What are the differences between CFDs, Options and Forward Deals (Futures)? Table of Contents

- CFDs on easyMarkets

- There are over 200 tradable CFD markets

- Available Transaction type in CFD markets

- 6 Benefits of CFD Trading with easyMarkets

- Example of CFD Trading

- Is CFD trading safe online?

- 1. CFDs are leveraged

- 2. Market risk

- Vanilla options on easyMarkets

- New to trading with vanilla options?

- Forward Deals on easyMarkets

- What is forward trading?

- How does forward trading work?

- Forward trading on easyMarkets platform

CFDs on easyMarkets

Contracts for difference allow traders to invest in a wide range of asset classes without having to actually buy the product. EasyMarkets offers over 200 financial product choices so you can trade the way you like.

- Order Guarantee

- Unlike stock trading, having buyers and sellers at all times means that you don’t have to keep holding your assets.

- Trade in both directions

- There is a chance to profit in any market, whether the market is up or down.

- Full flexibility

- Flexibility means that you can take advantage of market trends at any time by giving traders more variety in how to start trading.

- Leverage

- Leveraged trading means aiming for higher profits with a small investment. However, leverage increases both the potential for loss and the potential for profit.

There are over 200 tradable CFD markets

- Forex currency pairs

- Forex, or currency trading, is a huge international market with over $ 5.3 trillion traded daily. Open 24 hours a day, 5 days a week, there are 3 trading sessions around the world to benefit from it. With easyMarkets, you can trade both major and exotic currencies.

- Stock Index

- An index is a naturally diversified product that offers a portfolio of mixed stocks of large corporations. It tracks specific economic conditions and is directly influenced by interest rate policies, labor relations data, and currency strength. You can trade from 15 different CFD indexes on easyMarkets platform.

- Commodities

- Commodities are divided into agriculture (soft / crop) and energy (hard / mining products). easyMarkets offers seven agricultural commodities, from wheat to coffee and sugar. If you like the high volatility of energy commodities, you can choose from five products.

- Cryptocurrency

- Virtual currency is changing the contours of the international financial – has been touted as a stage of the next evolution of the currency. If you want to be at the forefront of the technology and currency markets, cryptocurrencies will be your best choice.

- Stock

- Stocks are a widely popular investment product because of the large amount of information available at the time of the transaction. Equities are less volatile than other CFD markets, making them a good choice for low-risk appetite traders.

- Precious Metal

- Metal trading has a long history. Now with metal commodity CFD trading, you can easily enter this exciting market without having to physically own the product. Gold, silver, and other precious metals are considered safe investment destinations and are used as risk hedges in times of market instability.

See available markets on easyMarkets

Available Transaction type in CFD markets

This derivative format is useful for traders who want to trade within margin, hedge risk against volatile markets, or want to make a profit no matter where the market moves. The ability to trade on both up and down markets is a major reason why traders prefer derivatives like CFDs.

- Day (spot) trade

- Buying and selling CFDs tend to take place within the same day. Choose from over 100 currencies, 5 precious metals, 14 indexes, and 12 products.

- Limit order

- Specify the price you want to hold a position in day trading. It runs automatically when the market reaches that price. You don’t have to look at the market all the time! You can cancel at any time before the contract.

- Forward transaction

- You can buy and sell at preset future dates and prices. You can trade without slippage or renewal fees, and of course, stop loss and take profit are guaranteed.

- Option

- You can trade with future dates and prices. You can buy, hold and sell positions until the maturity date. You can keep up with market trends and hedge risks. EasyMarkets options are cash-based and feature strikes and maturity dates. Access to over 30 currencies, gold, silver, oil and cryptocurrencies.

CFD trading hours vary greatly depending on the product class you are trading with. Opening hours, closing times and market breaks can have a huge impact on the price of your favorite products. That’s why it’s so important to keep track of these times. To find out about opening times, closing times, or short breaks in your favorite market, please visit easyMarkets trading hours page.

6 Benefits of CFD Trading with easyMarkets

The CFD (contract for difference), without having to own the underlying asset at all, are derivative instruments that individual when the market price of financial instruments has risen or fallen to be able to transactions (derivative financial instruments). With CFDs, you can access all international markets and trade a wide range of assets such as Forex, Commodities, Metals, Indexes, and Equities.

- With dealCancellation *, you can cancel an order within 60 minutes of opening it.

- With fixed spreads, you can always keep track of transaction costs.

- With a free stop-loss guarantee, your loss will never be less than your margin.

- There are no slippages on the easyMarkets platform.

- Your balance will never be negative.

- easyMarkets provides training and personal support.

Traders wishing to open CFDs must agree to enter into a contract with a broker. Under this agreement, both parties agree to exchange the difference in asset prices from the beginning to the end of the agreement. If your expectations are correct after the contract is signed, the profit is yours. If you don’t expect it, you will lose.

Example of CFD Trading

For traders who are new to CFD trading with easyMarkets, here are 2 examples of CFD tradings.

Example 1: Long position to make a profit

After careful analysis, you are convinced that Facebook stocks are currently below intrinsic value. Therefore, I decided to buy it in a long position because I thought the price would rise in the near future.

The company is currently trading at $ 301 per share. You bought 100 Facebook shares on CFD and made the total purchase amount to $ 30,100. The next day, Facebook’s share price rose 5%, soaring from $ 301 to $ 316 per share.

This rise in stock prices has earned you a profit of $ 15 per share, bringing the total profit to $ 1,500.

Example 2: Short position suffering loss

You are convinced that Tesla’s stock price is slightly higher than its original value, and it is likely to fall. So you decide to buy the stock of this company in a short position.

Tesla’s share price is $ 740 per share. You have decided to sell 25 Tesla shares on CFDs for a total sale of $ 18,500. However, the next day, Tesla’s share price continued to rise to a high of 5%, and if we traded here, we should have been able to trade at $ 777 per share.

This rise in stock prices eventually resulted in a loss of $ 37 per share, for a total loss of $ 925.

Note: These examples do not take into account the fees incurred for CFD trading. You can find out more about easyMarkets transaction fees in the Key Investor Information Documents (KIIDs).

Is CFD trading safe online?

If you start CFD trading without a good understanding of how it works, CFD trading is considered unsafe (because of the risk of losing your invested capital).

To reduce the potential for loss, you need to be aware of the associated risks and understand how to mitigate them. Risks to be aware of include:

1. CFDs are leveraged

Leverage allows you to trade at a larger amount than your initial deposit. In essence, if you want to open a trade, you only have to invest a portion of the total price of the position and the provider will “lend” you the uninvested balance.

Leverage is a double-edged sword. While it helps to increase the profitability of easyMarkets customers if the market moves as expected, it can also increase losses if the market moves unexpectedly. If you don’t manage your leverage properly, you can easily lose money in the end.

2. Market risk

The market can be very volatile. Therefore, the transactions you make may involve rapid market fluctuations. Markets fluctuate due to a variety of factors, including economic news, government, regulatory changes, and interest rate changes.

In order to alleviate the mental stress caused by market fluctuations, customers need to know the principle of market fluctuations before conducting CFD trading.

When used correctly, leverage can be a powerful tool. However, in order to use it properly, the following points must be considered:

- The more leverage you use, the higher the risk. Leverage increases profitability, but it can also increase losses.

- When using leverage, always check the indicators and take steps for risk management. Some risk management tools such as stop-loss guarantees and deal cancellation may be effective.

- The level of leverage available depends on the place of residence of the user. For example, the maximum leverage of European and Australian traders is 30: 1.

- Certain economic events and indicators can cause market fluctuations. Please note that these fluctuations can destabilize your profitability or loss potential.

Go to easyMarkets’ Official Website

Vanilla options on easyMarkets

Vanilla options are special deals available to easyMarkets customers for products of interest. Vanilla options are a unique feature that allows you to raise or lower product prices. With this trading method, you can easily grasp the amount of money invested in the market and the trading period. You can trade only by price without actually owning the product of interest.

Experience a different trading method with easyMarkets vanilla options.

Why trade vanilla options on easyMarkets?

- Trade major currencies, minor currencies and precious metals.

- Vanilla options allow you to trade both rising and falling prices.

- Understand the parameters

- The market sometimes becomes unpredictable. You can rest assured if you have something that you can control. With vanilla options, you can set the amount of risk and the trading period.

- Trade ups and downs in trends

- Vanilla options are different types of options. Do you think the products you pay attention to will go up? Do you think it will go down? Set the price you expect the item to arrive and the time it will take to reach it.

- Are you a new investor?

- Did you join easyMarkets newly? Knowing the tools available is essential to achieving your goals. easyMarkets has an extensive library of helpful guides, videos, and ebooks.

Try Vanilla Options on easyMarkets

New to trading with vanilla options?

Vanilla options can be a huge variety of trading methods. The main elements of vanilla options are calls (buy when the underlying asset price is expected to rise) or puts (buy when the underlying asset price is expected to fall), the strike price (maturity date or by the time the transaction is closed). Or there is an excess price) and a maturity date (the date the option expires). Vanilla options are the simplest trading option.

Buyers of vanilla options have rights but no obligations. The right to trade the underlying financial instrument at a specified price (called a strike price) and a specified date (called a maturity date). When buying a vanilla option, the buyer pays a premium for the above rights. The premium will be deducted from your account balance.

Vanilla options are used by both individuals and businesses due to their versatility. The vanilla option is used to estimate the price of the target product. Obviously, knowledge is the greatest asset in understanding product and market movements. And you can learn everything you need to know from easyMarkets’ Learning Center. Understanding what macroeconomic events affect the commodities you are trading is essential when trading options. Because we are trying to calculate the commodity price when the option expires.

The ability to set strike prices and maturities on your favorite products makes vanilla options a versatile option for new and experienced investors. Vanilla options are not only convenient for risk management but also suitable for matching different time periods and trading products to your investment strategy. You can trade active products in a short period of time, or hold stable products for a long period of time.

No matter what product vanilla option you choose, regardless of your trading experience, easyMarkets’ customer support, one of the best in the industry, will help you.

Learn how to trade Vanilla options

Forward Deals on easyMarkets

easyMarkets offers a variety of trading methods, including forward trading, which is an effective tool for protecting trading from unpredictable market movements. Forward trading is the best product for hedging because you can fix the price on a future date based on the current price.

Like forward and futures trading, forward trading in Forex has standard set periods, contract sizes, and procedures for settlement.

Futures trading is traded on regulated exchanges around the world, but Forex is considered over-the-counter trading. The reason is that there is no place to manage transactions and their payments, and two parties trade bilaterally from various locations around the world via online transaction platforms, telephones, etc.

- This is the most common method of hedging.

- You can calculate a reliable budget.

- You can reduce the stress of following the movement of Forex every day.

- It is a simple over-the-counter contract.

- There is plenty of time to hedge, with up to 30 days to due.

- Effectively manage account liquidity.

- Provides complete hedging and price protection.

- The best risk management tool for future volatility.

Go to easyMarkets’ Official Website

What is forward trading?

Forex (FX) forward trading is a contract used as a hedge when an investor makes a payment or receipt of foreign currency on a particular date in the future. A forward contract is basically a contract between a buyer and a seller to buy or sell a particular currency at a particular rate on a specified date. Forward contracts help investors cover or hedge future exchange rate fluctuations, and once payment details and forward contracts are agreed upon, investors say that foreign currency payments have been “locked”. Express

What this essentially means is that forward contracts allow the seller to set future foreign currency rates without having to pay any upfront payments. And since not all currencies are offered forward contracts, you need to check with your broker which currencies are available.

How does forward trading work?

A forward contract is an agreement between the seller and the buyer on the amount, price per unit, and delivery date. On the agreed delivery date, the buyer must pay the seller an amount at a pre-determined rate in consideration of receiving the goods. If the price on the delivery date is lower than the forward price determined in the contract, it means that the seller makes a profit while the buyer loses. Forward currency transactions can be said to mean that the two parties only agree on the amount of loss and profit rather than physically exchanging the currency.

Go to easyMarkets’ Official Website

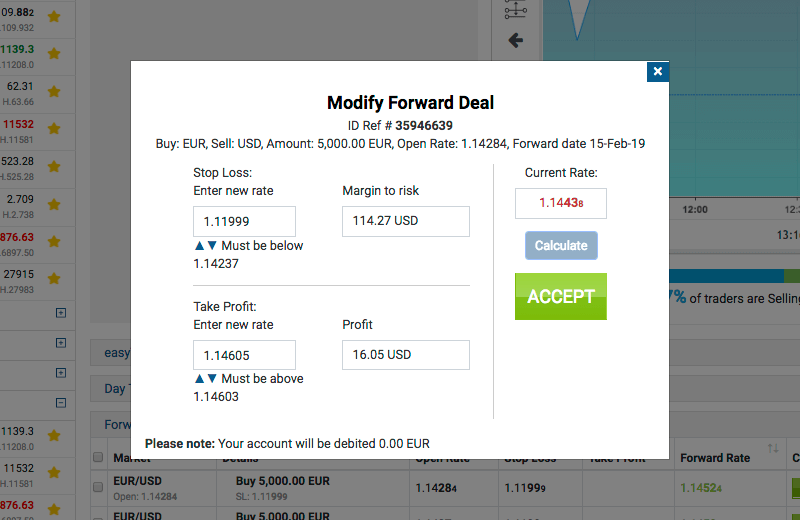

Forward trading on easyMarkets platform

On the easyMarkets platform trading page, you can choose day trading, forward trading, limit orders, or options.

Select a product from the Market Explorer to see if it is available as a forward transaction.

- Choose a market.

- Select transaction amount and risk amount.

- Specify the date of the forward transaction.

- Stop loss is displayed automatically.

- Press the sell or buy button.

You can adjust the stop loss and set the take profit rate from the trading area or the “Forward Trading” section under “Open Trading” in the menu. This will change the amount of risk and will automatically debit or deposit from your account accordingly.

On the easyMarkets platform trading page, you can choose day trading, forward trading, limit orders, or options.

Select a product from the Market Explorer to see if it is available as a forward transaction.

Please check easyMarkets] official website or contact the customer support with regard to the latest information and more accurate details.

easyMarkets] official website is here.

Please click "Introduction of easyMarkets]", if you want to know the details and the company information of easyMarkets].

Deriv

Deriv  AdroFX

AdroFX

![easyMarkets]](https://fofan.org/wp-content/uploads/2019/12/easymarkets_s_201911_001.png)