Learn the trading of profitable traders

Through the Top Trader100 of OANDA Labs, you can view the transaction summary of profitable traders and loss-making traders.

By comparing the content of their transactions, we can see the difference between the stronger traders and the weaker traders.

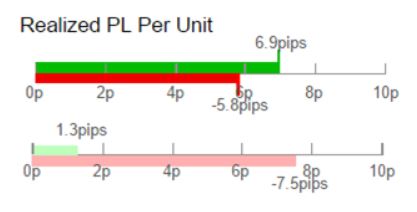

In this data, the most significant difference between profitable traders and loss-making traders is the Realized PL per Unit on the far right (statistics calculated on the basis of Pips for the average profit and loss of profitable and loss-making trades).

Profitable traders often have fewer average Pips for profitable trades and fewer average loss Pips for loss-making trades. On the contrary, loss-making traders have more average Pips for loss.

In other words, profitable traders have large profits and small losses, while loss-making traders tend to have large losses and small profits.

Even if people know that big profits and small losses are better in their minds, once they start trading, their attention will be focused on how to improve the winning rate, and there will be situations where big losses and small profits will gradually appear.

Open a Forex Trading Account – OANDA

As long as there are people who have experienced it, it is not too difficult to predict the take profit price if you look at the past charts, but once you look at the constantly changing chart, you will feel worried, and people who take profit prematurely are not less.

For such traders, please remember this information before entering the market.

Confirm whether the loss limit order is indeed placed, whether the expected profit is not too far away from the loss limit, etc., and aim to achieve a large profit and small loss transaction.

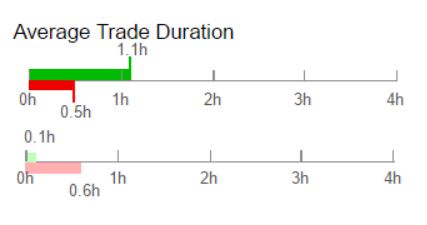

What needs attention after Realized PL per Unit is Average Trade Duration (average position holding time).

This project is also one of the projects where characteristics are relatively easy to appear.

Loss-making traders tend to hold losses for a longer period of time.

In other words, it is difficult to stop the loss in the state of the so-called warm water boiled frog, and there are many cases where the loss further expands.

On the contrary, profitable traders tend to hold profitable trades for longer periods of time. In other words, it is necessary to hold profitable positions to ensure profitability.

Of course, if you think that the profit has reached its peak, you must stop the profit without hesitation, but due to human nature, novices have a tendency to stop the profit prematurely relative to the stop loss.

For those with poor trading performance, please refer to these materials and re-examine your trading.

How to open OANDA’s Forex and CFD trading account?

Please click "Introduction of OANDA", if you want to know the details and the company information of OANDA.