What are FXPro's Leverage, Margin and Stop Out? Table of Contents

What is Leverage?

Leverage is a key concept for individual traders. Through it, you can use a smaller amount for transactions.

However, if you don’t know what leverage is and how to use it, you may lose all your margin in a few seconds-even without noticing it.

Therefore, for each leveraged transaction, the brokerage company will provide you with additional funds. Funds will be added to your own account and can be used for global market transactions under general conditions.

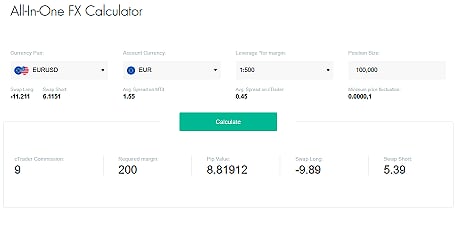

For example, the minimum trading volume for EUR/USD is 1 lot, which is worth 100’000 Euros. Your leverage ratio is 1:500 (the company will add 500 euros for every 1 euro). You only need 200 euros to create a position (the rest will be replenished by the company).

- ‘Lot’ usually refers to the trading volume (unit calculation).

- 1 lot in foreign exchange = 100,000 base currency units & minimum trading lot size is 0.01 lot (micro lot).

- Leverage enhances your purchasing power and allows you to trade more than your deposit amount.

- Double-edged sword-the higher the leverage, the greater the risk taken, so use leverage with caution.

Now you need to understand how to practice.

Find out more about FXPro’s Leverage

Example of Leveraged Forex Trading

Let us look at two possible scenarios.

Scenario A: Initial investment of 1000 Euros, leverage ratio 1:100 (the company will add 100 Euros for every 1 Euro), you can open a position of 100’000 Euros (for example, sell). If the price drops by 100 basis points, it means that your profit will be 1,000 euros.

Scenario B: The initial investment of 1000 Euros, you decide to open a 100’000 Euro buy position. However, the price did not rise, but suddenly fell by 100 basis points. The result is that your original 1000 Euro margin (that is, the total transaction amount) is almost immediately lost.

It is important to understand that using leverage will not only magnify the potential profit or loss, but also affect the cost of the transaction.

For example, if the spread of a certain product is 0.1%, the current price is $1000.

If a client deposits $1000 and does not use leverage, the spread will be $1, which is 0.1% of the deposit amount. If the client uses a leverage of 1:10, the spread will become $10 or 1% of the deposit amount.

The same applies to overnight interest charges, handling fees and other transaction costs.

The above is just a simple example to illustrate how leverage affects your investment funds, you need to focus on understanding.

Start Leveraged Trading with FXPro

What is Margin?

Margin is the deposit required in leveraged trading. These funds are “frozen” on your account before the end of the transaction to secure the position.

The exact amount of margin depends on the size of the position and the leverage you choose.

You can use this formula to calculate:

Unit transaction size / leverage ratio = base currency margin

Unit transaction size / leverage X exchange rate = quote currency margin

Now let us see how much amount you need for the leverage you choose:

- High leverage → less funds as margin

- Low leverage → more funds as margin

Therefore, if you want to buy a standard lot (100’000 Euro) of EUR/USD without using any leverage (1:1), you need to have 100’000 Euro in your account. However, when the leverage ratio is 1:100, you only need 1,000 Euros as the required margin. If it is 1:200, you only need 500 euros, and when the leverage is 1:400, you only need 250 euros.

Find out more about FXPro’s Margin

Fixed Margin Requirement for some symbols

Depending on different asset classes, some products have fixed maximum leverage.

To calculate the required margin for other products, you can use the following formula:

Trading volume / leverage X market price = margin (base currency)

Let’s look at an example, how to calculate the margin required for one lot of gold, using 1:20 leverage, dollar-denominated (1 lot of gold = 100 ounces, the current price is $1511.73)

100oz / 20 X 1511.73 = $7,558.65

For more details, please check FxPro “Leverage Information” or specific product information page.

Go to FXPro’s Official Website

Free Margin, Equity, Margin Level and Stop Out

Free margin refers to the unused amount in a trading account that can be used to create new transactions.

Available Margin = Account Balance – Used Margin

Equity is the balance in your trading account, plus (or minus) the profit (or loss) of any positions you hold.

The margin level is the ratio of your margin amount to the used margin.

When the margin level drops to 100%, it means that the entire balance of your trading account is used as collateral and no other positions can be created.

Forced liquidation (Stop Out) is the mandatory automatic closing of all positions of the trader in case his trading account balance falls below a certain level (which can be set manually by the trader).

- Margin – funds required for each transaction.

- Available Margin – the available funds when opening a new order.

- Net worth – the total balance of your account, including unrealized profits or losses.

- Margin ratio – displayed as %, which is the ratio of net value to used margin.

- Liquidation – when the margin ratio reaches a certain level, the position is closed (or partially closed) to prevent further losses.

What are “Lot” and “Unit”?

Lots usually refer to the trading volume (unit calculation). One standard hand of foreign exchange is 100,000 base currency units. Therefore, for EUR/USD, 1 hand is 100,000 Euros, and for USD/JPY 1 hand is 100,000 US dollars.

Thanks to online brokers, they also provide traders with small and micro-lots.

The following table will help you understand the lot position

Standard lot size (1.0) = 100,000 base currency units

Small lot size (0.1) = 10,000 base currency units

Micro lot size (0.01) = 1,000 base currency units

For other asset classes, the ‘lot size’ is a standard value. For example, one lot of gold is 100 ounces. For more details about the standard lot of each asset, please check the FxPro official website.

The lot size also determines the value of each point/tick, which will be introduced in another chapter.

In FxPro, all account types support micro lot sizes of 0.01 and higher.

Go to FXPro’s Official Website

Please check FXPro official website or contact the customer support with regard to the latest information and more accurate details.

FXPro official website is here.

Please click "Introduction of FXPro", if you want to know the details and the company information of FXPro.