Day trading, or ‘in-kind’, is a trade that starts on the same day and is usually completed by 10 pm Greenwich Mean Time. This trading method is one of the most popular trading methods that can be profitable through buying and selling regardless of the rise or fall of the market.

Market fluctuations in exchanges or CFDs are very small.

To reach the investment target, day traders need to use leverage, that is, margin trading.

Each trader has several free trading strategies, such as scalping, with the goal of profiting from occupying a position in a short amount of time.

Learn how to start, modify, and complete day trading on Deriv.

What can I trade as a day trade?

Deriv allows you to trade in all markets. You can trade all 98 currency pairs, 5 precious metals, 12 financial instruments, and 3 cryptocurrencies. Commodities are basically considered as’futures’ markets, but Deriv makes it easy to trade such commodities in kind. It should be noted that the contract expiration date and the sudden change in trading in some markets. For more information trading hours please refer to the page of ‘.

Deriv allows you to carry over day trading to the next day or later until the contract expiration date, but in that case you will be charged a carry-over renewal fee on a daily basis.

With a tool called dealCancellation, you can get a 60 minute margin to cancel a lost trade by paying a small fee. Day traders can use this tool in any significant event, before market release, and whenever market volatility is high. With Deriv’ unique tools, you can cancel trades and regain your investment funds even in the worst of situations, so you can rest assured when starting a large-scale trade.

Profit and risk of Day Trading

Day traders may use leverage, which essentially acts as a trade multiplier, to increase the proportion of their investment in the market. However, this can have both advantages and disadvantages. If you would like to see the leverage available, please see Deriv spreads.

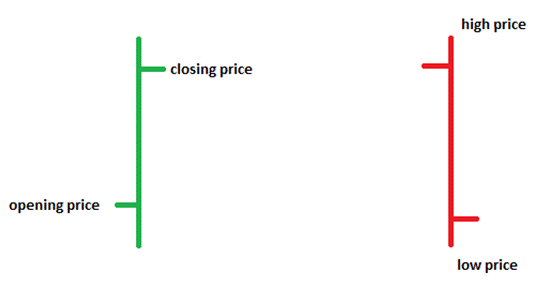

How should I use the trading chart?

The charts provided by Deriv are extremely flexible and easy to use. Charts help you understand market trends during the period, as well as identify up-to-date or declining trends, volatility, and price movements.

Log in to Deriv, click on the ‘Candle Feet’symbol and choose your preferred chart type – Bar (AKA OHLC), Candle Feet, Hollow Candle Feet, Average Feet, Lines, Area and Baseline. You can see the price on the right axis of the chart (Y axis) and the time frame on the bottom axis (X axis).

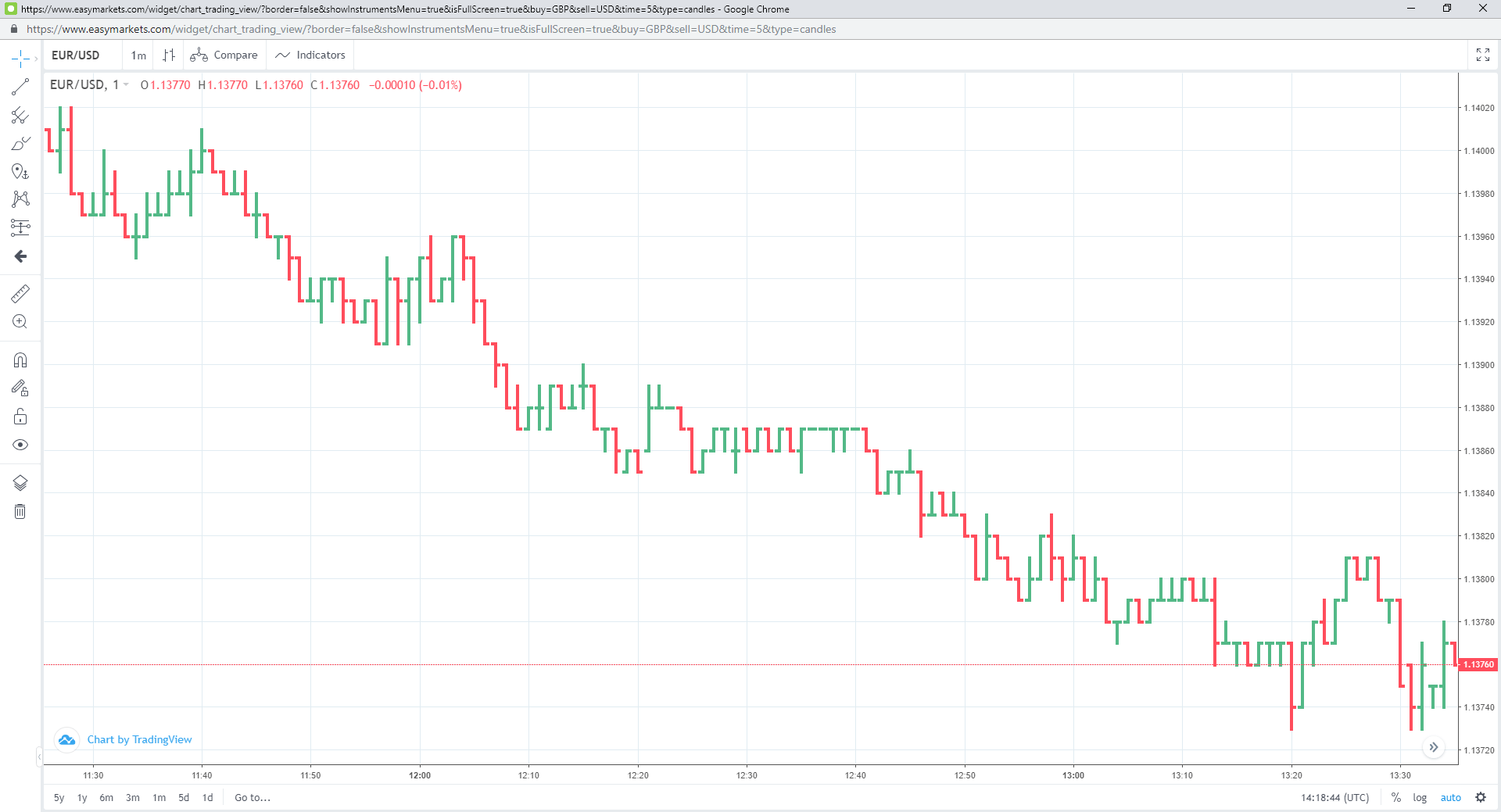

1. Bar chart

Bar charts (also known as open-high-low-close or OHLC charts) provide information about volatility not available with line charts. You can predict market trends through the range of volatility, open and close prices through the height of the bar.

In the image on the left, you can see that the closing price is higher than the opening price, and the overall price trend is positive, that is, it is on an upward trend. The image on the right shows that the closing price is lower than the opening price and is on a downward trend. The color of the bar shows the relationship between the closing price of the day and the closing price of the previous day. The green bar indicates that the closing price is higher than the previous day’s closing price. If the closing price is lower than the closing price of the previous day, the color of the bar will be red.

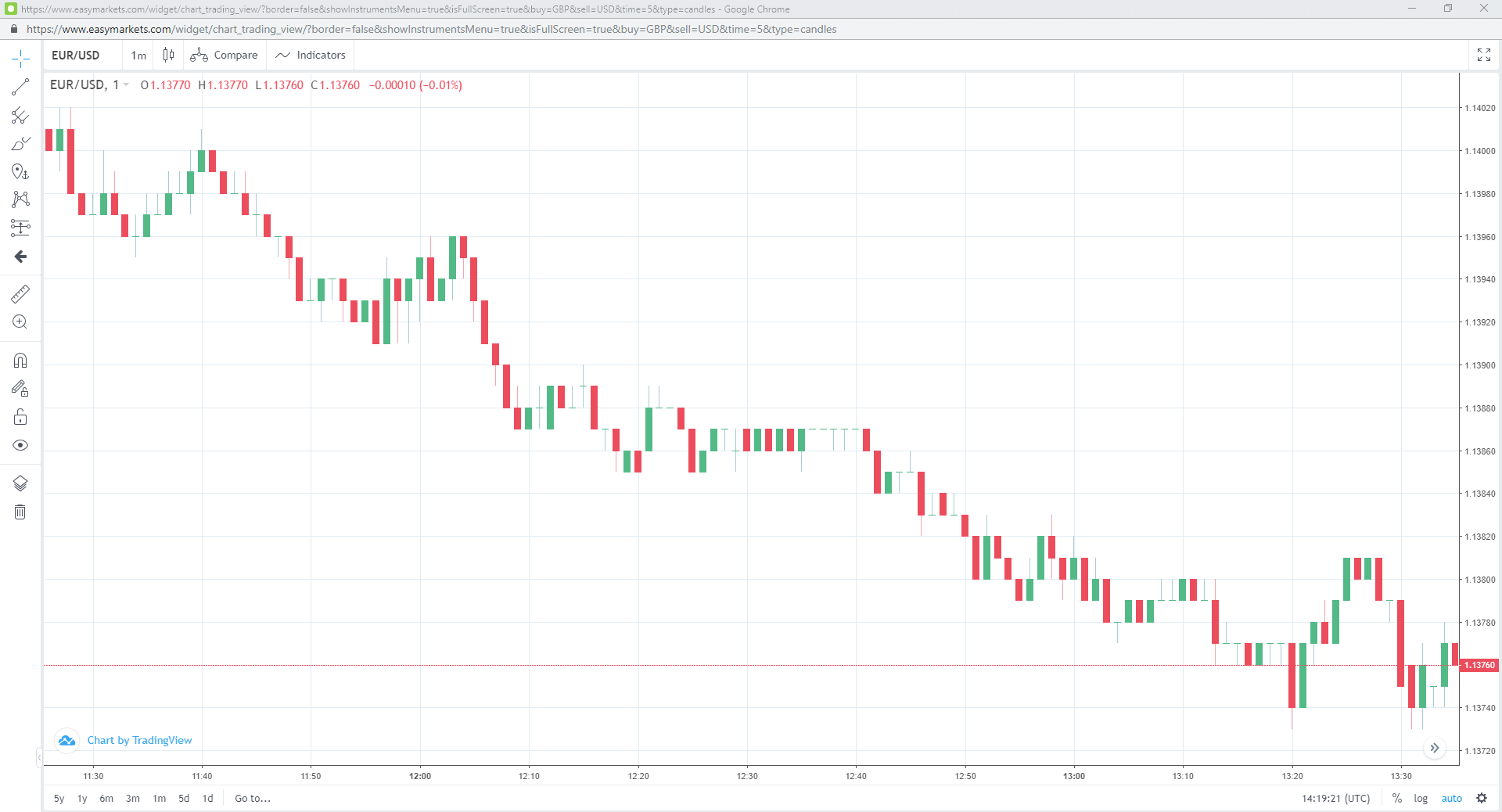

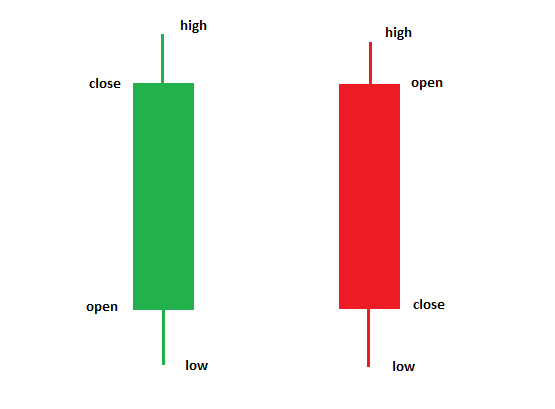

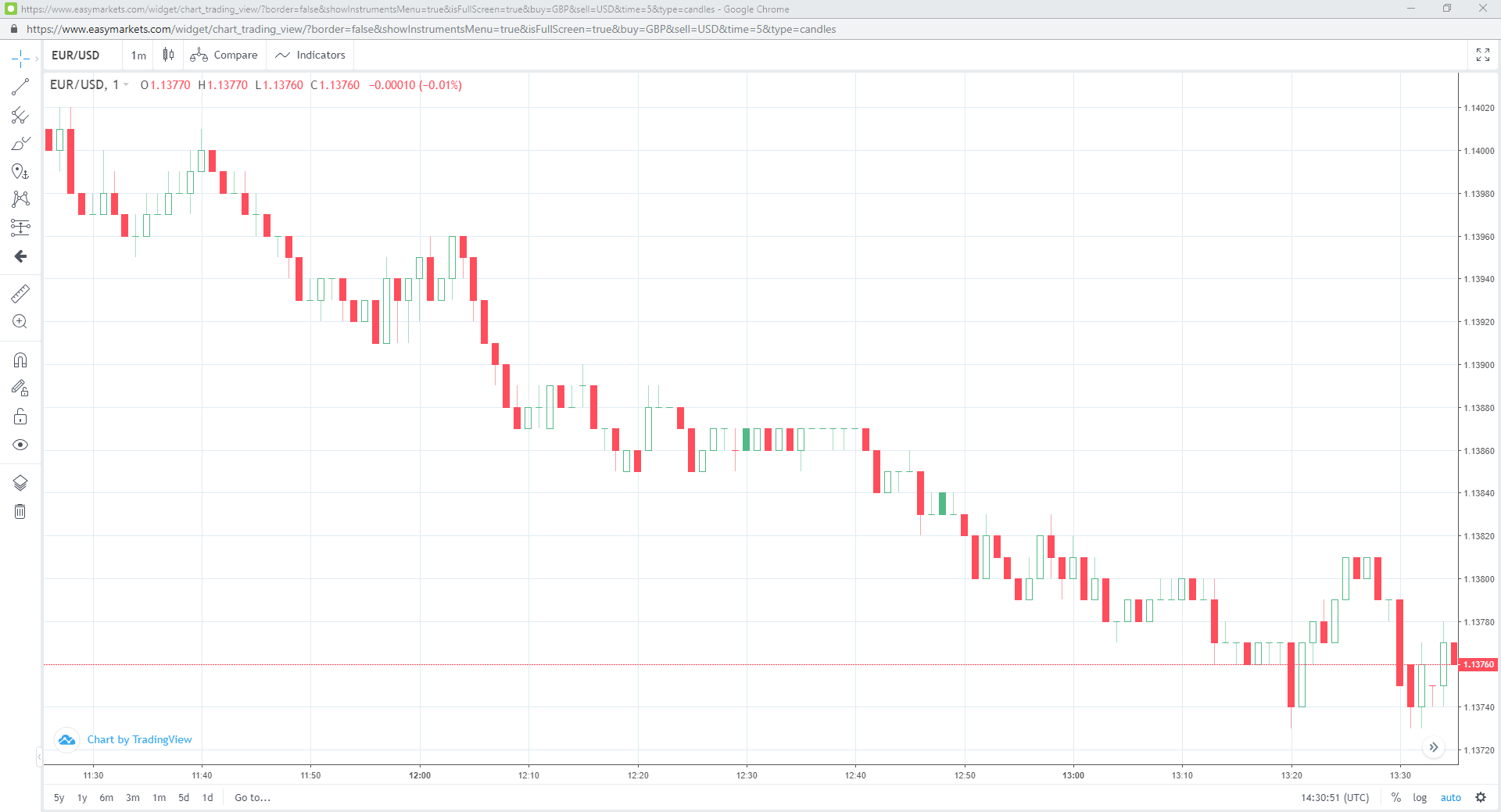

2. Candlestick chart

Candlestick charts are one of the most popular charts for keeping track of prices, as they provide a lot of information easily and instantly. A’candle’has a rectangular entity and indicates the range of opening and closing prices. Candles have vertical lines (or cores) above and below to indicate the upper and lower limits. A green candle indicates that the closing price is higher than the previous day’s closing price, and a red candle indicates that the closing price is lower than the previous day’s closing price.

Trade with the Candlestick chart

Meaning of Hollow candlesticks

Hollow candlesticks are one of the most popular chart types. For all candle bars, red or green indicates that the opening price is higher or lower than the closing price, some of which are middle candle bars. If the closing price is higher than the opening price, it is green and is known as a brush candle, and if the closing price is lower than the closing price, the candle bar is displayed in red and is known as a bearish candle. You can get more information by comparing the current price with the previous day’s trade.

- Solid green candles:

- The closing price is higher than the previous day’s closing price, but lower than the current opening price.

- Hollow red candle:

- The closing price is lower than the previous period, but higher than the current opening price.

- Solid red candle:

- The closing price is lower than the previous day’s opening price and the current opening price.

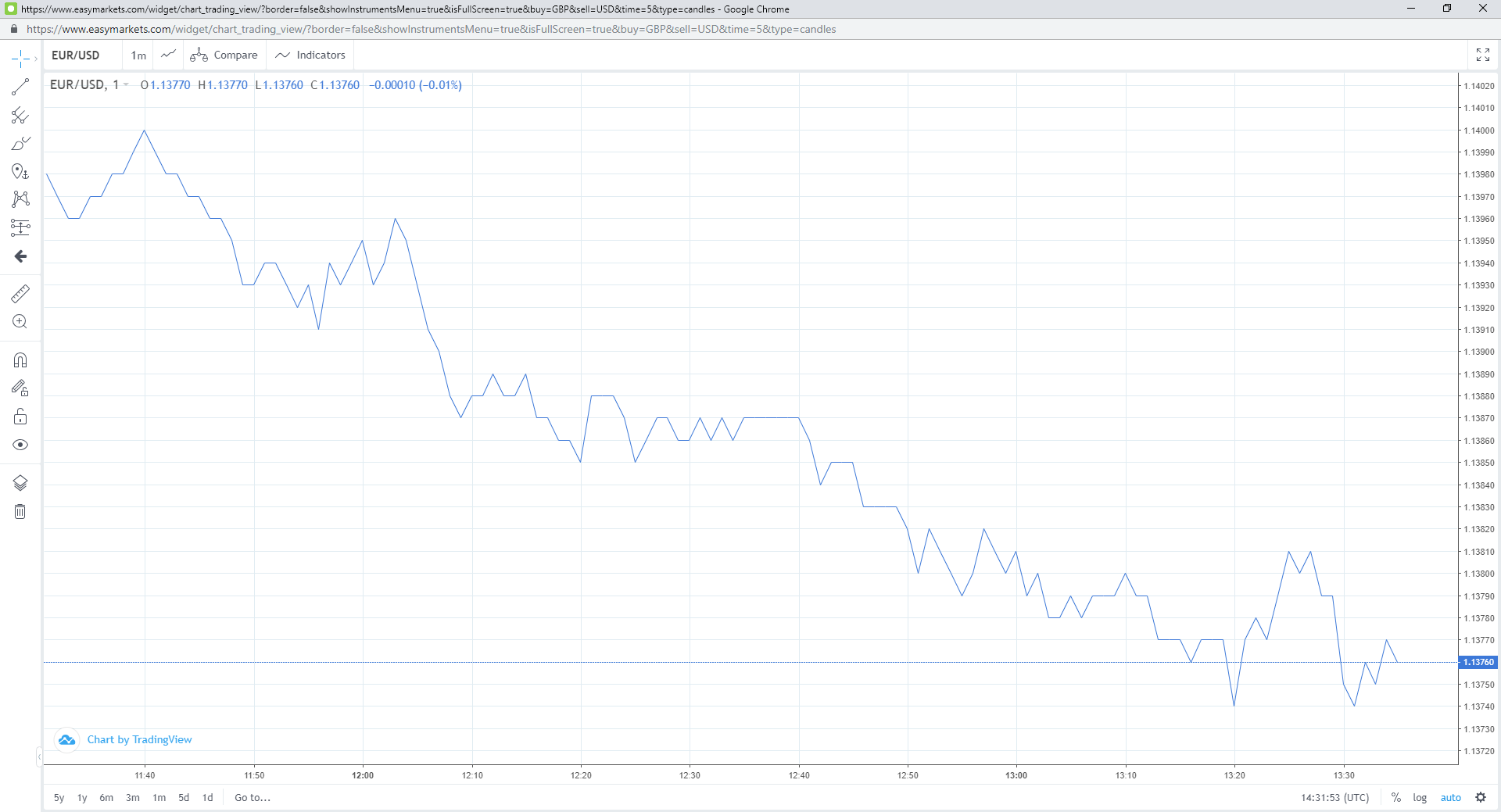

3. Line chart

The line chart is probably the most concise view of the data. The line connecting all the closing prices makes it possible to read the price movement within the period. You can also catch price movements quickly and clearly.

Please check Deriv official website or contact the customer support with regard to the latest information and more accurate details.

Deriv official website is here.

Please click "Introduction of Deriv", if you want to know the details and the company information of Deriv.

IronFX

IronFX

Comment by Diletta

March 26, 2024

Awesome bonuses, good leverage. A few hiccups, but support rocks!