It is not difficult for careful investors to find that there is a correlation between crude oil prices and the exchange rates of many countries’ currencies. The exchange rates of some currencies will advance and retreat with oil prices, and some will be contrary to the trends of oil prices. The factors behind it include energy distribution, Trade balance, market psychology, etc. These factors often influence each other and check and balance each other, thus causing fluctuations in oil prices and foreign exchange markets that we see. Since crude oil prices and the foreign exchange market influence each other, we will analyze the relationship between them from two perspectives.

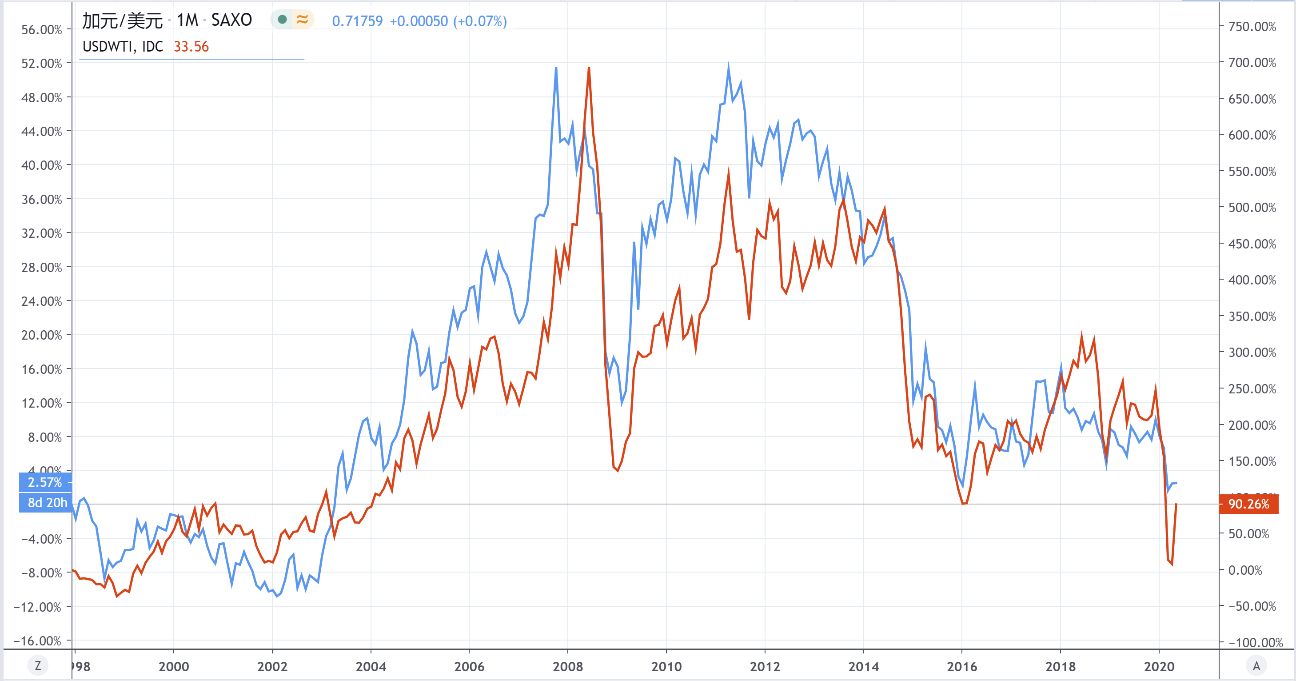

The first perspective is the impact of oil prices on the foreign exchange market. When oil prices change, the exchange rates of many oil-producing countries’ currencies (for example, Canadian dollars, Norwegian kroner, Russian rubles, etc.) tend to move in the same direction as oil prices. That is to say, if oil prices rise, these currencies will also appreciate and oil prices will fall. The national currency depreciated accordingly.

This is mainly because the production and export of crude oil is an important pillar of the economy of these countries. When oil prices rise, the same amount of crude oil can be sold for more money, thereby increasing the net exports of these countries and improving their international trade balance and balance. Fiscal revenues and expenditures will allow their economies to grow and enhance their international competitiveness, thereby promoting their currency appreciation.

At the same time, because crude oil is mainly traded in U.S. dollars in the world when the price of crude oil rises, more U.S. dollars will flow into oil-producing countries. These U.S. dollars often need to be converted into national currencies. The demand for currencies of these oil-producing countries will, As a result, rise, causing their currencies to appreciate against the U.S. dollar.

The relationship between the Canadian dollar (CAD/USD) and the oil price (WTI) (the blue line is the Canadian dollar, the red line is the oil price, the ratio is adjusted)

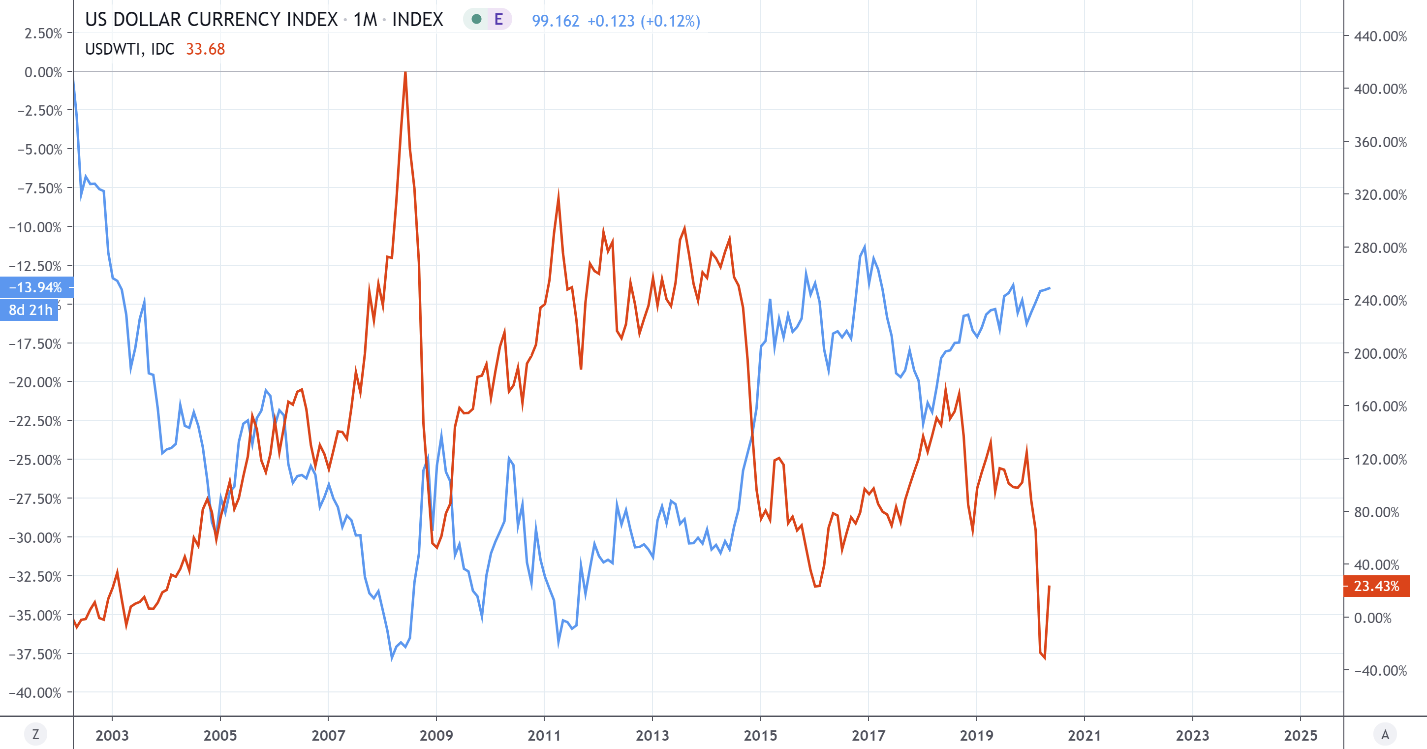

The second perspective is the foreign exchange market The impact of oil prices. Because most crude oil transactions are conducted in U.S. dollars, here we mainly discuss the impact of U.S. dollars (USD) on oil prices. Historically, the appreciation/devaluation of the U.S. dollar is mostly the opposite of the increase/decrease of oil prices. That is to say, when the U.S. dollar appreciates, oil prices tend to fall, and when the U.S. dollar depreciates, oil prices tend to rise.

This is because for many crude oil-importing countries, although the oil price may not change in terms of the dollar amount, as the dollar appreciates, the domestic currency required to purchase the same amount of crude oil will increase. Will become more expensive, which often reduces their crude oil purchases, thereby reducing the overall demand in the crude oil market, and ultimately leading to lower oil prices. Conversely, when the U.S. dollar depreciates, oil prices will become cheaper for these crude oil-importing countries, which will increase overall crude oil demand and cause oil prices to rise.

For example Japan, one of the major crude oil importers, usually buys crude oil in US dollars. We assume that the oil price is at 10 US dollars per barrel and 100 yen per US dollar. At this time, the oil price for Japan is 1,000 yen per barrel. Assuming that the U.S. dollar appreciates, 120 yen can now be exchanged for 1 U.S. dollar. This has caused the oil price for Japan to become 1,200 yen/barrel, an increase of 20%. This will make many Japanese crude oil importers choose to reduce their imports, thus making the crude oil market more attractive. The demand is reduced. With the supply of crude oil unchanged, a decrease in demand will reduce oil prices.

The relationship between the US Dollar Index and the oil price (WTI) (the blue line is the US dollar, the red line is the oil price, the ratio is adjusted)

IronFX

IronFX

Comment by Diletta

March 26, 2024

Awesome bonuses, good leverage. A few hiccups, but support rocks!