Global Market Sessions

One of the most exciting and interesting things about financial markets is the fact that they are open 24 hours a day. This allows operators around the world – no matter what time zone they are in – to trade during business hours, after work, or even overnight.

However, the trading conditions are not always the same throughout the day. Some moments of the day – or a ‘session’, are different from others and are characterized by greater volatility and liquidity.

It is virtually impossible to monitor your open positions at all times. With specific periods more vulnerable to volatility, it is important to know how your trades could be affected throughout the day and minimize risk accordingly.

When is the best time to trade Forex?

When is the peak of the financial market?

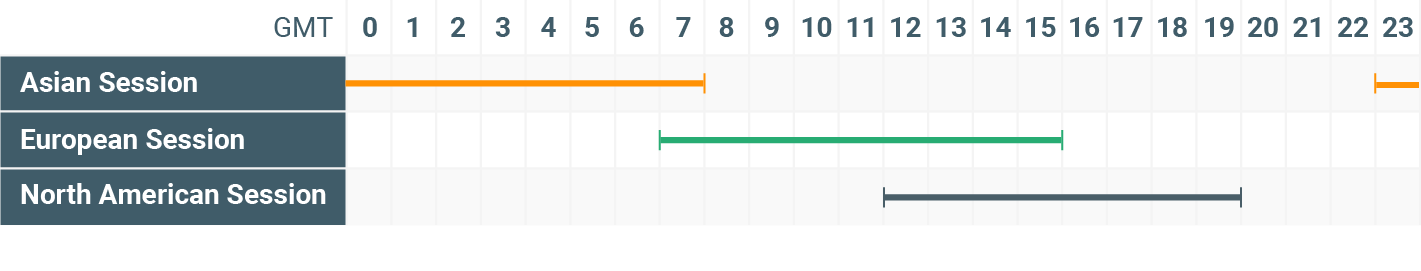

In general, there are three set periods when activity typically rises. These are known as the Asian session, the European session, and the American session. (More casually, these periods are also called Tokyo, London and New York sessions) This is because these three cities are the main financial centers of the world where large and influential institutions are located. When a session in each of these places opens, volatility and market movements rise. For example, when trading starts in London (around 8:00 am GMT) a major change in prices can occur. So if you have an open position in EURUSD, you should be aware of the European session time.

Each instrument reacts differently to each session. For example, a trader looking at the Australian dollar should know that the currency normally moves more during the Asian session, and again when Wall Street opens. On the other hand, if you are trading the Turkish lira, you should keep an eye on the market during the European session, but less volatility is expected during the Asian session. This doesn’t just apply to currencies – for example, when being bought or sold on the DAX, you will see that your profit or loss will fluctuate between 8am – 5pm, but it will probably move less during the European night. Each instrument has its own specification that you should know before opening a position.

See the Best Forex Trading Broker in 2021

Expect the unexpected in the market

Less liquidity leads to a stabilization of financial markets, which can be affected by so-called “ flash-crashes ” from time to time. In October 2016, the British pound fell more than 5% in a second after the close of the American session. A similar situation occurred in March 2016, when the price of gold fell, only to recover a few seconds later. Such declines can occur for a variety of reasons and it is important to remember that just because a market has acted in a certain way historically does not mean that it will always exhibit the same patterns of behavior. Make sure you take the time to identify the current direction of the market in multiple time frames.

When you trade forex and CFDs, you need to first determine which style best suits your trading personality. Are you comfortable with short-term market volatility, or do you prefer lower liquidity and holding points over a longer period of time? Do you want to keep your operations overnight, for a period of weeks, days, or months?

Decide how much time you can spend on your negotiation and find the best approach that works for you.

2021 Best Online Forex Brokers Ranking

fundamental analysis and technical analysis

We have two different approaches that traders can use to analyze the market. These are fundamental analysis and technical analysis.

On the one hand, fundamental analysis looks at the economic information of a company, raw materials or currencies; while technical analysis only uses charts, indicators and oscillators to predict future price movements.

What is Technical Analysis?

Today, there are three most popular technical analysis principles among traders to identify opportunities: “The market discounts everything”, “Prices move in trends”, and “History always repeats itself”.

- The market discounts everything

- Technical analysis only pays attention to price movements, ignoring fundamental factors, since factors that affect the market price are included within these movements. Therefore, all that needs to be examined is the price itself.

- Prices move in trends

- In technical analysis, price movements are considered to follow trends. This means that after a trend is established, future price movement is more likely to go in the same direction as the trend than against it. Most technical trading strategies are based on this concept. Access how to trade with the trend.

- History always repeats itself

- The cornerstone of technical analysis is the theory that history tends to repeat itself. As a consequence, technical analysis uses historical price data to predict when prices will change. This is where we see the support and resistance levels.

- Chart Styles

- Charts are the most important resource in the technical analysis arsenal. With the charts, it is tracked how prices have operated during a certain period of time, allowing to locate trends and use tools to predict where prices will change. An OHLC chart contains four types of information that are essential for a particular time period to provide you with a visual reference of price behavior. They highlight (on the left-hand side of the bar), the highest price (the high), the lowest price (the low), and the closing price (on the right-hand side of the bar).

- Candles

- Candles are one of the most popular charting tools, as they give us a visual reference to price movements over various time periods, such as a minute, an hour, a day, a month, and more. They operate like OHLC charts but differ in that they present a colored body to identify the differences between the opening and closing of the price of a bar.

3 Golden Technical Analysis Patterns

3 main chart types

To get started with chart analysis, it is key to understand what types of charts can be helpful in predicting market movements and how the different charts are constructed. The most popular charts are:

- Line charts

- Bar charts (OHLC)

- Candlestick charts

1. Line charts

A line chart is generated by connecting dots representing the closing price of various time intervals with a line. Line charts are one of the oldest types of charts, once used by stock traders. One of the benefits of using a line chart is the amount of visibility they offer. However, line charts only provide information about the closing price in a given time interval. The information that we do not have the possibility to know with the line charts is the opening price, the maximum price and the minimum price.

Let’s look at an example of a line chart on the 15-minute interval on the EUR / USD.

2. Bar charts

As opposed to line charts, bar charts provide traders with all the important information over a given time interval; The closing price, the opening price, the maximum and the minimum. You can understand it better by taking a look below our example:

The bar is constituted in principle by a horizontal line that is located on the left side of the vertical line and this represents the opening price of the selected time interval. After opening, the vertical line begins to form where the upper part of the vertical line represents the maximum of the time interval and the lower part of the vertical line represents the minimum of the time interval. When the interval ends, a horizontal line emerges on the right side of the vertical line showing the closing price of the interval.

What should be taken into consideration is that the left horizontal line is lower than the right horizontal line, and this bar represents a “rise” bar where the market gained power. On the other hand, if the left horizontal line is above the right horizontal line, then this bar represents a “decline” bar where the market lost momentum.

In conclusion, bar charts can provide us with all the fundamental information about a time interval, but, on the other hand, their defect is the lack of visibility, especially when it departs from the market. With an enlarged chart, it is very difficult to define whether a given bar was a rising or falling bar.

Below you can see an example of a bar chart in the 15-minute interval on the EUR / USD.

3. Candlestick charts

Candlestick charts have their origins in 18th century Japan when rice traders drew candlestick charts to analyze possible price movements that could affect their business. Like bar charts, candlestick charts provide the necessary information over a time interval and also solve the visibility problem, which is the weakness of bar charts.

A candlestick is shaped like a bar with a peculiarity; The horizontal lines extend to both sides and connect to form a body for the candlestick. If the given candlestick notices an increase the body will be white or green, while if the candlestick noticed a decrease the body will be black or red. Of course, the colors of the body of the candlestick may differ and this will depend on the market platform or your own preferences.

As we explained previously, the body will show the opening and closing prices and the vertical lines coming out of the body will show the high and low of the time interval. They are called shadows.

The funny thing about candlesticks is that they tend to create shapes and sequences of shapes that enable traders to understand current market sentiment and also help identify potential investment zones.

Which MT4 chart type is the best to analyse market trend?

What is Fundamental Analysis?

The two most common forms of analysis when it comes to the financial market are technical and fundamental analysis.

During this lesson, we will study fundamental analysis in more detail.

Unlike technical analysis, which looks at price action and trends to help pinpoint where they might go next, fundamental analysis takes into account all available data to help determine the relative value of a market. They then examine discrepancies between the current market price and their own valuations to find trading opportunities. For example, if they want to invest higher in Apple stocks if their valuation of Apple is higher than its current price per share.

While technical traders think that all the information they require is found on charts or the market, fundamental traders look at multiple pieces of information including political, economic, social, and macroeconomic releases, as well as corporate earnings.

Here are some of the more interesting macroeconomic data releases:

- Central bank policy and interest rate decisions.

- Employment market data in influential markets, such as data from non-farm payrolls in the US.

- Inflation data for the United Kingdom, the Eurozone and the United States.

- ISM, IFO, retail sales, industrial production.

- Corporate earnings reports.

1. Interest rates

Interest rates can have a direct impact on interest rates; often the demand for a currency with a higher interest yield is higher than the currency with a lower interest rate.

2. Labor market data

Labor market data, for example, US nonfarm payrolls, has a major influence on financial markets and can generate volatility in indexes and forex. The employment report is released on the first Friday of each month and reflects the total number of US workers at all businesses. This market is very susceptible to this type of data due to its implication when identifying the speed of economic growth and inflation. If nonfarm payrolls increase, it is a good indicator that the economy is growing. If increases in nonfarm payrolls happen quickly, it may signal that inflation could rise. If payrolls come in below expectations, forex traders will generally have to sell USD (USD link on the web) in anticipation of a weakening of the currency. If you exceed expectations, the value of the dollar frequently increases.

3. Inflation data

Inflation is the rate at which the price level for goods and services is rising. Central banks try to restrain inflation and avoid deflation, with the aim of keeping the economies of their respective countries stable.

4. Economic indicators

In addition to non-farm payrolls, there are other economic indicators that can have an impact on markets – such as retail sales figures. Retail sales are prominent economic indicators because consumer spending drives much of the economy.

5. Company Results

Fundamental analysts look at a company’s financial reports to determine if they are taking a position on that particular stock. This involves looking at the income, expenses, assets, liabilities, and all other financial aspects of a company, which are often made publicly available in quarterly income reports.

6. Economic calendar

You can check market data publications in the economic calendar of XTB’s xStation platform. Ads are classified as High, Medium, or Low, in terms of their impact and potential for market volatility. The calendar also features announcements by region and country, as well as information on forecast figures and previous data releases. If you look at the central column, you will see information about the type of data that will be published, and what type of repercussion it is anticipated to have on the financial market. The last column gives us a complete picture of the history of the publication and the consensus according to future publications. There are also bookmarks available for you to take advantage of, as well as Trader News and Chat to keep you up to date with what is happening in the market.

When is the Best Time (Hours) to trade Forex?

Please click "Introduction of XTB", if you want to know the details and the company information of XTB.