Fund Deposit and withdrawal of Exness. Table of Contents

- How much is required to trade FX and CFDs with Exness?

- Is Exness safe and secure to deposit

- How to deposit funds to Exness?

- Making a deposit to Exness's Demo account

- Processing Time of Fund Deposit and Withdrawal

- What happens when making a deposit in different currencies?

- Deposits from third parties are prohibited2

- Exness supports NBP (Negative Balance Protection)

- Verification of payment methods - Bitcoin and credit/debit cards

- Deposit Exness using prepaid cards

- What is CVV and where can you find it?

- What is 3D Secure (International Secure Payment)?

- Using more than one bank card to deposit funds

- How to delete your bank card registration in the client area

- Why you don't see some payment methods on Exness?

- Making a deposit with eWallet account registered with another email address

- Exness Traders App may show fewer payment methods

- How to withdraw funds from Exness account?

- "Out of Funds" error when making a withdrawal

- Fund goes back to the same source

- Fund Withdrawals while having open positions in the account

- In case you have withdrawn funds to the wrong account?

- In case the withdrawal amoutn returned to trading account

- How to cancel a deposit or withdrawal request

- The fastest way to deposit and withdraw funds

- Checking the status of your transactions

How much is required to trade FX and CFDs with Exness?

Just as the minimum amount that can be traded for each account type is different, the minimum amount required to trade indices also depends on the account type that trades that instrument group.

You can trade indices across all account types, so be sure to check the minimum deposit amount for each account type.

| Standard: | USD 1 |

|---|---|

| Standard Cent: | USD 1 |

| Pro: | USD 200 |

| Raw Spread: | USD 200 |

| Zero: | USD 200 |

The minimum deposit amount for certain professional accounts may vary by region, so we recommend that you also check the minimum deposit amount for your region.

In fact, the minimum amount required for trading can be affected by fluctuations in a number of factors, such as the current spread of each product in the index group and the contract balance requirement.

This can vary from day to day depending on market conditions, so it’s a good idea to make sure your conditions are unchanged before trading.

In addition, even if you register an account with the Exness Trader App, Exness offers a demo account with a balance of 10,000 USD that you can use right out of the box.

You can add or deduct your balance by pressing the deposit or withdraw button.

Is Exness safe and secure to deposit

Financial security is a top priority at Exness.

Exness takes strict measures to ensure the safety of your funds.

Here are the steps Exness is taking to ensure financial security:

- Separation of customer funds

- Customer funds are kept separate from company funds to protect funds from any events that may affect the company. Exness manages company funds to be larger than customer funds, so Exness can compensate you whenever necessary.

- Transaction Verification

- A one-time pin number will be sent to the customer’s mobile phone or email associated with the account (the security type selected at registration) upon withdrawal request to verify that the transaction was requested by the account’s legal owner.

Exness understands that transparency is essential to the success of both Exness and our customers.

To this end, Exness continuously publishes economic reports on its website for customers to check.

The report can be found here.

How to deposit funds to Exness?

Exness offers a variety of payment options including electronic payment services when depositing into your trading account.

You can make a successful deposit by considering a few guidelines:

- Please confirm that personal information area authentication has been completed. After the uploaded proof of identity and proof of residence is reviewed and accepted, verification is completed.

- The first deposit must meet or exceed the minimum deposit requirements for each account type. The minimum deposit amount for Standard and Professional accounts may vary.

- If you are using a specific payment system, please double check the minimum deposit requirements.

- Finally, please double check that the account number and Exness account holder and full name match whatever payment method you wish to use.

The steps required for depositing depend on the payment method you choose, but the first step is always:

- Log in to the personal information area.

- Select Deposit on the left side of the main menu.

- Please select the payment method you want to use and follow the instructions.

Exness does not charge fees for deposits and withdrawals.

However, certain electronic payment systems (EPS) have their own transaction fees, so it is best to consult our payment systems in advance.

Any additional steps will depend on the payment method you choose.

How to deposit and withdraw funds to/from Exness’s accounts?

Making a deposit to Exness’s Demo account

Depositing into a demo account is a straightforward process and is possible across multiple platforms.

If you are a PC user, just follow these steps.

- Log in to the Exness personal information area.

- Go to the Deposit tab.

- Select Demo account replenishment under Other methods.

- Select the demo account, amount, and currency, then click Make Deposit.

- A message appears indicating that the deposit was successful.

or

- Log in to the Exness personal information area.

- Find the demo account you want to deposit.

- Click Set Balance, then enter the amount to be reflected in the demo account.

- Click Set Balance again to complete the operation.

- The correct balance has been set successfully.

If you are an Exness trader user:

- Log in to the Exness Trader app.

- Press the dropdown and set as a demo account.

- Swipe until you find the demo account you want to deposit.

- Press deposit, enter the amount, and click Continue.

- A confirmation message appears indicating that the operation has been completed.

How to download and use Exness Trader Mobile App?

Processing Time of Fund Deposit and Withdrawal

How long will it take for a deposit or withdrawal transaction to be processed?

- Deposit time

- Depending on the payment method you choose, processing times may vary. All payment methods that you can choose from can be found in the Deposit section of the Personal Information area.

- Withdrawal time

- Most withdrawals are processed immediately* and funds are typically deposited within seconds. The term “immediately” means that the transaction is completed within a few seconds rather than being processed manually by a person in the finance department.

If you exceed the stated deposit or withdrawal time, please contact Exness Customer Support for assistance.

Deposits, withdrawals and transfers are all possible on weekends and holidays.

However, since weekends and public holidays are not’business days’, there may be some delays for tasks that require authentication.

Don’t be nervous and plan your strategy ahead of time by referring to the trading hours of the forex market.

How to make a deposit to Exness via online wallet (eWallet)?

What happens when making a deposit in different currencies?

You can deposit in any currency, but conversion rates may apply if your account currency does not match the currency you wish to deposit. In addition, currency rules may differ for each payment platform, so please check the deposit instructions.

To find out what the currency of your account is, log in to the client area and check-in which currency your tradeable balance is displayed.

Each account may have a different account currency set at the time of opening, and you cannot change the settings after opening an account for the first time (so please choose carefully).

How to deposit funds to Exness via credit/debit card?

Deposits from third parties are prohibited

Exness prohibits deposits from third parties, so you must use a payment system registered in your name to deposit funds into your account.

In the case of withdrawal, since funds can only be withdrawn using the payment system used for deposit, these measures are being taken to prevent disputes during the withdrawal of funds.

If for some reason your preferred payment system is blocked or unavailable, please contact Exness Customer Support for assistance.

Exness supports NBP (Negative Balance Protection)

If you find that your account balance is negative, we recommend that you wait for the account balance to be automatically corrected via a NBP operation, which is an operation that adjusts the negative balance of the account to zero.

Exness provides negative balance protection and executes NULL operations on all accounts with negative balances.

If you deposit to an account with a negative balance, only a portion of the negative balance will be deposited, so please contact Exness Customer Support to recover the deducted amount.

Verification of payment methods – Bitcoin and credit/debit cards

For transactions using Bitcoin and credit/debit cards, you must provide both proof of identity (POI) and proof of residence (POR) documents.

However, if this is your first time using most payment methods, address verification is not required.

In order to continue trading, you must verify all areas of your personal information.

To verify all of your personal information areas, log in and click Complete verification at the top of the main screen.

Follow the on-screen instructions to complete your economic profile and upload proof of identity and residency.

After verification is complete, you can trade with any available payment method (but regional restrictions apply).

For more information, please refer to the Payment Comprehensive Guide.

Exness FAQs – Everything about Account and Client Portal

Deposit Exness using prepaid cards

Exness accepts deposits using prepaid cards issued by banks and other payment institutions.

Also, when making a withdrawal, be aware of the following:

- All deposits must be withdrawn as a refund, which means you must withdraw an amount equal to the deposit amount.

- Proceeds can be withdrawn after all deposits have been refunded.

- Some payment institutions that issued prepaid cards may not allow withdrawal of profits. In this case, the withdrawal request will be rejected and the amount will be displayed again in your trading account in a few hours. You can then withdraw your proceeds using another payment system that you used to deposit. If you have never used another payment system, use your preferred payment system to deposit a minimum deposit before proceeding. In this section you will find details on all payment methods offered by Exness.

If you continue to have problems with the use of your prepaid card, please feel free to contact Exness Customer Support.

What is CVV and where can you find it?

CVV stands for Card Verification Code, Card Verification Value, and is a 3-digit number on the back of your VISA or Mastercard debit/credit card.

This is part of a measure to reduce fraud when paying online.

Exness requires you to enter your CVV number when attempting a card transaction.

CVV can be found on the back of the card.

What is 3D Secure (International Secure Payment)?

3D Secure (three domain authentication) is an additional security system for online debit/credit card transactions, and is implemented to prevent any fraud that may occur during the transaction.

Exness only accepts deposits and withdrawals for debit/credit cards with 3D Secure registered.

This adds the step of entering the card information and then entering the OTP (One-Time Pin/Password) sent to your phone to complete the transaction.

Open EXNESS’s Account for Free

Using more than one bank card to deposit funds

Yes, there is no limit to the number of bank cards that can be stored in the client area.

Please note, however, that withdrawals must be made in exactly the same way as the payment method used to deposit.

This is to prevent fraudulent withdrawals from your account by others.

Therefore, if you have used one bank card when depositing, the funds cannot be withdrawn using another bank card.

This rule is very important, so please be careful when trading, please click the following link for detailed information regarding payment.

Deposit and withdrawal of funds using multiple bank cards

You can use multiple bank cards to deposit funds into your account, and there is no limit to the number of bank cards you can use.

However, keep in mind the following basic Exness rules:

- The amount deposited by bank card must be withdrawn using the same payment method and amount used for the initial deposit.

- In the case of deposits with multiple bank cards in the trading account, proceeds must be withdrawn separately after withdrawal of the deposit amount.

- Profits to be withdrawn must be proportional to the amount deposited by bank card.

Suppose you have 2 bank cards and you deposit 20 USD with the A card and 25 USD with the B card.

At the end of the trading session, the proceeds were 45 USD.

Now you want to withdraw a total of 90 USD (including profits).

Before you can withdraw 45 USD of proceeds, you must withdraw 20 USD to A card and 25 USD to B card.

Proceeds must be proportional to the deposit amount, so you need to withdraw 20 USD to the A card and 25 USD to the B card in proportion to the amount deposited using both bank cards.

If you want to use that card to withdraw the same amount or withdraw your proceeds, it’s a good idea to check how much you have deposited with each bank card.

How to delete your bank card registration in the client area

Yes, any bank card you have added to the client area can be deleted by following these steps:

- Log in to the personal information area.

- Select Deposit> Bank Card.

- Select a trading account, enter the desired amount and click Continue.

- In the pop-up window that appears, select Delete this card, then click Yes to complete the operation.

When the operation is complete, the card is deleted.

Why you don’t see some payment methods on Exness?

If you don’t see a particular payment system in the Deposit or Withdrawal section of your client area, it may be that maintenance is currently in progress or that payment system has been temporarily removed.

Exness offers a variety of payment service options, but they know you prefer the payment system of your choice.

If you wish to make a deposit, please wait for the payment system to appear again.

If you are in a hurry, please consider using a different payment system

If you wish to withdraw, please wait for the payment system to appear again.

If you are in a hurry, please email us with the following information: This will help you check in detail what you have requested.

- Account Number

- Name of payment system required for withdrawal

- Account authentication password

The Exness customer support team will then review the status of your payment system and will help you or see if you can withdraw with another payment method.

Thank you for your patience while completing the maintenance.

Maintenance work can arise from a variety of problems, from problems with payment service providers to problems with the banking system itself.

Making a deposit with eWallet account registered with another email address

Yes, even if you choose an electronic payment service (EPS) registered with an email address different from that registered with Exness, you can continue to transact using that electronic payment service (EPS).

If the email registered with Exness and the electronic payment service (EPS) email are different, the deposit will be processed manually and may take a long time.

If you have any problems with your deposit, please contact Exness Customer Support.

Exness Traders App may show fewer payment methods

Exness Trader is an application that allows you to easily access and trade your personal information area (PA) on the go.

However, this app is shortly thereafter, and Exness is constantly updating it to meet your needs and expectations.

You may see fewer deposit/withdrawal payment options compared to the current web client area (PA), but please wait a bit as more work is in progress.

If you have any comments or a payment method you would like to see added, please feel free to contact our customer support team.

How to withdraw funds from Exness account?

It’s very easy to withdraw funds from Exness.

All you need to do is access your client area, payment system account, and security type (email/SMS) settings.

Here’s how to do it in detail.

- Log in to the personal information area.

- Click the ‘Withdrawal’ tab.

- Select the payment method you want to use.

- Enter your account number, payment method details, and amount to withdraw.

- Enter the verification code sent according to your security type (email/SMS) to complete the transaction.

Done. Within the set time, funds will be deposited into the settlement account.

We recommend using the payment method you used to deposit to avoid being denied withdrawal requests.

When withdrawing funds, the payment system must be the same as the system used to deposit.

If you are unable to access the payment system, please contact customer support with proof of this.

It must be registered in your name on the payment system you are using.

The withdrawal amount entered is always calculated in the account currency.

Exness does not impose limits on withdrawal, but depending on your payment system, there may be a minimum/maximum withdrawal limit.

You can also withdraw by tapping the ‘Withdrawal’ tab in the Exness Trader application.

Log in to EXNESS Client Portal

“Out of Funds” error when making a withdrawal

There are several workarounds, but in most cases the reason the problem arises is that there is not enough funds available for that trading account.

First, please check the following points.

- There are no open orders in your holding account.

- You have enough funds to withdraw into your account.

- Account number is correct.

- The currency of the funds you are withdrawing does not cause conversion problems.

If you have checked everything and you still receive the “low money” error, please contact Exness Customer Support with the details specified below.

- Account Number.

- The name of the payment system to be used for withdrawal.

- A screenshot or photo (if any) of the error message being displayed.

Fund goes back to the same source

You can only withdraw to the account which you have used for fund deposits.

Exness takes financial security very seriously and expects customers to use the same payment system and wallet for deposits and withdrawals to trade at the same rate.

However, Exness does not monitor each account, but the entire Personal Information Area (PA).

Therefore, if you make a deposit to one account using a specific payment system and then withdraw from another account in the same personal information area (PA) to the same payment system, the withdrawal amount exceeds the ratio of the deposit amount in the personal information area (PA) payment system and payment wallet.

Deposits and withdrawals must be made using the same payment method in accordance with Exness’ basic payment rules This is to ensure that funds are withdrawn to the legal account holder.

Please refer to this article if you are unable to use the payment method you used to deposit due to technical issues.

Fund Withdrawals while having open positions in the account

The remaining amount available for transactional transactions displayed in the personal information area is a ‘fluid’ amount of funds (changes at all times) and can be withdrawn from time to time.

However, it is not recommended to withdraw while holding an open position as the remaining available for trading may be reduced to an extent that affects the opened position, resulting in an unintentional stop-out and the position may be liquidated.

Contrary to intent, if you want to withdraw without affecting your contractable balance, we recommend that you read how to calculate your trading contract balance.

Which Exness’s account type is the Best?

In case you have withdrawn funds to the wrong account?

In case the withdrawal amount returned to trading account

This can happen if the withdrawal attempt was not successfully processed.

Let’s look at some of the possible causes of this problem.

- You entered incorrect information in the withdrawal format.

- The withdrawal request did not comply with Exness’ basic requirements. Exness’s general rules can be found here.

- You do not have enough funds to complete your withdrawal request. This can happen if you withdraw while you have open trading.

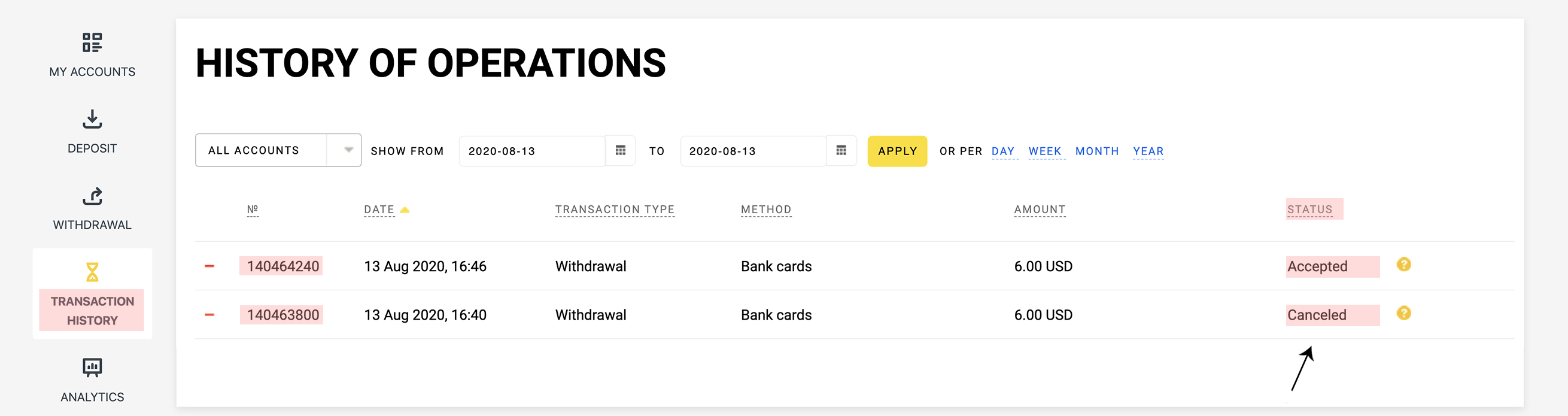

The withdrawal status can be checked in the Personal Information Area> Transaction History.

Do you have any other questions about withdrawals? Tap the chat icon below to contact a customer support expert.

How to cancel a deposit or withdrawal request

When you issue a deposit or withdrawal request by clicking Confirm Deposit or Confirm Withdrawal, the transaction details will be displayed in the Recent Operations section of the Deposit and Withdrawal area within the Personal Information area.

You can cancel a deposit or withdrawal by clicking the Cancel button under the status column for that transaction.

If you don’t see an option, it means that the transaction has already been processed and cannot be cancelled.

ELog in to EXNESS Client Portal

The fastest way to deposit and withdraw funds

Deposits and withdrawals processing time depends entirely on the payment method you choose.

Exness offers several payment service methods, some of which may change depending on your geographic location (automatically detected based on your account details).

In general, if you choose the deposit and withdrawal method specified as ‘instant,’ the processing time will be, on average, faster than the other methods.

There are many differences between each method, so it is difficult to recommend the fastest way to deposit or withdraw funds, but here are some considerations:

- The method used for deposit must be used in proportion to withdrawal. So, try to choose a payment method that has both the speed of deposit and withdrawal processing, which is the key to faster transactions.

- Most payment services offer ‘instant’ withdrawals, but this should be understood to mean that they are not handled manually by experts in the finance department, but are automatically executed by the system within seconds. This does not guarantee that the withdrawal will be completed instantly, but it does mean that the processing will begin immediately.

- Deposits and withdrawals are available 24 hours a day, 7 days a week. If the deposit or withdrawal is not executed immediately, it will be completed within 24 hours.

- Exness will not be liable for any delay in deposit and withdrawal processing due to the payment system.

Click this link for more details regarding the transaction.

Checking the status of your transactions

Where can I check the status of my deposit, withdrawal or internal transfer transactions?

All transaction records including deposits, withdrawals and internal transfers can be found in the client area.

- Log in to the personal information area.

- Click on a transaction history to briefly display a list of completed or pending transactions.

- Find the transaction history by transaction ID code number and check the status of the item.

- In Status, you can check the transaction status such as completed, pending, and rejected.

Complete means the transaction is complete.

Pending means the transaction has not yet been completed.

Rejected means the transaction was canceled for various reasons.

You can also filter the results by trading account and period. After setting the filter, click Apply.

You cannot directly cancel a pending transaction.

If you need to cancel your current transaction, please contact customer support immediately.

We recommend that you have your account details and password ready for identity verification.

Click this link to learn more about general payment information.

Please check EXNESS official website or contact the customer support with regard to the latest information and more accurate details.

EXNESS official website is here.

Please click "Introduction of EXNESS", if you want to know the details and the company information of EXNESS.

IronFX

IronFX

FXGT Broker Review: A Leader in High Leverage Forex and Cryptocurrency Trading

Comment by whatisgoingonTRUMP

February 17, 2025

Trump’s team holds 80% of the $TRUMP token supply, giving them the power to influence prices and put investors at risk. A crypto controlled by one group? Doesn’t seem very decen...