What's the difference between Gross and Net Position Accounting Systems? Table of Contents

Difference between Gross and Net Systems

Depending on the system of accounting for positions on the account, some trading functions of the platform behave differently:

The rules for the inheritance of Stop Loss and Take Profit are changed. More detailed information is presented in the user manual of the client terminal.

To close a position in the netting system, it is enough to perform a trade operation for the same symbol and in the same volume, but in the opposite direction. To close a position in the hedging system, explicitly select the “Close Position” command in the position context menu.

In a hedging system, it is not possible to reverse a position. In fact, the current position will be closed and a new one will be opened with a residual volume.

Choose from FXOpen’s Gross and Net systems

Hedging system (Gross)

This accounting system allows you to have on your account many trading positions for this and the same instrument, including multidirectional ones.

If there is an open position for a trading instrument and the trader makes a new deal (or a pending order is triggered), a new position is opened. The existing position does not change.

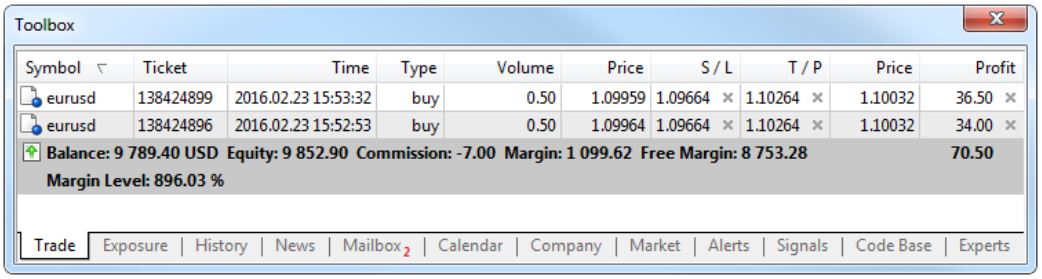

Below is an example of opening two transactions to buy EURUSD with a volume of 0.5 lots each:

Trade on FXOpen’s Hedging system

Netting system (Net)

This accounting system implies that at one point in time there can be only one open position on the account for the same symbol:

If there is a position for an instrument when a deal is executed in the same direction, the volume of this position increases.

When a deal is executed in the opposite direction, the volume of the existing position decreases, it is closed (when a deal is executed in a volume equal to the volume of the current position) or a reversal (if the volume of the opposite deal is greater than the current position).

In this case, it does not matter, as a result of what action the deal is executed in the opposite direction – as a result of the execution of a market order or the triggering of a pending order.

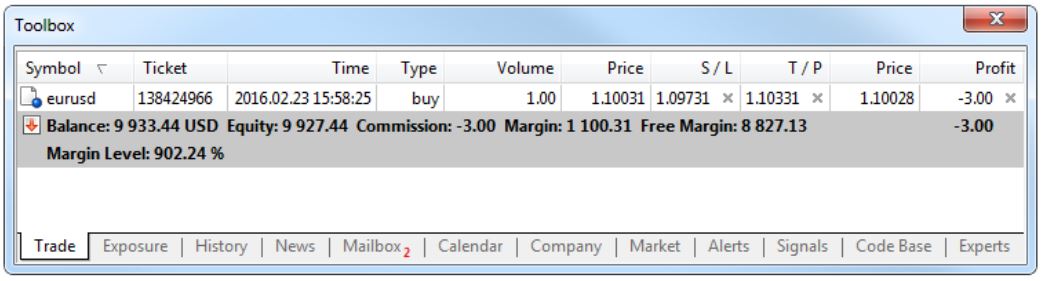

Below is an example of opening two transactions to buy EURUSD with a volume of 0.5 lots each:

Trade on FXOpen’s Netting system

Please check FXOpen official website or contact the customer support with regard to the latest information and more accurate details.

FXOpen official website is here.

Please click "Introduction of FXOpen", if you want to know the details and the company information of FXOpen.

IronFX

IronFX

Comment by Diletta

March 26, 2024

Awesome bonuses, good leverage. A few hiccups, but support rocks!