Learn how to spot a bearish candle (black) pattern and the best conditions to trade in price movements. Get tips on using indicators.

Trading with rising candles

A bullish candle is one of two types of candles that can be used to strategically buy stocks or other financial instruments at the right time in the market. In an in-depth look at technical analysis methods using bullish candles, this article covers the basics of how to trade using these patterns and provides additional resources to help you make profitable buying and selling decisions.

A bullish candle is an important and fundamental part of any stock chart. If you have more questions about bullish candles, please refer to our previous article before going any further. But to reiterate what was covered earlier, a bullish candle is formed when a trader (buyer) tries to raise the price. As a result, the candle closing the market more likely. On charts, rising candles are usually displayed in green or white.

The stock market is a battle between traders (buyers) who open long positions to raise the price and traders (sellers) who sell assets to lower the price. To survive in a dynamic market, you need to know which side is dominant at the time of the trade so you can make smart buying and selling decisions. You don’t want to short sell stocks that are going up, and knowing the difference can have significant consequences for your portfolio.

Simply put, a bullish candle makes buyers aware. The more buyers, the higher the asset transaction price. A bullish candlestick pattern is present on all charts. Therefore, it is very important to know how to interpret a rising candle.

An uptrend pattern tells you when a stock is in an uptrend. In technical analysis, a bullish candle is the first line of defense.

Traders identify trend reversals with bullish candlestick patterns and are an important part of their technical analysis strategy. Trading with these patterns is often used as part of a FX strategy, as it provides an immediate indication of market direction, which is very important in volatile markets.

A bullish candlestick is only part of a technical analysis strategy. Typically used in conjunction with volume indicators such as RSI to show trend strength.

A bullish candlestick pattern tells you that you are going to enter an uptrend after a downtrend. This reversal pattern is the time to open a long position as a signal that the buyer is dominating the market and may move further up.

How to interpret a rising chart pattern

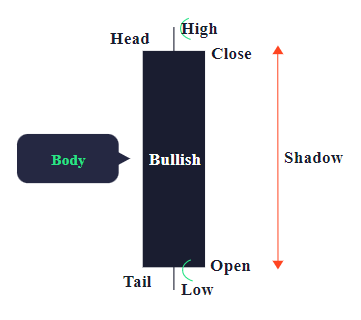

Each daily rising candle represents price data for the day and consists of the opening, closing, high and low prices for that day. The color of the body of the candle indicates whether the open or close is high. The same applies to each chart cycle. Traders can use all candlestick charts, from 1-minute to monthly candles.

A bullish candlestick pattern can further confirm buying pressure through other technical analysis instruments such as trendlines, momentum, oscillators, and volume indicators. While there are many bullish candles that signal buying opportunities, there are several uptrend price patterns that provide stronger reversal signals.

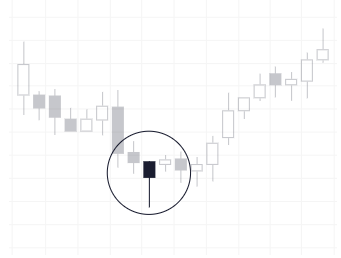

Rising Hammer

The rising hammer is one of the most popular patterns. It is observed during a trend bottom or downtrend. The meaning of the name is that it is a candle that hits the floor and rises. A rising hammer is a single candle pattern with a long lower tail and a short body located at the top of the single candle.

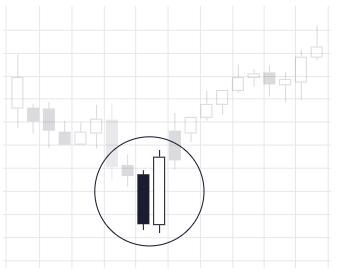

Ascending hold

An uptrend is a two-candle pattern. One of the candles is a long candlestick that wraps around the shorter black candle in front. This pattern is usually observed in a downtrend. The beekeeper does not have to cover the tail of the bee stinger, but instead it should completely cover the monsoon. This is an important floor transition signal.

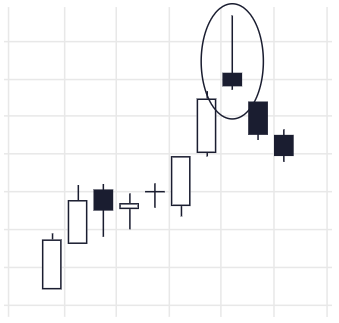

Ascending Inverted Hammer

The ascending inverted hammer consists of a negative bar followed by an inverted hammer. An important characteristic is that the upper tail is long and the body is short. This pattern is similar in shape to the falling shooting star. However, the reverse hammer is usually observed in a downtrend and signifies an uptrend.

Rising star

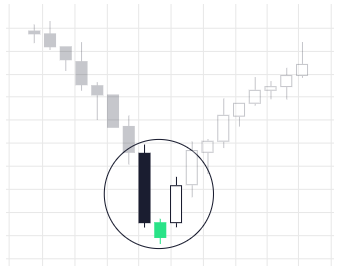

A rising star is a pattern of three candles. This is the main floor reversal signal. In this pattern, a negative candle is followed by a short candle with a downward gap forming a star. The closing price of the 3rd candle does not leave the body of the first white candle, which is an important bottom transition pattern.

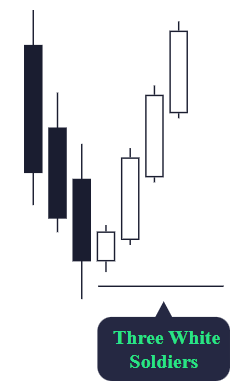

Rising Red Triangle Type

The bullish red triple is a pattern that signals a strong reversal. Consists of 3 normal or long beekeeping. The opening price of each daily is slightly lower than the closing price of the previous day, and the closing price is progressively higher. A stair-like shape formed in this way will signal a trend reversal. If you see this pattern, you need to be vigilant. A long beekeeping can also attract short selling, which in some cases causes the share price to fall further.

One of the five most popular bullish candlestick patterns to signal a buy. It helps to spot changes in market sentiment where the buying trend is outweighing the selling pressure. This downtrend reversal could yield long-term returns.

However, an uptrend by itself does not guarantee a trend reversal. You should wait until a subsequent price movement confirms a reversal of the trend before you start trading.

The bullish candlestick pattern you use to buy or sell stocks can be a secondary analysis that supports the fundamental analysis on which you make your buying or selling decisions. Check out Tifia’s online seminar to learn more about buying and selling with bullish candles .

Frequently Asked Questions About Rising Candles

- What is a bullish takeover pattern?

- A reversal pattern of two candles, with the second candle completely enclosing the body of the first candle. The length of the lower tail does not matter.

- When does a bullish candlestick pattern form?

- A bullish reversal pattern should form during a downtrend. Otherwise, it is a simple persistent pattern.

- Does the bullish reversal pattern require a bullish confirmation?

- Yes. The uptrend should be followed by a long bullish or a gap rise accompanied by an increase in volume. Typically, these confirmation candles should be observed within 3 days of pattern formation.

- How to trade a bullish candle?

- Traders usually take a long position when it breaks above the high of an uptrend.

Please click "Introduction of Tifia", if you want to know the details and the company information of Tifia.