easyMarkets MT4 Review. Table of Contents

- easyMarkets Special Features that makes the difference

- easyMarkets' Tools to get the latest information

- 1. easyTrade - Maximize your potential while limiting your risk

- 2. dealCancellation - For risk free trading

- 3. Freeze Rate - What is a freeze rate and how to use it?

- 4. Negative Balance Protection - NBP for all clients

- 5. Stop-loss guarantee - free and automated

- 6. No slippage - Innovative and unique trading tool

- 7. Fixed spread - Never change regardless of market conditions

Comparison of easyMarkets’ trading account types

The main differences of the account types available for easyMarkets are as follows:

| Platform | easyMarkets Web/App and TradingView | MT4 | MT5 | ||||

|---|---|---|---|---|---|---|---|

| Account Type | VIP | Premium | Standard | VIP | Premium | Standard | Standard |

| Spread Type | Fixed | Fixed | Fixed | Fixed | Fixed | Fixed | Variable (Floating) |

| Minimum Spread | 0.8 pips | 1.5 pips | 1.8 pips | 0.7 pips | 1.2 pips | 1.7 pips | 0.6 pips |

| Required Minimum Deposit | 10,000 USD | 2,000 USD | 25 USD | 10,000 USD | 2,000 USD | 25 USD | 25 USD |

| Minimum Trading Volume | 0.01 lots | 0.01 lots | 0.01 lots | 0.01 lots | 0.01 lots | 0.01 lots | 0.01 lots |

| Maximum Leverage | 1:200 | 1:200 | 1:200 | 1:400 | 1:400 | 1:400 | 1:500 |

| Trading Commission | None | None | None | None | None | None | None |

| Account Fee | None | None | None | None | None | None | None |

| Personal Account Manager | Available | Available | Available | Available | Available | Available | Available |

| No Slippage | Optional | Optional | Optional | Unavailable | Unavailable | Unavailable | Unavailable |

| Guaranteed Stop Loss | Optional | Optional | Optional | Unavailable | Unavailable | Unavailable | Unavailable |

| NBP (Negative Balance Protection) | Available | Available | Available | Available | Available | Available | Available |

| Trading Central | Unavailable | Unavailable | Unavailable | Available | Available | Available | Available |

| Sign Up Links | Open VIP Web Account | Open Premium Web Account | Open Standard Web Account | Open VIP MT4 Account | Open Premium MT4 Account | Open Standard MT4 Account | Open Standard MT5 Account |

Go to easyMarkets Official Website

easyMarkets Special Features that makes the difference

easyMarkets is committed to providing simple yet powerful tools and features for better trading and risk management.

- dealCancellation

- dealCancellation is one of the most unique trading tools offered by various brokers. With this tool, you can “insure” your transactions in one, three, or six hours by paying a small fee, which is determined by market volatility. Even if the market moves against you, you can cancel it, and you can recover the amount you invested and the loss you incurred.

- Freeze rate

- Did you come to the level you expected? Let’s pause. If you use this function, you can stop the price movement of the product you are trading instantly and trade. The rate is always moving. Even if you want to trade at a particular rate, you don’t know where the market will move. In such a case, “freeze rate”! That way, even if the market keeps moving, you can buy and sell at a price that stops momentarily.

- Free auto-setting stop loss

- By setting the stop-loss automatically, you will never deviate from the initially accepted level. Find out more about better risk management. easyMarkets is one of the first brokers to build a trading platform that guarantees that you will not lose more than your investment. Since its founding in 2001, easyMarkets has committed to the continuing and unchanged warranty for all account types and platform users.

- Hold limit order

- You don’t have to wait in front of the platform even if the current rate is different from what you want to trade. Hold limit orders allow you to buy and sell automatically when the market reaches a preset price.

- Free stop-loss automatic setting function

- Managing risk during a transaction is extremely important. Many investors take advantage of stop-loss, which closes when the market reaches a preset price. By automatically setting a stop loss, easyMarkets guarantees that you will never lose more than you expected. EasyMarkets automatic stop-loss setting is free. If you choose an acceptable risk level, your position will close when the price reaches that level.

- Fixed spread

- Spreads are part of the transaction cost at the time of execution. There are two positions in a transaction: a buyer (bid) and a seller (ask). The difference between the bid price and the ask price is the spread. easyMarkets has fixed spreads and spreads do not increase as market volatility increases. This guarantees price transparency and lets you know what you are paying when you place an order.

- Free take profit automatic setting function

- With TakeProfit, you can close your order when the market reaches the level you want to make a profit. This feature is a great tool for investors who want to pre-set the risk-to-profit ratio, which means that stop-loss can be used to set the maximum risk and TakeProfit can be used to set the expected profit. These features are guaranteed free of charge regardless of account type.

Go to easyMarkets Official Website and find out more about their latest tools today.

Go to easyMarkets Official Website

easyMarkets’ Tools to get the latest information

The small but important details that support your trading activities.

easyMarkets has got them all for you.

- Notification

- Knowledge is one of the best risk management tools. You’ll be notified about prices so you’re always on the lookout for market trends.

- Latest market price

- You can monitor prices, rate of change, and high/low prices of your favorite products and load them into your trading tickets with a single click.

- Inside viewer

- Find out what the market is thinking. Inside Viewer is easyMarkets’ unique tool and was first introduced to the market in 2009. You can gain a deeper understanding of price movements by showing whether the investor trading a product is on the sell or buy side.

- Price chart

- The market is constantly moving. You can better understand the movement of the market by looking at past prices and current prices, and also by looking at the patterns that are currently being formed. Overlaying technical indicators on the chart can help identify these patterns.

- Financial calendar

- Knowing what is happening in the world is important in trading. That is why easyMarkets is combining easyMarkets financial calendar with the trading platform.

- Market news

- Get the latest financial market news at your fingertips without having to leave the platform. With this feature, you will never miss the latest information on the market.

- Demo account

- Do you feel that you need a little more time to learn about trading strategies and build your own strategies? EasyMarkets demo accounts allow you to experiment with your trading strategies without risk while familiarizing yourself with the tools available and easyMarkets platform.

As a trader of easyMarkets, you can benefit from all of the above trading features for free.

1. easyTrade – Maximize your potential while limiting your risk

easyTrade is the revolutionary trading platform provided only for traders of easyMarkets.

Here are the main features of easyTrade platform.

- Risk

- Determine the maximum risk that can be tolerated in this transaction.

- Expiration date for transactions

- This is the expiration date of easyTrade. When this expiration date is reached, the position will be closed. You can close it at any time within the expiration date.

- Revenue simulation

- This convenient and easy-to-read graph shows changes in the price and revenue of the selected option.

- Up & Down

- Transaction volume converted to underlying assets. Shows the actual transaction value of the product for the option.

- Price

- The current market price of this product.

- Rise or fall

- This is the last step! Once you’ve set the risk and price for easyTrade, decide whether the rate will go up or down in the future.

- P & L target

- If you use the profit and loss target, you can automatically settle the position at the target price. Use the easyMarkets web platform or download the iOS / Android app to try out the new features. Simply select an open position and click the “Edit” button to set your P & L target.

- The profit is infinite

- The technology contained in easyTrade does not limit your potential. If the market moves in your favor, you can continue to make profits throughout the trading hours.

- Risk is limited

- One of the reasons easyMarkets devised and adopted easyTrade for a particular financial product is that easyMarkets can control maximum risk. This allows you to set the level of risk you can tolerate.

FAQs regarding easyMarkets easyTrade

Here is a list of frequently asked questions about easyTrade of easyMarkets.

- Can easyTrade trade in the short term (hours to days)?

- You can choose between 1/3/6 hours. You can trade in a longer time frame by using the vanilla option on the platform.

- What currency is used for “risk”?

- The base currency of your account will be used for risk claims.

- What happens to my account if the trading time expires without closing the order?

- If the market moves in favor, the current refund will be added to your net balance. If the market moves against you, the biggest possible loss will be the risk insurance you have already paid.

- How big is the risk now?

- The magnitude of the risk depends on the option price and the transaction amount. The volatility of your assets is also relevant.

- What is the transaction volume converted back to the underlying asset?

- The size of the order depends on the risk insurance, the trading time selected and the volatility at the moment the trading is opened.

- What is the level at which the “risk” you paid will be returned?

- When you reach the break-even point, the initial investment amount will be returned. There is no limit to the possible refunds if the rate moves beyond the break-even point.

- When does the open interest make a profit?

- The profit-making scenario is that profits begin when the market rate crosses the break-even point. If you cross the break-even point, you will be able to earn profits according to the movement of the asset rate in addition to the amount invested.

- Can you hedge?

- Hedges can be done as long as there is no malicious intent.

- Is there a cost to use easyTrade?

- Danger insurance that you will pay to open easyTrade.

- What is the maximum possible loss?

- The biggest loss is the amount you initially invested in a particular easyTrade order. No matter how unfavorable your pips are in the market, you won’t lose more than your risk insurance.

- Why is easyTrade better than binary options?

- Binary options are all or no options, but easyTrade will return your current refund. When trading binary options, the refund is set at 90% in advance, but in the case of easyTrade, there is no limit on the refund. In addition, easyTrade can be effectively used as a hedge, and it is not possible to close a transaction at any time before expiration with binary options.

- When will the transaction close?

- There are three reasons for closing: 1. The transaction expires when the maximum trading time selected (1/3/6 hours) is reached. 2. You can also close before the selected expiration time. 3. Closed when fraudulent activity is detected.

- What is the minimum / maximum amount of risk a customer can take?

- All currency pairs have a variety of risk claims to choose from. When entering risk claims, the system will display the range available for the selected currency pair.

- When is the best time to take a position on easyTrade?

- As with Forex trading, it is important to anticipate how the market will move. Market volatility can be added to your side by opening easyTrade. Use market movements to speculate on trends.

Find out more about easyMarkets easyTrade

2. dealCancellation – For risk free trading

It is one of the most innovative tools in the industry that enables risk-free trading. You will have 1 hour, 3 hours and 6 hours to cancel the transaction if the market moves unfavorably.

- Trading at big events

- There are brokers that raise margins or stop trading altogether when major events occur. easyMarkets is different. In fact, easyMarkets offers tools that allow you to trade with confidence even at large economic calendar events.

- Let’s use it!

- It’s tricky to place an order, but dealCancellation allows you to cancel a “losing” trade for a small fee, so you don’t have to worry about loss.

- Increase transaction size

- Don’t worry if you’re avoiding large-sized transactions because of the fear that you might lose money. dealCancellation gives you 1 hour, 3 hours and 6 hours. If the market moves against you, you can simply cancel your order.

- Take advantage of volatility

- Investors generally avoid volatility. This is because increased volatility can increase the risk of loss. But this also means more chances. You can take advantage of volatility as long as you have dealCancellation.

dealCancellation is a function of easyMarkets’ trading platform that allows you to cancel a transaction and recover your invested funds until the expiration date.

Trade with dealCancellation of easyMarkets

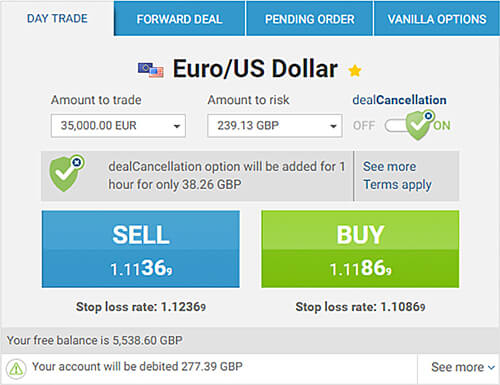

How to activate dealCancellation?

When you take a new position, enable deal Cancellation and choose a period of 1 hour, 3 hours or 6 hours.

Click the deal Cancellation icon on the transaction ticket to turn it “on” and the cost will be specified.

Clicking “Sell” or “Buy” will open order with that feature active until the deal Cancellation expires (1 hour, 3 hours, 6 hours).

Slide ON dealCancellation to enable.

If you want to see if deal Cancellation is turned on for a transaction, go to the open transaction report and you will see a shield icon next to the protected transaction.

Did you lose money from your order? It is okay if you cancel within the set time limit.

FAQs about easyMarkets’ dealCancellation

It is important to know how the dealCancellation works beforehand so you can take advantage of the tool correctly.

- Can I add dealCancellation to an existing transaction?

- No. You can add dealCancellation only when you first set up a transaction.

- Can I cancel a profitable transaction?

- You cannot cancel a transaction for which deal Cancellation is valid . You can close the position and materialize some profit.

- What if I “cancel” a transaction covered by dealCancellation?

- If you cancel the transaction, the risk insurance (loss) for the transaction will be returned to your account.

- Is there anything else I need to know?

- Due to fluctuations in the exchange rate, risk claims may differ when an order is canceled or closed once it has been converted to the base currency of the trading account.

- How long can I cancel a transaction with deal Cancellation?

- The standard setting is 1 hour (60 minutes), but you can also select 3 hours or 6 hours (1 hour, 3 hours, 6 hours).

- Does it cost anything?

- Yes. Prices are based on recent market volatility.

- Which products can use dealCancellation?

- dealCancellation can be applied to currencies and many of easyMarkets day trading products such as gold, silver and oil. Please note that these are subject to change. You can tell if dealCancellation is available by simply checking to see if the dealCancellation icon is displayed on your transaction ticket.

- What if I have a stop loss before the transaction is canceled?

- Another big advantage of dealCancellation is that if you cover your order with this feature, your trading risk insurance will be returned to your trading account even if you stop out before canceling.

Contact easyMarkets Support Team

3. Freeze Rate – What is a freeze rate and how to use it?

Freeze rate is a unique tool provided by easyMarkets that pauses the price movement of a product on the screen. This gives you a few seconds to place your order. These few seconds can make a significant difference in volatile markets such as Forex and cryptocurrencies.

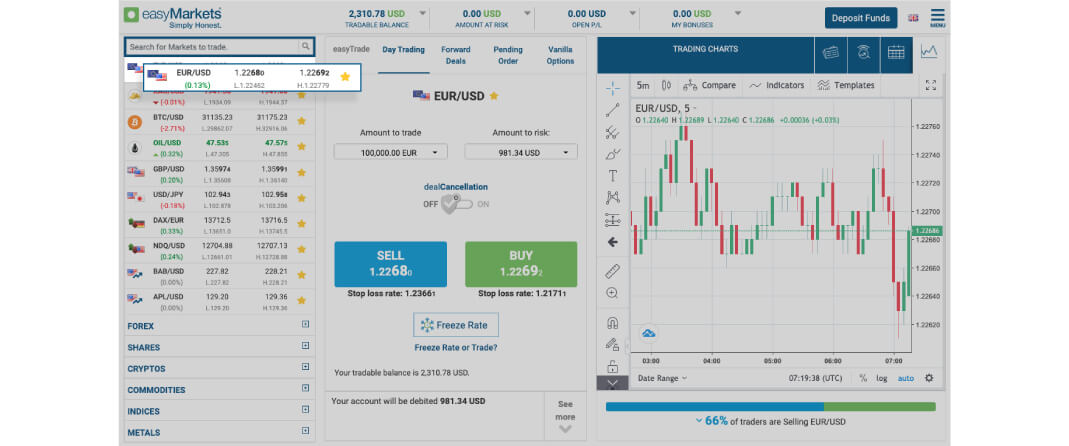

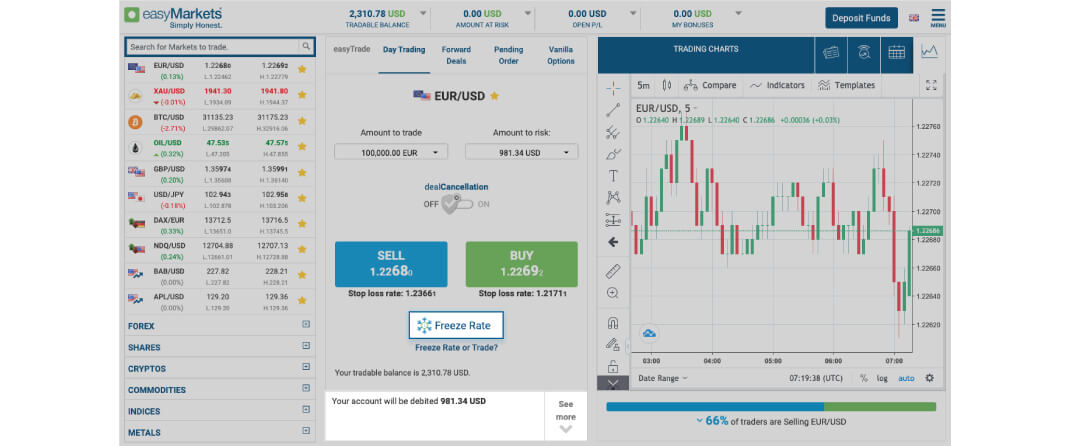

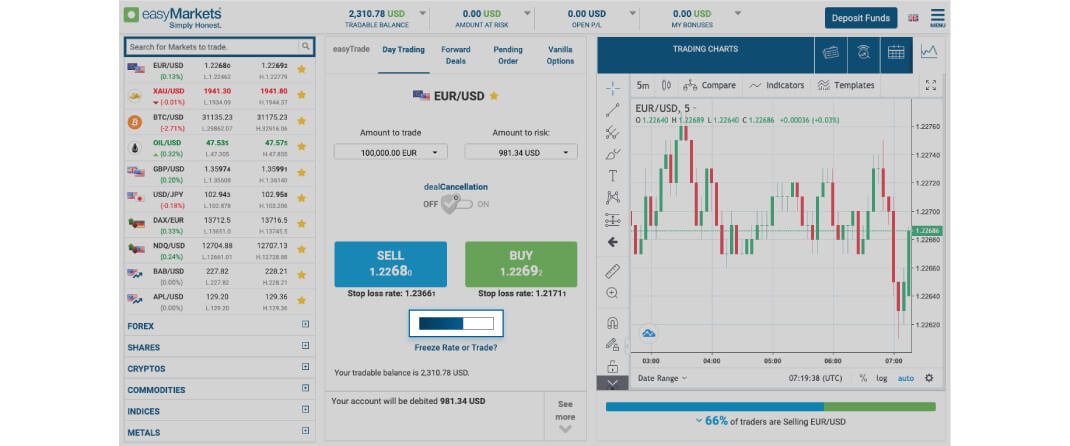

1. Click on your preferred instrument to the right.

2. Click on “Freeze Rate” between the “SELL” and “BUY” button.

3. This gives you a momentary buffer to press “SELL” or “BUY”. A bar will show you the duration of the freeze.

4. You can freeze the rate multiple times, but a slight delay may cause the price to be updated.

The value of suspending prices for 3 seconds in financial markets is significant. The higher the volatility, the more valuable this pause feature is.

These features are crucial at the time of central bank and politician statements, or before events that drive markets, such as the number of new non-farm payrolls in the United States.

EasyMarkets tools have good uses, and freeze rates are extremely valuable if you trade frequently during the day. For other strategies, easyMarkets offers dealCancellation, automatic stop loss/take profit setting, zero slippage, etc. on easyMarkets own web platform.

Go to easyMarkets Official Website

4. Negative Balance Protection – NBP for all clients

easyMarkets offers a range of risk management tools to help protect your clients’ transactions, accounts and funds. The Negative Balance Avoidance feature guarantees that your account will never be less than 0. This protection has been provided by easyMarkets as a standard feature since 2001.

With the Negative Balance Avoidance feature, your account balance will not be negative even if the market moves rapidly in the opposite direction of your expectations. This feature is especially important for new investors who are not familiar with how rapidly the market moves due to market announcements, opening of transactions, or general market volatility.

Combined with other risk management tools provided by easyMarkets, including dealCancellation * and freeze rates , investors will have greater market risk control.

The Negative Balance Avoidance feature guarantees that the account balance of an investor with an unrealized loss position will not be negative. Even if you find that you are losing funds rapidly due to a transaction failure, you can avoid having debts by depositing additional margin. Simply put, it automatically closes open positions where margin calls are falling rapidly.

In today’s complex environment, negative balance avoidance features help you manage volatility and take advantage of high volume trading sessions without worrying about debt. After all, most traders should agree that low volatility has limited opportunities and that low volatility is not ideal for individual Forex trading. However, it is “passing is not enough”. In Forex trading, too high volatility can wipe out your balance in an instant. That is why the negative balance avoidance function is so important.

What Happens When You Use Negative Balance Protection?

2015 was a particularly volatile city for global financial markets, including Forex trading. The Swiss National Bank’s decision to remove the three-year peg of the EURUSD exchange rate in January has created unprecedented volatility in the market, many brokers have gone out of business, and others are rushing to bail out. Caused the situation to do. Meanwhile, traders were left unexplained as to whether the broker would seek payment for negative balances.

The January 2015 SNB case highlighted the importance of guaranteed balance protection. The last thing a trader needs is to deal with losses that exceed the assets he has invested in, which is especially important given the nature of Forex’s personal trading. The great advantage of CFD trading is that it attracts people from all disciplines, including “social” traders and other ordinary people who trade in their leisure time.

At easyMarkets, it understands that traders are responsible for doing research and selecting trades, but easyMarkets also understands that brokers are responsible for facilitating trades in a variety of market conditions. That’s why easyMarkets guarantees negative balance protection.

Negative balance protection is a good representation of brokers

As already mentioned, not all Forex brokers for individuals offer negative balance protection. Many brokers claim to offer negative balance protection simply to assure new traders that they are a credible service providers. Some brokers claim that “guaranteed margin calls” areas new buzzwords in the industry as “ECN” and “STP” brokers, so they offer negative balance protection to attract new traders.

Traders can easily distinguish between brokers who simply say they offer negative balance protection and those who actually guarantee it. For new traders, how long has the broker been up and running? This tells a lot about whether the broker is well-capitalized and well-managed. If you want to screen 90% of your Forex brokers, simply look for a personal Forex broker that has been in operation for over 10 years. These brokers will probably guarantee a margin call that will avoid you from having debt.

5. Stop-loss guarantee – free and automated

EasyMarkets offers free stop-loss for all accounts as a standard feature. This feature is guaranteed on the web and in apps. It is also guaranteed to run at the price set by the user, which means that the transaction will be closed if the market moves contrary to expectations. This feature allows you to prevent unexpected losses and limit the maximum amount of risk you are exposed to when trading.

One of the elements of an effective trading strategy is risk management. Stop loss is one of the most common tools used to stop the rapid growth of loss. Many brokers offer it, but not all stop loss is the same. easyMarkets not only offers stop-loss at no additional cost, but is also guaranteed that your order will be fulfilled when the price is reached.

This is an important advantage: if the stop loss level is not guaranteed, slippage will cause unexpected damage and the risk will increase exponentially when the market volatility is high. However, easyMarkets ensures that stop-loss is executed at a preset rate, so you can trade with confidence.

Find out more about Stop-loss guarantee

Day Trading vs Swing Trading – Using Stop Loss

There is no “right” price or rule of thumb for setting a stop loss, but there are some approaches to keep in mind. If you are doing day trading, check the daily price range of the currency pair and set the stop loss outside that range. Stop-loss orders automatically close positions even if the market suddenly breaks the trend and moves significantly in the direction of loss. On the other hand, when trading swings, set the stop loss even further, such as twice the average daily price range.

After all, it takes knowledge, practice and analysis to get the most out of stop-loss when trading in this huge and dynamic market.

The easiest way to set a stop-loss order is to limit. The price that an investor sets for a position does not change until it reaches either the stop price or a specific limit price (the maximum price that can be set). It is this simplicity that makes pricing the most common form of stop-loss.

Get prepared for volatility with stop loss

The currency market tends to be highly volatile due to the many factors involved. These fluctuations create not only many opportunities but also pitfalls. If you take a position in the opposite direction of the market movement, these fluctuations will lead to loss. Since there is no crystal ball that predicts the future, no one can know 100% sure where the market will move. Given the risk of currency pairs moving in the opposite direction of what you expected, it is important to have a way to limit losses. Stop-loss is useful in that respect.

Factors that influence the Forex market and currency price trends include:

- Political events such as Brexit and the United States presidential election

- Economic indicators: interest rates, inflation, and employment data

- Policy changes: OPEC decisions, monetary policy changes, etc.

- Other events: financial crisis and natural disasters

- Market psychology

Go to easyMarkets Official Website

6. No slippage – Innovative and unique trading tool

Imagine that when you execute a trade, it will be executed at a different price. But forget about it anymore. Because on the easyMarkets platform, the requested price is the price at which the transaction will be executed. Innovative and unique trading tools, risk management and analysis tools In addition to these, easyMarkets platform features zero slippage. It is guaranteed that you can trade at the displayed price.

The question you want to ask is why slippage occurs. When the market becomes very active, the prices of goods can fluctuate sharply in a few seconds. These momentary fluctuations may be the result of software or server delays. But whatever the reason behind it, it leads to unexpected losses and profits.

EasyMarkets’ unique platform features zero slippage because it guarantees price transparency and your transactions are executed at the intended price.

7. Fixed spread – Never change regardless of market conditions

Fixed spreads help investors understand the basics of trading = spread costs, regardless of the market environment. EasyMarkets spreads are stable, regardless of market liquidity or volatility. Even when Bitcoin reached $ 20,000 during its historic rise, easyMarkets not only continued to offer cryptocurrencies but also did not change spreads.

The spread is the difference between the ask price and the bid price. Simply put, you can think of it as a retailer who buys a product at a wholesale price and sells the product with a little extra. Some brokers adjust the spread between this ask and bid prices depending on their volatility. This means that if the market is highly volatile, the spread may be different for each trade, even if you trade at the same time.

A complicated formula is required to calculate such a variable spread.

On the other hand, in the case of fixed spreads, you can know the spread cost in advance, so you can simply build your own strategy (whether long-term or short-term). This increases price transparency and makes costing more accurate before you start trading.

Fixed spreads do not change, but they vary from product to product. Variable spreads reveal market liquidity.

This depends on factors such as:

- Supply and demand of specific securities.

- Trading activity of the underlying asset as a whole.

Go to easyMarkets Official Website

Floating spread vs Fixed spread

For Forex trading, there are two types of spreads, variable and fixed.

Fluctuating or fluctuating spreads are constantly fluctuating between Ask Price and Bid Price 2 . In other words, the spread you pay to buy a currency pair will vary depending on things like demand, supply, and total trading activity.

Brokers that promise tight spreads generally offer variable spreads. The actual spread you pay may match what is being advertised by the broker, but this is not always the case. Spreads are generally tight during periods of moderate liquidity and active trading sessions. An easy-to-understand example is London-New York Overlap.

After all, variable spreads are said to be “totally market-dependent”.

Five benefits of fixed spreads

Unlike floating spreads, fixed spreads are set by brokers and do not change with market conditions or volatility. The spread provided is the spread to be paid.

Variable spreads advertised at 0.1pip are very attractive, but fixed spreads may be more likely to be profitable throughout your career. Below are five benefits of fixed spreads in Forex.

- More transparency

- In Forex, fixed spreads mean cost transparency. Get an accurate picture of the costs you pay for each transaction, regardless of interbank liquidity, time zone, or transaction volume. This guarantees that the broker will not be able to manipulate the spread at your convenience.

- Lower transaction costs

- Applying fixed spreads can significantly reduce transaction costs. There are no surprises on fixed spreads, so you can accurately budget transaction costs in advance. This will greatly improve the ability of investors to manage costs throughout their careers.

- Easily trade in news

- The high volatility of the Forex market is constant, not just during news events. While floating spreads may be beneficial in quieter market conditions, fixed spreads are ideal in more volatile market conditions and may open up more opportunities in those situations.

- Protective barrier against volatility

- Unfortunately, variable spreads complicate news trading due to the large volatility between Ask and Bid prices. Fixed spreads allow investors to participate in news trading as they would in normal market conditions.

- Make your short-term strategy more effective

- Fixed spreads make forecasting easy and accurate, as short-term Forex trading strategies can make huge numbers of trades in a short amount of time. Fixed spreads guarantee high price transparency, as the potential profits are small due to the nature of this strategy.

Trade with easyMarkets’ Fixed Spread

Please check easyMarkets] official website or contact the customer support with regard to the latest information and more accurate details.

easyMarkets] official website is here.

Please click "Introduction of easyMarkets]", if you want to know the details and the company information of easyMarkets].

IronFX

IronFX![easyMarkets]](https://fofan.org/wp-content/uploads/2019/12/easymarkets_s_201911_001.png)

FXGT Broker Review: A Leader in High Leverage Forex and Cryptocurrency Trading

Comment by whatisgoingonTRUMP

February 17, 2025

Trump’s team holds 80% of the $TRUMP token supply, giving them the power to influence prices and put investors at risk. A crypto controlled by one group? Doesn’t seem very decen...