How to open positions and pending orders on XTB xStation platform? Table of Contents

In this article, you will learn:

- The types of pending orders available on the xStation 5.

- How to enter a pending order.

- How to trade directly from the chart.

- The quotes and why it is one of the most important features of the xStation 5.

- How to enter a trade with xStation 5

- How to enter a trade from the chart

The types of pending orders available on the xStation 5

When trading in the financial markets, there are essentially two ways to open a trade.

- Instant execution:

- your trade opens immediately at the available price

- Pending order:

- your trade is opened when the market reaches a level previously specified by you

Over time you will probably realize that you use both types of transactions in your trading. But how exactly do these pending orders work? and why are they necessary?

It is important to always be up to date with the news of the markets and the most significant movements, but good planning is even more so. When you have your own point of view on a particular market, but don’t have time to constantly monitor prices by hand, pending orders are the perfect solution.

Unlike instant execution orders where the operation is entered at the market price at that moment, with pending orders you can establish orders that are opened once the price reaches a relevant level that you have previously chosen. There are four types of pending orders available in the xStation 5, but we can group them into two large groups: orders that expect to break a certain market level, and orders that expect to recover from a certain market level.

How to open XTB’s xStation account?

1. Buy Stop

The Buy Stop order allows you to place a buy order above the current market price. This means that if the current market price is € 20 and your Buy Stop price is € 22, a long or long position will be opened when the market reaches that price.

2. Sell Stop

The Sell Stop order allows you to place a sell order below the current market price. So if the current market price is € 20 and your Sell Stop price is € 18, a sell or “short” position will be opened when the market reaches that price.

3. Buy Limit

Unlike a Buy Stop, the Buy Limit order allows you to place a buy order below the current market price. This means that if the current market price is € 20 and your Buy Limit price is € 18, then that will open a buy order when the market reaches the € 18 price level.

4. Sell Limit

Finally, the Sell Limit order allows you to place a sell order above the current market price. So if the current market price is € 20 and the established price of the Sell Limit order is € 22, then once the market reaches the price level of € 22, a sell position will be opened in this market.

5. Open pending orders

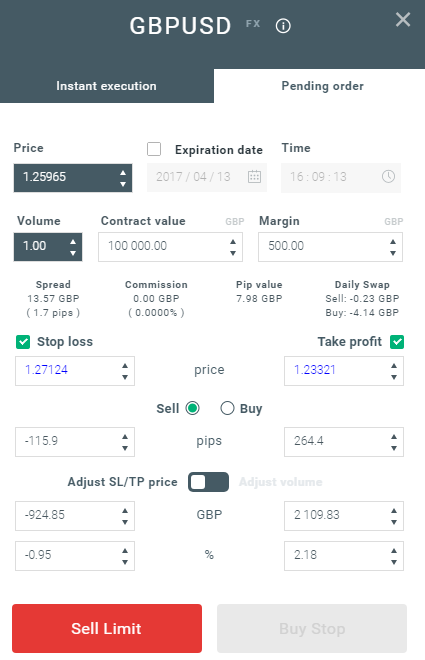

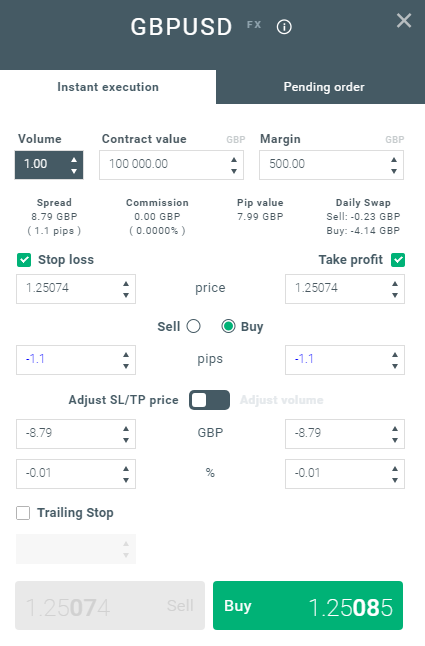

You can open an order window from the Quotes window by first selecting the market in which you would like to trade, and then double-click the “Order Window” button on the name of the market. Once this is done, an order window will open and you can select the “Pending Orders” tab.

Then select the market level where the pending order will be triggered. You should choose the position size based on volume, contract value, or margin. If necessary, you can also set an expiration date. Once these parameters are set, select the green or red button depending on whether you want to go long or short.

chartSetting up pending orders directly from the chart

Pending orders can also be entered directly from the chart you are currently analyzing.

You can do this by pressing the button that you will find in the upper left corner of the graph, as you can see in the image below.

Once this is done, move the mouse cursor across the chart to be able to select the level at which the pending order will open. Once the price level has been chosen, you can also select Stop Loss or Take Profit orders above or below your level.

After setting the levels, an order window will appear with all the chosen parameters. Now you just have to choose the size of the position and enter the order by selecting the red or green button depending on the type of order you are entering.

As you can see, pending orders are one of the most powerful features of the xStation 5. They are very useful when you cannot constantly monitor the market for entry points, or if the price of an instrument changes quickly and you do not want to miss the opportunity.

How to place orders on XTB’s xStation web platform?

The price quotes of the xStation 5

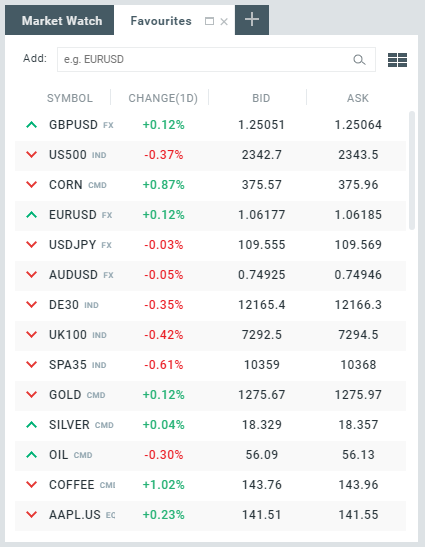

Quotes are basically your window to the world of investments from around the world. You can choose from Forex, Commodities, Indices, Stock CFDs, and ETFs. You have everything available in just one or two clicks.

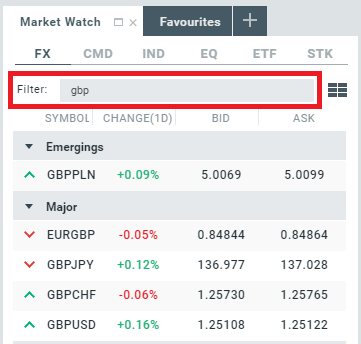

If you cannot find the instrument you are looking for, you just have to use the Filtering form.

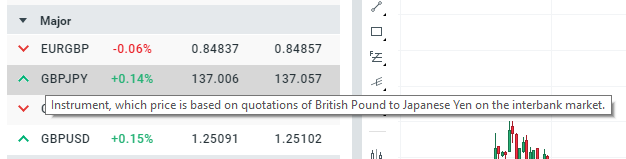

As you can see, all the available instruments have their own symbol, if you are not sure what each symbol means, hover over it and you will get more information.

For more details, click on the “i” icon of the instrument. The instrument information window will appear.

How to place an order on XTB xStation

There are several ways to enter a trade. You can do it through the quote window by double-clicking on the desired market and an order window will appear.

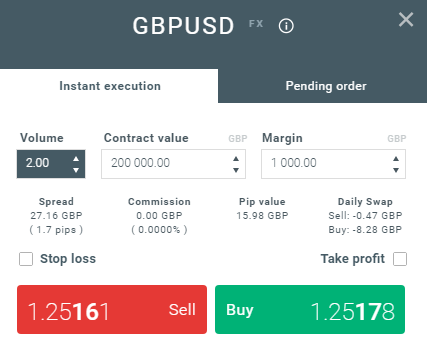

In the order window select the size of the position and if you want to apply Stop Loss or Take Profit orders.

The order window also has a built-in calculator that informs you of how entering an order will affect you, that is:

- The spread pips and the monetary value

- Commissions

- The pip value

- Daily swap points

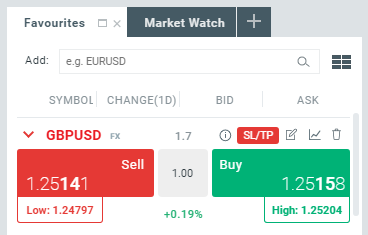

Let’s say you want to open a 1 lot GBP / USD trade. Select the volume of your trade using the built-in calculator.

Once you have selected the volume, you have to decide where you want your operation. If you want to “sell” or go short, you must click the red button. If you want to “buy” or go long, you must click the green button.

If you expect the market to fall, click on sell. If you think the market is going to go up, click on buy. Once this is done, your operation will already be entered. This option is known as trading through the order window.

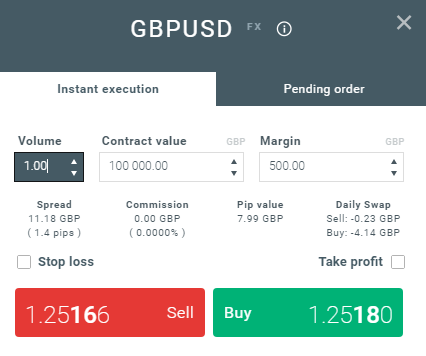

There is another alternative to speed up the way to enter operations in a single click, directly through the quote window. Once you find your market in the window itself and you have preselected the correct lot size, you just have to click on buy or sell and the operation will be entered automatically.

You may first see a confirmation window, in which you can select the option “do not show again” for future occasions. This allows you to enter orders quickly, in a single click.

How to place orders directly on charts

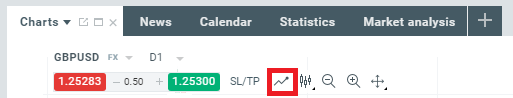

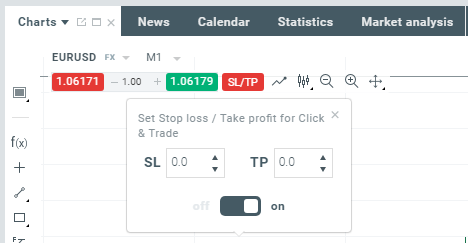

Another way to enter operations is through the buy and sell buttons that are inside the chart itself.

Once you have analyzed a certain market and want to enter a trade, you can do so from the upper left corner of the chart – where the buy and sell buttons are available, along with the option to modify the volume.

You can also set Stop Loss or Take Profit levels from the trading button from the chart. To do this, click on the “SL / TP” button next to the buy and sell buttons, and select your target levels.

As you can see, entering a trade in our advanced trading platform is simple, intuitive and fast. xStation 5 offers you various ways to enter orders to give you various options to suit your trading style.

Please click "Introduction of XTB", if you want to know the details and the company information of XTB.