Confirm the volatility and currency strength

Currency Volatility Chart is a tool used to confirm the volatility of each currency pair over a certain period of time.

You can confirm the volatility of the currency pair’s rise rate for 15 minutes, 1 hour, 1 day (24 hours), and one week, the highest and lowest prices during the period.

By using the Currency Volatility Chart, you can grasp the strengths and weaknesses of major currencies, check the market conditions, and help you choose currencies.

Try OANDA’s Currency Volatility Chart

Check the strengths and weaknesses of the main 7 currencies

Through this tool, you can select any currency pair for display.

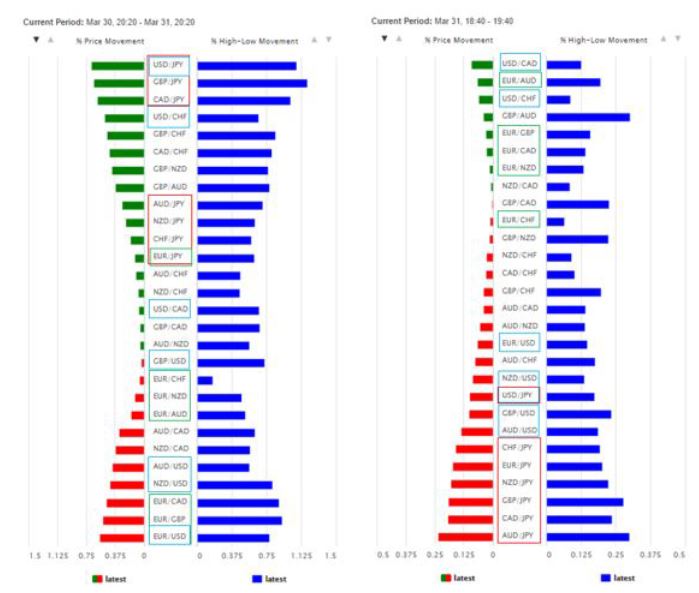

Here, we have selected 28 currency pairs between 7 currencies (USD, EUR, JPY, GBP, AUD, CAD, CHF, NZD) with a large trading volume, showing 24-hour fluctuations and 1-hour fluctuations.

If you look at the 24-hour chart, you can confirm that the dollar and yen crosses are rising. This shows that in these 24 hours, except for the weakening of the main seven currencies, the EUR, which has been weakened against the main currencies other than the Japanese yen, is in the process of weakening.

It can also be confirmed that on the contrary, USD is moving strongly against major currencies.

This situation is that within 24 hours, among the three currencies of USD, JPY, and EUR, the US dollar is in a strong position, while the Japanese yen and the euro are in a weak position.

On the other hand, if you look at short-term 1-hour fluctuations, you can confirm that in addition to the strength of the yen against all currencies, the euro is rebounding against currencies other than the yen, Swiss franc, and US dollar.

Although the strengthened U.S. dollar is weak against the yen during the 24-hour period, it is still moving strongly against other currencies.

If you sum up this part of the content, you can confirm that the yen is in a state of a short-term rebound in the context of continued dollar appreciation.

In addition, since the structure of “Japanese Yen, Euro VS U.S. Dollar” can be seen, it is easier to choose U.S. Dollars, Japanese Yen, and Euros.

Considering that the rebound of the yen is a short-term market, traders who consider the continued appreciation of the dollar can look for points on the chart to buy dollars. On the contrary, traders who consider that yen buying will increase in the future can look for points where the market really changes.

By grasping the volatility of major currency pairs, you can find out the strong and weak currencies in this situation, and then through the comparison of short-term, medium- and long-term volatility, if you grasp the long-term volatility and short-term volatility, it is easy to formulate a plan.

Go to OANDA’s Official Website

Please click "Introduction of OANDA", if you want to know the details and the company information of OANDA.