The MACD indicator, one of the common indicators. But in the foreign exchange market, I believe that MACD is not very suitable for short-term trading. Speaking of it, MACD still sees more in the stock market, and the display interfaces of stock software and foreign exchange trading software MACD are different, so will the usage change?

MACD is the abbreviation of Moving Average Convergence and Divergence. The Chinese name is “Smoothing Convergence and Divergence”. It uses fast (short-term) and slow (long-term) moving averages and the signs of aggregation and separation, combined with double smoothing operations. Regardless of the MACD with the word “average line” in its name, the calculation formula also starts from the average line, but from the display interface, it is not like an average line at all. However, we can understand the MACD through the moving average, such as the use of golden fork and dead fork, stability, and so on. It should be noted that MACD does not inherit the function of moving averages to identify trends. The author uses this indicator to observe the comparison of long and short sentiments.

How to trade Forex with Moving Average indicator?

First, briefly describe the basic rules of MACD, that is, use the distance between the fast line and the slow line to study the timing and signal of buying and selling. Therefore, MACD itself will send out long and short entry signals, but the specific user needs to be based on the actual situation.

1. MACD Parameter

The default MACD parameters of most platforms are (12, 26, 9), and DIF (also known as a fast line), DEA (also known as a slow line), and bar values are calculated through three numerical values.

DIF=EMA(12)-EMA(26);

DEA is the 9-day EMA value of DIF, which also becomes the MACD value;

bar value=(DIF-DEA)×2

Therefore, under traditional circumstances, MACD is based on two lines and one bar Show, but did you find that the foreign exchange platform only displays one line and one bar? That is because the calculation of the “bar value” mentioned above is omitted, so it is also called a single-line MACD. But don’t worry, the method of use has not changed much and normal use will not be affected. There is no need to modify this parameter, just use it directly (the author does not have a better parameter recommendation).

How to use MACD Indicator?

The use of MACD requires information: whether the MACD column and the slow line are above the 0 line or below the 0 line, the direction of the edge of the column, and the situation where the edge of the column forms a golden fork.

1. The 0-line problem

The 0-line is the long-short dividing line. Above the 0-line, it indicates that the mood on the disk is too high; below the 0-line, it indicates that the mood is relatively bearish.

Note that if you are too long and short, you must pay attention to timeliness, which means that the MACD value needs to be above the 0 line for a period of time to be considered as a too much prompt, and vice versa. Climbing to the 0 line in a “flash” style is not a signal of bulls.

Regarding above or below the 0 line, we are considering the question of who dominates the long-short sentiment, but quantitative changes can trigger qualitative changes. For a long time, the MACD value will stay above the 0 line for a long time. We must consider the trend to belong. , And the author believes that the key point that MACD cannot indicate a trend is that we cannot get an accurate signal that MACD confirms a trend.

Please remember: MACD stays above the 0 line, and the main consideration is to go long; MACD below the 0 line, the main consideration is to go short.

2. MACD column lengthening or shortening

The domestic A stock market is very particular about trading volume, so MACD will be understood in conjunction with trading volume, and the length of the column will be used to measure the low volume level. In the foreign exchange market, because the trading volume is too large, it is difficult to have indicators that can well reflect the trading volume level. At this time, it may not be appropriate to say that the MACD column reflects the trading volume. However, the author believes that the length of the MACD cylinder can still be used to perceive the contrast of long and short forces. Above the 0 line, the longer the cylinder is, the stronger the long power is compared to the short power, and the shorter the cylinder, the smaller the gap between long and short power. The opposite is true.

Therefore, if the MACD cylinder remains near the 0 line and has not been able to extend, it often reflects the situation that the direction is unknown and the disk is consolidating.

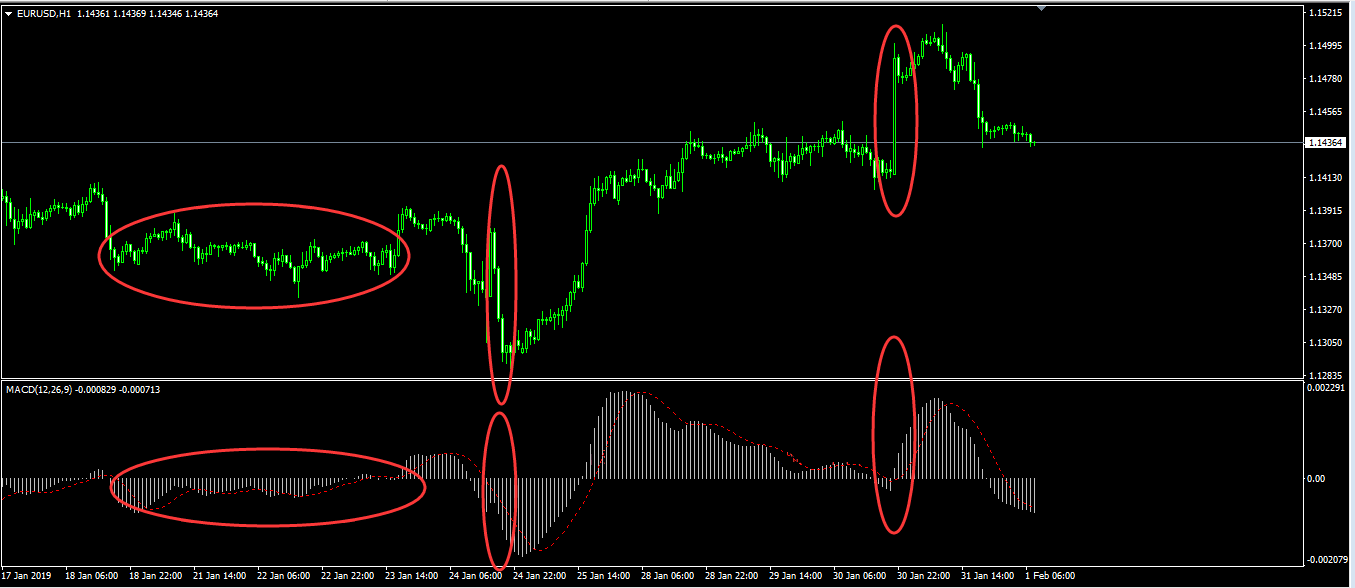

Then, combined with the K-line diagram, see Figure 2 below. Take the situation above the 0 line as an example. As the MACD cylinder gradually stretches, the exchange rate tends to go up, and when the MACD cylinder gradually shrinks, the exchange rate tends to go down. Based on this, we can observe: The direction of the MACD column edge line can point to the short-term direction of the exchange rate. However, what we need to pay attention to is mainly when the MACD column edge changes along the line, that is, when the column no longer stretches but starts to shrink or remains unchanged, because at this time, the disk may start to retreat or consolidate. It’s time to get ready for short-term swing trading.

So, are you going to play after you have turned it, or are there other more specific instructions? Let’s take a look at “Golden Cha” and “Die Cha”.

3. Golden Chas & Die Chas

Regarding “Golden Chas” and “Die Chas”, the author believes that everyone should be familiar with them. It is very simple: the MACD cylinder crosses the slow line above the golden cross, which is a long signal; the MACD cylinder crosses the slow line below the dead cross, which is a short signal.

The author hereby reminds us that not all the “golden forks” and “dead forks” are worth using.

Above the 0 line, the golden cross near the 0 line, with the MACD cylinder began to stretch, as a signal to enter the market. Below the 0 line, close to the dead cross of the 0 line, the MACD cylinder begins to stretch, as a short entry signal.

As for the dead cross above the 0 line and far away from the 0 line and the golden cross below the 0 line away from the 0 line, it is often accompanied by a correction of the disk. It is not recommended to enter the market.

4. In the use of MACD, the most striking thing is the deviation.

The divergence of MACD means that the overall direction of the MACD cylinder edge line is inconsistent with the movement direction of the K line within a period of time. The main reason is that the K line rises while the MACD cylinder edge gradually goes down. This is seen as a signal that the disk trend is about to reverse, and it is a good time to buy tops or bottoms.

However, MACD is not suggesting a departure from the trend reversal of time, approximately two do not prompt reversal of position, then the terms for the “chase sell” the foreign exchange market, It is a tasteless function.

The author here wants to say that whether the deviation function that others value can be used, it must be combined with the actual situation.

In summary, the MACD is not difficult from the point of view of the method of use. However, for the use of foreign exchange platforms, short-term trading is still limited in applicability. The author recommends that you use an oscillator to see if the comparison of long and short power will be easier to use, and from this perspective From a point of view, both long-term and short-term are applicable.