Open XTB Account for free - Trade over 2100 global markets Table of Contents

How to open XTB’s account?

Opening a trading account with XTB is quick and easy.

You could be trading in the financial markets within the next three minutes.

Just follow our three-stage process outlined below:

Fill out XTB’s simple online form and get instant access to XTB’s trading platforms, while your details are being verified.

You may be required to upload additional documents to verify your identity (proof of address, bank statement, etc.) through the XTB customer corner.

Once your application has been approved, you can deposit funds through XTB’s secure process and start trading!

How to start trading with XTB?

Doing your first trade can seem like a big challenge at first.

If you want to take a position in EURUSD through the CFD contract or buy Apple shares, you may want to develop a plan to guide you through the process.

In this article, we will present how you can prepare to start this first trade on your journey through the global financial markets.

1. Log in to XTB xStation or MT4 Platform

XTB’s easy-to-use, award-winning platform was designed in such a way that investors can find everything they need, regardless of their level of experience.

Access the financial markets from anywhere, with XTB’s applications for cell phones and tablets.

Download XTB’s trading platforms

2. Choose the market to invest

We trade the markets for financial reasons, but most of us may have limited time for analysis or decision-making at the beginning of this journey.

It may be wise to limit the number of instruments we sell at the beginning of this trip.

Trading is often done through CFDs, contracts that allow the use of financial leverage.

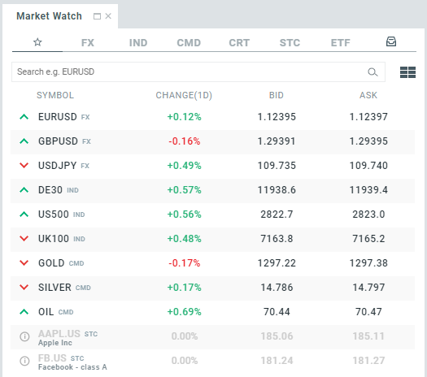

Four main categories of instruments available: Stock Indices, Currency Pairs, Commodities, and Cryptocurrencies.

Stock indices are among the most trending instruments, a factor that attracts many investors.

Price movements in equity indices are highly dependent on the pace of economic growth and the earnings of member companies.

Central banks play a key role in the foreign exchange market.

Unlike stock indices, in this market investors trade currency pairs, therefore they have to choose a “winner” and a “loser”.

This is often done by evaluating what central banks can do next.

Commodities can attract investors who do not want to follow all economic data, since in this case price movements often reflect changes in the availability of a particular product.

Last but not least, cryptocurrencies are new and volatile assets that often experience price movements on a scale not observable in the other markets.

In case you don’t have enough time to trade regularly, you can consider starting with stocks or ETFs.

Check out available markets on XTB

3. Make a deposit to your account

How big should your first deposit be? Unfortunately, there is no simple answer to this question.

XTB does not impose limits on the amount that one can deposit: it is the operator who must evaluate how much money they can spend to invest.

You must determine what your expectations are and what your risk appetite is.

Keep in mind that if you have ambitious business goals, you may need relatively more capital to meet them.

For example, CFD contracts allow the use of leverage and are therefore seen as risky markets.

However, this financial leverage allows for relatively larger positions.

You can make a deposit in a number of ways, most of which are quick and free.

Log in to XTB’s portal to make a deposit

4. Prepare to start trading

The revolution in technology allows access to global markets that are now at the fingertips of individual investors.

However, because of this, they often start trading without proper preparation. Don’t make such a mistake!

Education is crucial for an investor, especially at the beginning of their journey, as it is the easiest to make mistakes in the beginning.

Whether you are trading based on fundamentals (i.e. economic report) or technical signals, you need to be sure when you want to open a trade and under what circumstances you would want to close it.

Another crucial thing is to keep up with the market developments, as there are many factors that affect prices every day.

However, you don’t have to follow numerous financial news services to stay up-to-date.

An award-winning XTB research team works hard to make sure you stay informed of any major market movement or event.

You can find market research in the “News” section of the xStation trading platform.

In other sections, you can find the economic calendar and educational materials.

5. Place an order

Before you start trading the market, you must first find it on the xStation5 trading platform.

The aforementioned Market Watch will be useful here.

In the Market Watch section, you can find markets that are available to trade through the XTB platform: CFDs on forex, commodities, stock indices, cryptocurrencies, and cash stocks and ETFs.

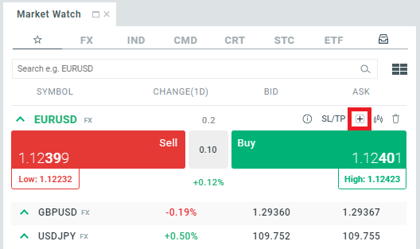

The best way for beginners to open a trade is to use the “New Order” function.

To open the ticket window, simply click on the “Open ticket” button in the Market Watch section of the platform or by right-clicking on the chart and selecting “Open ticket”.

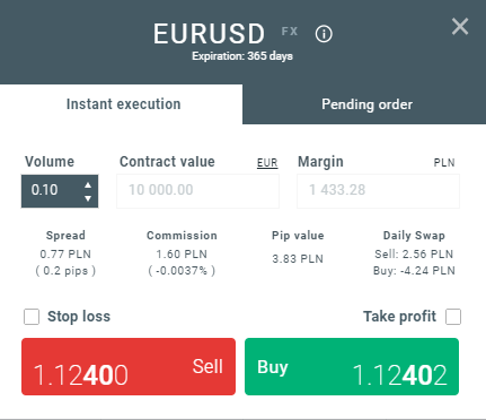

In the new order panel (example shown above) you can specify the size of a position you want to open, as well as define the SL / TP levels (Stop Loss and Take Profit).

In addition, the built-in calculator will inform you about:

- Face value of the transaction

- Required Margin

- Spread Value

- Commission Value

- Individual Pip Value

- Daily Trade Value

In case you decide to set the SL or TP levels, the calculator will also provide an approximation of profit or loss in case either order is activated.

The newly opened position will appear at the bottom of the xStation platform in the “Open Positions” section.

Once you have mastered placing orders with this method, you can try the fastest one: placing orders through the Click & Trade panel located in the upper left corner of the chart window.

6. Manage your orders

Opening a trade is one thing, but what if the market situation changes? You may be forced to change the parameters of your operation.

If you want to add/change Stop Loss or Take Profit levels, simply drag the SL and TP symbols on the chart to the desired level.

You can also double your position (open another order of the same size) or reverse it (close and open a position in the opposite direction) by clicking the buttons on the right side of the open trade.

7. Close your orders

The gains or losses you experience are not final until you close your position.

You can wait for the price to reach a predefined Take Profit order or close the position manually in the case your view of the market changes.

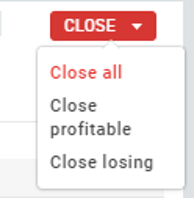

On the xStation platform, you can do this in different ways:

- Hover over your position on the chart and click the “X” button.

- Click the red “X” button on the right side of the “Open positions” tab.

In case you have more than one open position, in the “Open positions” tab you can click the “CLOSE” button and choose whether to close: all positions, only profitable positions or only losing positions.

As you can see, it is much easier to do your first trade than it seems at first.

Proper preparation to trade will increase your chances of becoming a profitable trader.

What documents are required by XTB?

XTB is a Global Broker, with offices authorized and regulated by the strictest regulators (FCA, KNF, CNMV, IFSC, among others), which implies that XTB’s must comply with the highest regulatory standards.

Once you have completed XTB’s opening form, you may have to upload additional required documentation in order to verify your details and activate your trading account.

For this, you just have to follow the steps indicated below:

Login to the Client Office using your login details.

Upload the required documentation.

Along with verifying your identity, XTB needs to verify your address:

Identity Verification: Must be a valid government photographic document.

Accepted documents include:

- Passport

- National identity document (both sides)

- Voting credential (both sides. Only applies to Mexican citizens)

Verification of address: It must be full-page, issued in the last 90 days, and it must not be in an online format.

Accepted documents include:

- Bank statements

- Utility bills (gas, electricity, water)

- Telephone bills (landline only)

XTB will be able to activate your account, once your documents have been received and approved.

You can access the Client Office using your smartphone and upload the required documents easily.

Simply type clientoffice.xtb.com into your mobile internet browser and follow the instructions to upload the documentation directly from the phone.

Why many investors choose XTB as their main broker?

There are many reasons to trade with XTB, and the followings are some of XTB’s main advantages.

- XTB is one of the largest brokers in Europe.

- XTB has an award-winning platform, with an average performance of 85 milliseconds.

- Access to over 1500 instruments.

- Training complete and free on the forex market.

- Advanced technical analysis tools with free integration.

- All data passes through a secure SSL connection.

For more information about XTB’s service and its latest offers, go to the official website below.

4 Simple Rules you must know before start trading

Trading the markets can be complex at first.

With a significant flow of information accessible online, as well as ever-emerging innovative methods for interpreting and analyzing highly mobile charts, data, and markets, it’s easy to feel overwhelmed or succumb to fear of the unknown.

Something not to lose sight of is simplicity.

In the first instance, do not get into complications with your trading strategy.

Consider a few simple and basic rules and build your experience from them.

1. Focus on certain markets

You should focus only on a small number of fundamental markets, only trade in the markets you know. Every day that you analyze, or open a position, is another day that you take in and get closer with your patterns, behaviors and movements. This means that you gradually understand what influences prices and how prices move.

Get closer to announcements that may influence the volatility of the selected instrument.

For example, if you are opening positions with oil, but you are not aware that every Wednesday there is the EIA Oil Report that is typical that generates price volatility in oil, you will be fighting a losing battle.

So take the time to understand what affects prices in the markets that are of interest to you.

The economic calendar that XTB offers on the platform gives you the possibility to keep up to date with macroeconomic data. T

his shows the previous and current data, also classifying them by their potential impact on the market.

For example, the release of US non-farm payrolls on the first Friday of the month is classified as high because they frequently create volatility in the price movement of USD currency pairs and global indices such as the US30 and UK100, as well as in the price of Gold.

See the list of available markets on XTB

2. Select the time period that suits you

The nature of your trading depends on the time periods you choose to operate.

For example, a long-term trader will manage his trades taking periods of weeks, months, and even up to a year.

Since trades are open for a long time, the number of trades is less – perhaps only five to ten a month.

Following this method, the long-term trader makes his decisions based on weekly or monthly charts and uses daily or four-hour charts to choose concise entry points.

On the other hand, a swing trader is a medium-term trader who opens positions for a few days, or maybe a week or two.

A daily trader is one who normally opens and closes a position on the day, although there are traders who decide to hold them for up to three days.

Take into account the various timelines that may suit your trading style and personality.

These time periods correlate with the time you can spend trading – either daily, weekly, or monthly.

If you have the ability to react to changing situations quickly and clearly, short periods of time may be suitable for you, while if you prefer to analyze the market more closely, longer periods of time are better.

Likewise, many people who have full-time jobs cannot review and be aware of their positions during the day and do most of their analysis at night or on weekends.

You must find the time period that works for you.

These are factors to consider cautiously.

3. Create a trading plan

Of course, create a trading plan.

You must know the direction in which you want to operate a market (up or down), the reason why you enter a position, particularly the entry and exit points, and how much capital you are willing to risk, all prior to starting to trade.

By putting together a trading plan, you can avoid classic mistakes that beginner traders make, such as poor risk management.

Your trading plan also functions as a reminder of the reasoning behind opening a position when you are considering modifying your tactics in the middle of an open position.

4. Risk management: always consider using a stop loss

As the name indicates, a stop-loss manages your losses in case the market price in your position moves against you.

Basically, a stop loss is a closing order where you stipulate how much risk you are willing to take on a trade.

If the market moves in the opposite direction to your position and you start to make a loss, XTB’s systems will automatically close your position at your previously determined maximum risk level.

You must program the price at which you want your position to close when opening a position or you can modify an existing one through XTB’s platform.

Stop losses can be used freely and protect your account from damaging market movements, but please note that XTB cannot guarantee your position for the entire time.

If the market suddenly becomes volatile and falls below your stop level (jumps from one price to the other without trading the levels between them), your position may be closing at a worse level than the one determined by you.

This is known as price slippage.

Guaranteed stop losses, that is, those that do not carry the risk of slippage, and ensure that, if the market moves opposite to your position, it closes at the determined stop loss level, they are available at no cost in the basic account.

Ask XTB’s account executives for more information, or find out how to manage your risk.

Please click "Introduction of XTB", if you want to know the details and the company information of XTB.