SuperForex adds more ETF CFDs on STP and ECN accounts Table of Contents

SuperForex ETF list updated

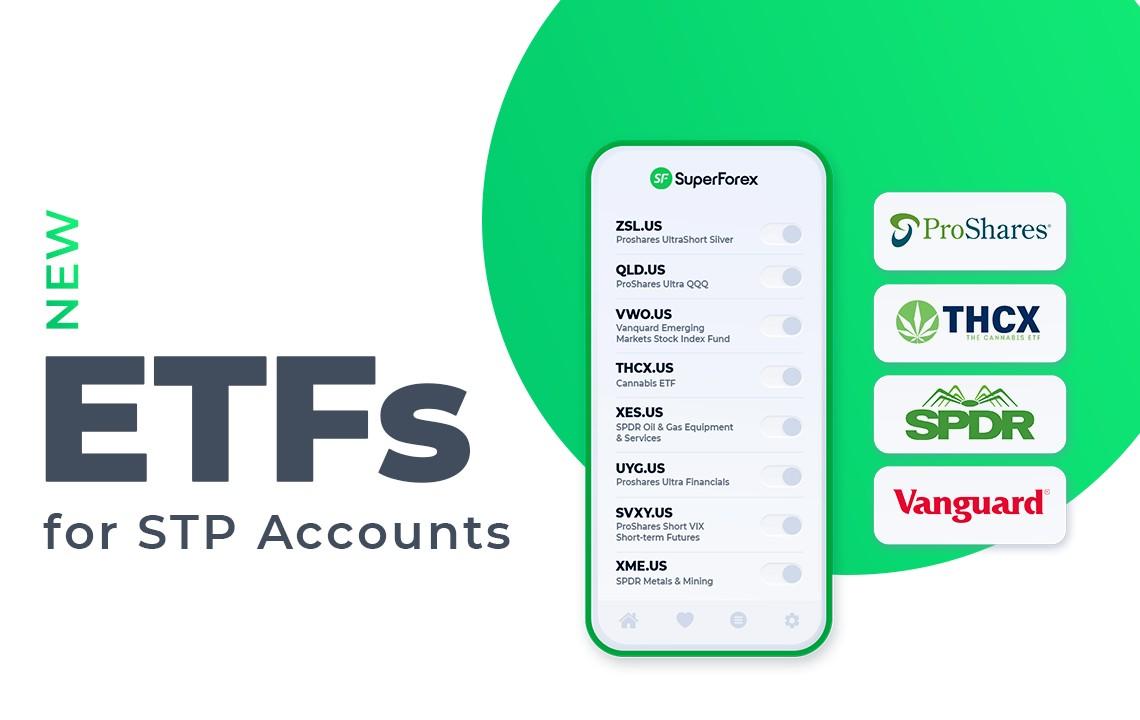

Superforex recently announced an update to the exchange-traded fund (ETF) list available from September 15th onwards which will significantly increase trading opportunities.

Any SuperForex trader who decides to invest their funds in ETFs will find that while both easy and flexible to use, this fantastic trading tool is extremely sophisticated, cutting-edge, and constantly evolving.

SuperForex has added more than 20 new trading assets to its list of exchange-traded funds (ETFs) which you can learn about by consulting the list below.

- Proshares UltraShort Silver – ZSL.IT.

- ProShares Ultra QQQ – QLD.IT.

- Vanquard emerging markets equity index fund – VWO.IT.

- Cannabis ETF – THCX.IT.

- SPDR Oil & Gas Equipment & Services – XES.US.

- Proshares Ultra Financials – UYG.IT.

- ProShares Short VIX Short Term Futures – SVXY.IT.

- SPDR Metals and Mining – XME.US.

It will be possible to trade in ETFs using an STP account and carry out any type of strategy to be able to obtain the maximum return from the investments made.

Trade ETFs on STP SuperForex Accounts

SuperForex offers a wide range of trading accounts, and each of them has been created to meet every need that can satisfy the trader.

Each type of account has different characteristics, so each trader will have to choose carefully to find the one that best suits their needs and that can be compatible with the strategies to be carried out to achieve the objectives set.

By consulting the following table you will be able to know in detail each STP account offered by SuperForex so that you can find the one that best suits your trading needs.

| STP Account Type | Standard | Swap Free | No Spread | Micro Cent | Profi STP | Crypto |

|---|---|---|---|---|---|---|

| Account Base Currencies | USD, EUR, GBP, RUB, ZAR, NGN, CNY, BDT, INR, THB | USD, EUR, GBP, RUB, IDR, MYR, AED, ZAR, NGN, BDT | USD, EUR, GBP | USD, EUR | USD | USD (BTC) |

| Required Minimum Deposit | $1 | $1 | $100 | $1 | $5000 | $100 |

| Maximum Account Balance | Unlimited | Unlimited | Unlimited | Up to $3000 | Unlimited | Unlimited |

| Maximum Leverage | 1:1000 | 1:1000 | 1:1000 | 1:1000 | 1:200 | 1:10 |

| 1 Lot Size | 10 000 USD | $100,000 | $100,000 | $100,000 | $10,000 cents | 10 BTC |

| Swap Points | Credited and Charged | None | None | None | Credited and Charged | None |

| Spread Type | Fixed | Fixed | Variable | Fixed | Variable | Fixed |

| Forex Copy | Available | Available | None | None | None | None |

| Available Bonuses | All bonuses | All bonuses | Welcome, Energy, Hot, Dynamic | Welcome, Energy, Hot, Dynamic | Welcome, Energy, Hot, Dynamic | Welcome, Energy, Hot, Dynamic |

For any information do not hesitate and visit the official SuperForex website, contact the support team who will be able to help you answer any questions.

What are ETFs?

Exchange-traded funds (ETFs) are passively managed investment funds or SICAVs listed on the stock exchange and as with all funds, when a trader decides to invest in ETFs it is as if he were investing his funds in a basket of titles.

Consequently investing in an ETF fund corresponds to combining its own funds with those of other investors and through this capital the fund manager will be able to purchase the instruments in which to invest and the result, whether positive or not, will depend on all the instruments on which the fund invests.

ETFs have as their investment target the exact replication of the trend and consequently the return of equity, bond or commodity indices.

The main advantages of investing in ETFs are as follows.

- Liquidity

- Since ETFs are listed on the stock exchange, they are extremely liquid instruments and this means that despite the decision to buy or sell new shares, there is no risk of stumbling into considerable fluctuations in value.

- Versatility

- Every trader of any economic depth, including the small saver, can decide to invest in ETFs without necessarily having to buy all the securities in the basket.

- Efficiency

- One of the main advantages that makes this tool extremely valuable concerns passive management and the cost of managing an ETF rarely goes beyond 0.5%, unlike that of an active fund which can easily go over 2%.

- Transparency

- The ability to access any type of useful information makes ETF instruments synonymous with transparency as it is possible to have an integral view of the instrument such as currency exposure or replication type.

- Security

- All funds invested by traders in ETFs are separate from those of the company that deals with their management and issuance.

- Strategy

- By investing in ETFs, it will be extremely easy and intuitive to develop multi-asset strategies that, by operating on macroeconomic trends, will be able to obtain the maximum return from the medium-term growth trends of the markets.

Please click "Introduction of SuperForex", if you want to know the details and the company information of SuperForex.