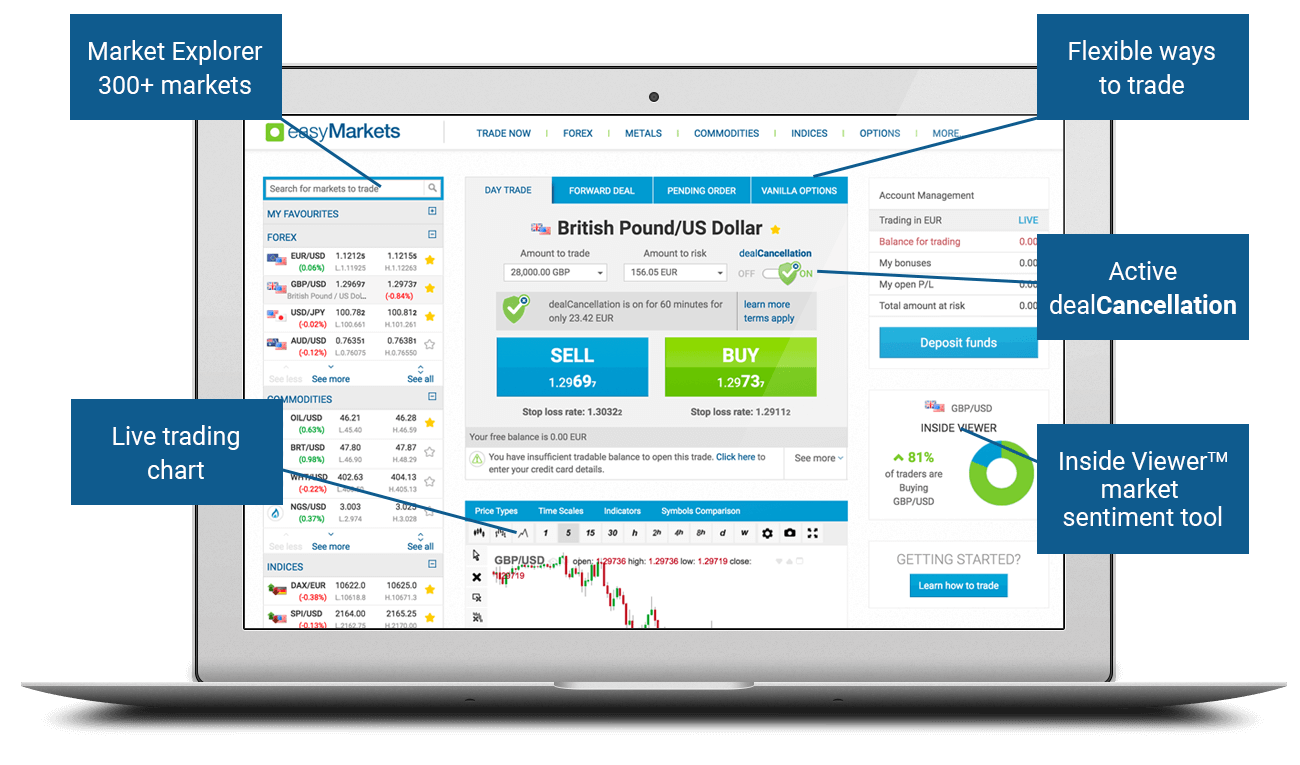

EasyMarkets platform overview

Trade global financial markets easily and securely on the easyMarkets platform. Trade all markets from one simple platform and take advantage of easyMarkets’ unique risk management tools that give you constant control over your trading.

1. Market Explorer

With Market Explorer you can find all the markets you can trade, including currencies (fx), metals, commodities, indexes and vanilla options. Find a single market or pair using the convenient search bar-you can also find products by nickname, for example by typing “kiwi” to see all NZD crosses. You can customize the Market Explorer to display your favorites with the click of a pair, which will be added to the tickets available for trading.

2. Account management

To the right of the trading ticket you will see an overview of your account, where you can see trading live accounts instead of demo accounts, account balances, available bonuses, and profits & losses for currently open orders. Below the chart you can see the details of all open trading and in the bar at the top of the platform you can see the full details of My easyMarkets.

3. Transaction ticket

Here you can choose the method you want to trade, such as day trading, futures trading, pending orders, or options. With this ticket, you can set parameters for trading such as market pair, trading volume, risk trading, and with or without deal Cancellation. The stop loss rate for an order is set automatically, but you can edit it from the open trading section even after you open the order. You can also see the balance available in your account and the amount deducted from your account for a particular order on your ticket. Click “Details” to see more detailed information such as the expiration date of your order.

4. Research and analysis

Below the trading ticket is a chart of the selected market, and on the right is the Inside Viewer, a market psychological tool that shows the direction in which many people are trading their pairs. Below the chart is a live feed of market news related to the pair, where you can get trading signals for that pair. There is also a financial calendar so you can check out any events that could affect the market.

You can find more information about easyMarkets platform and system requirements here and a comparison with MT4 platform to determine the platform that suits your trading needs.

Go to easyMarkets Official Website

What is Forex Trading?

Forex trading is essentially a transaction that sells one currency and buys another at the same time. In other words, it is a transaction that deals with currency pairs that are traded for each currency.

For example, the most traded currency pairs are the EUR / USD, or euro and US dollar. In fact, most currencies around the world are traded against the US dollar.

Since the currency value rises and falls with respect to each currency, it is possible to achieve the investment target. Many factors, including geopolitical and economic factors, can affect the rise and fall of currency values. By taking advantage of these fluctuations in currency values, currency traders invest in currency pairs that are expected to rise in value against the other currency in the future. The rates of currencies that are traded against other currencies are known as exchange rates.

Open easyMarkets Forex Account

How does FX pair trading work?

To understand currency pair trading, it is important to first familiarize yourself with the basic jargon. Therefore, when dealing with currency pairs, the first currency is called the base currency and the second currency is known as the quote currency or counter currency.

When checking the exchange rate, you can see the counter currency required to buy one unit of the base currency. For example, if the exchange rate of EUR / USD is 1.09705, you will need US $ 1.09705 to buy € 1.00. On the other hand, when selling currency, this exchange rate indicates how many units of counter currency can be obtained by selling one unit of the base currency.

When conducting forex trading, the broker will indicate the “ask price” and “bid price” and list each currency pair along with the exchange rate.

The ask price is the price that the broker wants to sell, or in other words, the amount that the trader has to pay to buy a particular currency pair. Bid, on the other hand, is the amount a broker pays to buy a currency pair and the amount a trader receives when he wants to sell to the market. The important thing to keep in mind here is that if you want to buy a bid price that is always lower than an ask price and clearly less than what a broker can expect to get when selling the same currency pair, give that a broker will obviously want to pay less to buy than what they expect to gain when they sell the same currency pair. The price difference between bids and asks is called spreads. This is usually a very small amount, from which brokers make money.

- Major currency pairs

- Currency pairs are categorized based on the amount of currency traded each day. The “major” pair is the most commonly traded currency pair and is usually traded against the US dollar. These major currency pairs include EUR / USD , GBP / USD , AUD / USD , USD / JPY , USD / CHF, NZD / USD and USD / CAD . These currency pairs are generally very narrow spreads and highly liquid markets, trading 24/7.

- Minor currency pairs and exotic currency pairs

- Currency pairs that do not include the US dollar are known as minor or cross currencies. These pairs tend to have slightly wider spreads and are usually not as fluid as the major pairs. However, these currency pairs are in a sufficiently liquid market and there is a potential to make a profit by investing. In addition, either or both currencies may be the major currencies, such as GBP / JPY or EUR / GBP.

Exotic currency pairs, on the other hand, are emerging market currency pairs that are not liquid and tend to have wide spreads. Let’s take a look at some of the most common minor currency pairs here.

Go to easyMarkets Official Website

Forex in every day life

When you visit a foreign country on vacation, you need to convert your currency into the currency of the country you are visiting. We usually carry out foreign exchange trading (FX) when exchanging money through a bank.

Let’s see how it works.

Let’s take a look at how it works, taking as an example the case of living in the United States and visiting Europe on vacation for about a month in July. When buying euros in US dollars, the amount of euros you get depends on the exchange rate at the time of the transaction.

- July

- At the EUR / USD exchange rate 1.20

- To buy € 1,000

- US $ 1,200 is required

Now, when you come back from your trip, you may want to exchange the leftover euros for dollars again. For the sake of brevity, let’s assume that you don’t have to spend any cash locally and want to exchange the same amount. The total amount of re-exchanged dollars will be different from the dollars sold last month, as the exchange rate can fluctuate by a few cents.

- August

- At the EUR / USD exchange rate 1.10

- Selling € 1,000

- You can collect US $ 1,100

With an exchange rate of 1.20, it costs US $ 1.20 to buy 1 euro. In this example, the exchange rate has fallen from 1.20 to 1.10 (10 cents), so you will lose 10 cents per dollar.

All figures are for illustration purposes only and are fictitious. This example does not take into account the spreads (commissions) paid to the bank for the transaction.

Invest in Forex online with easyMarkets

Forex market trading

Foreign currency trading is a mechanism for traders to buy and sell foreign currencies in order to profit from the difference between two different currency values. Traders buy currency’A’ against currency ‘B’, expecting the price of currency ‘A’ to rise. If the currency value soars, the transaction will be completed as soon as you earn profits. However, if the currency value declines, traders will incur losses.

When trading forex on a platform, you will be trading over-the-counter (OTC). That is, the trader guesses the market price of each currency but does not own the actual asset (in this case, the currency). Traders get the resulting profits (or losses).

Open easyMarkets Forex Account

Why is Forex important?

The foreign exchange market, or FX market, is the largest financial market in the world, with more than $ 5 trillion per day trading in currencies at various transactions, institutions and banks around the world. This makes even major stock markets such as the New York Stock Exchange, the London Stock Exchange, and the Tokyo Stock Exchange look small.

The exchange rate is the most important indicator of the economic welfare of a country. If the rate is high, the country can easily import and buy goods and services, and if the rate is low, it can easily export and sell. This helps the central bank’s monetary policy to balance the rates of each currency.

Go to easyMarkets Official Website

What makes the exchange rate fluctuate?

Multiple factors affect a country’s currency value when compared to other currencies. The importance and density of the following factors can all vary and must be considered in combination.

- Inflation

- In general, the lower the inflation of a country, the higher the exchange rate of the currency.

- Interest rates

- Central banks may manipulate interest rates to manipulate currency values. When high interest rates are brought to foreign investment, the exchange rate goes up, and when low interest rates are brought, the exchange rate goes down.

- Trade

- The ratio of exports to import prices leads to the balance of payments. If the ratio of exports is higher than that of imports, the goods in that country are in high demand, and the demand for that country’s currency required to pay for the goods also increases.

- Political Stability

- As a result of foreign investors seeking investment in stable countries, the demand for currencies in those countries increases.

Open easyMarkets Account for free

Comparison of easyMarkets’ trading account types

The main differences of the account types available for easyMarkets are as follows:

| Platform | easyMarkets Web/App and TradingView | MT4 | MT5 | ||||

|---|---|---|---|---|---|---|---|

| Account Type | VIP | Premium | Standard | VIP | Premium | Standard | Standard |

| Spread Type | Fixed | Fixed | Fixed | Fixed | Fixed | Fixed | Variable (Floating) |

| Minimum Spread | 0.8 pips | 1.5 pips | 1.8 pips | 0.7 pips | 1.2 pips | 1.7 pips | 0.6 pips |

| Required Minimum Deposit | 10,000 USD | 2,000 USD | 25 USD | 10,000 USD | 2,000 USD | 25 USD | 25 USD |

| Minimum Trading Volume | 0.01 lots | 0.01 lots | 0.01 lots | 0.01 lots | 0.01 lots | 0.01 lots | 0.01 lots |

| Maximum Leverage | 1:200 | 1:200 | 1:200 | 1:400 | 1:400 | 1:400 | 1:500 |

| Trading Commission | None | None | None | None | None | None | None |

| Account Fee | None | None | None | None | None | None | None |

| Personal Account Manager | Available | Available | Available | Available | Available | Available | Available |

| No Slippage | Optional | Optional | Optional | Unavailable | Unavailable | Unavailable | Unavailable |

| Guaranteed Stop Loss | Optional | Optional | Optional | Unavailable | Unavailable | Unavailable | Unavailable |

| NBP (Negative Balance Protection) | Available | Available | Available | Available | Available | Available | Available |

| Trading Central | Unavailable | Unavailable | Unavailable | Available | Available | Available | Available |

| Sign Up Links | Open VIP Web Account | Open Premium Web Account | Open Standard Web Account | Open VIP MT4 Account | Open Premium MT4 Account | Open Standard MT4 Account | Open Standard MT5 Account |

Please check easyMarkets] official website or contact the customer support with regard to the latest information and more accurate details.

easyMarkets] official website is here.

Please click "Introduction of easyMarkets]", if you want to know the details and the company information of easyMarkets].

IronFX

IronFX![easyMarkets]](https://fofan.org/wp-content/uploads/2019/12/easymarkets_s_201911_001.png)

FXGT Broker Review: A Leader in High Leverage Forex and Cryptocurrency Trading

Comment by whatisgoingonTRUMP

February 17, 2025

Trump’s team holds 80% of the $TRUMP token supply, giving them the power to influence prices and put investors at risk. A crypto controlled by one group? Doesn’t seem very decen...