How does FXOpen's PAMM Copy Trading Service work? Table of Contents

FXOpen’s PAMM Service

Considering the need to create a new investment instrument that would make the cooperation between Providers and Subscribers more efficient and transparent, FXOpen has made every effort to offer you an innovative and fully functional PAMM service.

The PAMM service is a software solution designed to reproduce the Provider’s trading strategies on one or several Subscribers’ accounts, as well as to automatically distribute profits or losses. The Provider trades with his own funds on his PAMM account and his trading strategy is replicated on the Subscribers’ accounts. The subscriber receives tools for analyzing the performance of Providers and choosing a PAMM account suitable for investment.

In addition, FXOpen PAMM provides clients with everything they need to successfully trade in the Forex market: exclusive trading conditions, reliable order execution, and professional support.

Find out more about FXOpen’s PAMM service

How to become a Signal Provider?

A provider is a client of a company who conducts successful trading activities on his account and provides an opportunity to copy his trading strategy to a wide range of interested traders.

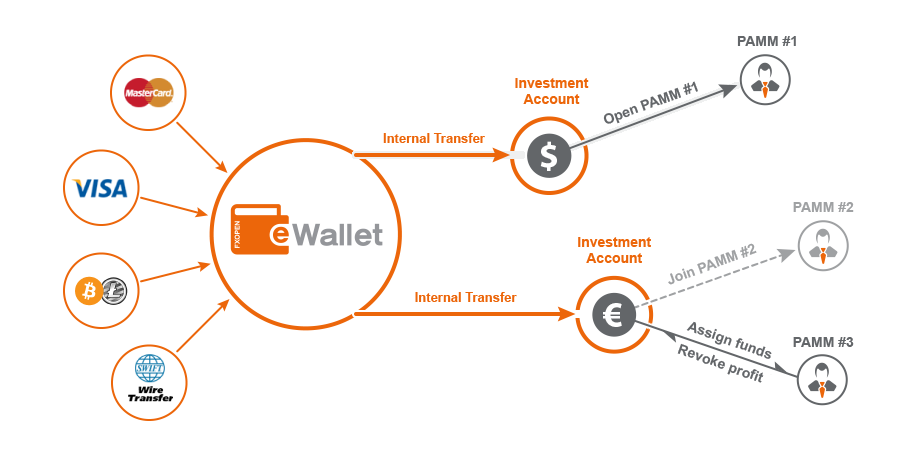

- Open an Investment Account;

- Top up your Investment Account in your Personal Account;

- Open a PAMM account and create an Offer;

- Attract Followers and get rewarded for replicating your trading strategy.

How to become a Subscriber?

Subscriber is a client of the company who has accepted the Provider’s offer and reproduces his trading strategy on his account.

- Open an Investment Account;

- Top up your Investment Account in your Personal Account;

- Select a Provider in the rating of PAMM accounts and subscribe to the automatic reproduction of his trading strategy;

- Withdraw the received profit.

Go to FXOpen’s Official Website

What is FXOpen’s PAMM service?

PAMM Service is a software solution designed to reproduce the Provider’s trading strategies on one or several Followers’ accounts, as well as to automatically distribute profits or losses. The Provider trades with his own capital on his PAMM account and his trading strategy is replicated on the Followers’ Accounts. The subscriber receives tools for analyzing the performance of Providers and choosing a suitable PAMM account.

The PAMM tool ensures an accurate and timely trading strategy for a follower.

It is an advanced software solution designed to unite experienced traders (Providers) and people interested in trading in the financial markets (Subscribers) from all over the world. Such cooperation is beneficial for all participants.

Clients have access to 3 types of PAMM accounts with the ability to trade through MT4 – PAMM STP, PAMM ECN and PAMM Crypto.

Start using FXOpen’s PAMM service

How does FXOpen’s PAMM service work?

Let’s look at an example to better understand how PAMM works.

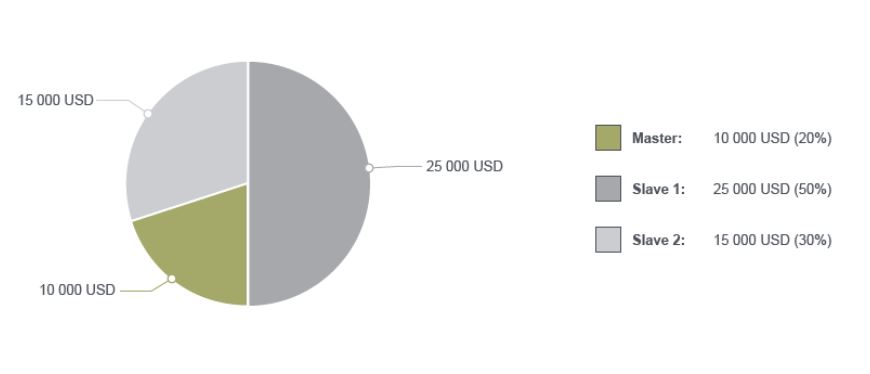

The user opens a PAMM account and becomes its Provider. The Provider sets the Provider’s Capital equal to USD 10,000 (Fig. 1). Then the Provider invites all interested clients of the company to place their funds in a PAMM account to manage them. At the end of each Trading Interval, the profit will be distributed among the Subscribers (including the Provider), and the Provider’s remuneration will be paid in accordance with the established parameters of the offer.

Let the Provider create an Offer with the following parameters: 30/5/10 – 6/4 – 10,000/1000/100 – 10,

The trading interval is a month.

Thus, if at the end of the Trading Interval the profit exceeds 10% of the assigned funds, Subscribers will pay the Provider a reward in the amount of 30% of the part of the profit that exceeds 10%.

Subscriber 1 and Subscriber 2 decide to accept the Provider’s offer. Subscriber 1 and Subscriber 2 assign USD 25,000 and USD 15,000 respectively to the Provider’s PAMM account.

Thus, the balance of the PAMM account becomes equal to 50,000 USD (see Fig. 2)

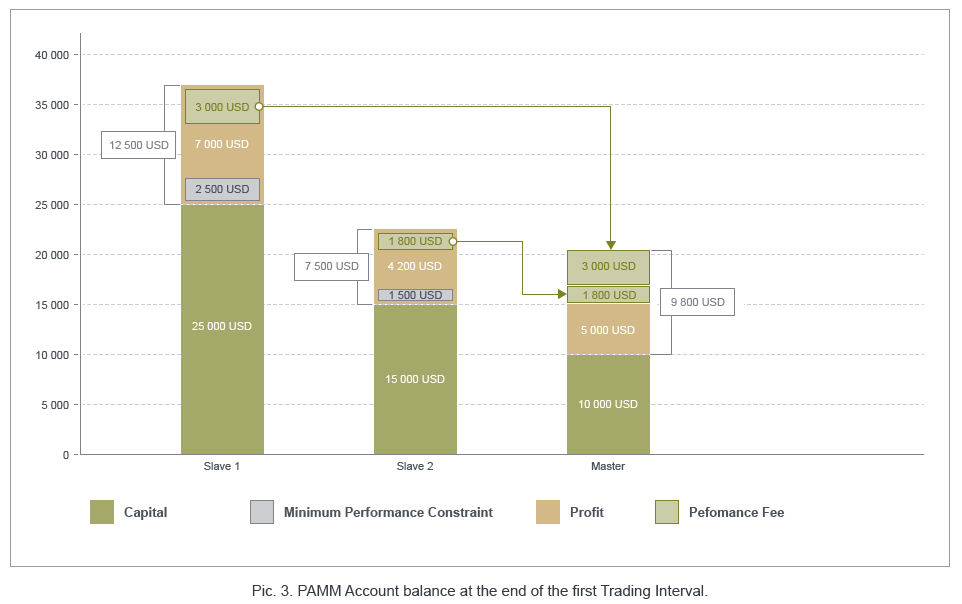

As a result of the successful activity of the Provider, by the end of the first Trading Interval, the balance of the PAMM account increased to 75,000 USD. Thus, the profit amounted to USD 25,000 (50% of the original balance).

Subscriber 1 made a profit equal to 50% (12,500 USD) from his own investment (25,000 USD). In accordance with the parameters of the Provider’s offer, the Limitation of the minimum yield is 10% (2,500 USD), therefore the Provider’s Reward for efficiency is calculated from the following amount:

12,500 USD (Profit) – 2,500 USD (Limit of the minimum yield) = 10,000 USD.

Subscriber 1 pays the Provider a Performance Remuneration in the amount of 30% of USD 10,000, that is, USD 3,000 (Fig. 3).

Subscriber 2 received 50% profit (7,500 USD) from his own investment (15,000 USD). In accordance with the parameters of the Provider’s offer, the Limitation of the minimum yield is 10% (1,500 USD), therefore the Provider’s Reward for efficiency is calculated from the following amount:

7,500 USD (Profit) – 1,500 USD (Limit of the minimum yield) = 6,000 USD.

Subscriber 2 pays the Provider a Performance Fee in the amount of 30% of 6,000 USD, that is, 1,800 USD (Fig. 3).

The Follower’s balance at the end of the Trading interval is calculated as follows:

Current Balance = Initial Balance + Profit – Performance Reward

Thus,

- For Subscriber 1: Current balance = 25,000 + 12,500 – 3,000 = 34,500 USD;

- For Subscriber 2: Current balance = 15,000 + 7,500 – 1,800 = 20,700 USD.

The Provider’s balance at the end of the Trading interval is calculated as follows:

Current balance = Provider’s Equity + Profit + Provider’s Reward for efficiency from Subscriber 1 + Provider’s Reward for efficiency from Subscriber 2.

Therefore, for the Provider:

Current balance = 10,000 + 5,000 + 3,000 + 1,800 = 19,800 USD.

During the first Trading Interval, as a result of the Provider’s successful work, the profit of the PAMM account amounted to 50% of the initial balance, that is, 25,000 USD. Each of the participants received their share of the profit:

Subscriber 1: 12,500 – 3,000 = 9,500 USD;

Subscriber 2: 7,500 – 1,800 = 5,700 USD;

Provider: 5,000 + 3,000 + 1,800 = 9,800 USD (5,000 – Provider’s profit, 4,800 – Provider’s rewards for efficiency).

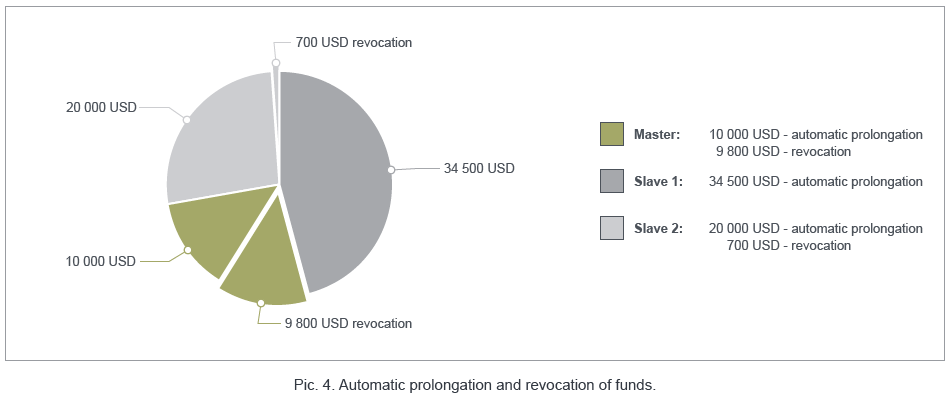

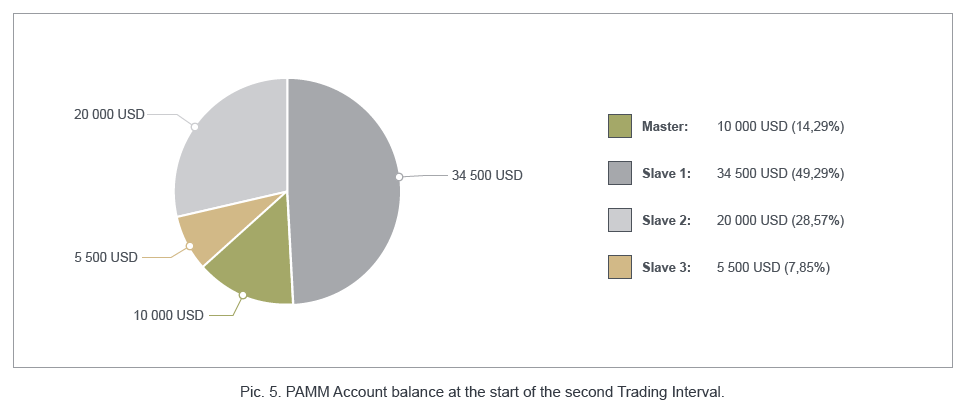

Before the start of the second Trading Interval, the Provider withdrew the profit (9,800 USD), Follower 1 reinvested all funds (34,500 USD), Follower 2 withdrew 700 USD and reinvested the remaining funds (20,000 USD) (Fig. 4).

In addition to the PAMM account, another Follower 3 joined and invested 5,500 USD (Fig. 5).

Thus, at the beginning of the second Trading Interval, the balance of the PAMM account amounted to 70,000 USD.

During the second Trading Interval, as a result of the Provider’s successful work, the profit of the PAMM account reached 100% (70,000 USD). The balance of the PAMM account is now 140,000 USD.

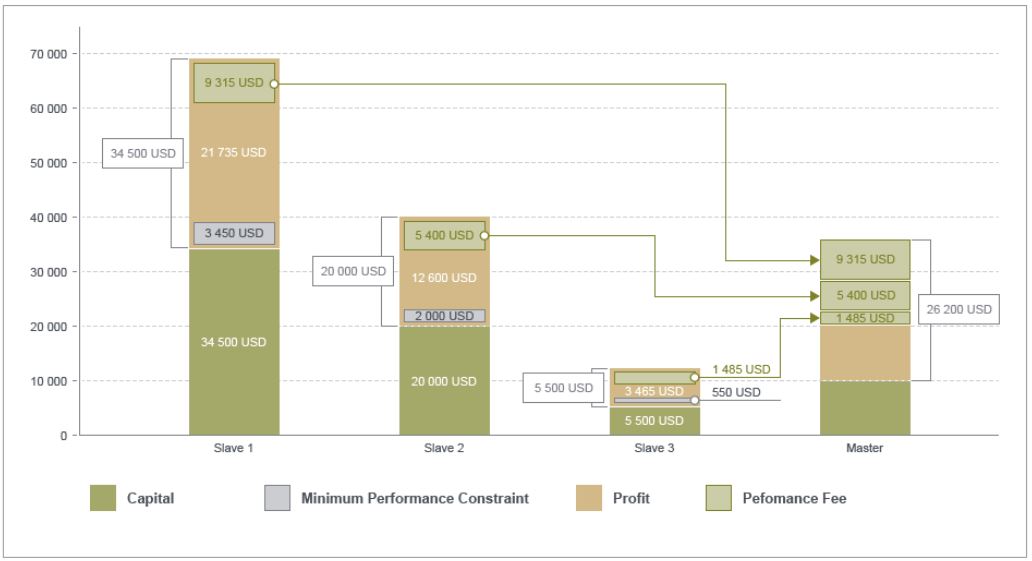

Subscriber 1 received 100% profit (34,500 USD) from his own investments (34,500 USD). In accordance with the parameters of the Provider’s offer, the Limitation of the minimum yield is 10% (3,450 USD), therefore the Provider’s Reward for efficiency is calculated from the following amount:

34,500 USD (Profit) – 3,450 USD (Limit of the minimum yield) = 31,050 USD.

Subscriber 1 pays the Provider a Performance Remuneration in the amount of 30% of USD 31,050, that is, USD 9,315 (Fig. 6).

Subscriber 2 received 100% profit (20,000 USD) from his own investment (20,000 USD). In accordance with the parameters of the Provider’s offer, the Minimum Efficiency Limit is 10% (2,000 USD), therefore the Provider’s Remuneration from profit is calculated from the following amount:

USD 20,000 (Profit) – USD 2,000 (Minimum Efficiency Limit) = USD 18,000.

Subscriber 2 pays the Provider’s Remuneration from the profit in the amount of 30% of 18,000 USD, that is, 5,400 USD (Fig. 6).

Subscriber 3 received 100% profit (5,500 USD) from his own investments (5,500 USD). In accordance with the parameters of the Provider’s offer, the minimum yield limit is 10% (550 USD), therefore the Provider’s Reward for efficiency is calculated from the following amount:

5,500 USD (Profit) – 550 USD (Limit of the minimum yield) = 4,950 USD.

Subscriber 3 pays the Provider a Performance Remuneration in the amount of 30% of 4,950 USD, that is, 1,485 USD (Fig. 6).

The Subscribers’ balance at the end of the Trading interval is:

1. For Subscriber 1: Current Balance = 34,500 + 34,500 – 9,315 = 59,685 USD,

Performance Reward = 9,315 USD (30% of 31,050 USD).

2. For Subscriber 2: Current balance = 20,000 + 20,000 – 5,400 = 34,600 USD,

Performance reward = 5,400 USD (30% of 18,000 USD).

3. For Subscriber 3: Current Balance = 5,500 + 5,500 – 1,485 = 9,515 USD,

Performance Reward = 1,485 USD (30% of 4,950 USD).

The Provider’s balance at the end of the Trading interval is:

Current balance = 10,000 + 10,000 + 9,315 + 5,400 + 1,485 = 36,200 USD.

The result of the Provider’s work on the PAMM account during the second Trading Interval is a net profit of 70,000 USD, which was distributed between the Subscribers and the Provider as follows:

- Subscriber 1 – 25 185 USD

- Subscriber 2 – 14 600 USD

- Subscriber 3 – 4,015 USD

- Provider – 26,200 USD (where 10,000 – net profit, 16,200 – Provider’s Rewards).

Note! In accordance with the parameters of the offer, the Provider’s Commission is 5%. Consequently, the corresponding amount is debited daily from the Subscribers’ accounts to the Provider’s account. For simplicity of calculations, we did not take this parameter into account in the examples. Detailed information about the Provider’s Commission can be found in the Offer Parameters tab.

Go to FXOpen’s Official Website

Go to FXOpen’s Official Website

Benefits of FXOpen PAMM for Subscribers

- The ability to independently control the funds and offer the Provider offers with its own conditions (Subscriber’s Offer)

- On PAMM accounts, only the Subscriber can assign and revoke part or all of the assigned funds at any convenient time. Thus, the possibility that an unscrupulous Provider disappears with your money or refuses to pay profit is completely excluded. The Subscriber has the opportunity to offer the Provider an offer with the parameters specified by him.

- Automatic distribution of profits and payment of rewards

- All settlement operations (distribution of profits, payment of remuneration to the Provider) are automatically performed by the PAMM Service software.

- Monitoring the effectiveness of the Provider’s trading strategy, rating PAMM accounts, assessing risk and profitability

- Choosing a competent and reliable Provider is a responsible and difficult decision. To facilitate this task, everyone is given the opportunity to assess the effectiveness of the Providers’ trading by monitoring trading activities and rating PAMM accounts. All information about PAMM accounts is presented in an accessible and understandable form, so even beginners can easily find a suitable PAMM Account Provider.

Become a subscriber of FXOpen PAMM

Benefits of FXOpen PAMM for Providers

- Many offers with different conditions

- The PAMM service allows Providers to create offers with different conditions. This flexibility of parameters helps the Provider to cooperate with Subscribers who have different capital and different risk attitudes.

- Automatic distribution of profits

- Profits and losses are automatically distributed by the PAMM Service between the Provider and each individual Subscriber Account based on a share of the allocated funds, so that each party receives its share of the profits. The PAMM Service guarantees that the Provider will receive its share of the profits and remuneration on time and exactly in accordance with the terms of the offers that were accepted by its Subscribers. Therefore, you can concentrate on the most important thing – trading for your clients.

- An informative and accessible system for monitoring trading activities

- A Potential Subscriber chooses a Provider himself based on profitability charts reflecting the Provider’s performance and its past results.

Become a Trader of FXOpen PAMM

Please check FXOpen official website or contact the customer support with regard to the latest information and more accurate details.

Please click "Introduction of FXOpen", if you want to know the details and the company information of FXOpen.

Deriv

Deriv  AdroFX

AdroFX