In the foreign exchange market, quotations are continuous for most of the time, but there will still be some breaks, that is, gaps. In the case of open positions, gapping may bring us unexpected profits, but it may also bring unexpected losses. And the gaps that we did not encounter can also exert other effects.

Gap, that is, the market price is disconnected and the quotation is inconsistent. It is divided into gaps that jump to higher prices and gaps that jump to lower prices. The most popular thing for stockholders on the A stock market is to buy the stocks with consecutive daily limits. There is no word board in the foreign exchange market, but gaps exist.

The gap in the foreign exchange market mostly occurred at the opening time on Monday morning after the weekend was closed. The fermentation of fundamental events over the weekend may be reflected in the gap on Monday morning. Of course, there is also a low probability of gaps within the normal quotation time, and this kind of often corresponds to major fundamental events. In short, gaps are unpredictable, and it is impossible to place orders at the timing of gaps to catch a wave of gaps (you can’t enter the market without opening before the gap, and it’s too late after the gap), so considering the gap, The author’s first suggestion is not to hold positions over the weekend for non-long-term trading.

While we can not grasp the basic upward market, but also can give upward to certain operating tips. The author’s reminder: For the gaps that are taken into consideration, the gap distance is recommended to be 30 points or more. Small gaps can be considered as meaningless.

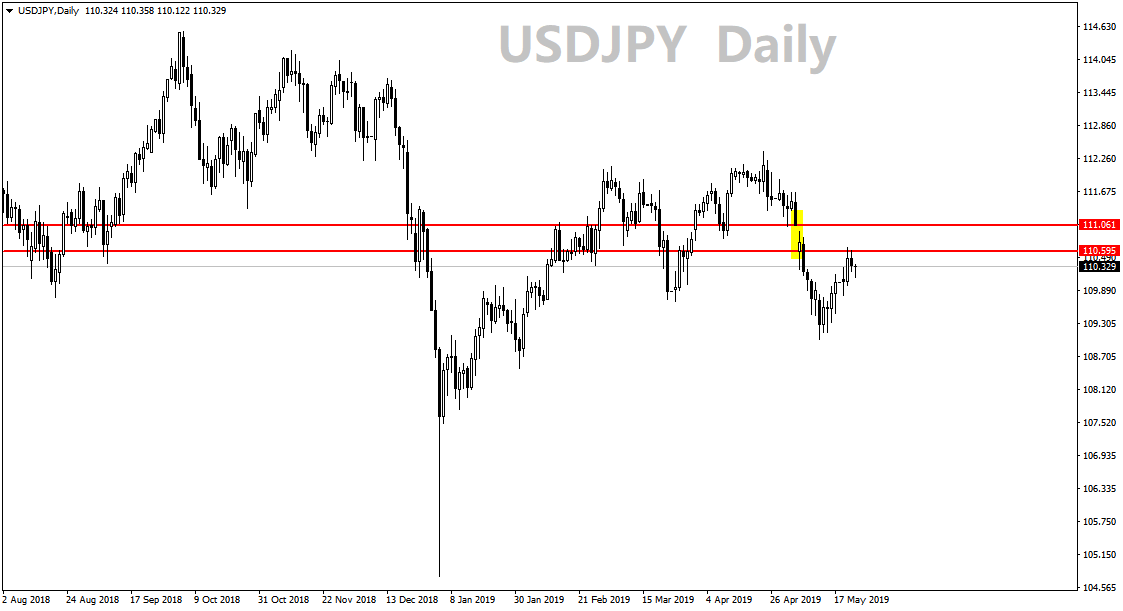

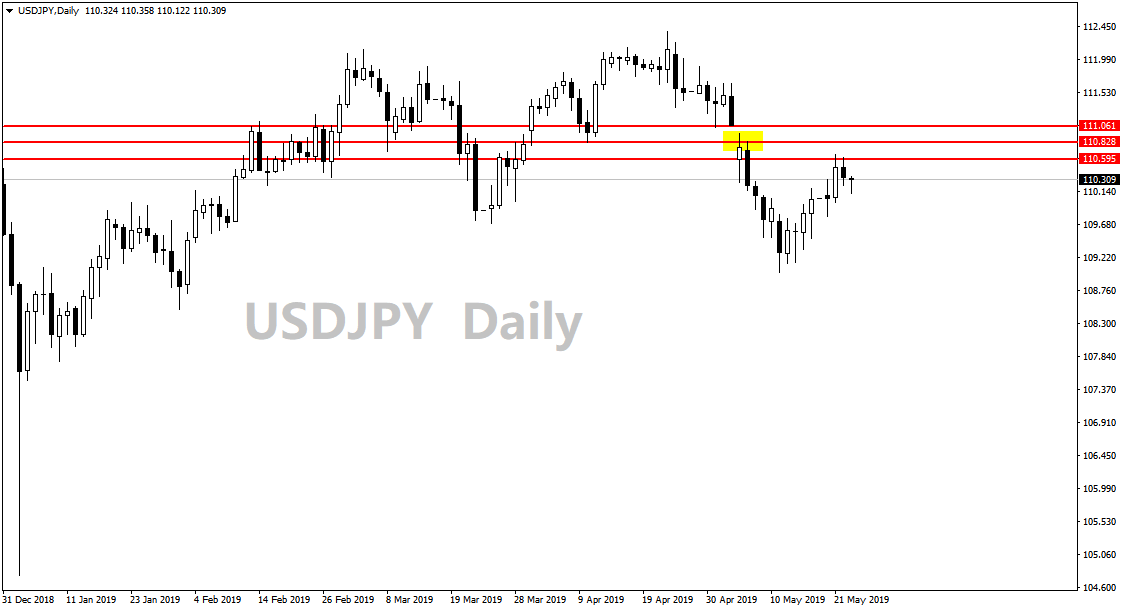

Behind the gap generally represents the short-term fluctuations of market sentiment. It can be considered that a high gap is the sudden force of bulls, and the bulls are stronger; a low gap is the force of shorts, and the shorts are stronger. If you can confirm it within a short period of time If the long-short sentiment continues, it may chase the order. As shown in Figure 1, the short position after the gap is opened lower and achieves a considerable profit.

So how to confirm whether the order can be chased after the gap?

First, breakthrough gaps are better.

Second, after the gap is not fully covered, you can consider chasing orders.

First explain what is a breakthrough gap. That is the price gaps from below the key level to above the key level, or the price gaps from above to below the key level. Among them, the breakthrough type gap for interval consolidation is the best (that is, the gap comes to the consolidation range. outer).

After the breakthrough gap, you can be prepared to look for entry opportunities near the key position that was breached.

For example, Figure 1 above is a breakthrough gap. If you fall below the previous low, you can wait for an opportunity near this low.

Covering involves the issue of gap windows. The price gap formed by the gap is the gap window. The upper and lower edges of the window are formed by the closing price of the K line before the gap and the opening price of the K line after the gap.

If the upper or lower edge is broken by the K-line entity in covering, it is called complete covering. Under full covering, no longer consider the chase after the gap, this gap is only regarded as an ordinary yang line or a yin line. If the upper and lower edges of the window are only tested, you can follow a short-term order in line with the K-line closing situation (breakthrough gaps can be directly considered chasing orders, non-breakthrough gaps need to consider the big trend), or a bold friend Place a test order (small stop loss) at the upper or lower edge.

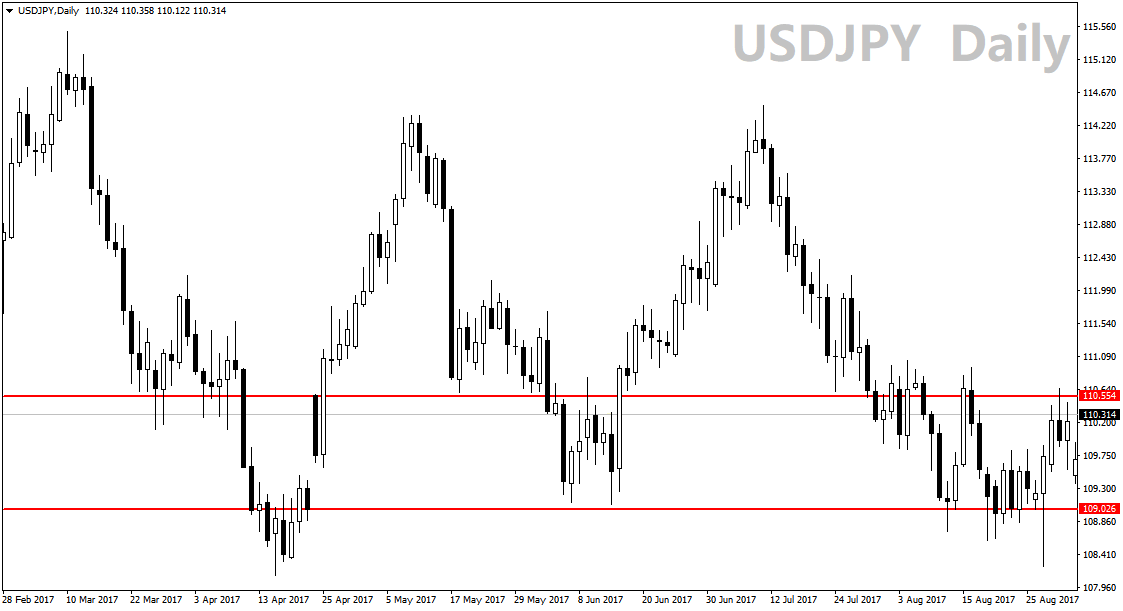

In the above figures 1 and 3, both are not fully covered by the window. Among them, figure 1 is the best way to chase orders with breakthrough gaps, while figure 3 is not a breakthrough gap, and it is in the rebound stage of a short trend. Single entry risk is higher (although the subsequent trend reverses, but the author believes that it is not appropriate to chase long orders through this gap at that time).

For the chasing orders after the gap, it belongs to the short-term emotional direction to make orders, not necessarily following the trend, so they are mostly short-term orders. Once there are signs of correction in the disk, you have to leave the market as soon as possible. And note that the above screenshots have chosen the daily chart for the convenience of explanation, but it is better to use the hourly chart in actual operation. After all, the timeliness of long and short emotions is shorter, and the effect of operating on the daily chart after a day or two is limited.

In addition, in addition to considering the follow-up order for the gap, the upper and lower edges of the window can also be the support and resistance levels of the future disk (one-time, if the position is broken, it will not be considered). Don’t ignore it when you draw the line.

IronFX

IronFX

Comment by Diletta

March 26, 2024

Awesome bonuses, good leverage. A few hiccups, but support rocks!