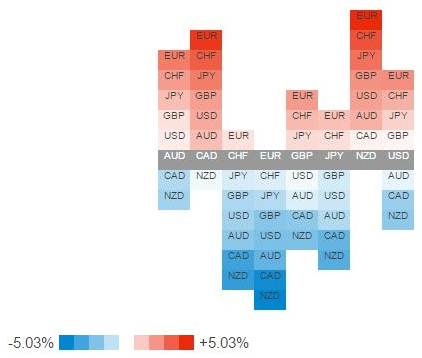

OANDA’s Currency Strength heatmap table is a tool that can check currency strength every day.

How to use OANDA’s Currency Strength heatmap table?

It is not a tool to find the entry point and settlement point of a trade. It is used when confirming the market situation and selecting the currency pair for trading.

Since the heat map is updated every day at 4 pm Eastern time in the United States (4 am Beijing time), as long as you check it every morning, you can notice the changes in currency strength every day.

If you often think about why the currency has a strong trend and why the currency will have a weak trend, we think you will gradually feel the market.

If you pay attention to the strength of market risk tolerance, the strength of resource prices, the unique trading news of each country, and the financial policies of each country, you can know the reasons.

If there is a currency of interest, check the chart of the currency pair related to that currency, and look for the possibility of a trend at the technical level.

The sequence is to first look at the currency pair formed by the currency that is obviously strong or weak through the Currency Strength heatmap. If you find the initial change that can grasp the trend, then pay attention to the currency pair and find the entry point.

If you can find a currency pair that also forms an easy-to-understand shape at the technical level, perhaps victory is in sight.

How to open OANDA’s Forex and CFD trading account?

Main Characteristics of each currency

- US Dollar

- Strongly influenced by US financial policies.

- Euro

- With the recent ECB easing, if the market’s risk aversion increases, there is a tendency to buy.

- Yen

- In the case of strong risk aversion, there is a tendency to buy. On the contrary, in the case of increased risk tolerance in the market, there is a tendency to sell.

- Pound Sterling

- There will be fluctuations similar to those of the U.S. dollar as well as those of the currency of the resource country. It is one of the more difficult currencies to predict. Since there will be continued strong progress, or a continuing trend of strong progress, you need to pay attention when there are obvious strengths and weaknesses.

- The Australian dollar

- In addition to being affected by resource prices, it is also a relatively high-interest currency in developed countries, and is a currency that has a greater correlation with the stock market. Therefore, when risk aversion is increased, there is a tendency to sell. On the contrary, when the risk tolerance of the market increases, there is a tendency to buy.

- Swiss franc

- A currency with a greater correlation with the euro. In addition, like the yen, it is a currency that is relatively easy to buy when risk aversion is intensified.

- Canadian Dollar

- Strongly affected by crude oil prices. If resource prices go down weakly, there will be a weaker movement.

- New Zealand Dollar

- Although it is a currency that is strongly affected by the price of food ingredients, when the overall price of resources falls, the currency of the resource country tends to fall collectively.

Open an account with OANDA today

Please click "Introduction of OANDA", if you want to know the details and the company information of OANDA.