How does Exness work as a Market Maker broker? Table of Contents

- Exness - Market Maker Forex Broker

- Available Order Execution Type on MT4 and MT5

- Instant Execution

- Market Execution

- What is a market order and how to set it up?

- How to start trading Forex with Exness

- How to earn money by trading Forex and CFDs?

- What is Forex Trading on Exness MT4 and MT5?

- Why Forex market is the largest in the world?

Exness – Market Maker Forex Broker

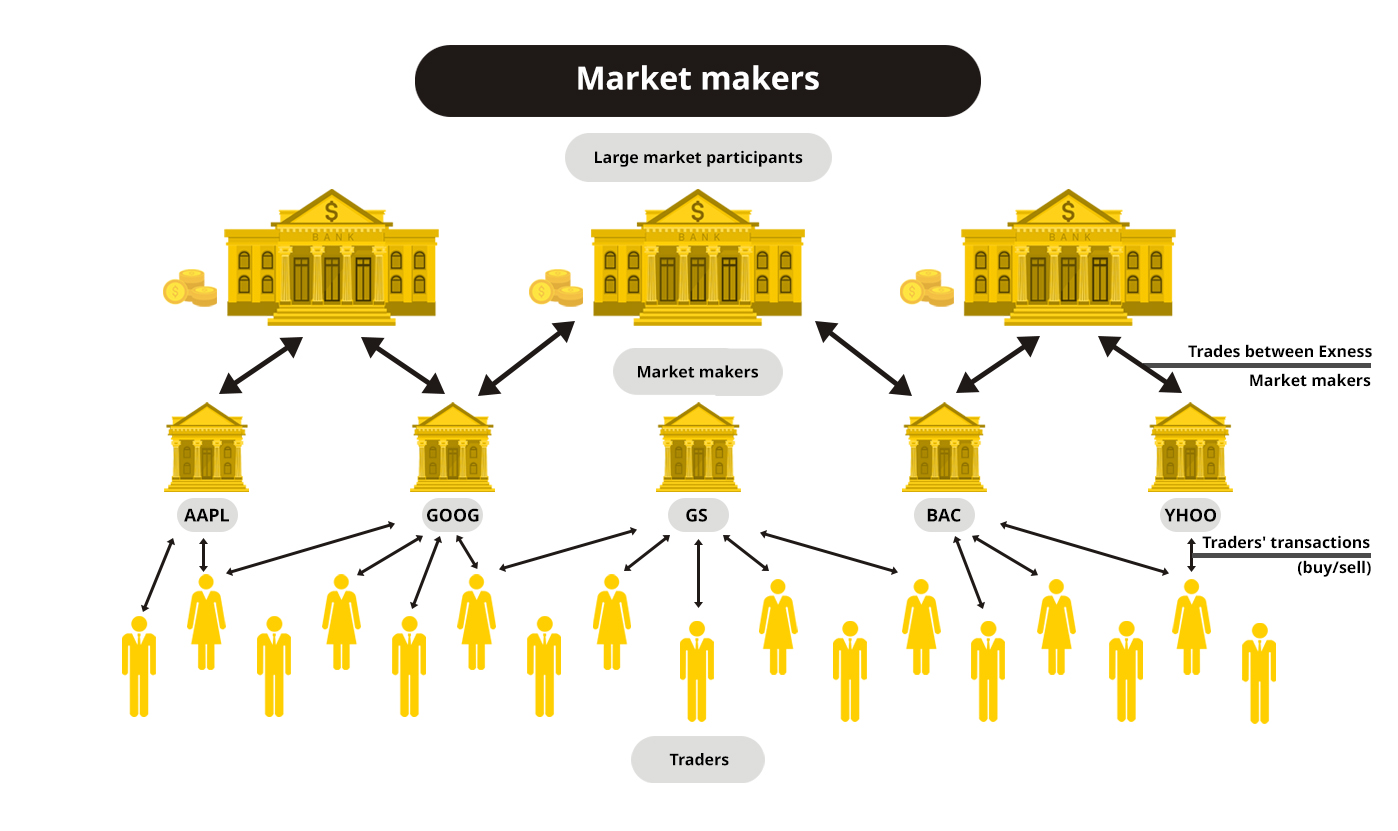

Market makers are financial companies that are always ready to buy or sell financial assets at open quotes in the long run. As the name suggests, these legal entities or individuals leave a detailed market record (tick) by participating directly in the transaction as a buyer or seller.

Market makers generally do three things.

- Set the bid and ask price for a specific currency pair.

- Exness accepts the price considering the details (leverage, spread, etc.).

- Market makers can hedge their orders to mitigate risk, but there are many options for approaching orders.

How Exness works as a Market Maker

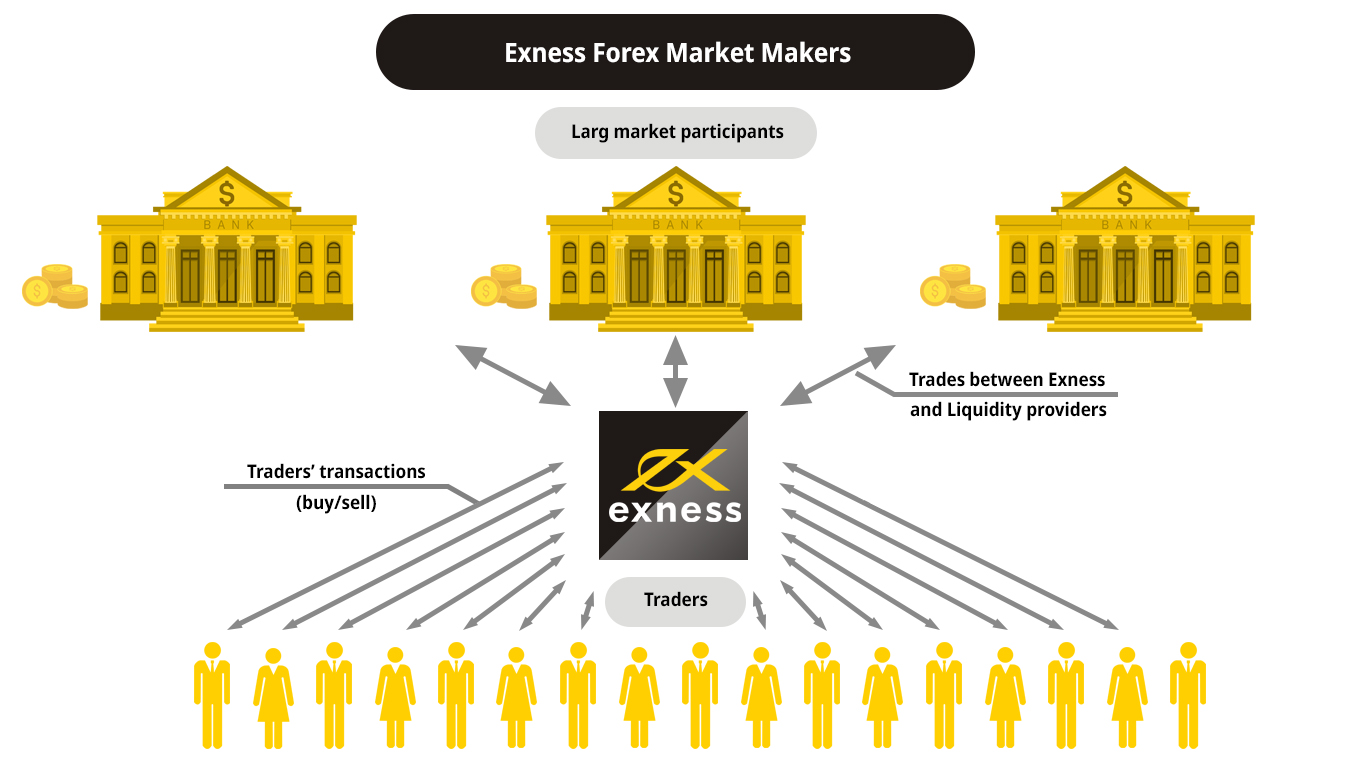

The important role of market makers is to provide liquidity, which can be thought of as a pillar supporting the growth of the foreign exchange market. Market makers create opportunities for other market participants to buy or sell a fairly wide range of stocks, currencies, futures and other trading instruments at open quotes. Market maker trading accounts for a large portion of the total foreign exchange trading volume and affects the exchange rate.

The goal of the market maker is to act as a counterplay, which is to match the buy and sell activity among customers, usually to collect profits through spreads.

Market makers best known for their large market players include Deutsche Bank, Barclays Capital, and UBS AG. When determining whether a bank is a market maker, the bank’s share of the total trading amount becomes more important than the total equity. In other words, the real ability of the bank to exert influence in the market by offering buy and sell prices is important. Small and medium-sized financial companies can also become foreign exchange market makers, but only the largest market makers are known to be large market players.

Exness is also a market maker and provides trading services to partners and clients in the financial markets.

Open EXNESS’s Account for Free

Available Order Execution Type on MT4 and MT5

There are two main types of order execution types: immediate execution and market execution. The two types run slightly differently and have different features and disadvantages.

1. Instant Execution

Immediate execution is a method of placing an order at the price requested by the trader or not at all.

As the price changes all the time, there are cases when the price requested by the trader does not match the order, leading to a reassignment of the quote. A quote override is a way to tell the trader that the requested price is no longer valid, giving the trader 3 seconds to accept or reject the new price. If you accept the new price, the order will be executed at the new price, and if you reject the new price or do not respond to a quote override, all orders will be canceled.

In addition, traders can set the order to be executed automatically when the requested price is within a certain range (or deviation). If the price fluctuates but continues to fall within the deviation set by the trader, the order will be executed at the revised price. If the deviation is exceeded, the trader will receive a bid reassignment message, which can be accepted, rejected or ignored. The results are as above

Example: Suppose the trader asks for a lot of GBPUSD with a price of 1.30442 and the deviation is set to 0.5. If the price changes to 1.80442 or 0.80442, the order is automatically placed at 1.80442 or 0.80442. However, if the price reaches 1.80443 (or higher) or 0.80441 (or lower), a quote override occurs.

2. Market Execution

Market execution is a way for a trader to execute an order at the current price in an instant. Because the price is constantly changing, the price at run time may be higher or lower than what the trader sees on the terminal program screen.

In market execution, unlike immediate execution, there is no requote, which is the main difference between the two types. However, especially during periods of intense market volatility, the risk increases as prices may fluctuate rapidly in a short moment.

The strength of this type is that it is the fastest way to execute trades and that it gives traders 100% market access.

Check the following table to compare the two types of order execution.

What is a market order and how to set it up?

A market order is trading that buys or sells security immediately at market price. There are two types of orders, buy and sell.

A buy order is an order to buy security immediately. Buy orders are opened at the asking price and settled at the bid price.

To set up a buy order:

- Double-click on the desired product in the market price to open the trading window.

- Set required inputs, such as trading volume, and check the types of trading executions possible for that instrument

- Click Copies.

- These transactions can be monitored in the Trading tab at the bottom of the trading terminal program.

A sell order is an order to sell a security immediately. A sell order is opened at the bid and ask price and is settled at the ask price.

To set up a sell order:

- Double-click on the desired product in the market price to open the trading window.

- Set required inputs, such as trading volume, and check the types of trading executions possible for that instrument

- Click Sell.

- These transactions can be monitored in the Trading tab at the bottom of the trading terminal program.

Which Exness’s account type is the Best?

How to start trading Forex with Exness

It’s really easy to start trading on Exness. We will tell you step by step.

To start trading, you need two things. It is a trading account and trading platform.

To open a trading account, you need to sign up and open an account on the Exness website (or use an automatically opened account).

You can download a variety of trading platforms from the Exness website. Go to Tools & Services> Trading Platform to download the platform you like. If you don’t want to download, you can also use the web browser platform option. You can read more about all trading platforms here.

Once you have set up an account, selected a platform and downloaded it, deposit and start trading.

How to open Forex trading account with Exness?

How to earn money by trading Forex and CFDs?

When trading, you generate profits when the price moves in your favor. To understand this, you need to know which direction the price is in favor of buy and sell orders.

Buy orders generate profits as prices rise. In other words, if the bid price at the time of liquidation is higher than the ask price at the time of opening, it can be said that the purchase order generated profits.

Sell orders generate profit when the price goes down. In other words, if the bid price at the time of liquidation is lower than the bid price at the time of opening, it can be said that the sale order generated profits.

What is Forex Trading on Exness MT4 and MT5?

Foreign currency trading stands for foreign currency trading and mainly refers to the exchange of currency for a variety of reasons, such as trading, trade, tourism, etc.

Let’s look at an example of how a profit or loss occurs due to exchange rate fluctuations.

Suppose a person goes on a holiday trip from the United States to Italy. The person exchanged 10,000 USD into Euros. Assuming that the USD/EUR exchange rate at the time was 0.91000, the EUR he held is 9100 EUR. By the time he left Italy, he had unused 1000 EUR left. Based on the exchange rate at the start of the trip, this is 1098.90 USD.

However, in this short period, the euro began to outperform the US dollar, and the current USD/EUR exchange rate is 0.86000. Converting the remaining euros into dollars yields 1162.79 USD.

Hence, this person has earned a profit of 63 USD from this transaction.

Forex traders are similar in that they trade in the foreign exchange market, but they are different because they aim to make profits by using currency exchange rate volatility. Forex traders study economic and social conditions and predict market trends, i.e. trends.

Based on this, they buy or sell the currency and then sell or buy it.

This is forex trading.

Please note: Exness offers CFDs (Difference Trading) in Forex trading, which means you are not physically trading currencies. A customer can only ask for a difference in the price of the currencies included in the particular currency pair selected.

Start trading Forex with EXNESS

Why Forex market is the largest in the world?

The market in which foreign exchange transactions take place is called the foreign exchange market. It is an international market where over-the-counter (OTC) transactions between traders are conducted electronically without going through the central exchange through computer networks around the world.

- The daily trading volume of the foreign exchange market exceeds 5 trillion USD. There is no commodity market, futures market or stock exchange on par with the foreign exchange market.

- Foreign exchange trading is conducted 24 hours a day from Monday to Friday. Market Maker Banks, brokerage firms (such as Exness), independent brokers, investors and traders can buy and sell currencies through the foreign exchange market.

- The quote (or price) is constantly fluctuating and reflects numerous trading, economic and other indicators, interest rates, time zones and preferences and expectations of banking and traders.

- Customers can trade on MT4 or MT5, an easy trading platform. These platforms allow all traders to receive real-time quotes from market participants such as banks and market makers.

Exness is a broker that provides high-quality trading services to clients around the world. Exness helps foreign exchange traders win by providing very low spreads as well as an easy platform to execute trading.

Please check EXNESS official website or contact the customer support with regard to the latest information and more accurate details.

EXNESS official website is here.

Please click "Introduction of EXNESS", if you want to know the details and the company information of EXNESS.