What is Standard & Poor’s 500 (S&P500, SPX500, US500)?

The Standard & Poor’s 500 (S & P500, SPX500) is a market capitalization-weighted stock index for the top 505 US stocks. The S & P 500 is made up of 505 large companies, centered on top-notch companies in the United States. The S & P 500 is widely known as a leading indicator of the performance of large-capitalization stocks in the United States. As such, the S & P 500 is one of the most watched stock indexes and is known as the leading stock index on the US stock market.

The S & P 500 covers about 80% of its market capitalization and is a more representative market indicator as it is made up of 500 companies compared to the Dow Jones Industrial Average of 30. The S & P 500 is highly regarded by investors around the world as an investable benchmark. The S & P 500 list is checked quarterly to ensure that the index eligibility criteria are met.

Buy and Sell Standard & Poor’s 500 (S&P500)

How to Invest in the Standard & Poor’s 500 (S&P500, SPX500, US500)?

The index reflects the overall performance of its base stock. When trading S & P 500 CFDs, trade the performance of 505 companies in one stock “basket” without initiating 505 separate trades and stay on top of the performance of all those companies’ stocks. can do.

The S & P 500 is a market capitalization-weighted index, so the larger the companies involved, the more likely it is to overwhelm the performance of the index. For example, if Apple’s stock price fluctuates significantly, the S & P 500’s performance could be affected in the same direction. Therefore, when trading the S & P 500, you should always be aware of the news and performance of the large companies in the S & P 500.

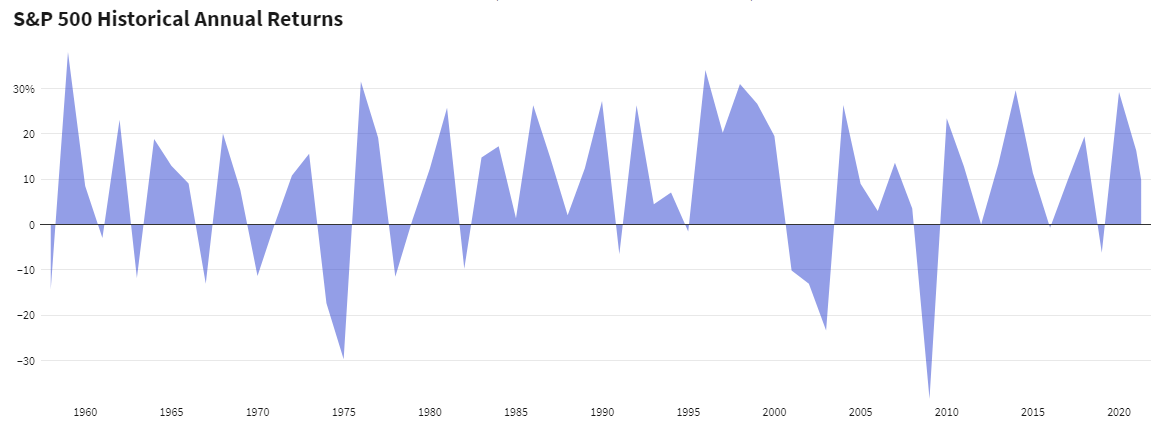

Historical returns on the S&P500 Index

The S & P 500 began in 1926 and initially contained only 90 stocks. From 1926 to 2018, the index’s average annual return is estimated to be 10-11%. In 1957, the S & P 500 expanded to 500 stocks, with an estimated annual average return of about 8% from 1957 to 2018.

The time to enter the market is important to recreate the S & P 500’s average return of 10%. The performance of the index will change depending on the market conditions each year. Traders who study the market before trading the S & P500, buy at the lows of the market and sell at the highs may experience higher returns than investors who buy at the highs of the market and sell at the downside of the market. It will be higher.

The table below details the S & P 500’s annual total nominal returns (including dividends but not inflation) over the last 50 years.

Please check FXPro official website or contact the customer support with regard to the latest information and more accurate details.

FXPro official website is here.

Please click "Introduction of FXPro", if you want to know the details and the company information of FXPro.