apple’s site.

When you use Internet constantly, your computer automatically caches IP addresses and other data of the Domain Name System.

Clearing out the cache helps update data and delete old data which may provoke connection problems.

Windows 10

- Holding down the Windows key, press X.

- Choose “Command prompt (administrator)”

- Type ipconfig/flushdns and press Enter.

- Type ipconfig /registerdns and press Enter.

- Type ipconfig /release and press Enter.

- Type ipconfig /renew and press Enter.

- Type netsh winsock reset and press Enter.

- Reload your computer.

Windows 7 and Windows 8

- Go to the desktop.

- Holding down the Windows key, press R (to launch the “Run” pop-up window).

- Type cmd and press Enter. (A command prompt will open)

- Type ipconfig /flushdns and press Enter.

- Type ipconfig /registerdns and press Enter.

- Type ipconfig /release and press Enter.

- Type ipconfig /renew and press Enter.

- Type netsh winsock reset and press Enter.

- Reload your computer.

17. What is the terminal time?

The “Market watch” window shows the terminal time.

It’s impossible to change it.

It corresponds to GMT+3 in the period from the last Sunday in March till the last Sunday in October.

For the rest of the time, it corresponds to GMT+2.

18. I cannot trade because when I try to open an order, I see the message “Trade stream busy”.

A message “Trade stream busy” appears in case of unsuccessful attempt to carry out a trading operation (for example: when you send a new trading order prior to getting results of the previous operation).

It can happen because of temporary interruptions of connection with the trading server.

In this case your new order will be queued in the client’s terminal, and this message will appear when attempting to execute any operation.

‘In order to clear the list of requests just restart the terminal’.

19. Why has the account history disappeared?

If the account history has disappeared, you shall do the following:

- Check the system date for correctness.

- Right-click on the tab “Account History” and select “All history”. You can also select the history for any period you are interested in.

20. How to calculate the cost of point?

You can calculate it with the help of the trader’s calculator.

The calculation formula is defined as follows:

The cost of point in the currency of the deposit:

(Cross-rate of the currency of the order to USD) х (order volume in lots) х 100000 х (point) / (current rate)

Where the transaction currency is the first currency in the pair.

For example:

EURJPY=162,30; EURUSD=1,4344;

The price of a point (EURJPY) = 1.4344 х 1 х 100000 х 0.01 / 162.3 = 8.83

The cost of point for CFD:

Volume (number of lots) х contract size х minimum value of the change of price

21. How do I calculate the margin required for opening a position?

The required margin amount can be calculated with the help of the “trader’s calculator”.

The calculation formulas are as follows:

Direct quote: Margin=Transaction Volume x Lot size/Leverage x Opening price

For example, Margin=1×100000/200 = 500 (500 EUR) for 1 EURUSD lot with 1:200 leverage.

If necessary, convert it into the account currency (for example, USD): 500 x 1.1300=565 USD.

Reverse quote: Margin=Transaction Volume x Lot size/Leverage

For example, Margin= 1×100000/200 = 500 USD for 1 USDCAD lot with 1:200 leverage.

Since the first currency in the pair is the USD, the margin is calculated in dollars.

If necessary, convert it into the account currency (for example, EUR): 500/1.1202=446.35 EUR.

Cross rates: Margin = Transaction volume x Lot size/Leverage x Current rate of the first currency in the currency pair to USD

For example, Margin = 1×100000/200 = 500 GBP for 1 GBPJPY lot with 1:200 leverage.

The margin value is always expressed in the base currency (stands first in a quote).

If necessary, convert it into the account currency (for example, USD): 500×1.4400=720 USD.

Indexes and oil:

Margin = Trade volume*Contract size*Price/Tick size*Tick price*Margin percent/100

An example for 1 UKBrent lot (as indicated in the specification: Contract size = 1, margin percent = 2, margin currency – USD, tick size = 0.001, tick price =0.1) Margin = 1*1*50,97/0.001*0,1*2/100 = 101,94 USD.

CFDs on shares

Margin=Transaction volume x Lot size x Price x Margin%/100

Since Margin% for all CFDs equals 5, the formula can be simplified:

Margin= Volume x Lot size x Price/20

Futures:

Margin=Transaction volume x Initial margin x Margin%/100

The initial margin and margin% are indicated in the specification of a financial tool within the trading terminal.

22. How much commission is charged when opening a CFD trade?

The commission is calculated by use of the following formula:

Commission = (current share price) x (transaction volume) x 0.05

23. What’s the difference between Futures/CFD/Forex profit calculation types?

Futures profit calculation type uses the following formula :

Profit=(Trade closing price-Trade opening price)*Tick price/Tick size*Trade volume

CFD profit calculation type uses the following formula:

Profit=(Trade closing price-Trade opening price)*Contract size*Trade volume

Forex profit calculation type uses the following formula:

Profit=(Trade closing price-Trade opening price)*Trade volume

- Trade closing price means the market price at which the trade was closed;

- Trade opening price means the market price at which the trade was opened;

- Tick price – the lowest value of an instrument’s price change expressed in the quote currency;

- Tick size – the lowest value of an instrument’s price change expressed in points;

- Trade volume – the trade volume expressed in lots;

- Contract size – the amount of commodity, currency, or asset units contained in 1 lot.

All the values are indicated in contract specifications within the MT4 platform.

24. Why is a fee charged or credited for overnight positions (Swap)?

Carrying over a position to the next day is executed with the help of short operations Roll-over or Swap (Tom/Spot).

The roll-over consists of two opposite positions for the same sum but different dates (Tom – tomorrow; Spot – the second working day) and slightly different rates.

The roll-over is an forced closure of the existing open position on a specific date and simultaneous opening of the same position on the next date at the price reflecting the difference in interest rates between the two currencies.

Depending on the direction of a position (Sell or Buy) the Client receives or pays the sum for carrying over the position (from one tenth of the point up to several points).

When transferring a position from Friday to Monday, the sum charged/paid is threefold.

The payment itself is done in the night of Wednesday.

25. Why does the Client pay or get money for carrying over a position?

The client pays or receives a payment for carrying over a position to the next day in case the client still has some open positions at the closing of the trading day.

The difference between rates of the national central banks whose currencies the client is using plays an important role when exchanging currencies.

This difference is built in to the swap points.

If the Client has sold the currency at the higher interest rate, he will pay for a position transfer.

If he has bought the currency at the higher interest rate, the broker will pay him for a position transfer.

This payment charged or received for having transferred a position is called Swap.

26. How long can I keep a position opened?

As long as you want, but you should keep in mind that if your position is still opened after 00:00 (the time of the terminal, see p.4.16) the fee (SWAP) will be paid or charged for each night while the position is kept opened.

27. What are long-term and short-term positions?

In the conventional sense, a long-term position is an order with an eye to get profit months or even years later.

Medium-term transactions are the deals where profit is expected within weeks or more frequently, months.

Short-term transactions are operations, which targets shall be reached in the nearest 1-3 weeks.

This definition for the terms of the positions is accepted in banks and investment funds and is also used by analysts making forecasts.

However, ordinary traders have different definition of long-term and short-term operations.

Intraday transaction is a transaction conducted within a day; trading in the few coming days is called short-term; medium-term operations are executed in the next week or two and long-term transactions are operations of the next month or two.

This definition is not accepted officially and is used by ordinary players at Forex.

28. What is “Margin Call” and “Stop Out”?

The Company has the right to compulsory close the client’s positions without prior notice, if the current equity is less than 100% of the margin required to maintain opened positions.

If several positions have been opened, the Company has the right to close one or several of them, starting with the one that is the most loss making at the moment of closure.

The current state of account is controlled by the server.

As soon as margin level reaches the value of 20% or less, the server activates compulsory closure of the position or all positions (Stop Out).

Stop Out is executed at the current market price on the first-come first-served basis.

29. What is “Credit Stop Out”?

If the margin requirement to maintain open positions is less than the amount of bonus funds, the Stop Out will occur as soon as the equity level reduces to the margin requirement level.

If the margin requirement to maintain open positions is higher than or equal to the sum of bonus funds, the Stop Out will occur as soon as the equity level reaches the level of bonus funds, or as soon as the Margin Level reaches the value of 20% (50% for CENT accounts).

The current state of account is controlled by the server that generates an order to close positions compulsorily in case the Credit Stop Out occurs.

The Credit Stop Out is executed at the current market price on the first-come first-served basis.

30. Why has a transaction on my account been closed without any notice?

Obviously there were not enough funds on the account to maintain the position opened.

As soon as Margin level is equal to or less than 20%, the server will close an order automatically.

Compulsory closure of the position is accompanied by the “stop out” notice in the log file.

Compulsory closure of the position in case of Credit Stop Out is accompanied by corresponding notice in the server’s log file with the comment “cso”.

In case of several opened positions, the position with the highest floating losses will be closed first.

31. What is a “trailing stop”?

When you set the “trailing stop” (for example for X points), the following procedure takes place:

The terminal waits until the position gains profit of X points (the amount specified in trailing stop).

After that, the terminal sets “stop loss” at a distance of X points from the current price (in our case, at the level of break-even).

If we receive quotes when the distance between the current price and “stop-loss” exceeds X points, the terminal will activate the command to change the Stop-Order for the distance of X points from the current price.

i.e. stop-loss follows the current price at the distance of X points.

Thereby, the “trailing stop” is the algorithm of controlling the “stop-loss” order – “price movement towards profit”.

32. How to reverse a position in MetaTrader?

Automatic reversal in MT4 is currently unavailable.

However there are several ways to do it manually:

- Open the opposite position and after that close the first one.

- Open the opposite position with twice as much volume and then close them using the option “Multiple Close By”. As a result, the “reversal position” is left. In such way you don’t have to pay spread for both positions, which can’t be avoided if you use the advice stated in p.1.

In order to reverse a position in MT5, you need to open an opposite position with twice as much volume: as a result, the reversal position will have the volume equal to the initial one.

33. Why are there only 4 currency pairs in “Market Watch”, although I know that the Company provides far more trading instruments?

Please right-click on any instrument in the “Market watch” window and select “Show all”; or select “Symbols” and after that indicate the trading instrument you are interested in.

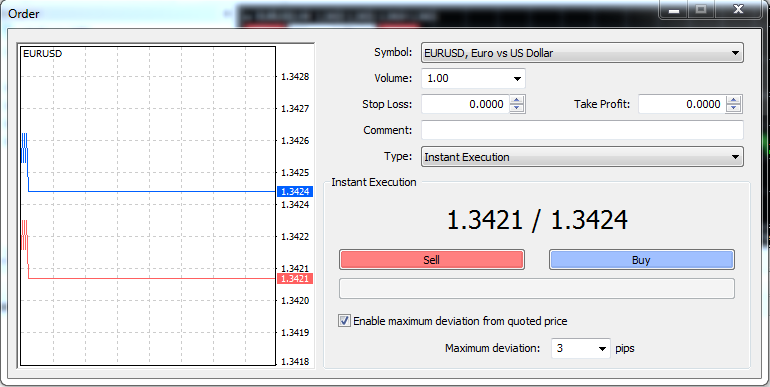

34. What is a maximum deviation of the price and what is this option used for within the trading platform?

A maximum deviation is a value of accessible deviation of the price expressed in pips.

By enabling the option “Enable maximum deviation from quoted price” in terminal automatically consents to a new price when opening an order if the new price doesn’t exceed the predetermined deviation.

This option is available for the Instant execution type accounts and will be much useful in the conditions of highly volatile market when prices change dramatically.

During strong market fluctuations it can be difficult to open an order, and the option “Enable maximum deviation from quoted price” can help to save your time.

Otherwise, in case a price changes fast when placing an order, the server will ask the trader to open a trade at a new price available for the moment.

It will take up some time and can prevent the possibility of entering the market.

35. How to set a maximum deviation from a quoted price when opening an order?

In case of strong market movement or when a server is rebooted, it can be difficult to place an order, so not to waste your time you can use the function “Enable maximum deviation from quoted price”.

To do this in the window of the trading terminal where you place your order tick the function “Enable maximum deviation from quoted price,” and indicate the value of permissible deviation in points.

Accordingly, if the price changes inside this range of 3 pips during the time of order opening, the order will be opened at a new price all the same.

36. What are the levels of support and resistance?

“Support” and “Resistance” are the concepts of technical analysis from the classic theory by J. Dow.

Support level is the level below the current market price, which suggests that the price rate can reverse upward.

Resistance level is above the current market price, suggesting that that price rate may go down.

37. What are the figures of profit or price movement?

Profit of 100 points is often referred to as the “Figure” of profit.

The figure of the price movement is the movement of price of 100 points.

The round amount is also sometimes called “the figure”.

For example: the expression “EUR/USD is going through the 17th figure” means that the rate went up above the level of 1.1700.

38. What is “Money Management”, or “Rules of money Management”?

Money management is the system incorporating certain rules in regard to admissible risks, as well as strict strategic framework for trading, such as: always consistent and unchanging tactics for placing orders, irrespective of time or conditions; thorough fundamental and technical analysis and desire to find the best points for entering the market.

Lately, this concept has become more general, and in the result of constant communication between traders at forums and seminars has lost its specificity; however at the same time it has become widely spread and easier for understanding.

Therefore, it is assumed that Money Management is a set of simple principles: to not risk more than one percent of the deposit at each deal; the principle of not entering the market (which means that it is better to wait for the better conditions and avoid transactions in case of ambiguous situation); to place stop-losses at the distance of 40-60 points from the price level of the transaction; to not chase instant profit of 20-30 points but concentrate on long-term and thus more profitable and less risky operations; constantly follow fundamental and technical analyses, basing your trading strategies on these analyses.

39. What is interest rate, % per annum?

These are interests paid on surplus funds (annual interest).

At the end of every day, at 23:59 (the time of the terminal, see p.4.16), the account status is checked and the amount of client’s own funds, which is not involved in the trading process, is determined.

The amount of the daily interest is calculated as follows:

%, daily = (free_margin – credit)*interest_rate/100/360

- “free_margin – credit” is the amount of client’s free funds at the time of calculation;

- “interest rate” is stated interest rate;

- “360” is number of days in the year.

The interest calculation algorithm is designed by a software developer and cannot be adjusted.

The value is calculated daily, stored and summed up automatically.

On the last calendar day of the month interests are paid for the whole month with the help of just one balance operation and with the “IR” comment.

If on the last calendar day of the month the account is archived, the payment of interest for the period when the account was active (daily interest paid in the current month) will not be made.

The account is archived if it has not been active for 90 days on condition that the account balance is less than 1000 units of the account currency.

If the balance is above this amount, the account will not be archived and the interest is paid in to the client’s account.

Please click "Introduction of LiteForex", if you want to know the details and the company information of LiteForex.

IronFX

IronFX

FXGT Broker Review: A Leader in High Leverage Forex and Cryptocurrency Trading

Comment by whatisgoingonTRUMP

February 17, 2025

Trump’s team holds 80% of the $TRUMP token supply, giving them the power to influence prices and put investors at risk. A crypto controlled by one group? Doesn’t seem very decen...