What is Range Break? Table of Contents

- Understanding Range Break Analysis

- Trading Ranges - Review and Basic Tactics

- Setbacks and the HF Principle - a philosophical approach

- The magician's approach

- Setbacks and the HF principle - an empirical approach

- Go With the Winner (GWTW) Tactic on Bullish Breaks

- The warning sign

- The Counterattack Tactic

- Some examples

- Conclusion

Understanding Range Break Analysis

Range break analysis is one of the most used techniques in trading and its knowledge can help the trader to broaden his spectrum of interpretation of the market.

Trading range breakouts are one of the most respected price movements by all technical analysts.

Trend followers love them and short-term swing traders who base their decisions on overbought and oversold situations are anxious about their appearance; Technical analysis books have a special section dedicated to range breaks and almost all trading methods incorporate a strategy for them.

In this article, I will briefly review the classic breakout strategy and discuss the Habit Force behind false breaks.

In the sequence, we will talk about CWTW and Counterattack tactics.

Trading Ranges – Review and Basic Tactics

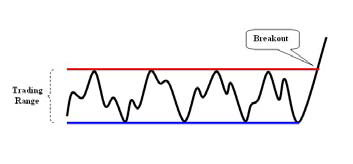

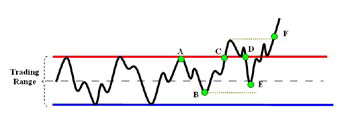

In figure 1 you can see what a classic trading range looks like.

As its name suggests, a trading range is a strip defined by two horizontal lines (a resistance line and a support line), which encompasses the price values (in black) of a tradable asset over a period of time.

Trading ranges are considered energy accumulation periods. When the price finally breaks the range, the accumulated energy is unleashed resulting in a significant price movement in the direction of the breakout.

The basic strategy against side markets is to wait until a breakout occurs and take a position in the direction of the breakout.

However, there are a number of short-term traders trying to profit from price swings within the trading range by buying near support and selling near resistance.

This last tactic satisfies swing traders’ need for action and has one main advantage: deep buy and sell levels.

However, there is a debate among trend followers and short-term swing traders about whether trading within a price range offers a significant advantage.

Some of the common drawbacks attributed to trading within the price range are:

- When the range becomes clearly visible to more and more traders, it is usually time to cut as catching a profitable move within the range requires a dose of lack of interest.

- The breadth of the range is not enough to compensate for the risk/reward ratio (including commissions) and, since time is money, the time taken to track price turns within the range subtracts much of the expected profit.

- Fundamentals seem to play no role in price swings within trading ranges so range traders rely solely on the technical aspect.

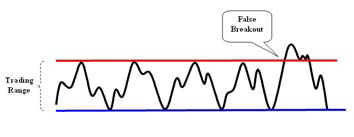

On the other hand, traders who base their positions on range breakouts often face frustrating “false breakouts”.

In a “false break” the price leaves the trading range (sometimes accompanied by significant volume), but not to start a trend in the direction of the break.

In figure 2 you can see what a typical false breakout looks like.

Price (in black) exits the range and tricks traders into taking a long position with a stop at the range’s previous resistance line.

The price is then rotated and the tendency of the markets to maintain their “habits” using the term “habit force” or “habit force” (abbreviated HF).

The HF principle states that markets enter a trend to maintain their “habits.”

One of Dow’s fundamental principles of trend continuation (a trend is active until it is exhausted) is a type of HF.

The price trend to reverse in the vast majority of trends is also a type of HF as retracements show that the price is reluctant to change in value and tries to return to its previous state.

Setbacks and the HF Principle – a philosophical approach

The vast majority of breaks are accompanied by setbacks.

The retracement is formed when the price tries to re-enter the range after a breakout and this is another type of HF as the price actually tries to follow its oscillatory movements within the range.

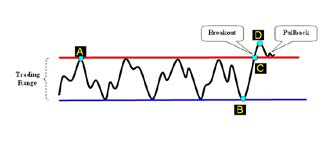

Figure 3 shows the case of an upward break accompanied by a setback.

From point A to point C, the price has a habit of being within the range defined by blue support and red resistance lines (medium-term habit).

From point B to point C the price is under the effect of the short-term uptrend (short-term habit).

As soon as the price reaches the resistance level two forces are applied to it.

The short-term force tries to push the price above the resistance and the medium-term force tries to send the price back to the blue support line.

At this point, considering the old saying that says “The longer the habit is maintained, the more difficult it is to overcome”, we could expect the medium-term habit to beat the short-term one.

If you’re wondering, “… then why are so many technical analysts trying to get into a stock as soon as a breakout occurs?” The answer is simple: if a break turns out to be valid and a trend starts in the direction of the break, this trend is usually very powerful.

Technical analysts try to enter the trend as soon as possible and make as much profit as possible, but at the same time take rigid precautions by using tight stops that execute without delay.

This is evident in David Ryan’s approach to breakage discussed in the next paragraph.

The magician’s approach

In his book Market Wizards, Interviews With Top Traders Jack D.

Schwager reproduces the David Ryan interview, which uses many ideas from William O’Neil’s stock selection method, which is based on “buying power” ( that is, the purchase of the best-performing stocks from both a technical and a fundamental point of view).

According to Schwager, Ryan’s approach to breakouts to the upside is to buy a stock as soon as it is breaking a long-term range and at the same time place a stop-loss order at the top of the range.

As Ryan says in Schwager’s book: “If the stock re-enters range, I have a rule of thumb to cut at least 50 percent of the position.

Often times when a stock re-enters range, it returns to the range.

Even if Ryan’s approach is to “buy strength” (thus buying promising and healthy stocks), it is obvious that he adheres to the HF principle and is not based on the premise that a break to the upside necessarily implies a strong uptrend.

On the other hand, a more detailed analysis of Ryan’s words leads us to the Counterattack tactic.

If when a stock re-enters the range, it frequently returns to its lower end, then it may be a good idea for short-term traders to take a short position the moment the stock re-enters the range after the break.

We will cover the Counter-Strike tactic later in this article.

Ryan however is not a supporter of the Counterattack tactic and I think he does so not only because he focuses on the long and profitable trends,

Setbacks and the HF principle – an empirical approach

One of the main reasons for David Ryan’s (and almost all technical analysts) preference for breakouts to the upside is that after a breakout of a long-term range there is no significant resistance above price.

In other words, everyone who has bought within the range is on the profit and the stock is not under selling pressure.

This is true in most cases, especially when the breakout occurs after a very long trading range (several months or years), but the frequency of pullbacks after breakouts shows that there is actually selling pressure after the breakout.

The breakout by everyone who was “stuck” in value during the range development, finally finding the opportunity to exit at a very favorable price.

Go With the Winner (GWTW) Tactic on Bullish Breaks

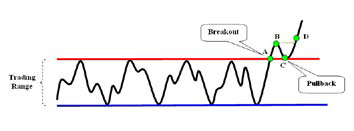

Given that in reversals there is a battle between a short-term and a longer-term habit, a conservative approach would be to wait and see who will be the winner before acting.

How can you tell who has won? In cases of a breakout to the upside, just look for the price to break above the breakout bar after having retraced.

In figure 4, the best time to take a long position is neither in A, nor in B or C, but in D.

In D it is clear that the force of habit, which has been responsible for sending the price of B a C is not stronger than the force of habit that wants the price to go up.

This type of trading action (hereinafter referred to as GWTW) is of course more conservative than the one that follows the price as soon as the breakout takes place.

The main advantage of GWTW is an adaptation to market conditions at the right time.

Furthermore, if a stop loss is set at the resistance of the previous range (horizontal red line in figure 4), the risk/reward ratio is considerably higher for cases where the BC segment (see figure 4) is not high enough.

The warning sign

Are there price signals that you can warn of a possible breakout? The answer is yes in most cases.

Many bullish breaks usually take place after a price failure to get close to the support level of the range.

Within a range, price tends (by definition) to move from the low of the range to the top of the range.

A price failure to reach the bottom of the range indicates its tendency to change this habit.

In figure 5 you can see an emblematic case of a break to the upside.

The price oscillates within a range and sequentially touches the red and blue lines that define the range.

After reaching a local high at point A the price drops to point B, which is well above the support level (blue horizontal line), but is lower than the midline of the range.

In the sequence, the price advances strongly (point C) and then breaks the resistance level (red horizontal line).

The warning signal is given at point C.

The GWTW strategy is able to save us the frustrating case in which the price falls back and re-enters the range (point D), thus activating the stops.

Even if the price returns to the range there is still hope for a profitable long position if the price does not reach the support level of the range (point E) and more likely if the price does not fall below the level of point B.

The signal of Buy occurs at point F, where the price exceeds the initial break with a stop loss at the top of the range.

Note that the example in Figure 5 is the general case.

Often times the price will not drop to point E after the breakout and will quickly move from point D to point F.

Also, even though a pullback is shown in figure 5, the warning signal is generally a significant indication that A pullback may not form and is one of the cases where it may be worth entering the breakout, especially if it breaks all-time highs.

Simply put, when you are considering going into a breakout without waiting for a pullback, check to see if a warning signal has already occurred as this will increase the odds in your favor.

The Counterattack Tactic

Ranges that are not well defined (that is, ranges whose support/resistance is not clearly defined) are more prone to false breakouts as the breakout itself is difficult to define and see.

In these cases, short-term traders can make a profit through the Counter Attack tactic.

For this tactic, the range support/resistance limits (which are used to provide breakout signals) should be defined in such a way that the zone contains the vast majority of prices and leaves out only very brief exaggerations (spikes, etc.) If the price re-enters the range after a break to the upside, a sell signal is triggered with a stop loss at the high marked after the break,

The Counterattack tactic can also be applied at well-defined ranges.

The logic behind this is that many technicians will use the range resistance as a stop loss when they go long at the break, so when the price clearly re-enters the range, a cascade of stop-loss orders will be triggered resulting in a price drop.

There are a few things to keep in mind regarding the Counterattack tactic. First, the risk/benefit ratio is extremely important.

The range must be wide enough to compensate for the associated risk, which is defined by the stop loss level.

In the second place, It would be wise to use a suitable filter to determine if the price turn within the range is acceptable and this is because after a breakout there are traders who wait for a pullback and place their buy orders at the resistance level of the range.

Third, there should be no warning signs before the break.

Some examples

Although we have seen the GWTW and Counterattack tactics for breaks to the upside it can also be applied to breaks to the downside with the corresponding conversions.

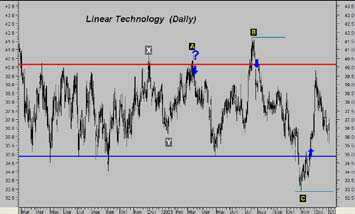

The Applied Materials (NDX) daily chart is presented in Figure 6.

The blue and red horizontal lines define a range.

Points A, B, C and D indicate false breaks and blue arrows indicate possible entry points for the Counter-Strike tactic.

Green horizontal segments show preferred stop loss levels.

A similar example is shown in Figure 7, this time with the Linear Technology (NDX) daily chart. The Kickback signals (blue arrows) after points B and C are clear (green horizontal line segments show stop losses).

A sell signal is displayed after point A with a question mark above it to show that relying solely on the information in the chart with this Counter signal is very risky.

The reason for this is the warning signal at A.

(Note the price movement from point X to point A and the low at Y).

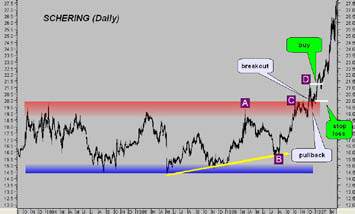

Figure 8 shows Shering’s daily chart (DAX).

There you can see a not so well defined wide range, which lasted more than three years.

The resistance and support levels for this range are not very clear and therefore are presented as red and blue bands, respectively (note that the upper and lower limits of the red band are defined by price data prior to the end of the period).

Since the price fell from point A to point B and then advanced again and entered the red band, it is considered that there is a warning signal at point C because B is above the blue band.

The price penetrates the upper limit of the red band, reaches point D, moves away from the red band, and then advances again to new highs.

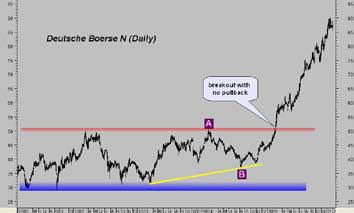

We have the last chart example in figure 9, where you can see the daily chart of Deutsche Böerse N (DAX).

This example has been chosen to demonstrate that when a warning signal is present (see point B), a break may not be followed by a pullback.

In general, breaks to the upside of very long-term (and preferably narrow) ranges after a warning signal and under bullish conditions for the market, in general, do not tend to pull back.

Conclusion

Breakouts can be very profitable when a proper trading tactic is applied.

In this section, I have tried to present two methods of dealing with breaks: the GWTW and the Counterattack.

Although no rigid trading rules have been given for these methods, I believe my article can help you in your trading and analysis.

I chose not to refer to the concept of technical indicators or volume because my intention was to focus only on price movements.

However, I believe that the methods presented here are not entirely complete without the help of the volume.

My approach to volume spikes (although controversial to many analysts), which often accompany breakouts, is presented in my article titled “Spike Up The Volume”, which was published in the June 2005 issue of the Technical Analysis of Stocks & Commodities magazine.

The article complements the two methods presented here.

Candlestick analysis can also be of great help for both tactics.

I highly recommend Steve Nison’s book Japanese Candlestick Charting Techniques if you are interested in learning candlestick patterns.

IronFX

IronFX

Comment by Diletta

March 26, 2024

Awesome bonuses, good leverage. A few hiccups, but support rocks!