Fundamental analysis on Deriv

Fundamental analysis is the study of economic, industry, and company conditions in an effort to determine the value of a company’s stock.

Fundamental analysis typically focuses on key statistics in a company’s financial statements to determine if the stock price is correctly valued.

I am one of the few traders who actually looks at both fundamental and technical analyses, but technicals are my main focus, and I will cover this style of analysis in more depth further on.

The typical approach to analysing a company involves three basic steps: economic analysis, industry analysis, and company analysis.

Economic analysis on Deriv

The economy is studied to determine if overall conditions are good for the stock market.

Is inflation a concern? Are interest rates likely to rise or fall? Are consumers spending? Is the trade balance favourable?

Is the money supply expanding or contracting? These are just some of the fundamental analytical questions to determine if economic conditions are right for the stock market.

Industry analysis on Deriv

The company’s industry obviously influences the outlook of the company.

Even the best stocks can post mediocre returns if they belong to a struggling industry.

It is often said that a weak stock in a strong industry is preferable to a strong stock in a weak industry.

The US S&P 500 is divided into 11 sectors:

- XLC (Communication services)

- XLV (Health care)

- XLY (Consumer discretionary)

- XLI (Industrials XLU Utilities)

- XLB (Materials)

- XLP (Consumer staples)

- XLRE (Real estate)

- XLE (Energy)

- XLK (Technology)

- XLF (Financials)

Within these sectors, we will have a number of stocks.

For example in the Energy sector, you will find Chevron Corp (CVX) and Exxon Mobil (XOM).

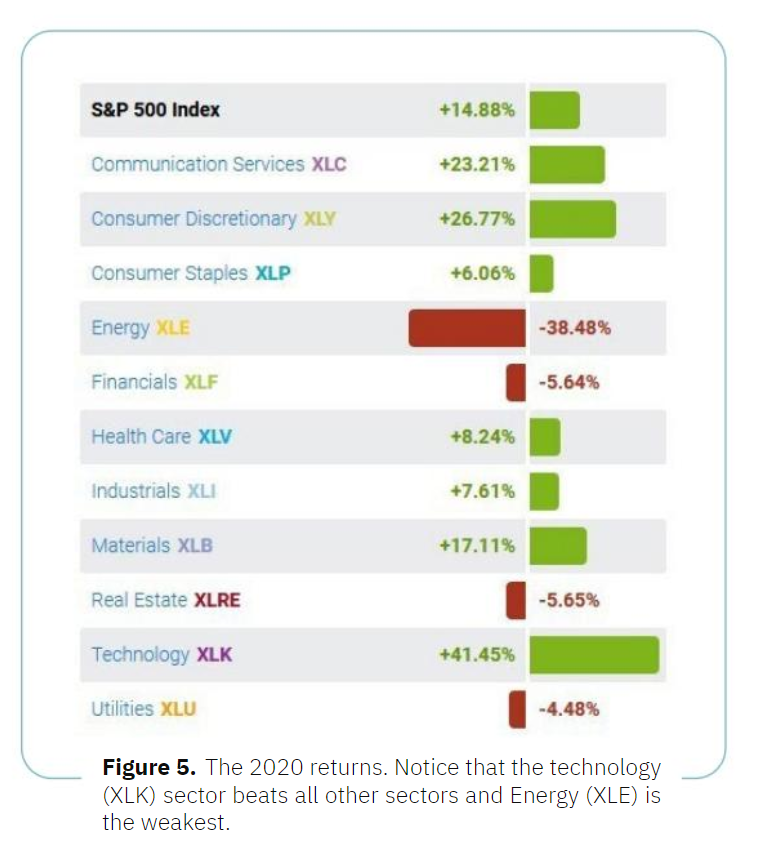

More information about each sector is available in detail. Whether the overall market S&P 500 is going up or down, there will always be leading and lagging sectors.

Of course, one strategy is to do a “pairs” trade where we trade on one stock, for example, Facebook, going up and another, e.g. Delta Airlines, going down.

We could also go long on the S&P 500 but short a few of the individual stocks within the S&P 500.

So we may go long on the S&P 500 but exclude (short) energy stocks.

Figure 5. The 2020 returns. Notice that the technology (XLK) sector beats all other sectors and Energy (XLE) is the weakest.

Company analysis on Deriv

After determining the economic and industry conditions, the company itself is analysed to determine its financial health.

This is usually done by studying the company’s financial statements.

As I have stated, my style is technical, so I am not going into fundamental data in depth here, but I will give a quick overview.

There is no doubt that fundamental factors play a major role in determining stock price.

However, if you form your price expectations based on fundamental factors, it is important to study the price history as well.

Otherwise, you may end up owning an undervalued stock that remains undervalued.

My own view is that fundamentals do matter especially over the longer term.

However, technical trading works better for short-to-medium-term time frames.

A stock which can appear very overvalued on fundamentals can keep going up and become more overvalued.

At the time of writing this guide, Testa (TSLA) on most fundamental valuation models seems very overvalued, yet the stock price keeps going up.

In 2020, TSLA was up over 650%, but its fundamental earnings had not improved.

Short selling can be very profitable, but overall most of your profits will come from going long, as a stock can go up exponentially, but it can only fall to zero, and that does not happen that often.

One of the main fundamentals to look at are company earnings. In The US, earnings are reported quarterly, and you will also have an annual report.

Investment brokers will try to forecast earnings, and companies can issue guidance.

A surprise (better earnings) can lead to a spike in the share price, and negative earnings will lead to a fall.

Of course, you need to remember that “markets look ahead”. You will often see good earnings, yet the stocks could fall.

Why would this be? Well, it’s due to expectations.

If good earnings are already factored, the stock price is already fully valued. You may also see negative earnings and the shares go higher.

Again, expectations may have been for worse earnings.

Or the earnings could be bad, but a statement that comes out is more positive, and there is evidence that the company is turning around.

As you can see, focusing on the fundamentals to predict the future value of stocks is not an easy task.

There is plenty of fundamental data available, such as EPS (earnings per shares) and P/E (price-earnings ratio).

Problems with fundamental analysis

A problem with fundamental analysis, or trading based on the news, is that, in many cases, the data looks backward, so it only reflects upon what has already happened.

The other problem is that data can be interpreted in many different ways.

For example, a higher unemployment number can be seen as negative.

A greater percentage of people out of work implies more benefits being shelled out at the government’s expense, fewer people paying tax and an overall weaker economy.

However, on the positive side, it would also typically mean that wage inflation remains low — since current employees are less likely to ask for a pay raise if others are ready to swoop in and take their jobs.

It would also mean that central banks are less likely to raise interest rates.

Major banks produce a vast amount of analysis on economies — much of which is freely available.

However, it is questionable how useful this data is to the financial trader, especially in shorter-term trades.

For most, technical trading will offer an easier way to follow the stock market and trade individual stocks and indices.

Professional tools are now available to all.

On a side note: Deriv’s unique synthetic indices are available for trade round the clock, every day of the week, even on holidays and weekends, and are not affected by the news.

You can learn more about them in my new ebook How to Trade Synthetic Indices.

Please check Deriv official website or contact the customer support with regard to the latest information and more accurate details.

Deriv official website is here.

Please click "Introduction of Deriv", if you want to know the details and the company information of Deriv.