Fibonacci in Forex. Table of Contents

- Learn about Fibonacci Retracement Trading Strategy

- Who is Fibonacci? Introduction to "Mathematics"

- Introducing Fibonacci in the foreign exchange market

- Draw Forex Fibonacci Retracements in MT4

- Fibonacci retracement strategy for foreign exchange trading

- How to use Fibonacci for Forex trading?

- Fibonacci retracement trend-tracking strategy

- Confirmation of secondary indicators

- Looking at trends across multiple time frames

- How to enter the foreign exchange market

- Take profit and stop loss levels

Learn about Fibonacci Retracement Trading Strategy

The tool derived from the Fibonacci sequence is one of the most effective tools in the field of foreign exchange technical analysis. This is not surprising, as they can show key turning points where prices may reverse. Forex Fibonacci levels are widely used by retail foreign exchange traders and traders of major banks and hedge funds. This article introduces how to use Forex Fibonacci Retracements in trading. We will explore its digital origins and show how to apply the Forex Fibonacci Retracement on the chart.

Who is Fibonacci? Introduction to “Mathematics”

Leonardo Pisano, born in Pisa in 1170, is known by his nickname Fibonacci. He was educated in North Africa, traveled around the world, and studied different number systems and calculation methods. The Roman numeral system was the most popular at the time, but Fibonacci recognized the great advantages of the Arabic numeral system used in the countries he visited. He began to study this new system, and in 1202, in his famous book “Calculation”, also known as “Book of Calculation”, introduced what is today known as Indian notation-the Arabic counting method.

It had a profound impact on European thought because the arithmetic operations with Arabic numerals were much faster and more efficient than the old Roman system. This book was widely copied and attracted the attention of Holy Roman Emperor Frederick II, who awarded him a Fibonacci salary in recognition of his contributions.

The book is composed of three parts. The first part introduces from 0 to 9 and position markers. This book shows the practical value of the new digital system through its applications in bookkeeping, weight calculation, interest, exchange rate, and other applications. The second part involves a series of problems faced by merchants, such as commodity pricing, profit calculation, and currency exchange. The author is mainly famous for the Fibonacci numbers and sequence of numbers introduced in the third part.

The Fibonacci sequence is a series of numbers, where each number is the sum of the previous two numbers. 0,1,1,2,3,5,8,13,21,34,55,89,144…and all the way to infinity.

This sequence is directly related to the “golden ratio” because the ratio of any two numbers in the sequence is very close to 1.618. Therefore the number 1.618 is called the pi or golden ratio.

The golden ratio often appears in nature, architecture, fine arts, biology, and even the financial and foreign exchange markets. Examples where the golden ratio appears to include the Great Pyramid of Giza, Leonardo’s Mona Lisa, Nautilus shells, spiral galaxies, sunflowers, branches, beehives, and human faces.

Use Fibonacci for Forex trading

Introducing Fibonacci in the foreign exchange market

You will see the most commonly used 61.8%, 38.2%, and 23.6% foreign exchange Fibonacci retracements in financial markets. These numbers do not come directly from the sequence but from the mathematical relationship between the numbers in the sequence.

The 61.8% ratio comes from dividing the previous number in the Fibonacci sequence by the next number. For example: 34/55 = 0.6181.

This 38.2% ratio is obtained by dividing the number in the Fibonacci series by the second number afterward. For example: 34/89 = 0.3820.

The ratio of 23.6% comes from the Fibonacci sequence divided by the third number afterward. For example: 34/144 = 0.2361.

Go to OctaFX’s Official Website

Draw Forex Fibonacci Retracements in MT4

To draw the Fibonacci retracement line, you need to click on the Fibonacci indicator in the toolbar in the upper left corner of the screen.

In the case of a decline, double-click and drag from the high point of the fluctuation range (previous high) to the low point of the fluctuation range (recent low). The software will automatically find 23.6%, 38.2%, 50%, and 61.8% retracements The level of the bit. These horizontal lines show where the reverse market will most likely encounter resistance in the future in other words, prices may rebound and fall back.

In the case of a rise, double-click the low point of the fluctuation range and drag it to the high point of the fluctuation range. You will see 23.6%, 38.2%, 50%, and 61.8% horizontal lines on the chart. These lines represent the level of possible support for the price-in other words, the price may rebound and recover.

Fibonacci retracement strategy for foreign exchange trading

Forex Fibonacci retracement levels are determined by the highs and lows on the chart, and the key Fibonacci retracements of 23.6%, 38.2%, and 61.8% are displayed in the fluctuation range. These horizontal lines represent potential reversal levels. Fibonacci retracements can help determine where to place orders, gain profits or stop losses. They can also point out key support and resistance levels.

Usually, the correction level is calculated after the market has risen or fallen sharply, and it seems to flatten out at a certain price level. The most common Fibonacci retracement levels are 61.8% and 38.2%. By drawing a horizontal line in the fluctuation range table to determine the area of the market callback, and then restore the general trend formed by the initial large price changes. When the market reaches major price support or resistance levels, it will oscillate sharply.

There is usually a 50% retracement line or 0.5 line in the Fibonacci horizontal grid. It is not a Fibonacci number, but it is widely regarded as an important turning point.

Forex Fibonacci Retracements often form important support and resistance levels and can be very accurate. Try Fibonacci retracements in different markets and time frames to find the most suitable foreign exchange trading strategy for you.

We have also prepared an article to introduce more foreign exchange Fibonacci retracement strategies. You will know how to combine Fibonacci retracements with indicators, find the right time to enter the market and how to define a trend that spans multiple time periods.

Use Fibonacci for Forex trading

How to use Fibonacci for Forex trading?

In the first part, we discussed the origin of the foreign exchange Fibonacci sequence, which was originally proposed by Leonardo Pisano (nicknamed Fibonacci) in the book “Mathematics” together with the Indo-Arabic number system. In Fibonacci’s original sequence, each number is the sum of the first two numbers: 0,1,1,2,3,5,8,13,21,34,55,89,144,233,377 and so on. Divide the previous number by the next number to calculate the “golden ratio” (φ = 1.618), for example: 8/13 = 61.53%, 34/55 = 61.81%.

The 23.6%, 38.2%, 50%, and 61.8% of the Fibonacci retracement line play an important role in the financial market and are used to define the key position of the price reversal. Fibonacci retracements help determine the strategic position of entering the market, prevent losses and determine areas of support or resistance.

The second part will introduce Fibonacci’s most powerful and easy-to-understand application in foreign exchange market transactions.

Go to OctaFX’s Official Website

Fibonacci retracement trend-tracking strategy

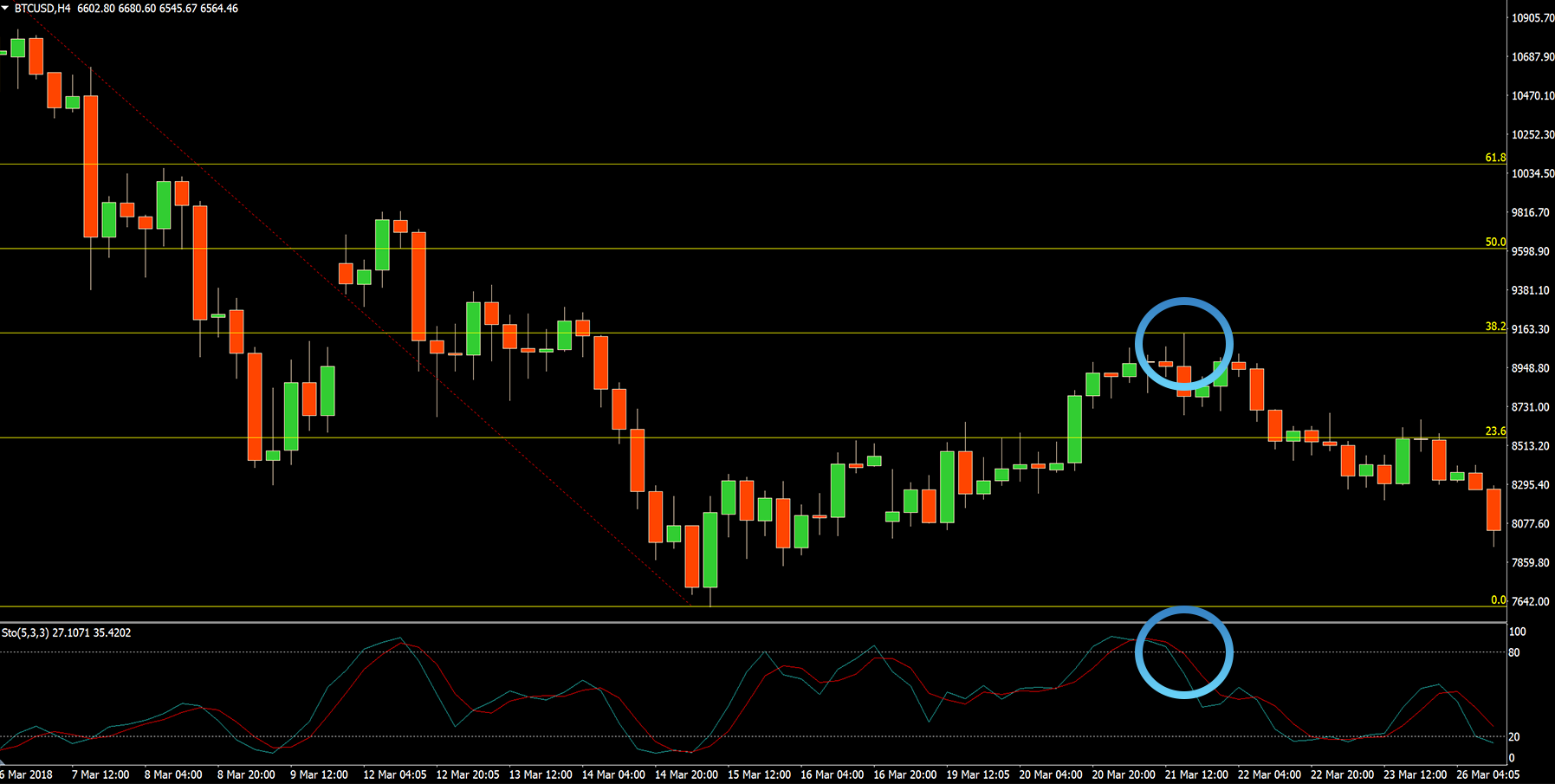

Before we start, let’s take a look at the Bitcoin 4-hour chart:

![]()

Here we can see that the price was in a downtrend before the rebound, and rebounded accurately at the 38.2% retracement line.

After reaching the 38.2% Fibonacci water retracement level, the price reversed and fell, which is the direction of the overwhelming trend.

As can be seen from the chart, there are several different callback levels: 23.6%, 38.2%, 50%, and 61.8%.

They all represent potential downside resistance levels. Therefore, these levels all represent potential entry points for re-entering the downtrend. This means that we have four potential reversal points to enter the market. But which location should you choose?

Technical indicators and price trends can help you.

Confirmation of secondary indicators

Looking at the chart above, we can see that the Stochastic Oscillator provides us with a clue that the market will reverse. The Stochastic Oscillator is above the 80 lines and bent downward, which is a bearish indicator.

Therefore, as the price rises to the 38.2% correction level and the stochastic oscillator sends out a sell signal, a good time to sell orders gradually emerges, which is what the trading industry calls “short”.

Use Fibonacci for Forex trading

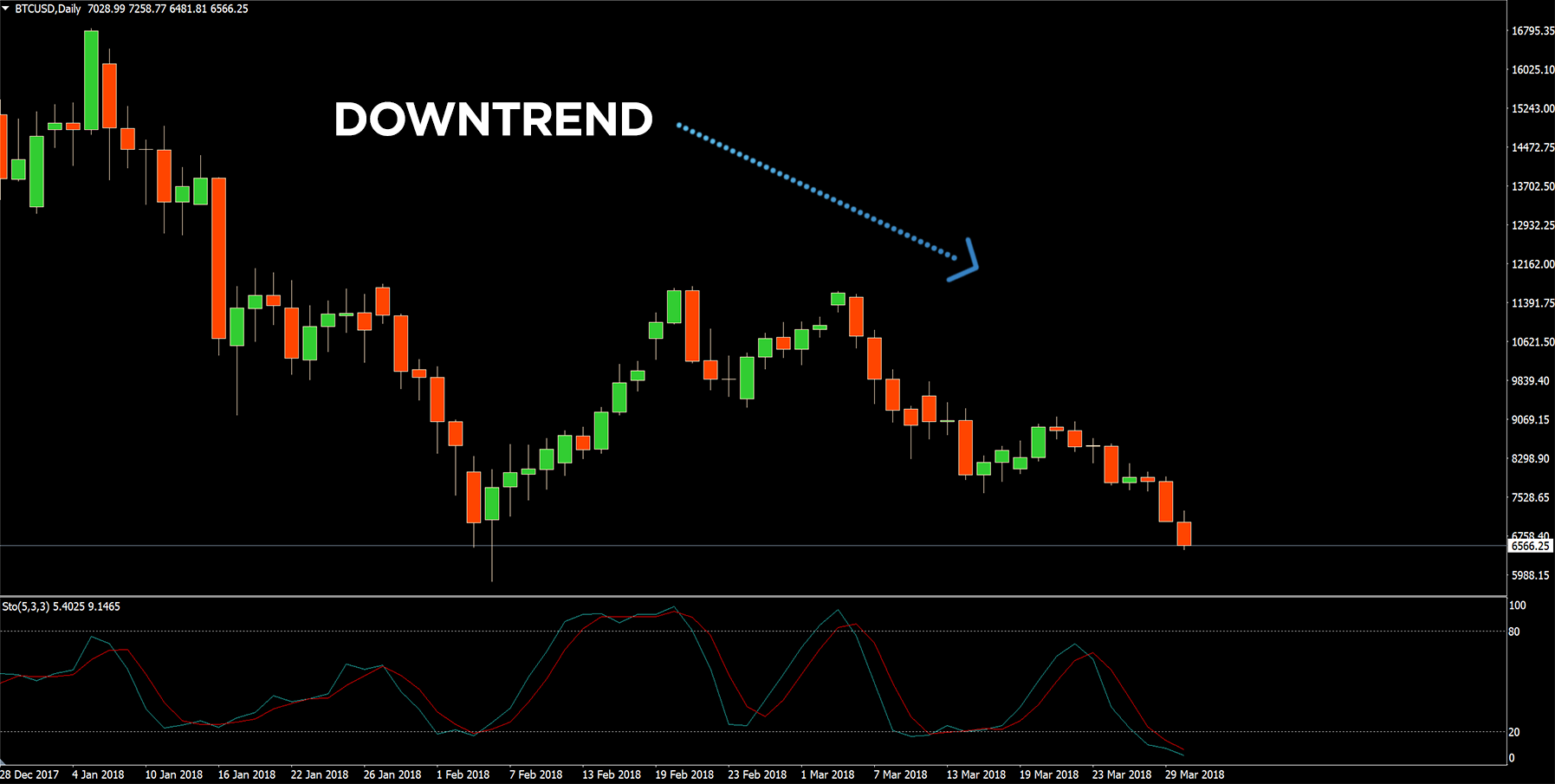

Looking at trends across multiple time frames

A good trader is like Sherlock Holmes, who constructs cases based on multiple clues. We found two good clues to short positions, but this is not over yet.

Enlarging the picture and looking at the daily chart above, we can see that the trend is also roughly downward in this time frame.

This further supports the judgment of selling Bitcoin at the 38.2% Fibonacci retracement level.

For short positions (sell transactions), we would like to see a downward trend in the market over multiple time frames. For long positions (buy transactions), we want to see the market in an upward trend over multiple time periods.

The Fibonacci rebound on the four-hour chart is relatively large. The 38.2% line was at 9119, and the price fell all the way to 8190 US dollars, a drop of more than 900 US dollars.

This is a foreign exchange strategy that can be applied in different time frames. For example, you can find similar settings on the 30-minute chart instead of the four-hour chart we used as an example.

Remember that in a shorter period of time, you will get more signals, but their reliability will decrease.

Conversely, in a longer time frame, you will get fewer signals, but they will be more reliable.

Go to OctaFX’s Official Website

How to enter the foreign exchange market

To enter the foreign exchange market at the Fibonacci retracement level, you can set a sell stop order (in the case of a downward rebound) or a buy stop order (in the case of an upward retracement). Or, when the price reaches the Fibonacci level, you can choose to place an order manually using a market order.

Take profit and stop loss levels

A good rule of thumb is to set a profit target that is more than 3 times the loss target. Therefore, in the above foreign exchange transactions, we can set the risk to $200 and the profit target to $600.

Fibonacci retracements will help determine support and resistance areas, but by combining them with other indicators and foreign exchange strategies, the tool can be used to the greatest effect. For example, you can use stochastic oscillators to define trends and price reversals. Fibonacci retracements are trend-following tools, and viewing trends in multiple time frames will give you more accurate predictions. Fibonacci retracements are a good confirmation tool that can ensure high-probability trading combined with the strategies presented in this article. We hope you can find the best way to trade using Fibonacci retracements.

Use Fibonacci for Forex trading

Please check OctaFX official website or contact the customer support with regard to the latest information and more accurate details.

OctaFX official website is here.

Please click "Introduction of OctaFX", if you want to know the details and the company information of OctaFX.

IronFX

IronFX

FXGT Broker Review: A Leader in High Leverage Forex and Cryptocurrency Trading

Comment by whatisgoingonTRUMP

February 17, 2025

Trump’s team holds 80% of the $TRUMP token supply, giving them the power to influence prices and put investors at risk. A crypto controlled by one group? Doesn’t seem very decen...