What is the Margin?

- CFDs are a leveraged product. This means that you only need a fraction of the face value to get the same exposure in the market.

- When a trade is made, a certain outlay is needed to open the position.

- Margin is not a cost, it is an amount of money frozen while your position is open, and returned once the position is closed.

- Your margin level is the deposit required to maintain an open trade on your account.

- For example, with a leverage of 1: 200, you will need 0.5% of the nominal value for the margin of the operation.

What’s the relation of Leverage, Margin and Margin Call?

What is the profit from the margin?

Margin trading – also known as leveraged or leveraged trading – allows you to gain large market exposure with a relatively small deposit.

This means that, if the market moves in your favor, your return may be higher than in traditional trading.

Margin trading gives you the ability to get a higher return on your capital by committing only a fraction of the trading value as an initial deposit.

You can take larger positions than you could take by making physical purchases.

This means that your return, in proportion to your initial investment, would be much higher.

However, keep in mind that just as your profits grow, so do your potential losses.

You can lose more than you initially deposited if you do not carry out proper risk management.

Start Trading Forex and CFDs with Leverage

Margin – as an example

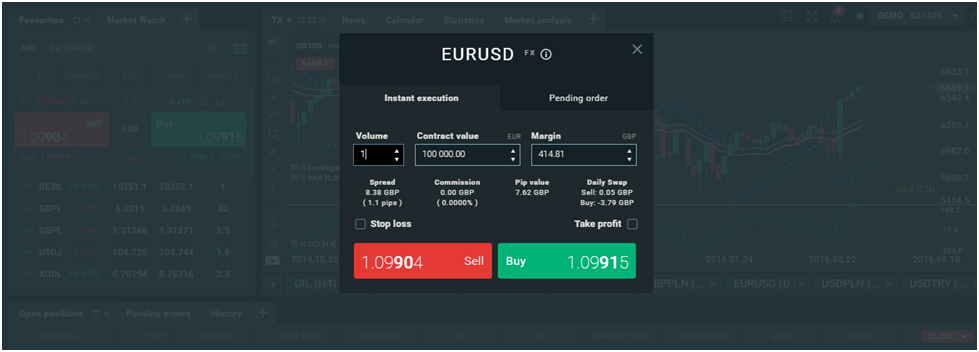

Let’s say you would like to open a position on the EURUSD and your account leverage is 1:100.

That means only 1% of the total contract value is required as a margin.

The xStation’s trading calculator instantly determines the required margin cost, according to the volume used and the leverage of the instrument traded.

In the example, one lot of EURUSD requires approximately 415 GBP.

What is Margin? What is Leverage?

Margin levels and initial deposits required

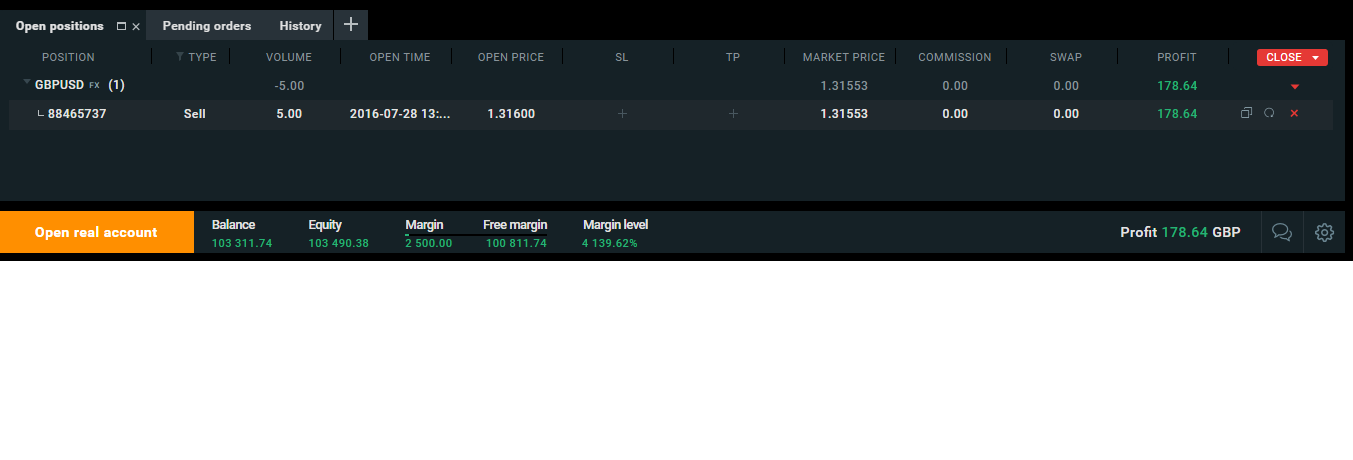

To open and maintain your positions, you must have sufficient resources to cover the margin requirements at all times.

The free margin represents the amount of capital that you have available to carry out new operations and cover negative price movements in your open positions.

At XTB, they trade at a 30% margin level.

The limit level is calculated by dividing your equity by the required margin and then multiplying by 100%.

On XTB’s trading platforms, you will find an indicator called “margin level”.

When this indicator falls below the 30% level, the open position with the highest loss will be automatically closed.

This system allows us to help you avoid incurring greater losses.

To avoid your position being closed due to a stop-out, you will need your margin level to always be higher than 30% by depositing new funds, thereby increasing your equity.

Open XTB’s Forex and CFD Account

What is Margin Level?

The Margin Level is a risk management indicator that helps traders understand the influence that open transactions have on their account.

It is calculated through the following formula:

Margin Level = Equity / Margin x 100%

If a trader does not have any open trade, his margin level will be equal to zero.

Once the position is opened, the Margin Level will depend on the:

- Volume

- Instrument

- Leverage

The best platforms in the world calculate the Margin Level automatically, and it should be displayed next to other factors related to the funds invested by the trader such as balance, equity, margin, and free margin.

Understand the pip and margin value

Risk management is one of the most important factors in your trading strategy.

Learn why you should focus on selecting your position and why risk management is crucial to your trading success.

Pip Value and Margin

One of the first decisions you have to make as a trader when starting your investment process is to choose the trading volume that suits your operations.

The choice of trading volume will depend on many psychological factors, as well as emotional comfort and aversion to risk, but the choice of trading volume will be in sync with the risk management you intend to implement.

This means, in other words, that understanding how trading volume can affect you is crucial as the volume you choose will determine both the margin per trade and the pip value.

Margin

When we open a transaction, you will need a certain amount of payout. This is known as the margin.

Margin is not a cost, it is an amount of money that is frozen in a given transaction and returned to you once the transaction has been closed.

It is essential to know how much of the margin will be so that you can evaluate not only the risk itself but also the funds available that will allow you to open positions in parallel.

The important thing is that, with CFDs, only a fraction of the face value is required to be able to open a position.

For example, with a leverage of 1: 200, you would only need 0.5% of the face value for the margin of the trade.

Trading example

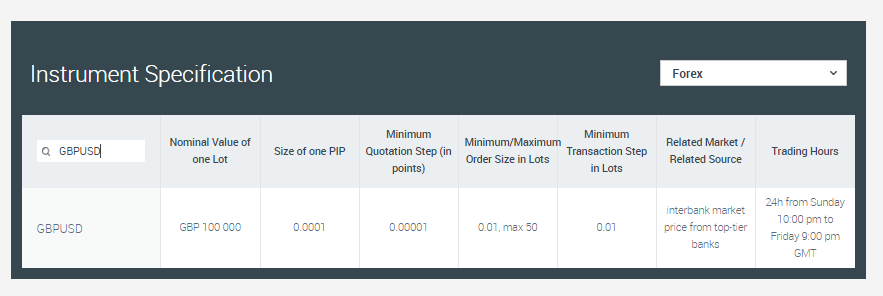

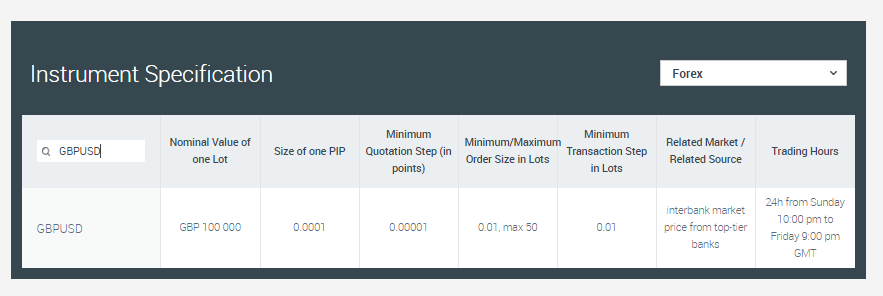

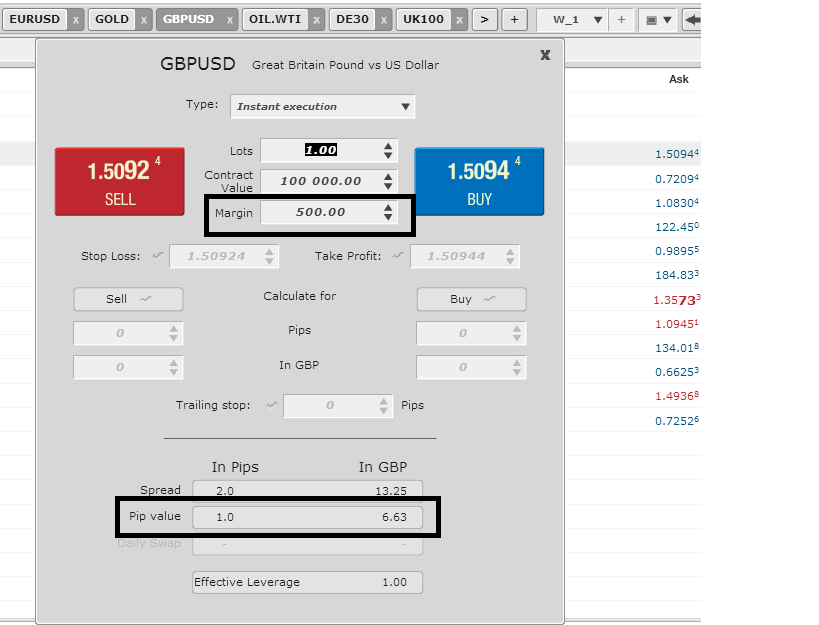

Let’s say you want to open a 1-lot GBP / USD trade with 1: 200 leverage, but you don’t know what the par value per lot is for this asset.

This information can be found in the instrument specification table.

On GBP / USD, the face value per lot is £ 100,000.

If the leverage is 1: 200, you will only need 0.5% for the margin of this asset, calculated in the base currency of the currency.

So you need £ 500 for the margin of a 1 lot trade.

From a risk management perspective, the margin is very important and the common notion applies that traders should not enter positions with a margin greater than 30% of the total capital invested.

Going back to the example above, if your starting capital is £ 5,000 and you want to open a 1 lot trade then that would represent 10% of your total capital because the required margin with 1: 200 leverage would be £ 500.

It is key that before you open a position, analyze what your maximum margin will be and do not break any of the rules set by yourself.

Following strict risk management regulations is essential to achieve success in the financial markets.

Pip value

The second factor that will influence the size of the volume is the pip value.

In the investment process, it is important to know the value of the pip, particularly for risk management purposes.

You must know how your portfolio will be affected if the market goes 100 pips in your favor, or 100 pips against you.

To calculate the pip value, you can use the instrument specification table again.

To calculate the pip value for 1 lot, the “Nominal Value of a lot” is multiplied by the “Size of a PIP” and the value will be in the quoted currency:

100,000 x 0.0001 = $ 10

This means that if you open a 1 lot trade on GBP / USD and the market moves 100 pips in your favor, you would make a profit of 1000 USD (10 USD x 100 pips). On the other hand, if the market does not move in your favor, you would take a loss of $ 1,000.

This calculation will help you establish at what market level your maximum allowable loss might be and where you can place a Stop Loss order.

The general idea is that you do not incur losses greater than 5% of your total capital in a position.

The reason for this is that the market is based on probability and you must give your strategy a statistical opportunity in the analysis, to identify if it has a greater probability of achieving success rather than defeat.

Example: We open a 1 lot trade on GBP / USD where the pip value is 10 USD.

You will also comply with the rule of not accepting a loss of more than 5% of your total capital. So your total capital is £ 5,000 so your maximum assumed loss is £ 250, which is roughly $ 380.

If you know that 1 pip is worth $ 10 and your maximum assumed loss is $ 380, then dividing $ 380 by 10, your maximum Stop Loss level is 38 pips.

Forex Basic – Bid & Ask, Spread & Pips and Long & Short

Should you perform these calculations manually?

Fortunately not. The xStation Marketplace platform has a built-in smart calculator that helps you with all of these calculations.

Just double-click on any instrument in the Market Watch / Quotes window.

What is margin, margin level and free margin?

How to manage open trades and profits

Risk management is one of the most important factors in your trading strategy.

Learn why you should focus on selecting your position and why risk management is crucial to your trading success.

Trading markets are closely related to the concept of probability.

What’s more, you should not only consider the number of successful trades but make more profit when the markets move in your favor – and lose as little as possible when they move against you.

It is for this reason that the concept of the risk-reward ratio is so important.

This concept is linked to how traders manage their open positions and how they can achieve their profits.

In this lesson, we will assume that the minimum accepted risk: profit ratio is 1: 3, and this means that for the trader to make money, he must then achieve three times what he agrees to lose.

The main reason for this is to be able to generate profits with a smaller number of winning transactions.

Setting this scenario, let’s use the following example:

- When the trader has a successful transaction, his earnings add up to £ 300.

- When the trader has a losing trade, his losses increase by £ 100.

With this ratio, the trader can generate profits if he has a success rate of only 30% as you can see below:

30 winning trades x £ 300 profit = £ 9,000

70 losing trades x £ 100 loss = £ 7,000

Net profit = £ 2,000

It may seem that having a 30% success rate is not positive, but the example above shows that it can help you succeed in the financial markets.

This ratio will help develop a scheme that will point out how traders handle their open trades.

When you open a trade, you must decide what your maximum allowable loss will be and set a stop loss.

If you use the risk to reward ratio 1: 3, when the profit reaches an amount three times higher than your stop loss, you have two possibilities:

Access to XTB’s xStation platform

Closing the transaction

Closing a transaction at a profit three times higher than the accepted loss is never a bad idea, but what you should consider is how you will react, emotionally speaking, if the market continues to move in the direction you aimed after closing the position.

This is a difficult time from an emotional point of view, where many traders will try to get back to that winning trade.

Unfortunately, trying to go back and make decisions based on emotions is one of the biggest mistakes a trader can make.

Change the stop loss

After the position reached its target, you can change your stop loss to a level lower than the current market price.

In this way, you will be guaranteeing the profits obtained and giving you the opportunity to have higher profits, where the difference between the current price and the modified stop loss can be taken into account as the amount of money you are willing to pay to have the opportunity for the market to give you higher profits.

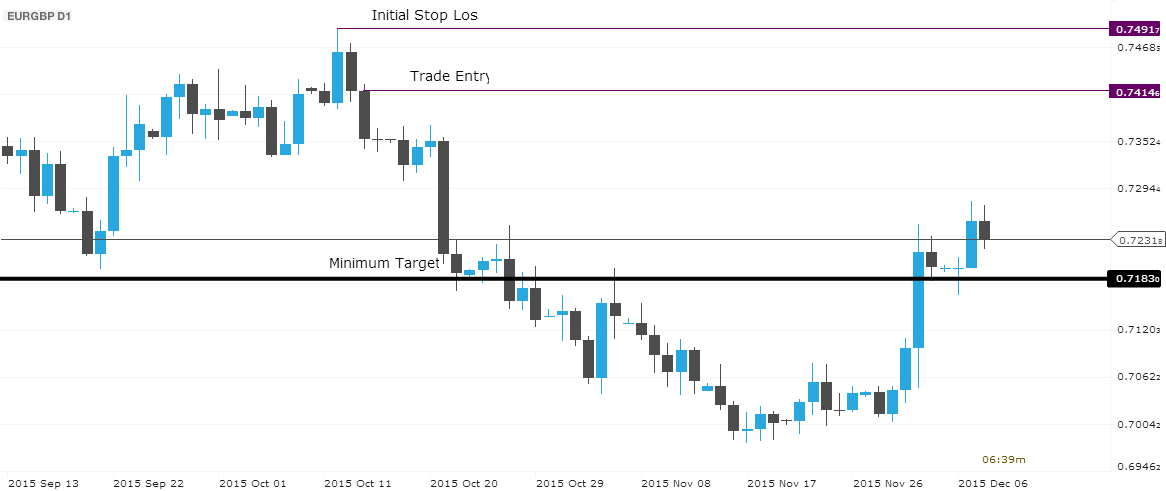

Here, the trader opens a EUR / GBP trade, determining a stop loss and the minimum target three times higher than the stop loss value.

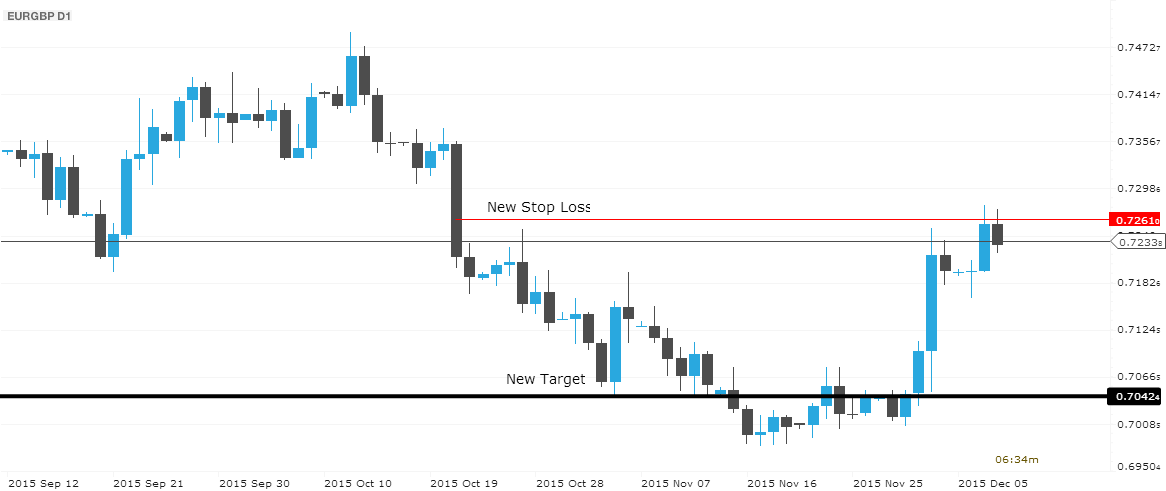

After the market reaches the trader’s goal, he modifies his stop loss to a new level and reassigns his target, giving the chance to increase profits in the same operation.

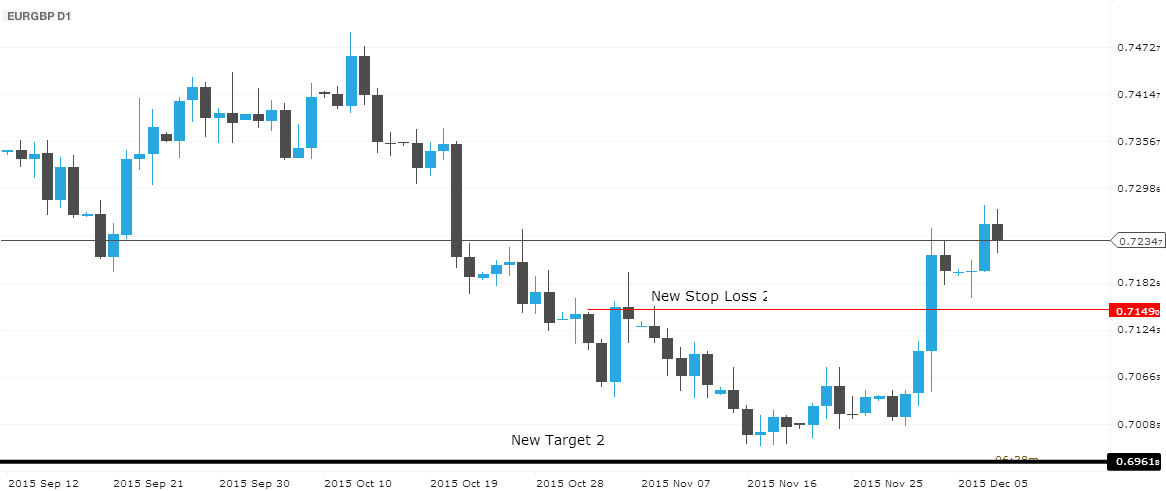

The market reaches a new target for the trader, after the trader repeats the previous action of modifying both, both the stop loss and the target level.

Unfortunately this time, the market did not allow the trader to keep his position open and closed the trade at a new stop loss.

These are two of the most popular ways to handle your open transactions and reap the benefits, but there are more options that may suit your level of emotional comfort.

For example:

- Modification of Stop Loss to profit of 0 pip:

- The main idea is that when the market has covered the cost of the operation, you can change your stop loss to a profit of 0 pip. This method provides emotional comfort. Whatever happens to the market, the worst that can happen is that the operation closes without profit.

- Change of Stop Loss based on previous highs and lows:

- The main idea is that when the market breaks a high in an uptrend, you can reassign your stop loss to a level either below the candlestick that breaks the high or to a safe level that is below the previous high. On the other hand, in a downtrend, a stop loss can be reassigned after the market breaks the last low and the stop loss can be set either above the candlestick that breaks that low or by the previous high.

We will show below an example modification of the Stop Loss based on previous highs and lows.

Here we see that the trader opened a transaction at the level of the blue line and assigned the initial stop loss on the green line, subsequently with each break of the last minimum the trader reassigned a new stop loss at the maximum of the previous maximum.

After three stop-loss modifications, the market closes the trade.

In conclusion, there are several ways to manage open operations and increase the probability of achieving higher profits, as well as the growth of the risk: profit ratio as much as possible.

Try to analyze what percentage of successful trades you require if you increase the ratio from 1: 3 to 1: 5 or possibly 1: 8.

Please click "Introduction of XTB", if you want to know the details and the company information of XTB.