Initially, the proposed indicator was developed for analyzing price extremes, but in the process of modifications and improvements it has turned into a full-fledged trading system based on trend reversals. The indicator calculation combines the assessment of price, trend strength and pivot levels.

Eye indicator parameters and settings

The method for calculating key points is based on the analysis of fractals, and the graphical constructions resemble the famous ZigZag. Not so long ago, the Forex Eye indicator was actively advertised and was successfully sold on a wave of excitement. Today it can be found on the network for free, versions 8.5 and 10 are considered quite stable – we will use them to illustrate the work on the trading signals of the Eye strategy. There are many parameters in the settings, but all unnecessary things can be turned off:

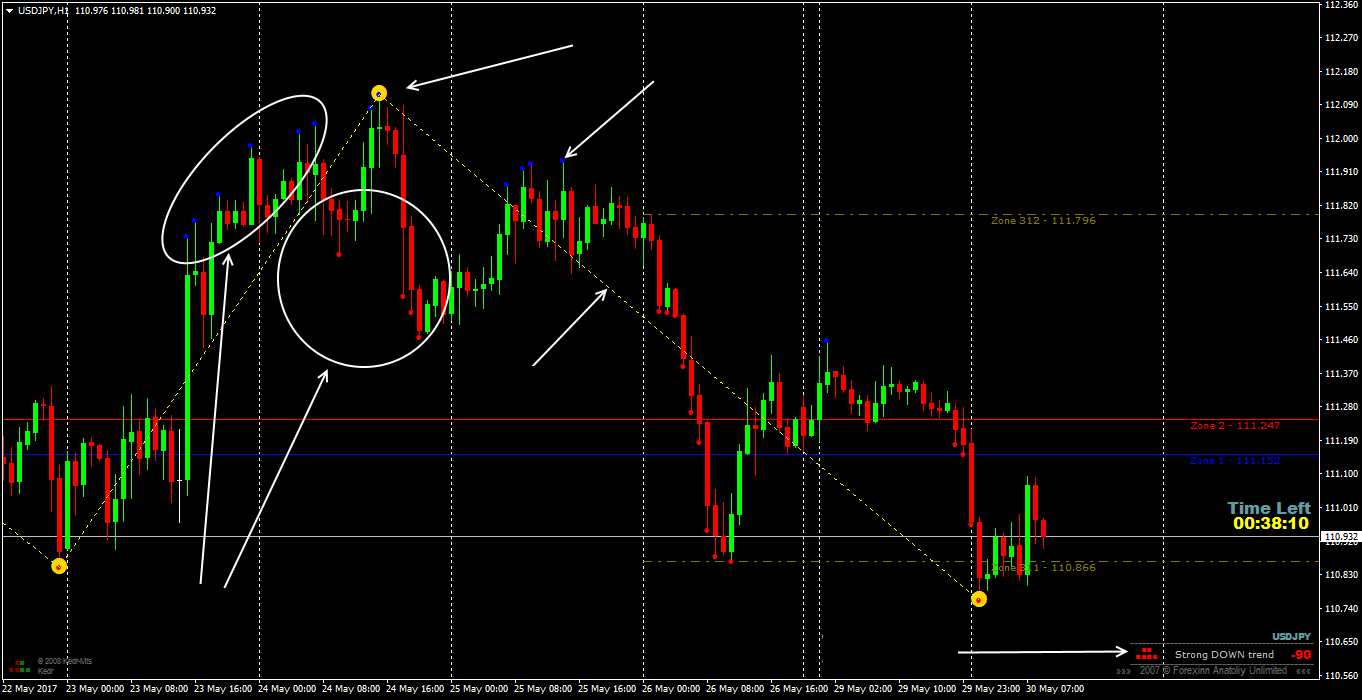

The main markers of the Eye indicator for receiving trading signals:

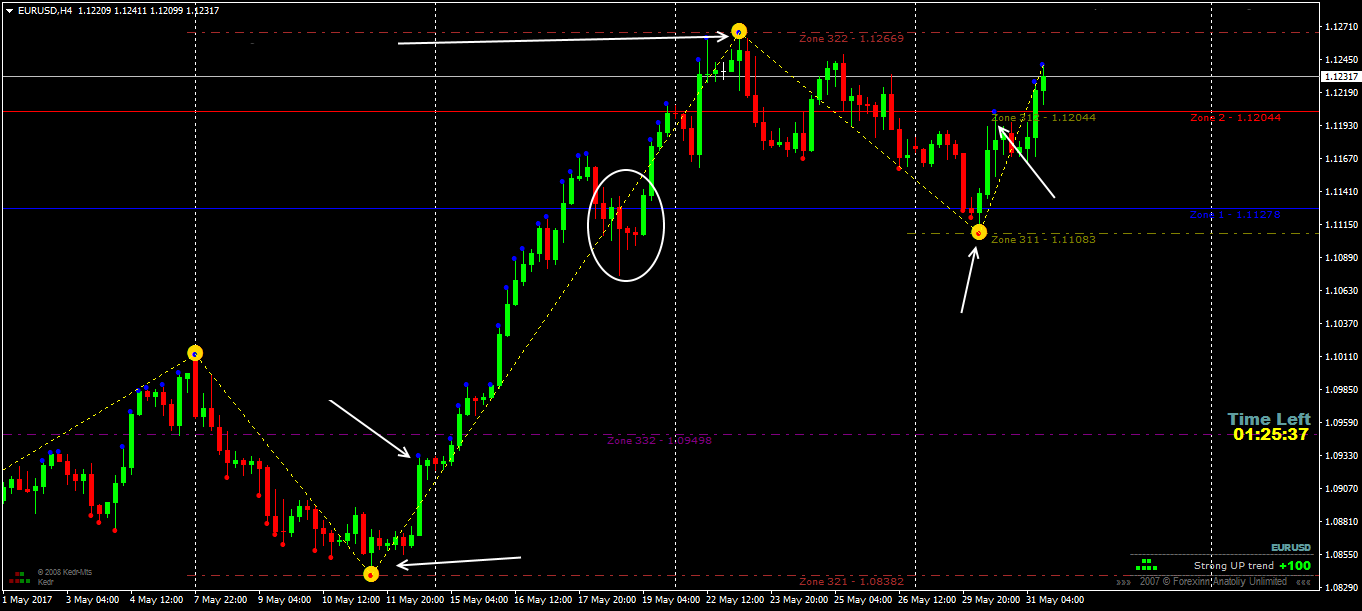

Large points of yellow (by default) color or “Eye”: the moment of trend reversal (at least medium-term), a point inside the red color (“red Eye”) – bearish reversal (we trade only in BUY); “Blue Eye” – bullish trend reversal (trade only in SELL).

Small blue dots (Hi) on top of a closed candle: local max, the first after the red Eye is a confirmation signal to buy, further – an indicator of the continuation of the bullish trend.

Small red dots (Lo point) below the closed candle: local mins, the first after the blue Eye – a confirmation signal to sell, further – it supports the bearish trend.

Trend lines connecting the “Eyes” of different directions.

An approximate view of the working screen of the Forex Eye indicator (according to version 8.5).

The information panel shows:

- Trend assessment: directional (strong, moderate, weak) or flat (horizontal);

- Time until the current candle closes;

- Historical extremes (3 hours, 3 days, 3 weeks, 3 months) with an estimate relative to the current trend.

General view of the Eye indicator version 10 with basic reversal levels:

Forex Eye indicator: description of trading signals

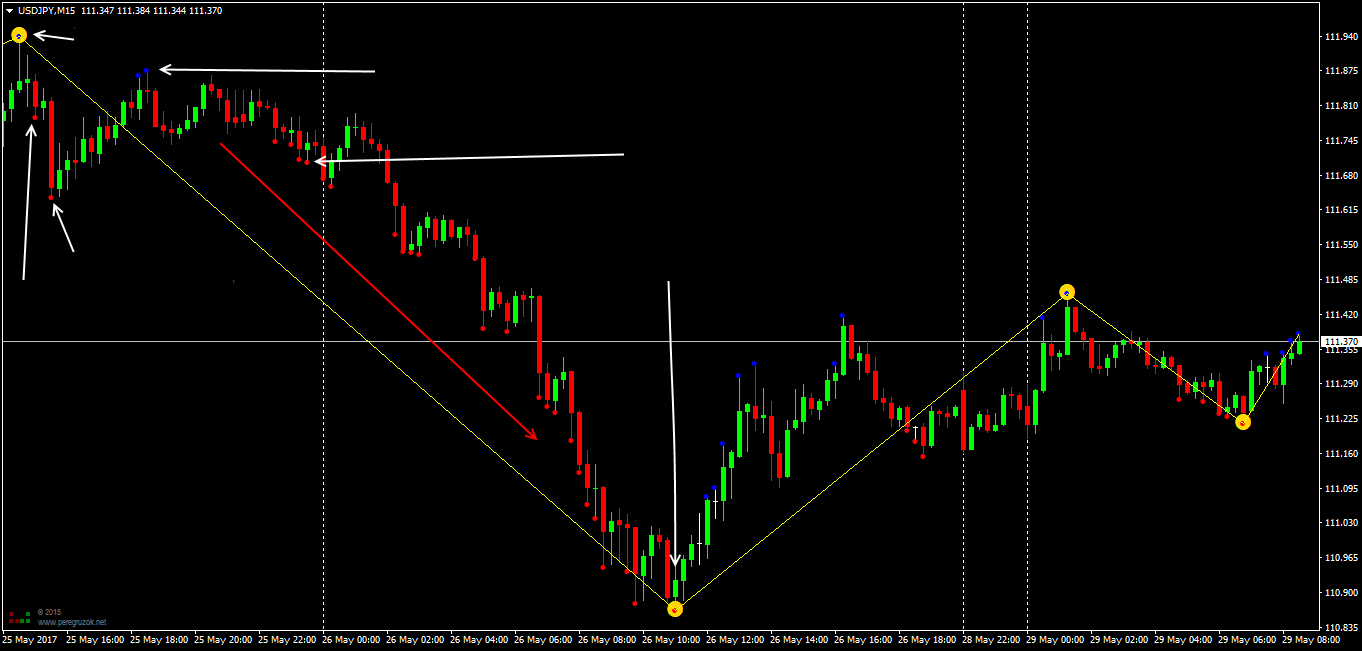

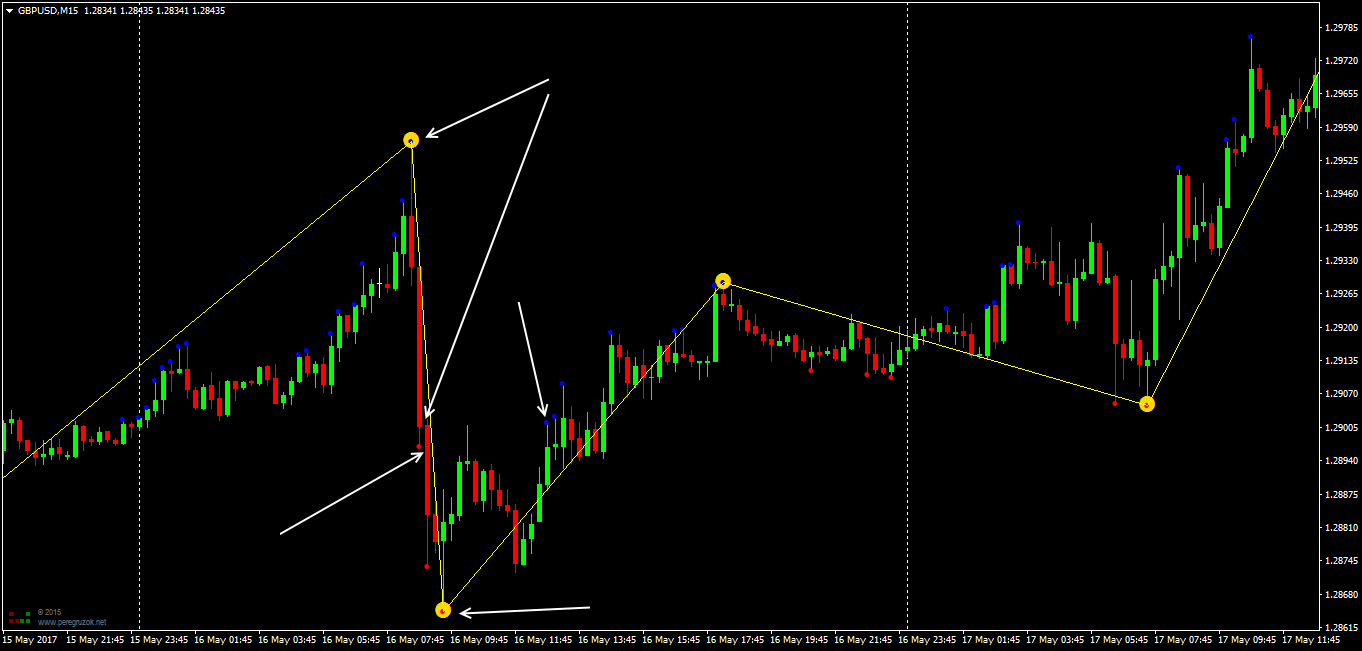

The strategy tries to combine signals of long-term and short-term extremes: the Eye point – shows a global reversal (it is also called a swing), small points of the corresponding color should confirm the trend. The moment of entering the market according to the Eye indicator takes into account three factors:

- The appearance of an Eye of the corresponding color;

- Changing the color of the sequence of Hi-Lo points (after the Eye);

- The general direction and strength of the trend – according to the information panel.

Trading assets: all currency pairs, stable futures in a non-speculative market. To open a position after the appearance of the Eye, at least one local extremum of the corresponding color must appear. The first StopLoss is set behind the Eye level (above / below), then it moves in accordance with the capital control methodology as the trading situation develops.

The Forex Eye indicator version 10 additionally shows strong reversal levels: support – blue, resistance – red. They can be used to set take profits, as well as additionally control trades when the price reaches the control level zone.

Advantages and Disadvantages of the Eye Strategy

Almost the only but very significant drawback of the Forex Eye indicator is redrawing, which, frankly, is not entirely clear, given that the basis of the calculation is a fractal. As a result, the appearance of the Eye point and even the formation of the necessary local extremum after it does not mean a reliable entry point at all. If, after the appearance of conditions for entry, the indicator’s internal calculations show that the next extremum is “more suitable” for the main pivot point, the Eye marker is quietly redrawn, and often in the opposite direction. So it is imperative to monitor an open deal and take profit on a regular basis. None of the indicator versions was able to get rid of the redrawing effect, especially on small timeframes, which is why it is strongly discouraged to use the indicator on periods less than M15.

The use of the Eye indicator during periods of speculative movements may cause an entry too late, because the confirming local extremum appears too late, as a result, you can “get” to an equally fast retracement. Experienced mid-term recruits

may well use the Forex Eye indicator to control the global trend, but at the same time it is enough to successfully trade corrections on a shorter period.

In general, the appearance of a global pivot point always makes it possible to correctly assess the situation and prepare for opening or fixing a deal. The Forex Eye indicator determines basic reversals quite accurately, but to improve its accuracy it is still recommended to use it in conjunction with the Alligator and moving averages – to control the trend, and the popular Awesome Oscillator – to control the entry point. The main benefit of using the Eye indicator in such a trading system is that you will never hang on sideways trends, because all transactions will be opened only on active movement.