ECN brokers transmit their clients’ limit orders to the market.

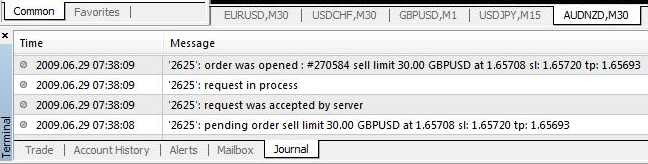

This can lead to situations like the one shown in figure 14.

Once the limit order is placed, the client must provide the required level of margin for this position.

If at the moment when the required price is reached, there are not enough free funds on the account, then the missing margin will be automatically added to the client’s account (Credit In) and the order will be executed.

Immediately after the order is executed, the loan amount will be automatically debited from the account according to the credit out procedure.

If after the execution of the order and writing off the credit (credit out) the margin level is below 50%, the order will be immediately closed in accordance with the Stop Out procedure.

Therefore, I would like to remind clients about the need to monitor the free funds on their trading accounts in order to avoid the above-mentioned situation.

If, after the execution of the order and writing off the credit (credit out), the margin level is higher than 50%, the order will remain open until the SL or TP level is reached, or the client will not close the position manually.

Free Margin = Equity – Collateral for open positions – Collateral required for an activated pending order

at the moment of activation (do not confuse the moment of order activation and the moment of execution), the order was greater than or equal to zero.

If the Free Margin is less than zero, the Pending Order is deleted with the corresponding entry “canceled by dealer” in the “Account History” tab.

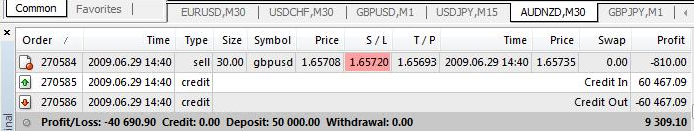

Below are examples of situations when the price of limit orders reached the required level, but there was not enough margin on the account at the time of execution.

A limit order to sell GBP / USD ( Sell Limit ) with a volume of 30 lots was opened at 07:38:09 server time (see the logs above).

At the time the Sell Limit order was executed, the account did not have enough free funds to open a position, so the account was automatically replenished by $ 60,467.09 (Credit In).

Immediately after the order was executed, the credit amount ($ 60,467.09) was automatically debited from the account ( Credit Out ).

The above is also true for pending Stop Orders – if at the time of activation there was enough Free Margin on the trading account, but not at the time of execution (for example, due to a significant change in the price of the instrument during this period), then the Credit In / Credit Out procedure will be applied.

This situation is also possible if the open price of such an order falls into the Price Gap.

Contact FXOpen’s Support Team for more

Please check FXOpen official website or contact the customer support with regard to the latest information and more accurate details.

FXOpen official website is here.

Please click "Introduction of FXOpen", if you want to know the details and the company information of FXOpen.