What are Guaranteed stop-loss orders?

Protect your positions from market gapping and slippage with a guaranteed stop-loss order (GSLO). Available on forex, indices, gold, silver and crude oil. Upgrade to a professional trading account and get additional margin relief when you place a GSLO on your trades. Available on the OANDA Trade platform and mobile and tablet apps.

Guaranteed stop-loss orders protect your positions by guaranteeing to exit your trades at the exact price you specify, regardless of market volatility. This is different from stop-loss orders, which may be filled at a worse price level than the one you may have requested due to “slippage”. GSLOs incur a fee (or GSLO premium), but this is only charged if the GSLO is triggered.

GSLOs protect your trade against slippage or gapping

Placing a GSLO would protect your trade from this slippage. As seen in this chart, the market gapped but the GSLO was still filled at the requested price level. Since the GSLO was triggered, a GSLO premium was charged. If you had placed a stop loss order, your trade would have been closed at the next available price when the markets reopened for trading.

How to place guaranteed stop-loss order on OANDA

How to place a guaranteed stop-loss order on OANDA Trade mobile, web or desktop?

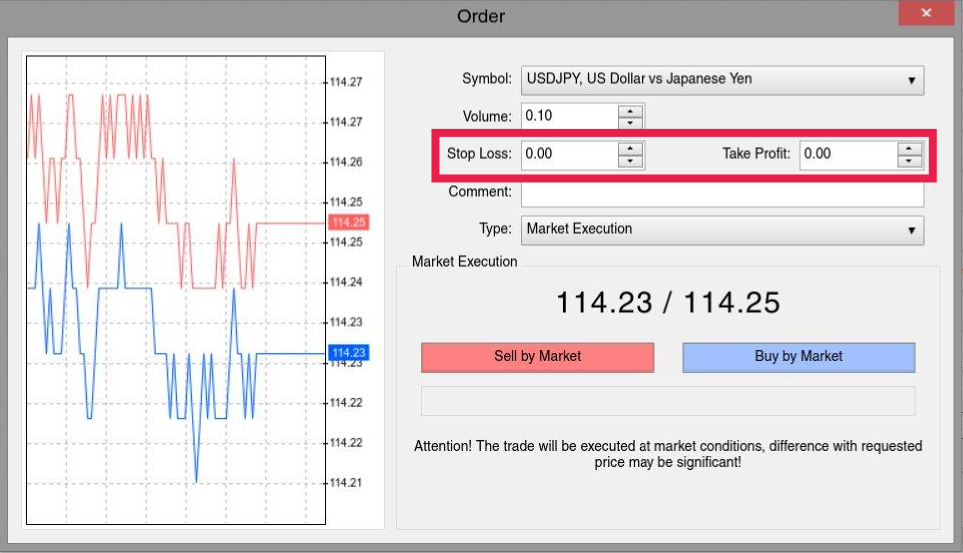

To add a GSLO to order, simply tap the stop loss button and set your GSLO level either by price or select the level by the number of pips away from the entry price at which you would like your GSLO to be triggered. A GSLO must be placed a ‘minimum distance’ away from the entry price. This minimum distance is displayed on the ticket. The GSLO will be selected automatically here when adding a stop.

If a trade has a GSLO associated with it, this is displayed on the portfolio/trades screen like a normal stop-loss, with an additional “G” next to the stop loss level.

Trade with OANDA’s guaranteed stop-loss

The importance of a stop loss

Trading on foreign exchange is a series of activities. Not only can every trader know how to calculate profit, but he can also learn to stop losses on time, close orders and complete transactions. A one-minute delay often leads to serious losses.

It is very important to control the trading process near the computer (at least when opening an order). Sometimes this is impossible. In this case, it is better to use pending orders , such as stop-loss or take-profit orders. When you happen to be unable to manage the situation of closing orders (even if you are in control and are near your computer), don’t forget this difference. In this case, not only will you have no profit, but you will also lose the money in your account. But if you act in time, you can usually avoid such “accidents”.

So, what is a stop loss?

Limitation of loss. In most cases, the stop loss limit does not exceed 10% of the margin of each order. If the company is geared towards novices, the limit may be as high as 15-20%. Therefore, the main task of this order is to reduce the trader’s losses.

Although stop loss has many advantages, many experts do not use it. The reason for this uncertainty is the debate about possible losses. Some experts believe that all deposits of traders can be absorbed through a stop loss. Others believe that if there is no stop loss, the trend is usually not unfolding, and the price will “kill” these deposits. It is worth noting that if you wait for the price to return to the previous level, you can avoid these losses in the first place. The opinion and the outcome of the transaction are different.

In any case, we cannot cast aside any point of view. You can cooperate with Stop Loss or not cooperate with it. But in most cases, stop-loss selling makes sense. To prove this, we can say that this is a very popular amount for experienced traders. In most cases, the success of the transaction depends on the size of the trading instrument. You can set a limit of less than 10 points, and lose all the margin, or part of the margin. Or you can place an order at the level of 150-200 points. You must consider whether the stop loss depends on the number of deposits and the chosen share.

Imagine a common situation: there is approximately $1,000 in a trader’s account. At the same time, the order volume is 1 share, the stop loss is set at 50 points, and the profit is set at 100 points, which means that a larger part of the deposit is likely to be lost. If the stop loss is placed at 300 points between the highest and lowest price levels on the weekly chart, then profits may increase significantly. Among them, the chance that the order will eventually close to the stop loss is minimal.

How to use stop loss?

If it is a buy order, the stop loss must be lower than the open trade level. The goal is the same-to minimize the possibility of loss and increase the possibility of retaining margin in the event of a substantial reduction in the price.

If a sell order is established, the stop loss must exceed the level of the open order. In this case, if the price increases, the loss will be minimal. There are some traders who try to move the stop loss and expect the price to reverse. This is not a good idea, because in 50% of the cases it will lead to higher losses.

The special case of using stop loss-trailing stop loss. This function can move the boundary of the stop loss after market changes. When the market exceeds 15 points in the desired direction, the border automatically shifts. Among them, if the trailing stop loss works at least once, the trader will get his profit. In the case of a price reversal, the trader will not lose his profit, and the profit will be fixed at the last trailing stop loss level.

Stop loss is not used with the tap resell strategy. Because in this case, the time spent on selling may have a negative impact on profitability.

In any case, we need to use stop loss, because only with the help of this tool can we guarantee the safety of the margin. Of course, you must know how to use it, otherwise the effect may be counterproductive.

Trade with OANDA’s guaranteed stop-loss

Risk Management

As you know, every transaction in the currency market exposes a certain level of risk. In order to reduce possible losses and increase profits, traders will use some risk management methods. There are some types of risk management:

First, you should conduct a prior analysis. You need to establish positions objectively and rationally. If a trader knows what is happening in the foreign exchange market, he can increase his chances of making huge profits. The prior analysis includes current affairs analysis, the determination of high and low positions of the day, and the identification of current trends.

Trade with OANDA’s guaranteed stop-loss

Creation of trading plan

The second method is to create and follow the trading plan.

Every trader has his own trading strategy. Some traders use fundamental analysis, others use technical analysis, and some other traders only use their own intuition. The only difference is the profit of each trader’s strategy. You can create your own strategy, or use an existing strategy and adjust it yourself. If a trader uses a certain algorithm and follows its rules, then he can analyze his own mistakes and not repeat them in the future. What can also help is not to follow emotions when trading. Any strategy must be a profitable long-term investment. When a trader uses a trading strategy to have good and stable results, it is best not to start trading on a real account.

It is not recommended to use more than 5-15% of the total account deposit for each order.

How to manage foreign exchange trading risks

Determining the proportion of losses is another method of risk management.

The essence of this method is to estimate the loss during the transaction. In addition, it is necessary to diversify transactions. It is not recommended to use more than 5-15% of the total account deposit for each order. Remember that many currency pairs are interrelated.

It is best to deposit the total amount, which is free to use.

The next method is the use of stop loss. When/after the order is opened, you should place a stop loss order. Normally, this method is not applicable when using a tap resale strategy. However, trading without a stop loss is very dangerous.

In addition, it is very important to admit your mistakes. If you have made some mistakes, you need to make up for the loss and analyze the situation. It is not recommended to try “The staying time is longer than the lost time”. If losses are increasing and the price is moving in the opposite direction, it is better to close the order.

If you are not confident, it is best not to start trading.

Another method worth mentioning in risk management is emotion control. Impulse and greed are unacceptable in the currency market. It is best to use awareness and good judgment. Only in this way can you respond to changes in the market. If you feel too nervous, it is best to interrupt the transaction. Psychological factors are important to every trader.

In addition, if you are not confident, it is best not to start trading. In this case, it is best to stay away from the market. If you think you may have misunderstood the signal, do not open the order. Details and clarity are very important in trading. Only in this case can you get your profits in the foreign exchange market.

These very simple but effective risk management methods allow you to reduce losses, increase your profits, and quickly respond to price changes in the market.

Trade with OANDA’s guaranteed stop-loss

Please click "Introduction of OANDA", if you want to know the details and the company information of OANDA.

IronFX

IronFX

FXGT Broker Review: A Leader in High Leverage Forex and Cryptocurrency Trading

Comment by whatisgoingonTRUMP

February 17, 2025

Trump’s team holds 80% of the $TRUMP token supply, giving them the power to influence prices and put investors at risk. A crypto controlled by one group? Doesn’t seem very decen...