Moving Average indicator on OANDA MT4

Traders are constantly looking for a tool that can accurately show the time required to participate in a transaction to buy or sell. Regardless of the fact that all professional traders apply personal trading strategies, things have repeatedly proven that they are still constantly looking for simple ways to work effectively in the foreign exchange market.

How to apply the moving average indicator?

The use of simple methods achieves a reduction in losses and an increase in income. Moving averages are worthy of such tools, because they are used by most traders in the foreign exchange market to eliminate noise and find market entry and exit points.

The moving average shows the average price of a currency pair over a period of time. When calculating the moving average, the average price of the currency over a certain period of time is mathematically calculated. According to price changes, its average value is also limited by up or down changes.

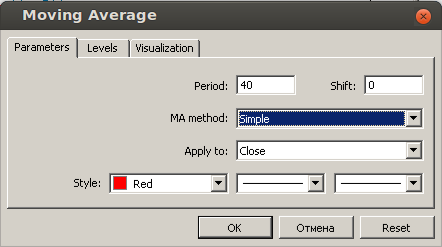

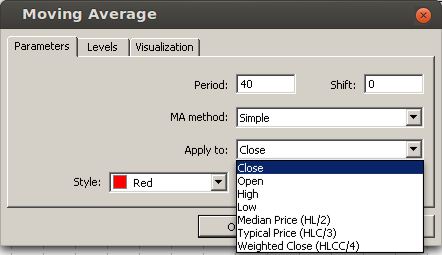

The moving average on the chart shows the average price of a particular currency pair in the previous period, that is, it will smooth the price chart. In the period when more average values are calculated, the corresponding graph will be smoother. Although moving average curves can also be calculated on the basis of “high”, “open” and “low” averages, they are usually made on the basis of the currency’s closing price.

If the price is stable and the fluctuation range is close to the moving average, it is not recommended to open new positions.

In a shorter period, the moving average responds more quickly to currency pair price changes, but, at the same time, it is not enough to filter “noise”. For longer periods, the moving average will offset the effects of noise, but the response to trend changes will be delayed.

Sign up with OANDA to trade Forex

Using the Moving Average on chart

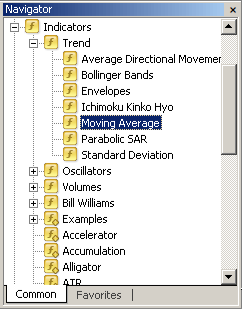

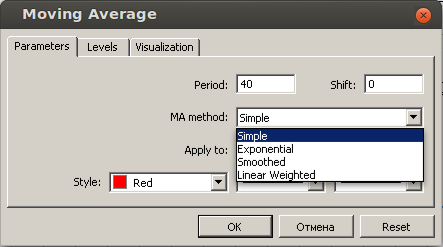

Moving average is the most commonly used technical indicator in real trading. Usually used for demo transactions and transactions on real foreign exchange accounts on platforms such as MT4, 4 types of moving averages are proposed: simple, exponential, smooth and linear weighted moving averages.

Moving averages smooth the price data to form a trend indicator. They will not predict the direction of the price but will determine the direction in which the price movement is delayed. Moving averages start to lag behind the current price because their values for all time periods are based on the results that the currency has shown before. Regardless of this lag, moving averages can help moderate changes in currency pair prices and filter out noise.

This movement is considered to be the basis of many technical indicators, such as the Moving Average Convergence and Divergence and Bollinger Bands. Simple and exponential movements can be used to determine the direction of the trend, points of exit and entry into the market.

As for other indicators, moving averages are used to facilitate traders to predict future prices. Taking into account the sliding angle, you are more likely to determine the direction and strength of potential price changes in the currency market.

As already mentioned, this technical indicator refers to the main indicator of the foreign exchange market. However, unless you have determined the clear rules for moving averages to work on a demo account, otherwise, there is no need to open a real trading account. Otherwise, the chance of becoming one of the losers will greatly increase.

Please click "Introduction of OANDA", if you want to know the details and the company information of OANDA.

IronFX

IronFX

FXGT Broker Review: A Leader in High Leverage Forex and Cryptocurrency Trading

Comment by whatisgoingonTRUMP

February 17, 2025

Trump’s team holds 80% of the $TRUMP token supply, giving them the power to influence prices and put investors at risk. A crypto controlled by one group? Doesn’t seem very decen...