Last time we talked about the 123 rule for judging trend reversals, and in this regard, it also extends the 2B rule. Of course, the 123 rule also has a failure condition, which is also worth considering, and this is what will be discussed below.

The 123 rule for judging the short-term trend reversal of the disk is simple and practical, not limited to cycles and varieties, but its shortcomings are also obvious, that is, it indicates that the entry point is very late, which is simply unacceptable for impatient friends. In terms of entry points, it is indeed an extension of new content, that is, the 2B rule.

The specific content of Rule 2B is: in an uptrend if the price breaks shortly or is very close to the previous high and fails to rise continuously, and then quickly returns, the uptrend is likely to have changed; similarly, in the downtrend, if the price If it drops for a short time or is very close to the previous low and fails to continue the downward movement, and quickly reverses, then this downward trend is likely to have changed.

Judging from this description, the 2B rule can be regarded as a special form of the 123 rule. It can not only assist in judging the trend reversal but also prompt the entry point earlier. In short, it is the high (low) before the interview and the rapid turnaround. Look for opportunities for admission. Some friends may think that the entry point of the 2B rule is the previous high or the previous low, but the 2B rule can only be completed by confirming the rapid turnaround. The corresponding entry point is also difficult to fall in the previous high or the previous low, and at least it is waiting to test the previous high ( After the low) point, turn the K line to close.

2B rule on OANDA MT4 can be regarded as a good news for the impatient, but the accompanying risks are also obvious. Take a closer look, the 2B rule will judge the trend reversal and prepare to enter the market after the short-term failure to continue the trend after testing the previous high (low). It does not rule out the possibility of interval consolidation in the disk. That is to say, based on this, judge the subsequent trend against The correct rate of transfer is not high. According to its entry, it is necessary to treat profit margins conservatively. As far as safety is concerned, the 2B rule may be used as a warning signal and combined with the quasi-digital trading strategy mentioned by the author before.

In addition, after the emergence of the 2B rule, the 123 rule may continue to be completed. The emergence of the 2B rule requires a condition, which requires a test of the previous high (low) (not a confirmation breakthrough), and the V-shaped reversal cannot appear in the 2B rule.

Regarding the 123 rule and the 2B rule, we also need to consider the conditions that show that they are no longer valid, and adjust the actual operation in time.

There are two conditions for invalidating the 123 rule:

- The new trend is not confirmed on the disk and it returns to above (below) the previously broken trend line;

- It does not return to above (below) the trend line, but the previous high (low) is confirmed breakthrough.

Because the 2B rule does not require the cooperation of the trend line, the only condition for failure is to confirm the high (low) before the breakthrough.

In fact, 123 laws and 2B rule whether the application is considered an invalid condition, in essence, is shifted in the use of high and low points Or move down the principle of judging trends. Only the high point no longer moves up or the low point no longer moves down, this is the 2B rule. The high point no longer moves up, and the low point is likely to move down, or the low point no longer moves down, and the high point is likely to move up, then the rule of 123. If these conditions are not met, then these two rules will fail.

During the trading process, we can draw a trend line to highlight the trend, and after the trend line is confirmed to be broken, the trend line becomes invalid, and the trend is considered to be suspended, but this invalid trend line may also be used for subsequent judgments of new trends And to provide help is the 123 rule.

Dow theory can be said to be the originator of the analysis theory in the trading market, but the author believes that it is more of a theoretical framework, and more methods for judging and confirming market trends have to be refined. Victor Sporrandi refined a small point in the trend confirmation part and simplified it with the trend line, and finally proposed the 123 rule to judge the trend reversal.

The specific content of the 123 rule

- The upward trend line is broken downwards, or the downward trend line is broken upwards;

- The upward process no longer creates new highs, or the downward process no longer creates new lows (that is, it just tries to test the previous high or the previous low without breaking the position);

- In a downtrend, the price breaks through the previous rebound high, or in an uptrend, the price crosses the previous short-term retracement low.

After satisfying the 123 rule of appeal, there is a high probability of trend reversal on the disk, and the entry point appears after the breakthrough is confirmed in step 3.

123 rule on OANDA MT4 is very flexible in actual use. This is reflected in its order can be disrupted (213, 321 and other orders are possible, but must be Satisfy the completion of step 3), and it is not necessary to complete all 3 steps (there may be no step 2, that is, V-shaped reversal).

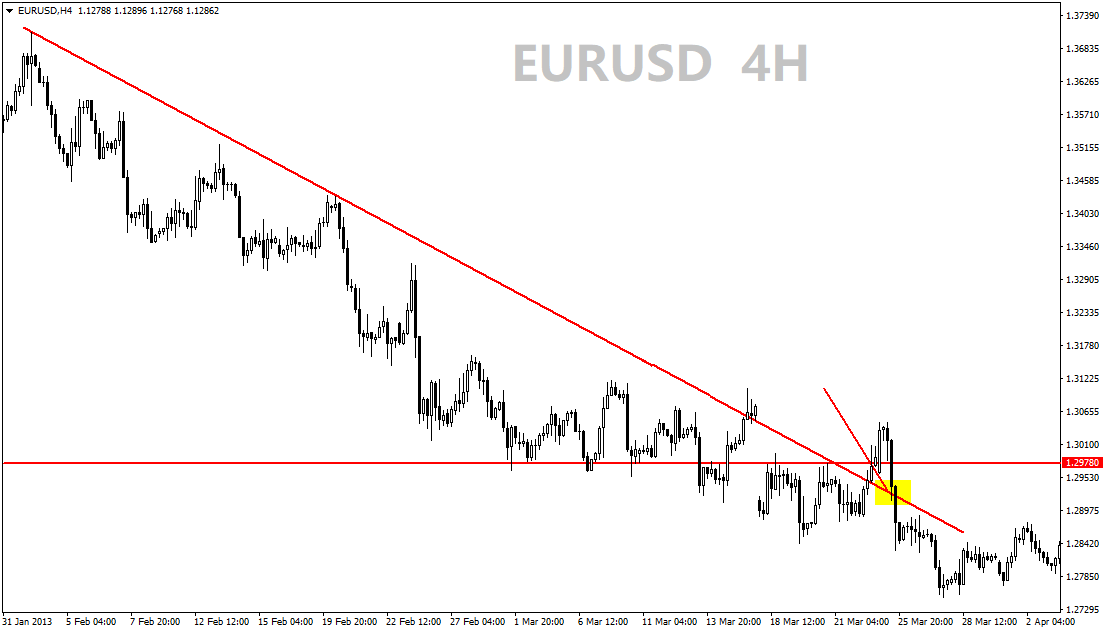

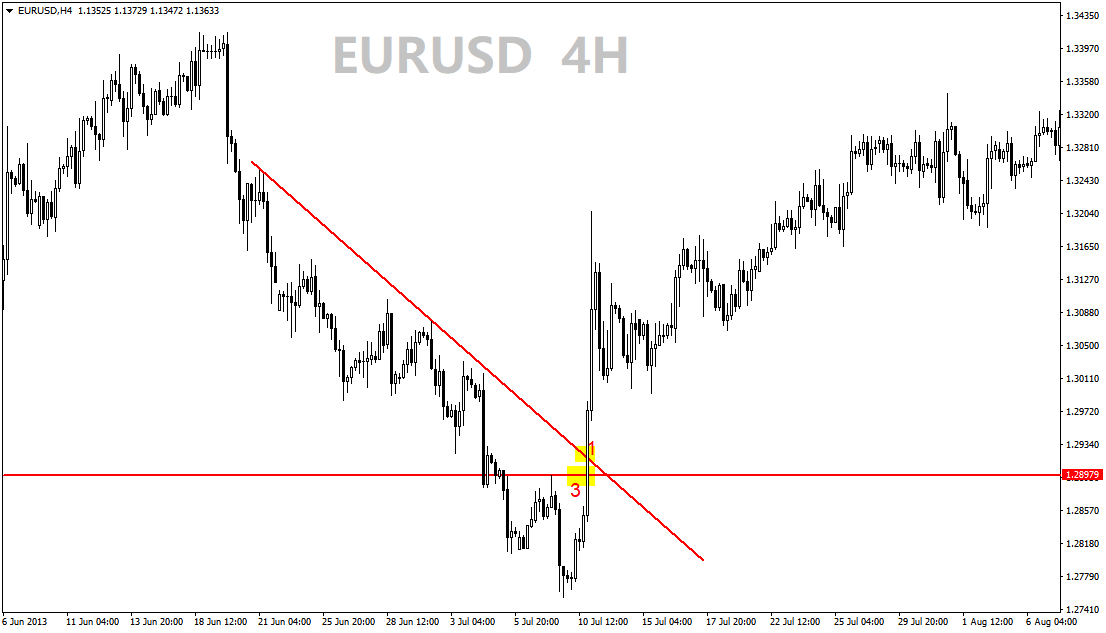

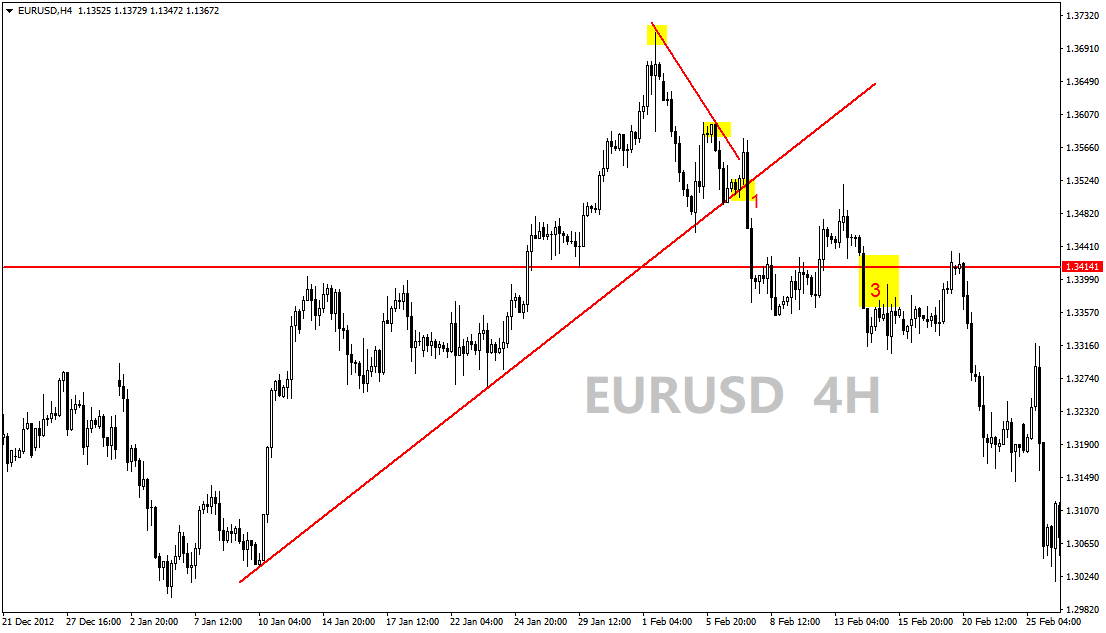

Through the above picture presentation, showing the use of 123 rules are very simple, but there are still some difficulties, the author step by step instructions.

The first point is about testing the previous high or the previous low in the second step. In many cases, the board did not test to the previous high or the previous low, but formed a lower high or a higher low, as shown in Figure 1 and above. Figure 2. This is no problem, but how far is the distance between the previous high and the high point formed after the trial can meet the 123 rule? Or is it said that the low point formed after the trial is more than how far away from the previous low is not counted as completing Step 2?

The author tried to search for the answer, but did not find a satisfactory explanation. Then, the answer given by the author is that the slope of the connection between the low point before the connection and the low point after the trial is formed is preferably no more than 30 degrees. On the contrary, if the slope of the connection exceeds 30 degrees, it should be considered as the second step. The 123 rule of existence.

For this, need to pay attention to is that the formation of the inflection point to be low to prevail.

Of course, the 30 degrees given in the appeal is not an authoritative statistical data, it is for reference only, and you can also measure it according to your own understanding.

The second point is how to find the position to be broken in the third step. This has to be considered in different situations, that is, the case of completing step 2 and the case of not having step 2.

The first is the situation where step 2 has been completed. Then the position that needs to be looked for is: in the upward trend, the low point formed between the previous high and the second test high point is located.

For the 123 rule without step 2, the position to be broken in step 3 is: under the upward trend, the previous high and the previous high The immediately adjacent low point before.

In addition, the 123 rule is one of the methods to judge trend reversal, if it happens to run into a reversal pattern composed of a series of K lines ( That is, while forming a reversal pattern, it also satisfies the 123 rule), what should be done? The author suggests that this situation should be dealt with according to the reversal pattern, because the reversal pattern may be able to indicate the possible distance of the subsequent travel, and the 123 rule cannot do anything at this point.

Say it at the end. The 123 rule is not a means to judge that a trend reversal is 100% error-free. In fact, it is not uncommon to extend the original trend again after meeting the 123 rule. Therefore, after completing the 123 rule, it is okay to conclude that the disk reverses in a short period of time, but the general trend reversal may require more information for consolidation and confirmation.

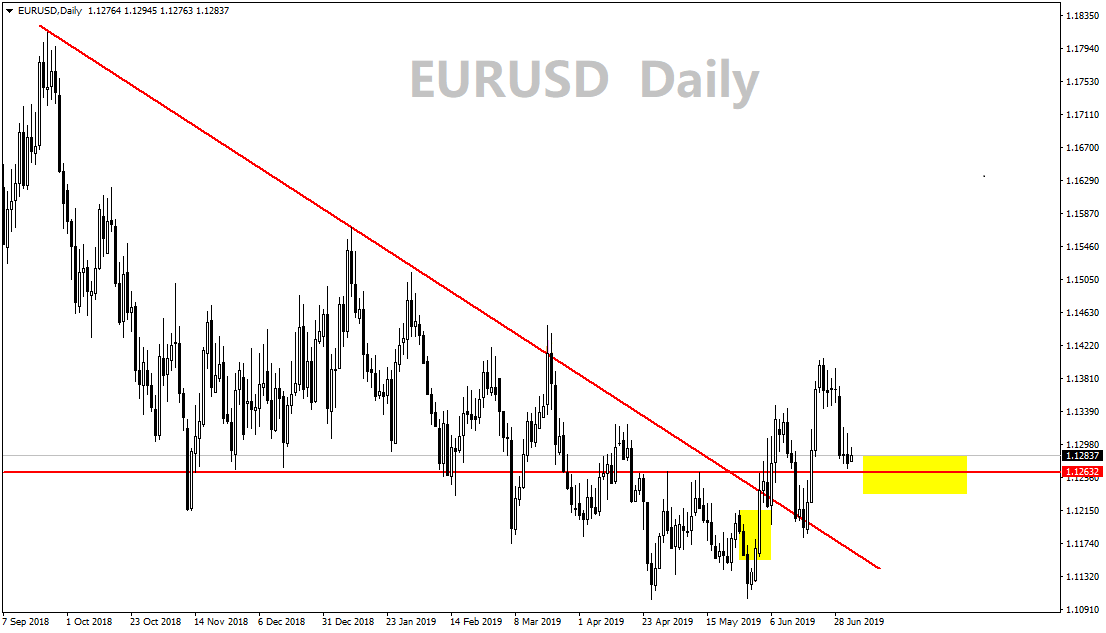

The following is the situation of the current completion of the 123 rule for EUR/USD, and everyone can pay attention to it.

IronFX

IronFX

Comment by Diletta

March 26, 2024

Awesome bonuses, good leverage. A few hiccups, but support rocks!