The last time we introduced the Bollinger Channel that the Bollinger Channel did not perform well in prompting entry, and it was more suitable for prompting volatility. But as a trend indicator, there is still a way to find long and short direction signals and find entry points on the Bollinger Channel, that is, using the Double Bollinger Channel.

The single Bollinger channel in the default state reacts sensitively to the board but is not good at promoting trends and timing of entry. At this point, we can make up for it through the double Bollinger channel. However, it should be noted that under the Double Bollinger Band, our focus is no longer on disk volatility.

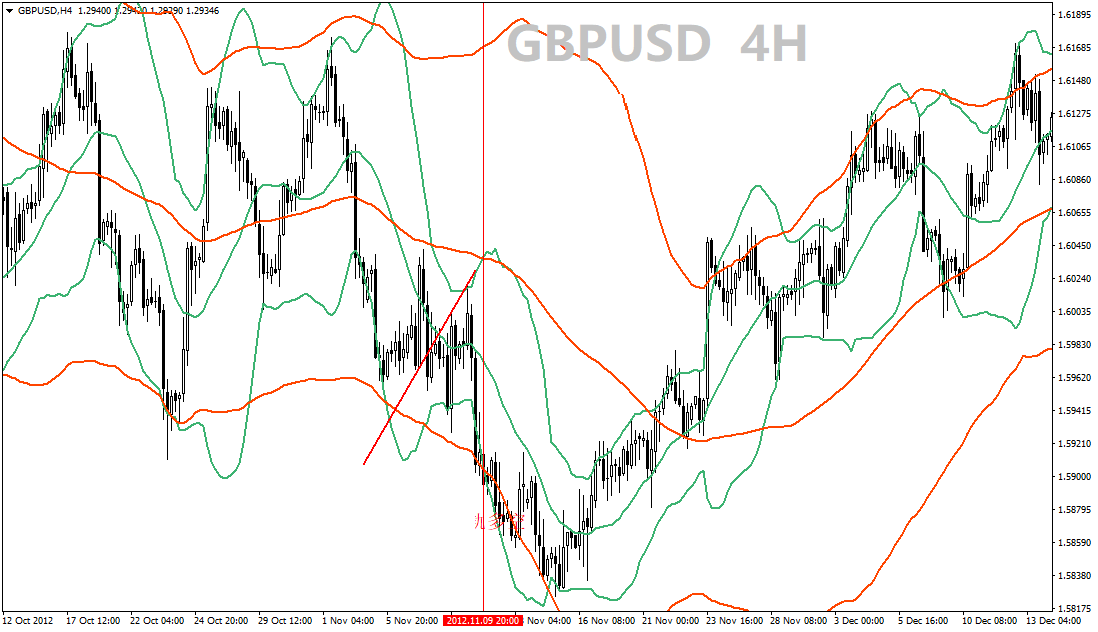

Regarding the parameter setting, the author takes (20,2) and (80,2) as the standard.

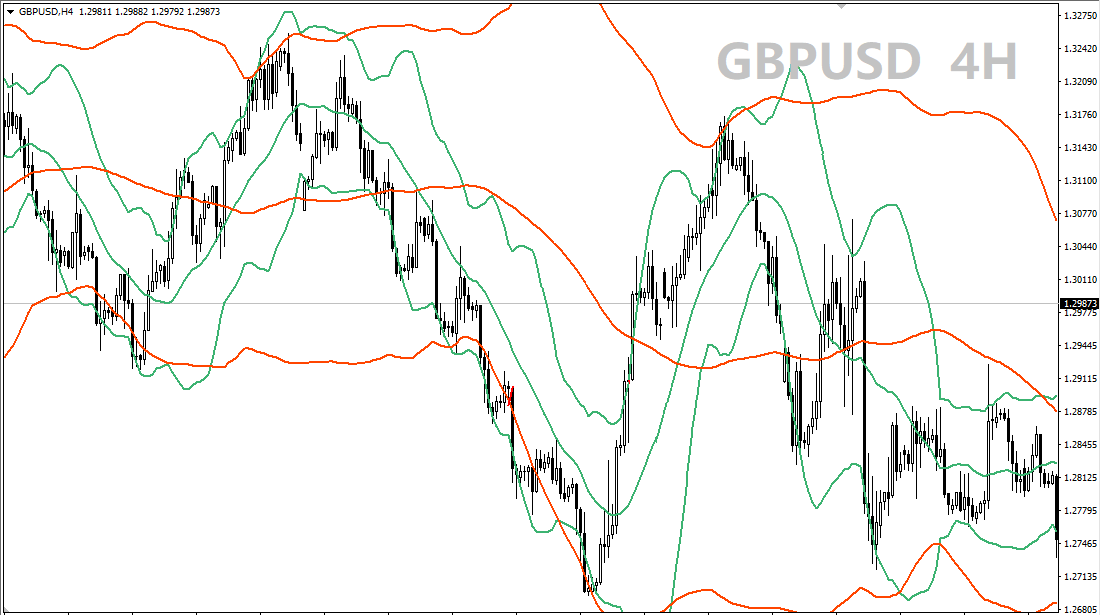

Figure 1 As of April 23, 2019 ONADA MT4 can be seen from the parameters, double Bollinger bands remain under a state of default, suggesting that volatility is still there, in front also said the This will not be the focus of the Double Bollinger Channel. The middle rails of the 2 Bollinger channels are 2 moving averages: MA (20) and MA (80). Undoubtedly, MA (80) can indicate a certain trend direction, and the remainder of the double Bollinger channel for the trend direction comes from this.

In other words, if MA(80) moves up, it is mainly to go long, and if MA(80) moves down, it is to be short. The MA(80) level points, it is recommended to do less or not to do. But if this is the case, why use the double Bollinger channel? Isn’t it enough to add another MA (80) to the single Bollinger channel? No, the other two upper and lower channels are still functional.

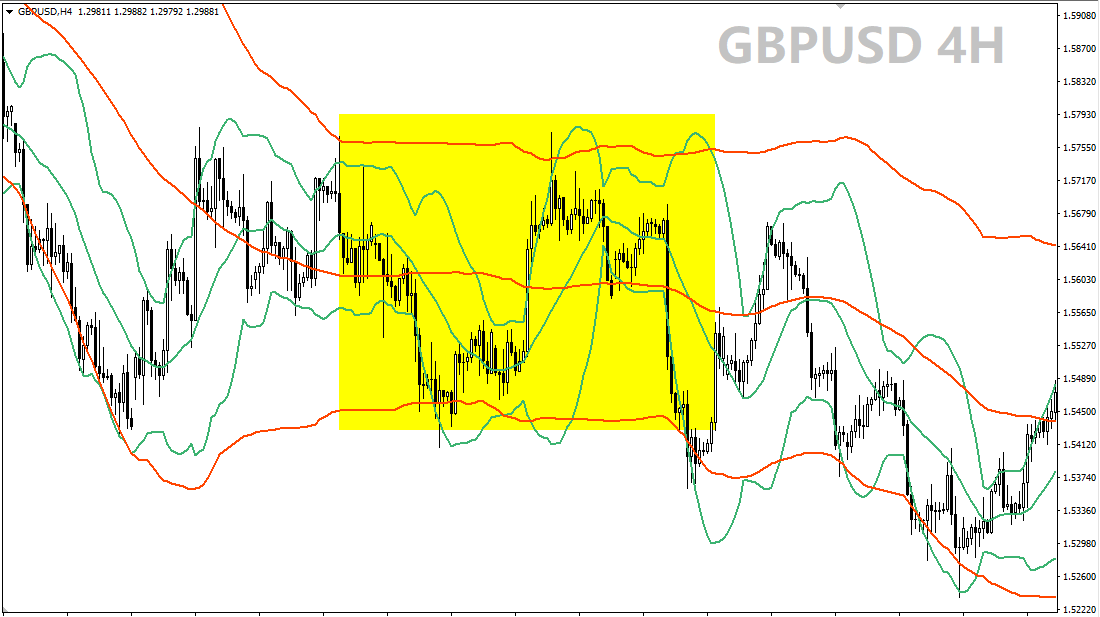

Let’s start simple. When MA(80) points horizontally, the corresponding Bollinger Channel (hereinafter referred to as the Great Bollinger Channel) is often also oriented horizontally. At this time, the upper and lower rails of the Bollinger Band become resistance and support levels. Radical friends can look for short opportunities near the upper rail and long opportunities near the lower rail. The profit space considers the distance between the upper and lower rails. However, if the Bollinger Channel (hereinafter referred to as the Little Bollinger Channel) corresponding to (20,2) is also pointing horizontally at this time, it is not recommended to operate, so the timing plate often oscillates within a narrow range and the range is limited.

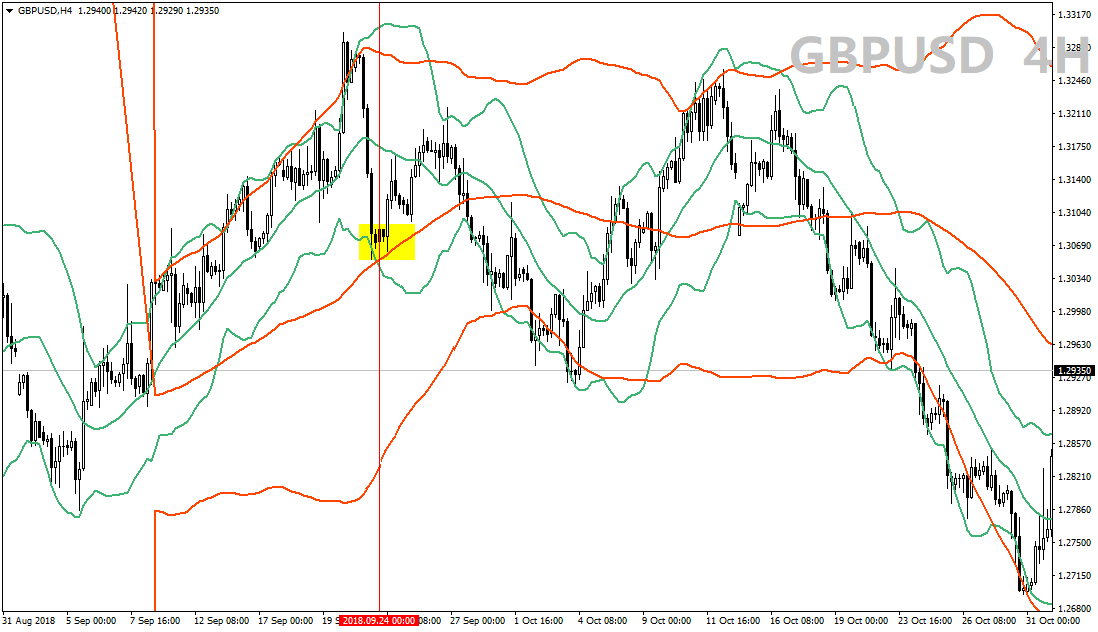

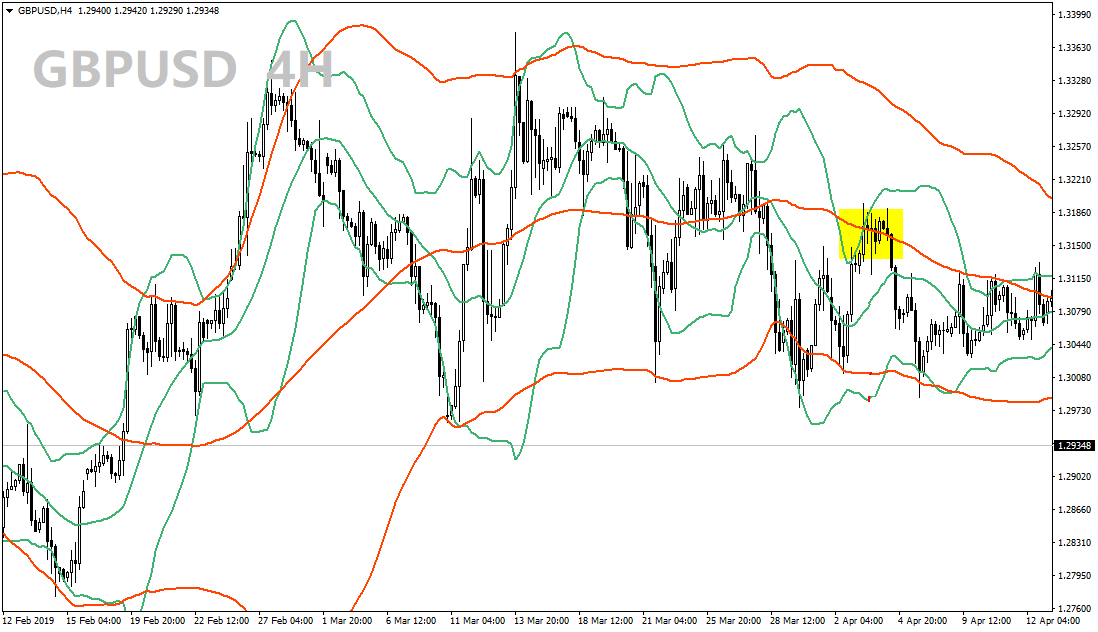

When MA(80) is up and down, long and short are easy to set in one direction, but the specific entry point is slightly complicated, let me take it slowly. When MA (80) is up, look for long opportunities. If MA (20) is also up, when waiting for the lower rail of the Xiao Boling Channel to cross the middle rail of the Big Boling Channel, you can enter the market with the Yang line. If MA (20) goes down, before the two middle rails intersect, wait on the middle rail of the Great Bollinger Pass. If the K line does not break the middle rail, then prepare to enter more.

MA (80) down, look for short opportunities. If MA (20) goes down, wait for the upper track of the Little Bollinger Channel to cross the middle track of the Big Bollinger Channel, and enter the long-short order with the Yin line. If MA (20) is upward, before the two middle rails intersect, wait on the middle rail of the Great Bollinger Channel. If the K line does not break the middle rail, it is ready to enter the air.

So the admission is settled, what about going out? Such as the following 3.

- If the K-line passes through the Bollinger Channel, the K-line passes back to the Bollinger Channel.

- If the K line passes through the Great Bollinger Channel and is in the Small Bollinger Channel, the direction of the upper and lower rails of the Small Bollinger Channel shall prevail.

- If the K-line passes through the Koblin channel, the K-line passes back to the Koblin channel.

From the above entry methods, we can see that the entry position is not fixed and needs to be used in conjunction with the K-line. Compared with other methods, the advantage of the double Bollinger channel may not be obvious, and it is suitable for short-term trading. But if you like to use the Bollinger channel, you can think about it more.

Finally, in the process of using, because there are already 6 lines in the double Bollinger Band, it is not recommended to add indicators, which makes the board more complicated.