What is eToro's Social and Copy Trading Service? How does it work? Table of Contents

- eToro - Social and Copy Trading Platform Provider

- Copy Other Investors' Trades for Free

- eToro's the Popular Investor program

- Stay Updated with the social news channel

- Your eToro Profile to manage activities

- eToro is made for Investors

- Follow eToro on social media

- How do you know if a stock is a good investment?

- Industry Comparison - Why is it essential when investing in stocks?

- Why eToro is great for investors?

- Conclusion

eToro – Social and Copy Trading Platform Provider

eToro delivers on the promise of social trading to the world.

eToro is the world’s leading social trading network.

With the support of millions of users in more than 140 countries, eToro has been able to leverage its knowledge and experience to create practical investment tools.

In addition to being a one-stop shop for stock investing, online investing, cryptocurrency investing, and much more, it has also introduced many innovative features in the field of social trading.

But what makes eToro a social platform? The variety of social features that eToro offers is vast and extends far beyond the investment platform itself.

Aside from being a pioneer in social functions and making the financial market more accessible and friendly to almost anyone in the world, eToro has extended its reach and keeps its social channels active.

Copy Other Investors’ Trades for Free

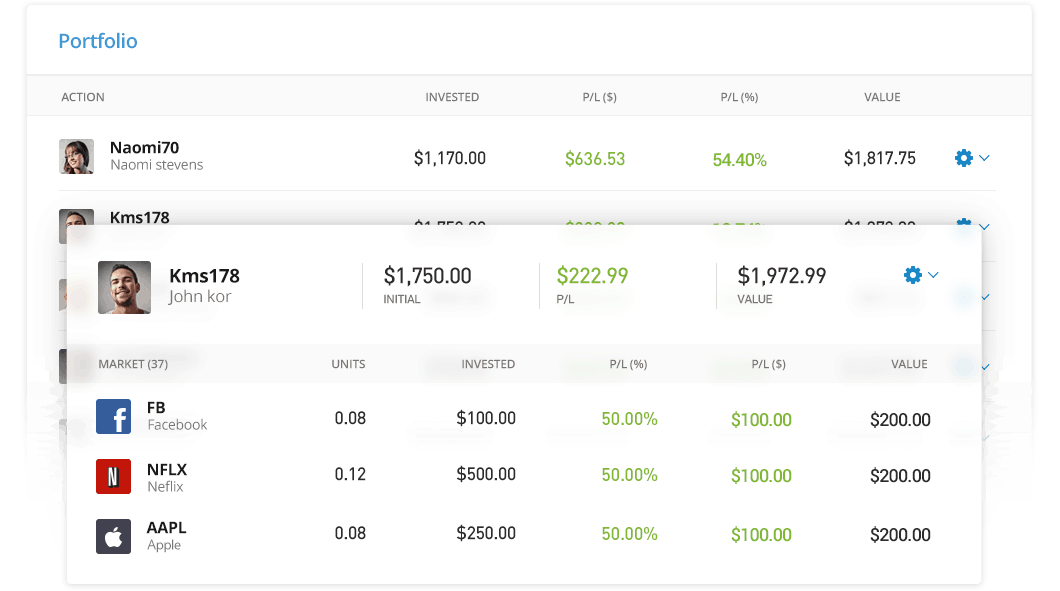

Discovering other investors to copy is fairly intuitive: on the Copy People screen, there are several methods for locating investors whose short-term and long-term investment needs may match yours.

The Editor’s Choice section features Popular Investors (more about this program below) recent investment successes and worth checking out.

In addition, it is quite easy to find investors using the search tool and filtering the results.

There are numerous parameters to choose from, such as profit, risk rating, location, and many others.

As eToro operates with complete transparency, every copied investor has valuable information in their eToro profile that will help them decide the ideal options for creating their portfolio based on people.

eToro’s the Popular Investor program

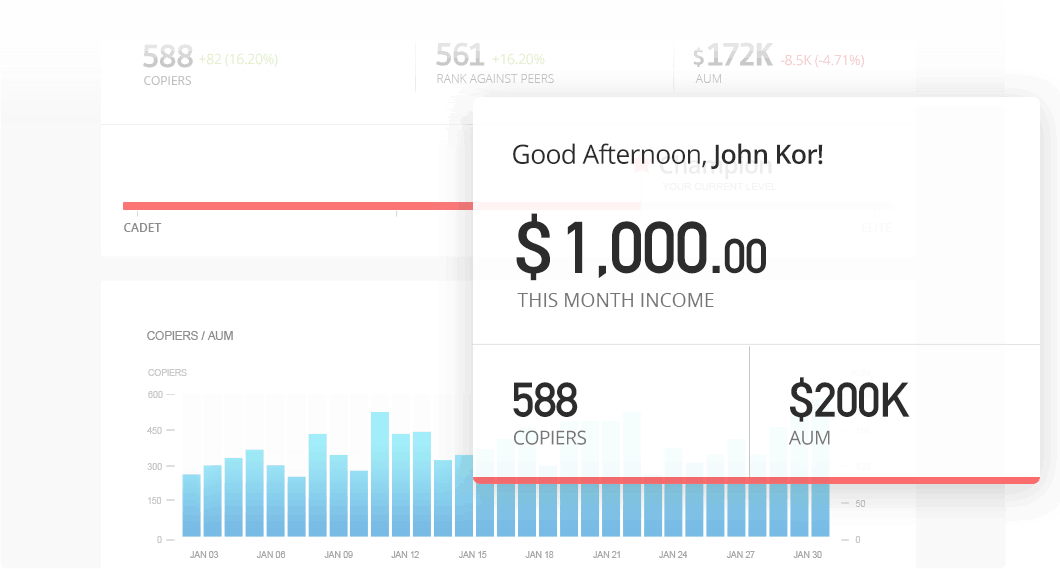

To create a powerful community of short- and long-term investors, and to encourage successful investors to share their wisdom, eToro has created the Popular Investor program.

This program rewards successful members of the eToro community for allowing others to copy their trades.

Simply put, the more copiers they have, the more money they make.

The money that Popular Investors earn from this program is additional to that obtained from their investment operations and can be up to 2% of the total assets they manage.

The democratization of financial literacy has created a situation where anyone who spends time and effort studying the markets and designing an effective short- and long-term investment strategy will have many options for success.

It is, therefore, no surprise that Popular Investors come from various walks of life, and this program has enabled many eToro investors to earn a second income regardless of their financial background.

Join eToro’s Popular Investor program

Stay Updated with the social news channel

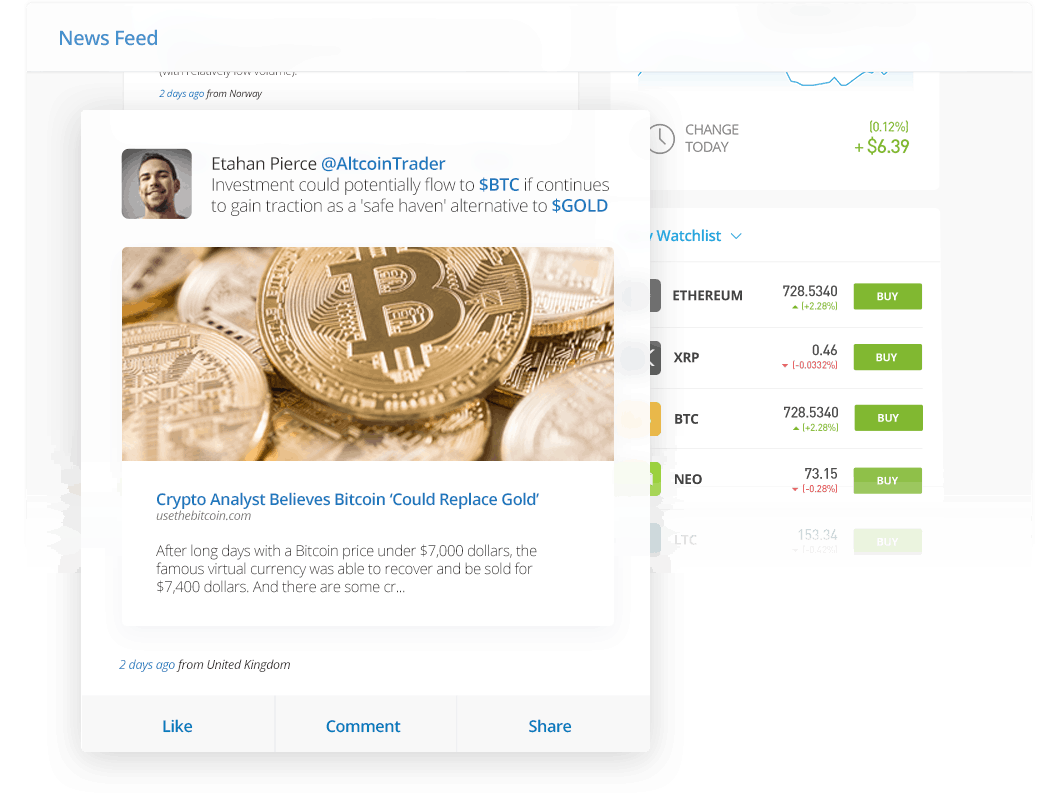

Another unique feature of eToro is its personalized social news channel.

By incorporating elements from the world of social media and online investing, your news feed will help you follow the financial instruments and investors that appeal to you, engage with other members of the eToro community, engage in open discussions, and much more.

Just like on a social network, you can post your articles (and even tag the instruments or people you talk about), share posts on your channel, comment on others’ posts, and gradually create a channel that suits your interests, short and long-term investment.

On the eToro platform, you will also receive notifications when a user you are copying publishes an article, or when an asset on your watch list is showing very volatile, and many other important information.

Notifications will appear both on the web platform and automatically on your mobile device.

Your eToro Profile to manage activities

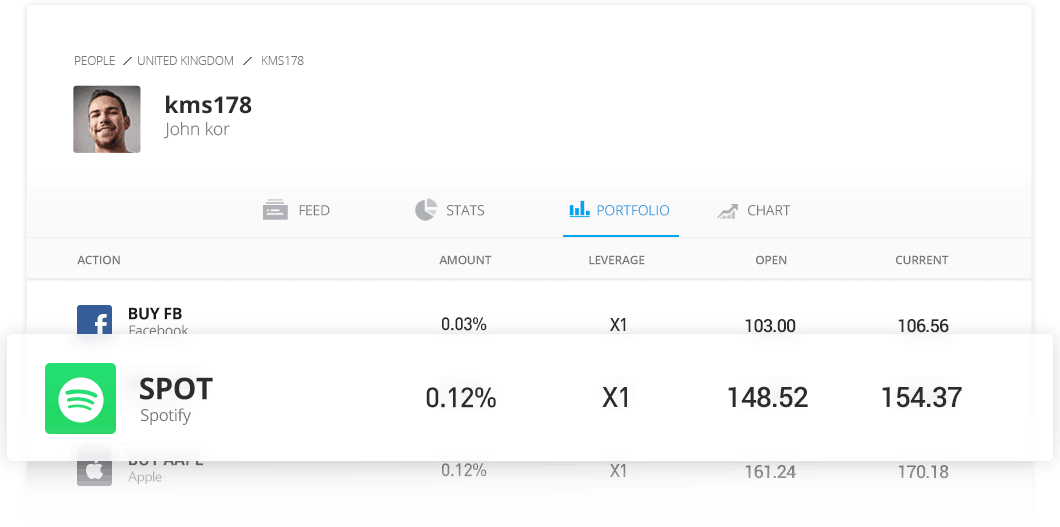

Your profile on eToro is your way of introducing yourself to the eToro community and obtaining valuable statistics on your trading habits.

If you want to have copiers, be sure to verify your account, add a photo for your profile, and write something about yourself.

There are four tabs on your profile:

- Channel:

- Shows all your social activity on the eToro network, including your posts and comments. This tab also shows your bio, so don’t forget to write a few words about yourself and your investment strategy.

- Statistics:

- Presents your earnings and your success / failure ratio since you joined eToro, allows you to follow your risk ranking, shows you the composition of your portfolio and more.

- Portfolio:

- This tab shows the community your portfolio data, allowing other investors to see what you are investing in in the short and long term, which can help them decide whether or not to copy you.

- Graph:

- This tab presents a simulation of what an investment of $ 10,000 would yield over time if it were invested in you.

eToro is aware that some clients prefer to keep their investment activity private.

If you prefer to share less information, toggle the switch in the “Private profile” field in your profile.

To customize the privacy of your profile, go to the profile privacy settings.

eToro is made for Investors

Because eToro places such importance on open speech and sharing wisdom, the platform also offers social features beyond the platform itself.

For example, investors can easily share their investment decisions and actions on other social networks, such as Facebook and Twitter.

Additionally, eToro clients can use the platform’s advanced technical analysis features to create their own charts to support their investment actions and share them on and off the platform.

eToro maintains a close, professional and friendly community, but for this, it asks its clients to comply with the Community Guidelines.

Follow eToro on social media

eToro is active on many social media to keep not only members of the own community informed, but also the general public on social media.

You can find eToro at:

- Get recent eToro news, find out about new products, tune in to live broadcasts, and stay in touch with the eToro community.

- Receive real-time information about the eToro platform and special promotions, follow recent news and join financial conversations on the Twitter-sphere.

- Follow eToro news in a clear, short and graphical format. Follow eToro’s public information and get more information about the platform and its features.

- Youtube

- Explore various content including video tutorials, interviews, informational videos, and much more.

- Telegram

- Receive notifications when the platform is active or inactive, information about new products, and important news and notifications about the eToro platform.

eToro has the utmost consideration for the security and personal information of customers, so eToro will never share your personal information.

To ensure the protection of your information and your funds, eToro uses various cybersecurity measures, encryption techniques, and deposit your funds in top-tier banks, so you can rest assured that your investing experience at eToro will be completely secure.

Are you ready to take your first steps, join the financial-technological revolution and explore the infinite possibilities that social trading offers?

Check out eToro’s latest activities

How do you know if a stock is a good investment?

In the stock market, we all want to get our money right and make a good investment.

Who would want otherwise? But this is not an easy task.

If we want to operate in the stock markets with certain guarantees of success, we have to be guided by specific indicators that provide us with information on the suitability of investing in this or that company.

And it is precisely this important aspect that we are going to talk about today on eToro.

We will review which are the best indicators to maximize our chances of being right when making a stock investment.

How to start the Copy Trade of Stocks (Shares) of eToro?

What is a Stock?

First of all, we will briefly review what a stock is.

Yes, you probably already know what it is, but maybe you will learn something new that has eluded you until today.

Sometimes we understand what a thing consists of, but we don’t know how to define it correctly.

Find out below a precise definition of what a stock is:

A share is an investment that represents an ownership interest in a company that is publicly traded on the stock market.

It may or may not be included in a stock index ( shares of companies that make up the Ibex 35, for example).

Its listing price depends on the sale and purchase operations carried out by the shareholders.

Now that you have a definition clear and delimited, it is a good time to get into the subject and discover all the tools at your fingertips to make a good stock investment. Keep reading!

How to follow the company’s activities?

Financial news, together with the results of a company, are one of the indicators that most help us when it comes to determining whether or not a stock constitutes a good investment.

In order to make use of this very useful tool, it is essential to know how to follow the economic news and the results of a company in which we are thinking of investing.

To do this, you can take a daily look at today’s financial news section on eToro or read the digital or paper business press.

Businesses also often post their detailed results on their web pages, so it’s always a good idea to visit them.

This way you will be able to know all the relevant information to issue an informed value judgment about a specific company.

How to start investing with eToro’s Copy Trading Service?

How to know if a company is in a good condition?

In addition to financial news, fundamental analysis indicators for stocks come to our rescue.

They will be very useful when buying shares, for all types of investment horizons: short-term investment, long-term investment, etc.

These indicators will allow us to evaluate the performance and risk when acquiring a certain share.

Next, we review some of the main financial indicators to evaluate the advisability of investing in one stock or another.

1. Market capitalization

This is one of the financial indicators most used by analysts and investors.

It represents the value of a company determined by the total amount of its shares traded on a given stock market.

It is constantly manifested with variations in its value due to the demand in its buying or selling trend while the market where it is listed is operational and open.

It is calculated by multiplying the number of shares that a company has in circulation by the current price of each of these shares.

As a general rule, a company with a large market cap is usually synonymous with a consolidated company.

Thus, for example, the case of Apple stands out, which has already overcome the barrier of the $ 2 trillion of market capitalization.

2. Net Profit

What is an actual return? Net profit gives us the answer.

It is another of the financial indicators most valued by investors when it comes to analyzing whether it is convenient to invest in a specific company.

It is the final money available that a company has left after deducting all expenses and all taxes.

It allows us to know the real health of a company and all this in a single figure in a clear and simple way.

3. GPA or EPS

Earnings per share, earnings per share, earnings per share, GPA, or EPS cannot be missing from your trading toolbox either.

This financial indicator is calculated by dividing the net profit by the number of shares outstanding.

It is one of the most used ratios since it gives us valuable information on how much profit each individual share has based on the total net profit of the company.

In short, the GPA or EPS gives us the answer to the question of how to calculate the performance of a stock.

4. PER

The PER or price earning ratio is a simple valuation tool that allows us to evaluate the price we are paying to acquire the shares of a company based on its profits.

Its calculation is very simple and it is one of the main financial indicators available.

Simply divide the price of a share by the earnings per share of the company (the EPS or EPS we just talked about).

Thus we will obtain the PER.

This indicator allows us to know the number of times the market is willing to pay for the benefits of the company that we are analyzing.

If it is still not clear to you, an example will clear up any possible doubts: a PER 10 indicates that the market is willing to pay € 10 for every € 1 of the company’s profit (that is, 10 times its profits).

Therefore, the PER reveals a very important piece of information, since we will know how much investors are willing to pay for each euro of profit generated by the company we are analyzing.

5. D / FFPP

If we want to know the state of health of a company, the debt-equity ratio (abbreviated as D / FFPP) comes to our rescue.

It will provide us with invaluable information: the level of debt of a given company based on the funds it has.

Logically, the smaller the level of debt that this ratio gives us, the better level of financial health the company in which we are considering investing will have.

6. Dividend

The dividend yield is the percentage that tells us the proportion between the dividends paid by a company to its investors and the price of the shares of said company.

To calculate this financial indicator we must divide the dividends distributed by a company during the course of a year by the price of the current share price and multiply them by 100 to obtain a percentage figure.

The dividend yield is a financial indicator especially valued among lovers of passive income since it allows making a selection of shares based on the annual payment of dividends.

How to open eToro’s Copy Trading account?

Industry Comparison – Why is it essential when investing in stocks?

When we consider what stocks to buy, it is essential to make a sector comparison before jumping into the water.

Not all business sectors behave the same, nor do they all offer us the same risks or potential benefits.

Some sectors are more suitable for aggressive investors, such as the biotechnology or electric vehicle sector.

Others, on the other hand, are better adapted to conservative or defensive profiles, such as the food or public utilities sector.

It is up to you to weigh how much risk you want to take and what profit you hope to get.

Why eToro is great for investors?

Much has happened since back in 2006 eToro was founded, one of the first 100% digital brokers in the world.

And since then, the company founded by Yoni Assia has not stopped growing and improving to satisfy the new investors of the future: Investigate tab, statistics page, simple interface, multiplatform support, social trading, security, etc.

Below, we briefly review what are the main advantages that eToro offers to take your trading strategy to the next level.

1. Investigate tab

This section accessible to all registered eToro users democratizes access to professional tools that have not always been easy to use.

In the Investigate tab we can find very valuable data on various companies, accompanied by recommendations from expert analysts (purchase, sale, or portfolio maintenance), target prices of shares, a market sentiment with respect to a particular company, etc.

Access to eToro’s Investigate Tab

2. Statistics page

This is one of the main functionalities that eToro offers: its renewed detailed statistics page.

In one place you can access all the relevant financial indicators for your investment portfolio.

Five cards will bring together your performance, your risk, your copiers, your trading and additional information.

3. Easy-to-use interface

Many investors find that the interfaces of most digital brokers leave a lot to be desired.

This is not the case with eToro, which from the beginning decided that the appearance of the interface was essential for a pleasant and uncomplicated trading experience.

The interface designers have decidedly opted for the fewest possible steps to open and close operations, and have adapted all operations to mobile devices so that no difference is noticed whether it operates from the mobile phone or from the computer.

4. Cross-platform support

With eToro, you can forget about any type of device limitation.

You will not need to use any specific software on a computer.

You can operate from where you feel most comfortable: from your computer, mobile or tablet.

In its PC / MAC version, all you have to do is access the eToro website to start trading in the markets.

In its version for mobile devices (Android / iOS), you can download an official application from the application stores that will allow you to do exactly the same as in the web version of the platform.

Versatility and absolute control for investors!

5. Social trading

If the eToro platform stands out for something, it is because of the revolution it has generated with its firm commitment to social trading on its platform.

The choice of stocks is thus made easy when we are not sure where to invest, as eToro will replicate the trading operations made by the best traders enrolled in the eToro social trading program.

To increase our chances of success eToro will also have specific filters that will allow us to copy the trader that best suits our preferences and risk appetite.

Experience the Social Trading with eToro

6. eToro Security

EToro Security is a platform regulated by the FCA, CySEC and ASIC.

Its user verification system, its SSL encryption system, or its technical service available at any time of the day also help the most demanding users and those concerned about the safety of their money to sleep peacefully.

In short, you will not have any problem in this sense when operating in the financial markets.

Conclusion

In conclusion, now you know what a stock is, how to follow the economic news and the results of a company, and what financial indicators can help you when it comes to choosing the best possible stock investment.

You have also discovered the importance of choosing a specific stock sector based on your own investor profile (aggressive, conservative, intermediate, short-term, long-term, etc.).

Finally, you have discovered why eToro is one of the best options to be able to apply all this new knowledge acquired.

What are you waiting to do?

Start Social and Copy Trading with eToro

Please check eToro official website or contact the customer support with regard to the latest information and more accurate details.

eToro official website is here.

Please click "Introduction of eToro", if you want to know the details and the company information of eToro.