How to start trading Oils (Brent and WTI) with XTB? Table of Contents

Why is oil considered the number 1 commodity?

Crude oil is recognized as the number 1 raw material in the world, mainly due to the fact that it is used to produce liquid fuels that are used in various means of transportation: water, land and air.

It is also used for the production of lubricants, paraffin, asphalt, mazout, so it is used for the maintenance of machinery, road construction, as a source of thermal energy, as well as to generate electricity.

Additionally, oil is used to produce many synthetic materials.

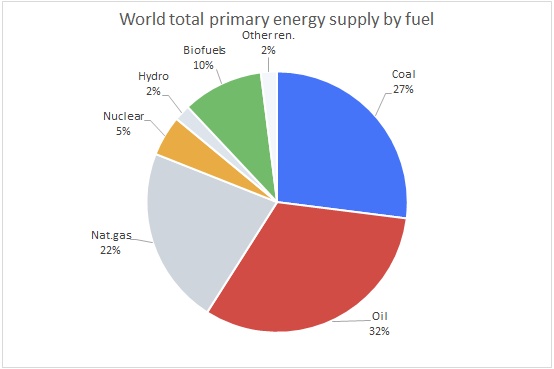

However, the most important use of oil is for energy.

Currently, it represents about 1/3 of the global energy supply! It is not surprising that it is the most traded commodity in the world, providing it with great market liquidity.

What Affects Oil Prices?

The price of crude oil reacts more to changes related to fundamental factors: supply and demand.

The difference between supply and demand leads to an increase or decrease in inventory levels.

In this case, the old market principle works, which says that for a large number of products on the market, the price is low.

However, if there is a shortage, the price can increase considerably.

The oil market is very balanced and the surplus or shortage is usually a small part (up to 1-2%) of the supply.

Also, demand is price inelastic.

Simply put, we generally refuel the car regardless of the price at the pump.

Therefore, changes in supply generally lead to short-term price fluctuations.

It takes a long time from the time of exploration and drilling of the first well to constant production, so production does not always adapt quickly to market needs.

However, if for some reason part of production were to stop (for example, through employee strikes or political unrest), the price could react strongly.

What reports should you pay attention to?

When it comes to the oil market, there are several key reports to consider.

They are published for different periods at different intervals.

Those posted frequently have the biggest impact on current price changes.

1. Variation in Inventories:

The United States Department of Energy (DoE) publishes the report on crude oil inventories weekly (normally every Wednesday at 4:30 pm BST).

- Change in US oil reserves

- A change in inventories at Cushing, WTI’s crude oil billing site

- Change in inventories of other petroleum products, estimate of US production, implicit demand for petroleum and other products.

Importantly, this is a weekly report, so it has a great impact on the oil market.

US oil inventories account for the vast majority of OECD oil reserves, so the DoE report has the biggest impact on short-term price formation.

The day before (Tuesday at 10:30 pm) the inventory report of the American Petroleum Institute (API) was published.

In this case, manufacturers and other market participants freely report inventory levels.

It can show what to expect from the DoE report.

The data from both reports is available in the economic calendar on the xStation platform!

2. Balance Sheet Reports

These are mainly reports from OPEC, IEA, EIA and also private market participants.

Take Bloomberg, which provides production estimates for the largest producers at the end of each month.

The above reports are issued monthly, quarterly or annually and show how supply and demand have changed.

They also present forecasts for future periods.

3. Variation in the number of oil rigs

This report is fundamental mainly for the United States.

Today, the vast majority of new production in the US comes from shale, and maintaining production in the US requires a constant shift from oil rigs.

A large number of active oil rigs means large investments in the oil market and indicates higher production.

The number of active oil rigs is highly dependent on market prices.

It is usually posted on Friday afternoon.

This data is available in the economic calendar on the xStation platform!

4. COT / CFTF Report

Investors and market participants in futures contracts should provide information on the size of their positions in the oil market.

The CFTC report for most markets in the US is released every Friday at 9:30 pm BST.

The ICE report is released Monday.

Using information about the number of short and long positions and their spread, you can determine the market sentiment.

Too high a sentiment can lead to price correction.

You have the COT data indicator available on the xStation platform so you don’t have to search for the data yourself!

Start investing in Oil market with XTB

Why do investors choose oil?

Oil is the most important global commodity and is often treated as an economic barometer.

In addition, the importance of this market makes trading fluid and continuous, transactions can be concluded from Monday to Friday almost 24 hours a day, which is also important in the context of transaction costs.

The price of oil, like stock indices, can reflect the economic situation.

However, in the case of oil, current demand and supply are more important.

This also means that some investors choose oil as a market that better reflects the current situation than equities (stocks).

What are the basic differences between Brent oil and WTI?

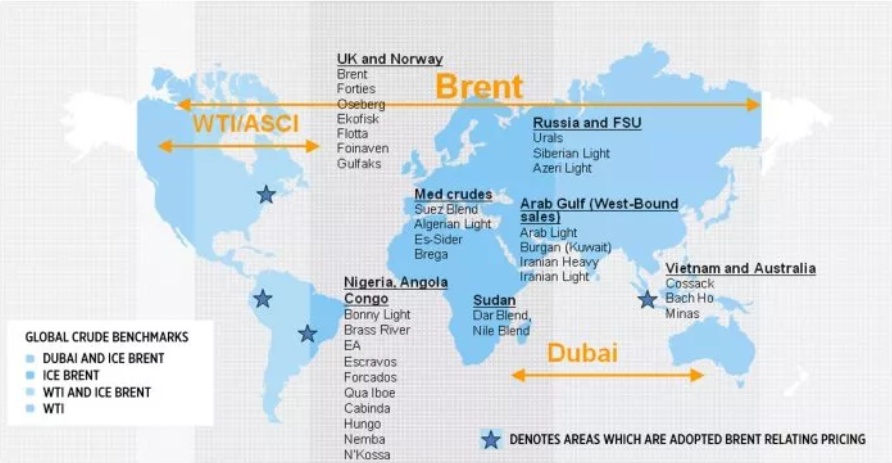

There are two of the most frequently mentioned oil benchmarks in the oil market: Brent and WTI.

However, there are more types of oil, depending on their properties or where they are extracted.

The price also depends on your properties, location or transportation.

Brent crude oil (OIL):

comes from 15 oil fields located in the North Sea.

The low sulfur content, which is below 0.37%, indicates that it is a sweet oil, and its low density allows it to be described as light, ideal for the production of diesel and gasoline.

It is estimated that almost 70% of global oil transactions are with Brent oil.

Brent crude futures contracts are traded on the London Intercontinental Stock Exchange (ICE).

Trade Brent crude oil (OIL) with XTB

West Texas Oil (OIL.WTI):

West Texas Intermediate, is extracted in the United States, Texas.

Due to the sulfur content, which is below 0.24%, it is known as a light sweet oil because it has a low density.

WTI Crude is the underlying instrument for futures contracts on the New York Mercantile Exchange (NYMEX).

It is characterized by its high quality, one of the highest in the world.

The difference in value between Brent crude oil and WTI crude oil, that is, its differential, is in favor of WTI oil, which has better parameters of density and sulfur content.

Trade West Texas Oil (OIL.WTI) with XTB

How can you invest in oil with XTB?

The easiest way to gain exposure to oil is by trading OIL or OIL.WTI CFDs.

Contracts for differences are extremely fascinating instruments with many interesting features that affect the uniqueness of this product:

- Derivatives whose price is based on the price of the underlying instrument

- Leverage

- Allow investment in both a rise in prices and a fall in prices

The possibility of taking long positions (buy order) or short positions (sell order) in combination with the use of the financial leverage mechanism makes these types of contracts currently one of the most flexible and popular types of trading in the markets.

XTB offers investments in CFDs for Brent Crude Oil (OIL) and CFDs for WTI Crude Oil (OIL.WTI), that is, instruments whose price is based on the current price of Brent Crude Oil and WTI, which are quoted on the market.

The xStation platform, which is a complete trading tool, also gives you the opportunity to secure fast transactions easily, which is especially necessary when investing in leveraged instruments.

In xStation, thanks to the calculator built into the order window, you can configure the Stop Loss or Take Profit order according to the assumptions resulting from your own investment strategy.

To start investing in the oil market, simply open an investment account.

The process of opening an account at XTB is done completely online and only takes a few minutes.

To check the xStation platform and test your own investment strategy, it is worth opening a free demo account with virtual funds.

Access to the platform is possible through your browser, the desktop executable version and the mobile application, thanks to which you can quickly and easily control your operations from anywhere in the world and from all devices that support Android and iOS systems.

What you should know before start trading Oil?

At XTB, CFDs are based on futures contracts that are traded on exchanges, which expire every month.

XTB offers CFDs with an expiration date of 365 days (does not apply to share-based CFDs and ETFs) so that XTB’s clients do not have to close a position based on a series of contracts that expire every month to open another new position.

In this way, clients can continuously hold, up to 365 days, a CFD based on the price of oil, without having to open new positions every month, as is the case in the underlying market.

Typically, the transition to the next contract (expiration) occurs a few days before the expiration date of the current future contract in the underlying market.

XTB will inform you about the next reinvestment dates in the news for Traders.

Oil will be a strategic energy resource for a long time.

The relationship between demand and supply can have a great impact on the price.

In the case of the oil market, it is extremely important to track the release of important reports that can increase market volatility.

Oil CFDs, which are available on XTB, provide additional opportunities to spot new interesting investment opportunities both when the price of this product rises and falls.

The situation in the financial markets will be linked to the oil market for a long time.

Please click "Introduction of XTB", if you want to know the details and the company information of XTB.