How to place market orders and pending orders (stop loss and take profit) on FXOpen's platforms? Table of Contents

Placing “Market Orders” on FXOpen

A market order assumes the fastest execution.

Such an order will almost certainly be executed, but not always at the best price for you.

In moments of strong market volatility, the gap between the price you see when you open a position through the trading terminal and the price at which the order will be executed can be quite large, but at such moments this is the only way to have time to execute the order before the price moves even further.

When you click the Sell by the market or Buy by market button (“Buy by the market”) in the trading terminal, you need to understand that the order will be executed at the market price reached at the time the order to buy or sell is received by the counterparty.

Due to the fact that the volume available at the time of order execution is limited, this price may differ from the one that you saw at the time of opening a position from the terminal.

To ensure the best execution, the client’s order is automatically “combined” with opposite paired buy or sell orders and executed in one block with them, or, conversely, is split into several smaller transactions.

For example, a client 1 wants to open a short position of 400,000 GBP / JPY using a Market Executed order (market order).

At the same time, Client 2 placed a buy order on GBP / JPY at 1.5876 for 300,000, and Client 3 placed a buy order for GBP / JPY 200,000 at 1.5878.

This means that Client 1’s order to sell 400,000 GBP / JPY will be executed at a price of 1.5877.

Warning at the bottom of the “New Order” window in the trading terminal: ” Attention! When the order is executed on the market, the price will be determined by the dealer ”does not meet the terms of trading via ECN!

When a client chooses market execution, he cannot set Stop Loss or Take Profit levels when opening an order, but these parameters can be added to an already open position using the Modify Order function.

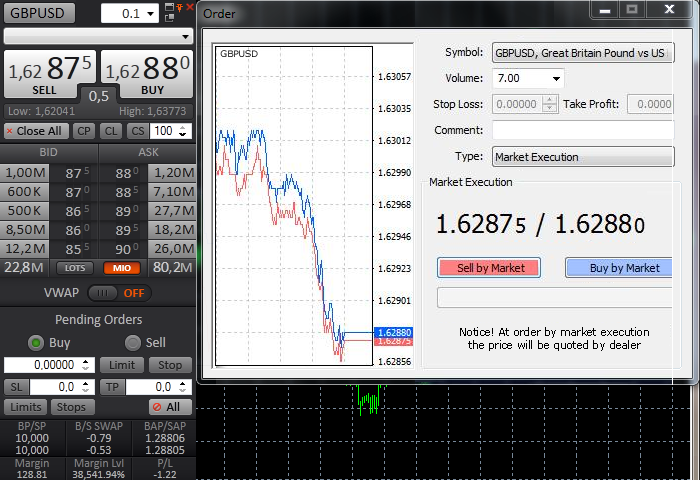

As seen in the figure above, the best price in the order book for opening a short position in GBP / USD with a volume of up to 10 standard lots is 1.62875.

The client wants to sell 7 lots of GBP / USD and to open such a position he needs to click the Sell by a market button in the New Order window.

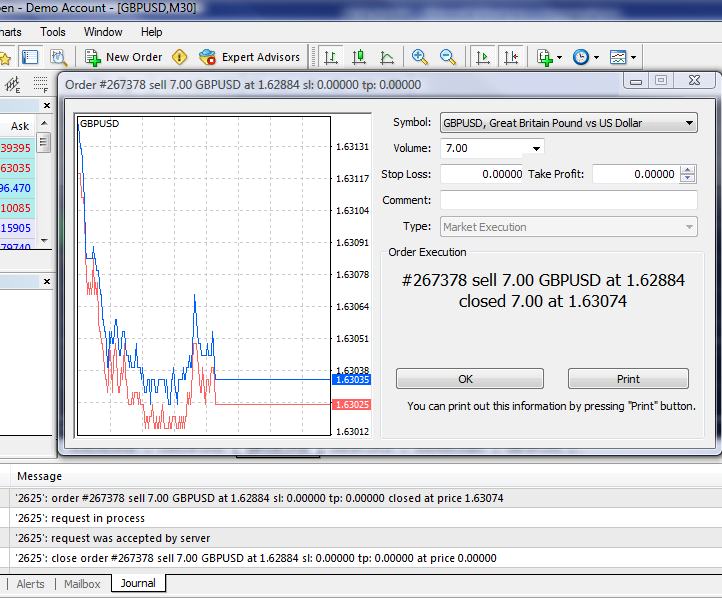

Immediately after the market order is executed, a confirmation window will appear on the screen.

The figure shows that the order was executed in full requested volume, 7 lots, at a price of 1.62884, which is 0.00009 better than in the “order book” at the time the order was placed.

As mentioned above, the sell order was automatically “matched” with the buy prices received from the liquidity providers just when the short position was taken.

This principle works in both directions and depends only on liquidity in the market.

In the “Journal” tab, the client can find a record with more detailed information about opening a position.

1.2009.06.25 05:30:42 ‘2625’: order sell market 7.00 GBPUSD sl: 0.00000 tp: 0.00000

2.2009.06.25 05:30:42 ‘2625’: request was accepted by server2009 3.2009.06.25

05 : 30: 42 ‘2625’: request in process

4. 2009.06.25 05:30:43 ‘2625’: order was opened: # 267378 sell 7.00 GBPUSD at 1.62884 sl: 0.00000 tp: 0.00000

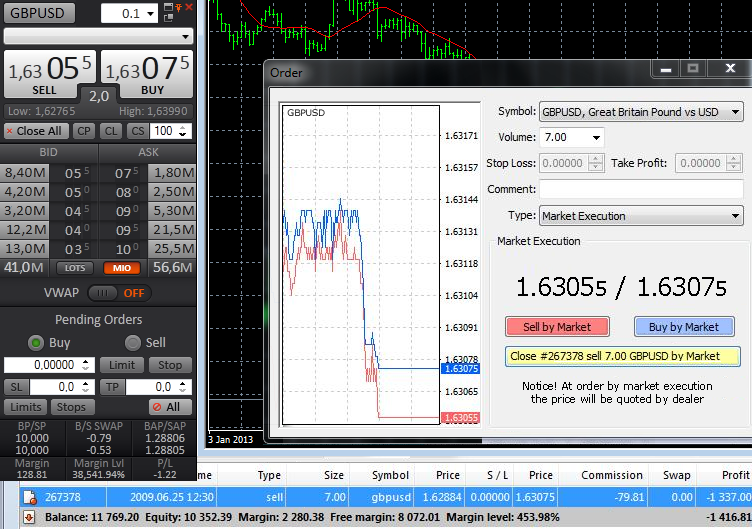

The figure above shows that the best price to close a short position with a volume of up to 18 standard lots is 1.63075.

To close a position, the client needs to click the yellow button Close # … sell 7.00 GBPUSD by Market in the trading terminal window.

Immediately after the client has made a request to close a market order from the terminal, a confirmation window will appear on the screen.

The figure shows that the order was closed in full: 7 lots, at a price of 1.63074, which is 0.00001 worse than the price in the “order book” at the time when the client closed the order from the terminal.

The order to close the short position was automatically matched with counter prices from clients and liquidity providers.

Logs with details of position closing are available in the “Journal” tab in the trading terminal.

Go to FXOpen’s Official Website

Placing “Stop Loss” and “Take Profit” on FXOpen

Stop Loss and Take Profit levels can be set for a pending order or added to an already open position.

After the pending order is executed, the Stop Loss and Take Profit levels will be automatically added to the open position.

Orders of this type minimize losses if the price of a financial instrument starts moving in a direction that is disadvantageous for the trader.

When the market price reaches the set level, the order is closed automatically at the current market price, similar to Market Order execution.

The execution price of a Stop Loss order may differ from the price level set when the order was opened.

If the SL order-level falls in the middle of the price gap (Price Gap), then the order is executed at the quote that was fixed at the end of the price gap.

The client (trader) can set the SL level only for an already open position or for a pending order (Limit or Stop order).

If the level is SL is placed very close to the open price of a pending order, this can cause the immediate closing of a pending order just executed.

In the trading terminal, long positions are closed at the BID price and short positions – at the ASK price.

Take Profit Orders of this type are designed to close a winning position if the price of a financial instrument moves in a direction favorable to the client and reaches the set Take Profit level.

The execution of this order consists of closing the position according to the rules for execution of limit orders.

TP the order will be closed at a specified or better price.

In case of low market liquidity, there is a possibility of partial execution of the order, that is, part of the position will remain open.

The client can set the TP level only for an already open position or for pending orders (Limit or Stop orders).

Open FXOpen’s Account for free

Stop order to buy (Buy Stop) and Stop order to sell (Sell Stop)

Pending order (pending order) is executed when the market price reaches the level set at exhibiting this order.

When opening a short (sell) position, a stop order is placed below the current market price, and when opening a long (Buy) position, it is placed above.

When the price reaches the Sell stop or Buy stop level, the position is opened automatically at the current market price, similar to market execution (Market order).

The price at which Sell stop or Buy stop order will be executed may differ from the price you set when the order was opened.

If the price set when opening a stop order falls in the middle of the price gap (Price Gap), then the order is executed at the quote that will be received first after the price gap.

This can happen when market volatility is high.

Stop Loss and Take Profit orders can be added to pending orders.

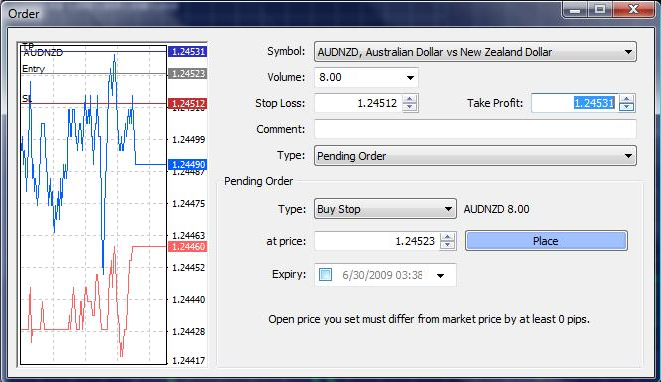

Current market price: Bid – 1.24460, Ask – 1.24490 The price set when opening an order (order price) – 1.24523, must be higher than the Ask level of the current market price.

When the market price reaches the level of the order price, the position is opened automatically at the current market price, as if executed “by the market” ( Market Order ).

Stop-Loss (SL): 1.24512. The level must be set below the order price. If the market price has reached the SL level, the order will be closed automatically at the current market price, similar to Market Order execution.

Take Profit (TP): 1.24531. The level must be set above the order price.

When the price reaches the TP level, the position is closed automatically at the TP level or at a better price according to the rules for execution of limit orders.

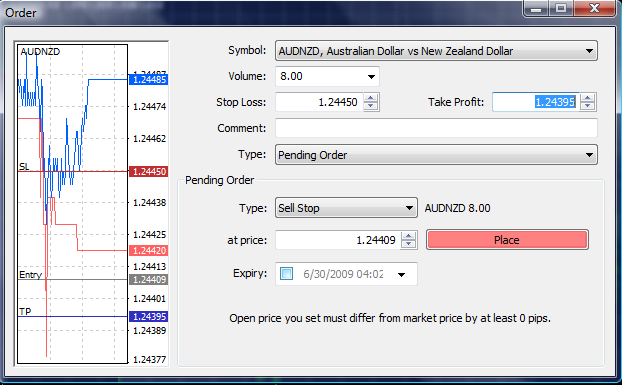

Current market price: Bid – 1.24420, Ask – 1.24485 Price set when opening an order (order price): 1.24420 must be below the Bid level for the current market price.

When the market price reaches the order price level, the position is opened automatically at the current market price, similar to Market Order execution.

Stop-Loss (SL): The 1.24450 level should be set above the order price. If the market price has reached the SL level, the order is closed automatically, similar to the Market Order execution.

Take Profit (TP): 1.24395 level should be set below the order price. When the price reaches the TP level, the position is closed automatically at the TP level or at a better price according to the rules for execution of limit orders.

Go to FXOpen’s Official Website

Please check FXOpen official website or contact the customer support with regard to the latest information and more accurate details.

FXOpen official website is here.

Please click "Introduction of FXOpen", if you want to know the details and the company information of FXOpen.

IronFX

IronFX

FXGT Broker Review: A Leader in High Leverage Forex and Cryptocurrency Trading

Comment by whatisgoingonTRUMP

February 17, 2025

Trump’s team holds 80% of the $TRUMP token supply, giving them the power to influence prices and put investors at risk. A crypto controlled by one group? Doesn’t seem very decen...