You should buy or sell?

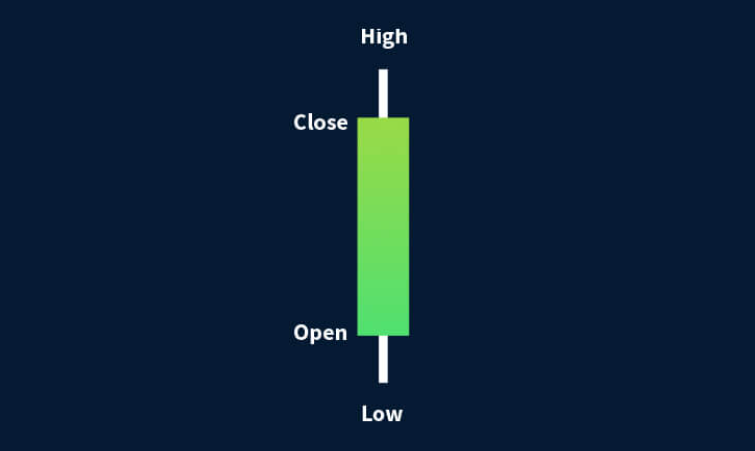

Traders who make buying and selling decisions based on indicators face several dilemmas when choosing the “best” price to apply to the indicator calculation. Since most traders these days use Japanese candles for chart analysis, the 4 prices – open, high, low, and close – are clear candidates. Of course, this price is just the minimum you can choose from on a candle chart. Choosing a “price” can be difficult, especially for beginners, as there are many other possible combinations.

Closing price

It is a well-known fact that many traders, both novice and expert traders, find closing prices most useful. This idea is primarily held by stock market traders, who believe that all the information they need to make a buying decision is contained in the closing price for the day. The closing price includes the two-sentiment (economic indicators, monetary policy, political situation, public sentiment) of the day and reflects what is expected to occur until the next opening time.

Even Charles Dow, considered the “creator” of technical analysis, considered the closing price to be the most important price of the day. But how should Forex traders view the closing price? Unlike the stock market, which opens in the morning and closes in the afternoon, instead of being open 24 hours a day, the Forex market is open 24 hours a day on weekdays. There is no set opening or closing time, and the market is open all the time!

Instead of opening and closing times, the foreign exchange market offers different time cycles. Each candle represents price movement over a period of time: 1 minute, 5 minutes, 15 minutes, 30 minutes, 1 hour, 4 hours, 1 day, 1 week, 1 month, etc. Forex traders can also treat the closing price at which the candle ends in a similar way to stock market traders.

Other price options

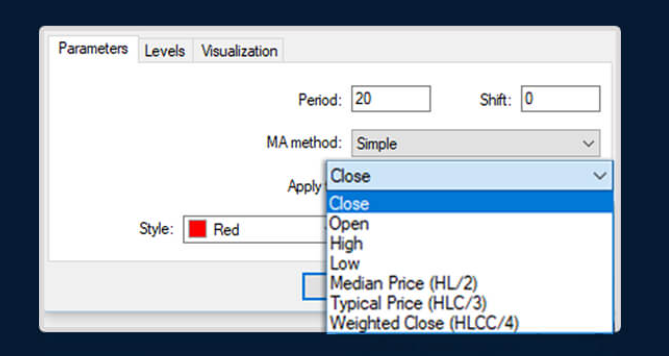

So, no matter which market you trade in, the question still remains as to which price is “best” to use. For this reason, the trading platform offers several choices.

- Market price

- High price

- Low price

- Closing price

- Middle price

- Regular price

- Weighted closing price

I can argue that this is a subjective choice, but I think there are better prices than others.

One way to choose the “best” price is to follow market convention. For example, in the stock market, the majority of traders pay attention to the daily closing price, so it is often reasonable to use the closing price in the calculation of the indicator.

Market price

On the other hand, the opening price represents a trader’s reaction to events that have occurred since the last closing price. The Market Profile method uses market prices to provide a description of market reaction.

Middle price

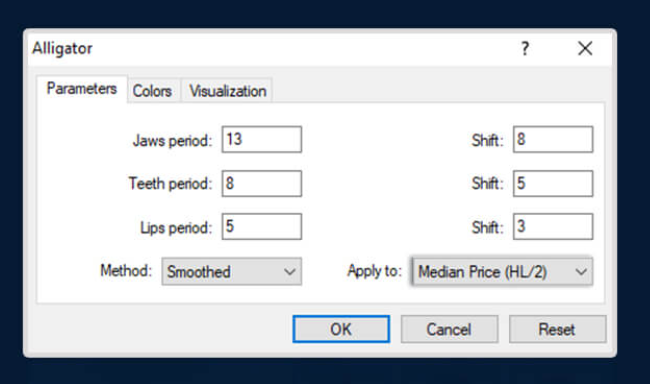

A trader can also choose the midpoint (high + low) / 2 of the candle instead of one price, which is called the mid price. Alligator metrics use weights to calculate lips, teeth, and jaws.

Regular price

Another way to describe extreme prices (high and low) and close during trading hours is to use regular prices. The formula for regular price is (high + low + close) / 3 .

Weighted closing price

The closing price is what many traders consider to be the most important price, so it is not surprising that many traders choose a weighted closing price when making a buying or selling decision. In this case, the formula is (High + Low + Close + Close) / 4 . You can quickly see that there is more weight on the closing price compared to the other prices. In addition, support and resistance lines are drawn including candle highs or lows. Similarly, the price check of the candle pattern follows the high and low.

Therefore, there is no single “best” price to apply for calculating indicators or creating lines or objects when making buying or selling decisions. The choice can actually be subjective. Otherwise, you can base your decisions on market practice or math. The choice is yours!