Best Forex Broker for Scalping - What you should know to become a Scalper Table of Contents

The Best Forex Broker for Scalping Strategy

Are you looking for a broker to perform a “Scalping Strategy” to make short-term but many profits?

LMFX, a licensed online Forex and CFD broker that allows traders to perform any types of trading strategies including “Scalping”.

In fact, LMFX is known as one of the best Forex brokers to perform Scalping strategy because of their:

- Low latency and fast execution;

- Unlimited MT4 trading platform;

- and, low spread and low trading commission.

With LMFX, you can perform Scalping on the MT4 with no limit, offering you one of the best trading environments for the strategy.

Now you know that you can freely perform Scalping on LMFX MT4, we are here to show you everything you need to know to start winning with the Scalping strategy.

Starting from the mechanism of Scalping, read through to understand and plan your investment well.

What is Scalping?

Scalping is an intraday trading technique.

This strategy is based on opening many positions and closing them with small profits.

Yadix MT4 welcomes Scalping, HFT and other aggressive trading strategies.

Different traders apply different strategies, this is not only based on their experience and knowledge but also on their personality. While investors tend to keep positions open for months or years, traders keep positions open for days or possibly weeks. On the other hand, scalpers keep their positions open for only a few seconds or minutes.

It is a strategy that requires discipline and a very good risk management system.

The reason for this is because scalpers close positions with little profit and their risk management system do not allow them to hold negative positions for long, simply because a large loss can cover a large number of small previously made gains.

Additionally, scalping requires discipline because sometimes a large number of positions are opened per day in very short intervals of time, between one and five minutes when the market can be very dynamic.

One of the reasons that scalpers operate in the short term is simply because it may be easier to generate a profit on a short move in the market compared to a move over a long time, which not only may not develop for days.

You can also face profound corrective moves.

Another crucial factor in scalping is that your broker provides you with quick execution even in times of market volatility.

Something to note is that scalping is a strategy rarely used by beginner traders.

Not only because of a matter of knowledge and discipline but because time conspires against people with 9 to 5 jobs.

What are supports and resistances?

Levels of “supports” and “resistance” are phrases frequently used in trading when prices have difficulty breaking.

Support levels tend to stop prices from falling below a certain level.

Resistance levels tend to stop rising prices and act as a price ceiling.

Understanding and identifying support and resistance levels is vital in technical analysis and trading in general.

There are a wide variety of tools that can help you understand where these levels can be found.

How can I find support and resistance levels?

A support level is below the current price of an instrument and tends to be when prices find support while falling.

A resistance level is above the current price of an instrument and acts as a ceiling for prices as they rise.

As a support level, this means that generally, the price tends to bounce off this level rather than break it.

When support/resistance levels are broken, a breakout or bounce typically appears – until another support or resistance level is encountered.

Support and resistance levels are fundamental factors for technical traders because these are commonly the levels at which positions are open and looking for bounces or breaks.

Additionally, after a broken support level, a new resistance level begins, and when a resistance level is broken a support level begins.

There are a host of analytical tools and methods that help identify support and resistance levels, these include:

- Previous highs and lows

- Candlestick patterns

- Moving averages

- Trend lines

- Bollinger bands

- Fibonacci retracements

Let’s focus on some examples below:

Here we have a chart of the US500, where a trend line has been formed.

This trend line acts as a support level, not allowing the market to break out.

This example shows a Simple Moving Average applied to Silver.

As you can see, the SMA initially acts as a significant resistance level for the market, but once it is broken it becomes a support level.

This is an example of the USDCHF, where you can see that the high acts as a significant resistance level.

The market approaches this level four times, breaking it only with a candlestick shadow, not a whole body indicating weakness.

In conclusion, there are a wide variety of methods that indicate support and resistance levels, and in some technical analyzes, they can be interpreted as the analysis of support and resistance levels.

What is a pip?

A pip is the smallest price change in an instrument

“One pound one point” means that you gain or lose one pound for each pip movement in price.

You can determine how much you win or lose per pip each pip movement by using the lot size to set the volume of your trade.

Most currencies are quoted by four numbers after the period.

A pip is the smallest amount by which an instrument can vary in value. Pips are also known as points or ticks, and in most currencies, it is the fourth digit after the decimal – but in some cases, it can be the second.

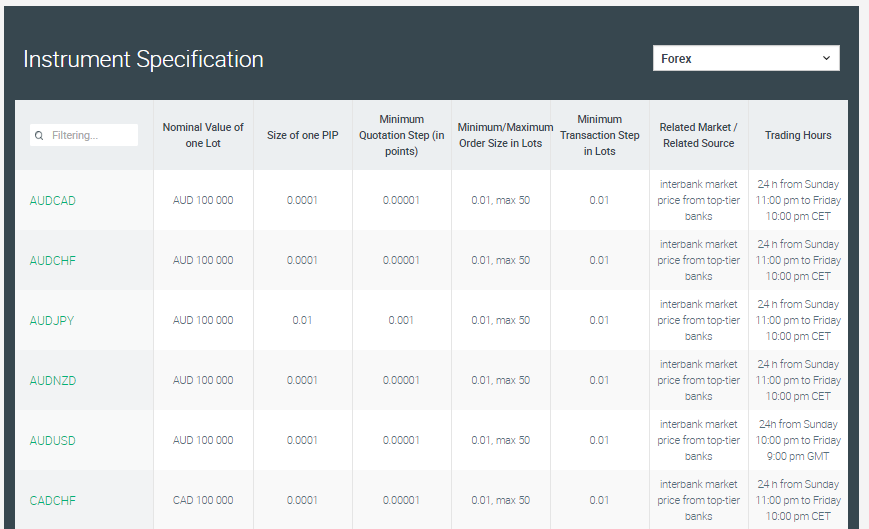

If you want to know the exact size of a pip on a given instrument, you can visit LMFX’s instrument specification page and see the column “Size of a PIP”.

As you can see on the page above, a pip in AUDCAD is the fourth digit after the decimal while a pip in AUDJPY is the second digit after the decimal.

LMFX also provides greater accuracy in determining the price of an asset by adding a digit.

As an example, EURUSD has a buy price of 1.09952.

The pip is the fourth digit after the decimal, this number being 5.

If the sale price is at 1.09964 and you are interested in calculating the spread of this market, simply subtract 1.09952 from 1.09964 and you will have a spread equal to 1.2 pips.

Understanding the pip value is vital for any trader – it is essential to understand the value of your position and calculate how much profit or loss you project if the market moves to a certain pip level after the position was opened.

The value of the pip depends on the chosen market, as well as the volume selected for the position.

With the MT4 platform, you have to calculate the pip value manually.

However, one of the functionalities of the MT4 is to provide this value depending on the volume of the operation and the chosen market.

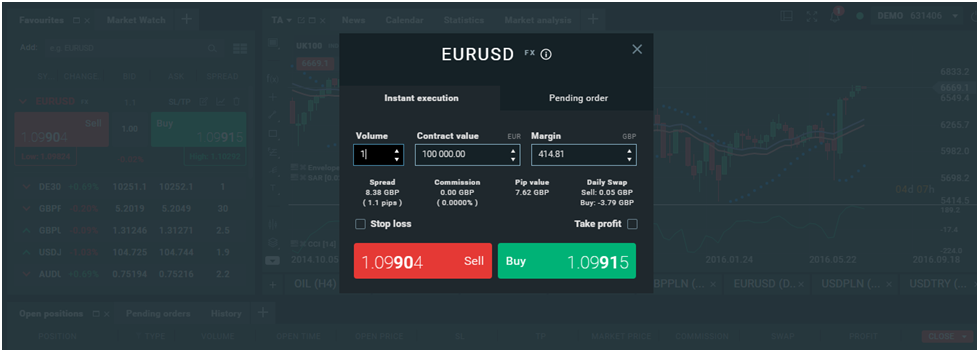

In the example below, a one-lot transaction on the EURUSD has a pip value of £ 7.62.

This means that if the market moves in your favor by 10 pips, you will generate a profit of £ 76.20 (7.62 x 10).

On the other hand, if the market moves against you by 7 pips, in this case, you will have a loss of £ 53.34 (7.62 x 7).

It is very important to know the pip value before opening a position in the market to fully understand the potential size of a profit or loss.

What is volatility?

Volatility refers to the amount of uncertainty, risk, and exchange fluctuation in a given period of a financial instrument.

It is the statistical measurement of the return dispersion for a given instrument.

There are two types of volatility: historical and expected.

In times of high volatility in the markets, prices tend to change rapidly and dramatically in a short period of time.

When markets are not volatile or “flat”, market movements and trends are gradually formed.

Volatility can occur after macroeconomic data or after unexpected events such as natural disasters or political events.

More experienced traders tend to trade in times of high volatility, looking to open and close positions in short periods of time.

In the screen above we have a good example of both high and low volatility.

This normally occurs after significant macroeconomic data that traders were expecting.

After the data is released, a strong or significant move can develop very quickly – as we see on the EURUSD chart above.

This particular example came after the publication of nonfarm payrolls.

It is also interesting to note that once the initial reaction to the data was over, the market lost its volatility and returned to range-limit trading.

The example above is the result of Brexit, where the UK100 fell more than 600 pips in less than an hour, showing the increase in risk aversion towards the British economy in the short term.

What is a Stop Loss order?

It is a capital protection measure that traders use to limit the loss of the operation.

It is the price level at which the position would be closed to avoid losses greater than the limit that the trader tolerates for a given position.

It is an automatic execution order that closes the position without the trader having to continuously monitor it, thus providing some security and operational comfort.

Risk management is one of the keys to being successful in financial markets and a basic issue in money management.

Let’s look at the example above.

The trader has opened a long position on the EURUSD waiting for the price to rise to 1.09935, the level shown by the upper line.

The lower line indicates the Stop Loss level, set at 1.09842.

If the market falls below the previous level, the position will automatically be closed in losses, protecting the capital from adverse movements beyond said price.

Generally, you should not risk more than 5% of the capital for each position. Stop Loss helps minimize and contain losses in a controlled range.

In situations of extraordinary volatility, it is possible to suffer price gaps.

In these situations, the Stop Loss may not be guaranteed.

If the market undergoes a movement that is too wide and the price at which the trader set the Stop Loss is skipped, it will be executed at the first available price instead of the desired level, due to the sliding or “slippage” of price.

The Basic account, however, offers guaranteed Stop Loss that is executed at the price level set by the trader even in highly volatile situations where price gaps are generated.

Master the psychology of trading

Trading can become emotionally difficult, especially when prices are moving quickly and you are witnessing your profit or loss fluctuate.

The emotional consequences can lead him to perform an impulsive operation, where logic and rationality are overcome by the emotional part.

Due to this, it is very supportive to generate a trading plan to stay focused on a strategy when we perform each operation.

Next, we will discuss the typical emotions when trading and how to overcome them:

- Expectation

- Every trader is waiting for their trades to be winners and that their analysis of the market was correct. But expectation can lead to confusion, even more so if prices start to turn against you. Be aware of this and stick with your strategy. When prices start to move in a direction opposite to the one you are targeting in your trade, you should close the position at the best possible price.

- Fear

- Feeling fear when opening a position is a fairly common feeling, especially for beginners. Most of the fear associated with trading is a consequence of taking a loss. You need to accept that losses are common when trading and you must not let fear get in the way of taking a solid opportunity. If you are still fearful of trading, then perhaps you should look for longer periods of time.

- Greed

- This is perhaps the worst emotion for some traders. Greed can make you chase the market, generate losses, over-trade and most damagingly, convince you to put your strategy aside. Create a trading plan and stick with it. Some traders believe that the best way to follow your own rules is to write them down – that way, you have a visual reminder every time you open a position.

- Emotions – Put them aside

- The best way to protect yourself from emotions that have a negative impact on your decisions is to treat trading like a business. You need to create a detailed trading plan and strategy behind each position you take and follow the rules of your plan. Even the best traders suffer losses. It is part of being a trader. The most important thing when you suffer a loss is to learn from it, not repeat the same mistakes, and move on to the next potential opportunity.

Utilize Pending Orders

There are 2 types of transactions; instant executions and pending orders.

While instant executions open at the current market price, pending orders allow you to place orders that will be activated once the price reaches the level chosen by you.

There are 4 types of pending orders that you can use at LMFX and these include:

- Buy Stop

- Sell Stop

- Buy Limit

- Sell Limit

1. Buy Stop

The Buy Stop allows you to place a buy order above the current market price.

This means that if the current market price is 20 USD, and the Buy Stop price is located at 22 USD, then once the market reaches the price level of 22 USD, the buy order will be executed at that price.

2. Sell Stop

The Sell Stop allows you to place a sell order below the current market price.

This means that if the current market price is $ 20 and the Sell Stop price is set at $ 18, then once the market reaches the price level of $ 18, the sell order will be filled at that price.

3. Buy Limit

Buy Limit allows you to place a buy order below the current market price.

This means that if the current market price is $ 20 and the Buy Limit price is set at $ 18, then once the market reaches the price of $ 18, the buy order will be executed at that price.

4. Sell Limit

The Sell Limit allows you to place a sell order above the current market price.

This means that if the current market price is $ 20 and the Sell Limit is set at $ 22, then once the market reaches the price of $ 22, the sell order will be filled at that price.

The simplest way to set pending orders is directly from the chart, this is possible on the MT4 trading platform.

Please check LMFX official website or contact the customer support with regard to the latest information and more accurate details.

Please click "Introduction of LMFX", if you want to know the details and the company information of LMFX.

Deriv

Deriv  AdroFX

AdroFX