The beautiful name Three Indians hides the classic “Three touches” scheme – probably the most ancient pattern of visual analysis, which remains effective on almost any trading asset precisely because of its simplicity.

General idea of Three Indians

The famous Larry Pasavento calls this construction “Pattern 1-2-3”, and in the theory of wave analysis it is classified as a diagonal triangle. It is necessary to track the appearance of successive extremes step by step, after which the current trend reverses. The pattern assumes the location of three key points on the same line in the direction of the global trend (a small deviation is allowed on speculative bars), that is, if you build a trend line at two key points, then at the point of the third touch you can enter the market following the trend. TakeProfit is located at the extremum of the pattern, StopLoss is at the level of the second key point.

The trading technique came from the futures market, at the moment there are no contraindications for use on Forex, with the exception of cross-pairs or any other assets with volatile volatility.

Trading signals for the Three Indians strategy

The pattern can be built on any timeframe, starting from M5, the main thing is to correctly recognize two key extremes. Nevertheless, we would like to remind that any chart pattern inspires confidence on a period not lower than M30. As applied to this technique: at small periods, the “Indians” may not be noticed, but until the third touch on W1 occurs, you can simply forget about the pattern.

It is assumed that no additional indicators are used, and entry points are determined only graphically. So a slight “backlash” in the construction and development of the pattern is quite acceptable.

The standard bullish pattern assumes an uptrend (the baseline is drawn at the lows of the price) and a buy trade after the third touch point.

According to the bearish pattern on a downtrend (trend line at the highs), a sell trade is opened after the third touch.

The emergence of the Three Indians pattern (at the bottom or at the top) means that the market is gaining interest in the trend reversal, we should expect at least a strong correction. This is a harmonic pattern, so its movement can be tracked by Fibonacci levels . Let’s consider the trading technology using the bullish option as an example.

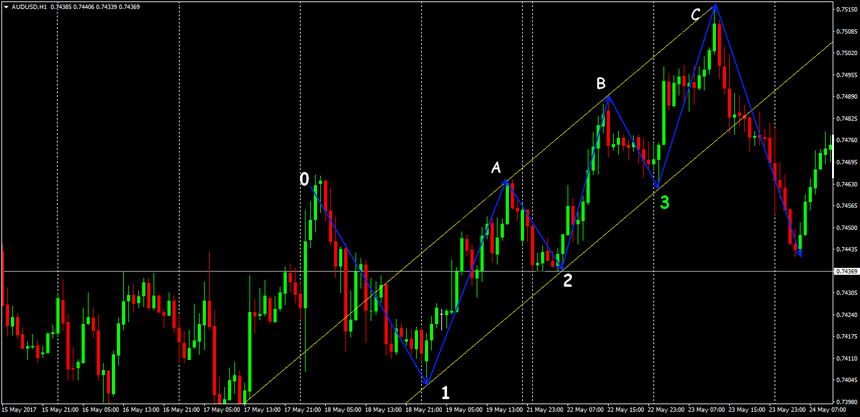

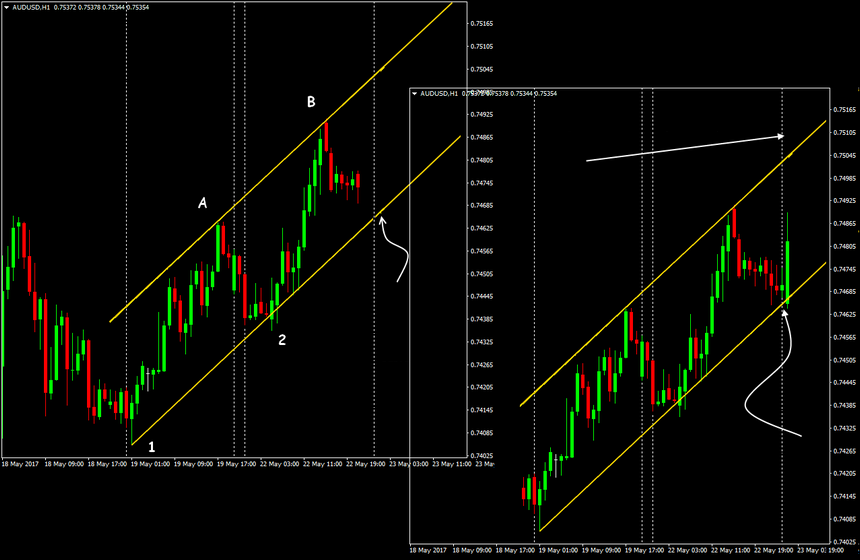

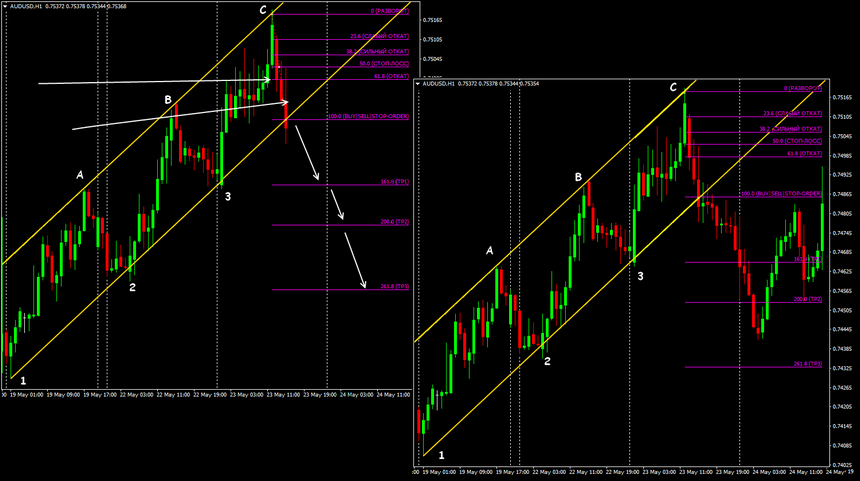

First, we visually look for a suitable structure and roughly define the area for the entry point:

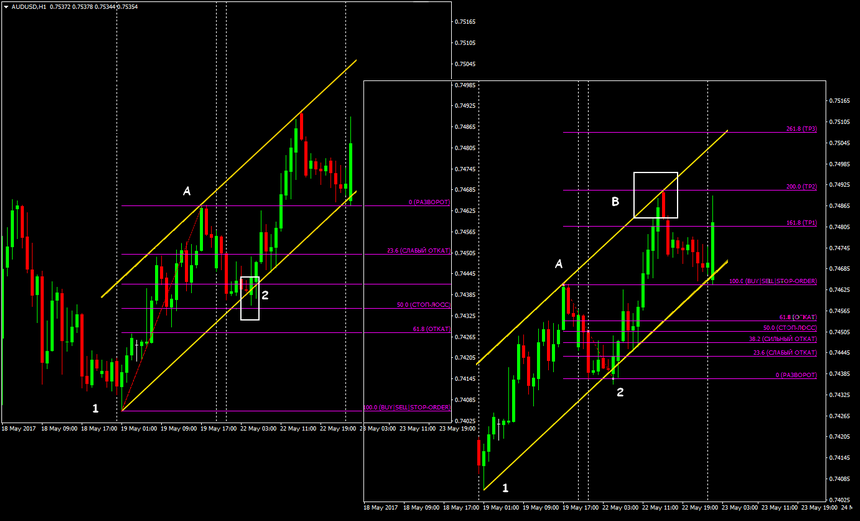

To correctly assess the position of the target point for the Three Indians figure, we check the constructed pattern “for harmony”. The first impulse in the direction of the trend: segment 1-A (first maximum), then correction A-2 appears. For a perfect pattern, point 2 should be between the 50% and 61.8% Fibonacci levels on the 1-A line. This means a fairly deep correction – the market in the opposite direction is depleted.

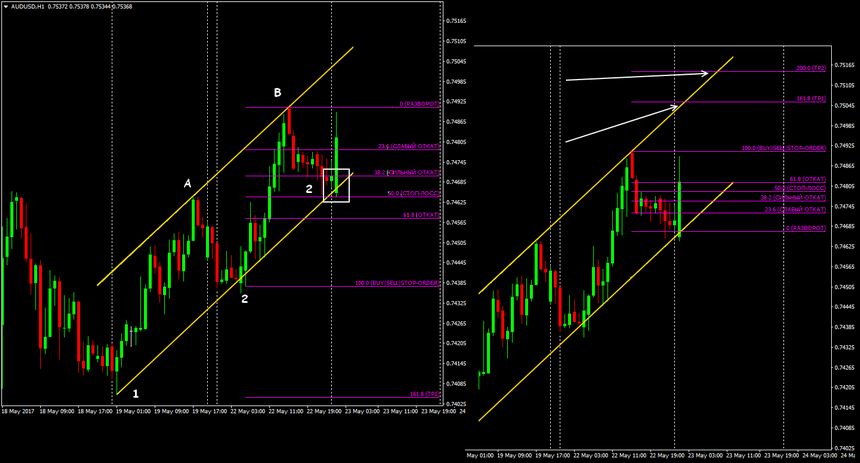

Point B should be located close to the levels of 127.2% -161.8% of the Fibo ruler, built on the second wave – along wave 2-B. After point B appears on the Three Indians pattern, the third wave begins to form, on which we will enter the deal along the trend – to point C.

The conditions for entry point (3) are similar to point 1: if you build a Fibo grid based on the impulse of wave 2-B, point 3 should be located between the 50% and 61.80% level of the Fib line, that is, there should be another deep correction.

It is recommended to enter with a BuyStop pending order just above the calculated point of contact with the pattern’s entry line. Before TakeProfit, at the calculated point C, we fix the profit by trailing. Recommendations for StopLoss – at the closest minimum to the point or using the usual money management method.

The Three Indians strategy assumes that on the third wave, the current trend begins to weaken and the likelihood of a reversal after point C increases (in this case, down). For example: after working out a buy order to point C, you can enter selling on a pullback, of course, if the market situation allows.

Assessing the quality of the Three Indians pattern

If we start to build lines on the price chart at any two points, we will get a lot of options for potential points of the third touch. How do I filter out the most reliable ones? There are few conditions for building a reference figure:

- The formation of a pattern and the first entry is carried out only along with the trend if you want to trade the counter-trend – analyze similar graphical constructions Head-Shoulders, Pennant, Wedge, etc.

- The point of contact should “pierce” the trend line and immediately rollback. If there is a trade in the area of the key point, the pattern becomes unreliable.

- The key line should be built from the outside, without crossing the price in the near past.

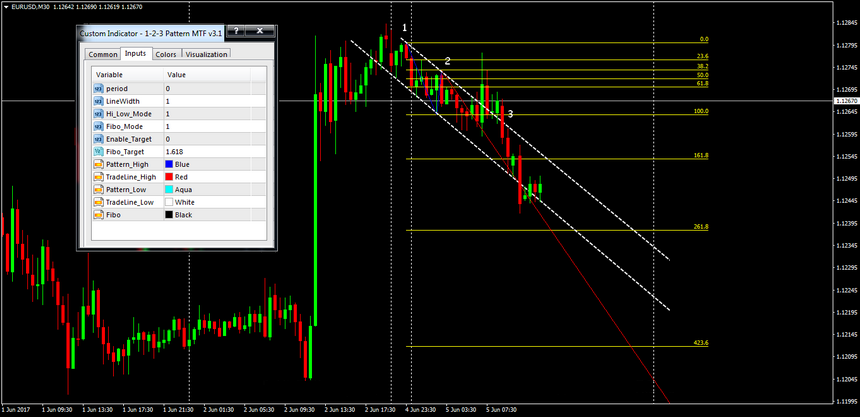

Today, technical indicators have been developed that analyze the price chart for the formation of the Three Indians pattern and carry out constructions of at least the first three waves.

There are several practical points to be made about the Three Indians Forex strategy:

- You should not immediately open a deal, believing that the price will surely bounce off the trend line exactly at the calculated point of the third touch. The graphic pattern works as a signal confirmation, but not as an entry signal.

- Most often, at the calculated point, the price still touches, but this does not mean that a serious pullback is guaranteed. This can be a usual small correction, so if there is the slightest suspicion about this, you need to move StopLoss, at least to the breakeven level.

- You need to be especially careful when using limit orders for this strategy. The base line is sloping, the third touch point is practically unknown and the limit order will have to be constantly adjusted. It is better to open a deal manually, already upon the third touch, then you can calmly control the situation.

In practice, it is still worth confirming the entry point with standard trend indicators, for example, Parabolic ; from oscillators, it is recommended to use the Awesome Oscillator .