Is OctaFX really a STP and ECN broker? Table of Contents

- What are ECN and STP Forex Trading?

- OctaFX has No Re-Quotes

- News Time and Scalping are welcome on OctaFX

- How to define a bad Forex broker?

- Why you shouldn't trade with Market Makers?

- OctaFX supports traders' successes

- Why doesn't OctaFX have Re-Quotes?

- Why my orders are not executed at the market price?

- Fixed Spread or Floating Spread. Which is better?

- What is Slippage and Why does it happen on OctaFX?

- Why Stop Loss Orders are not guaranteed on OctaFX?

- Currency pairs and Exchange Rates

- Type of transactions and how they work

- Leverage, trading volume, required margin.

- Balance, equity, available margin, and margin level

- How to start trading Forex and CFDs with OctaFX?

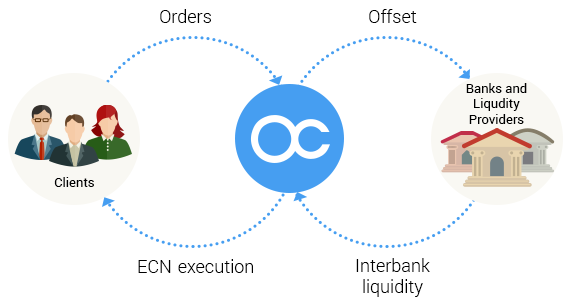

What are ECN and STP Forex Trading?

This is the business model of a broker (generally showing the difference between a broker and a “market maker”), and the client’s order is sent directly to one or more liquidity providers’ execution ends.

There may be an unlimited number of liquidity providers (ie, banks, quotation matchmakers, other financial institutions).

Brokers with more liquidity providers can provide customers with better transaction execution (more liquidity, less slippage).

What kind of a real STP broker—it does not absorb orders, but sends orders to liquidity providers, acting as an intermediary between the customer and the real market.

- ECN (Electronic Communication Network)

- STP (Straight Through Processing)

Open OctaFX’s ECN and STP account

OctaFX has No Re-Quotes

Any broker that re-quotes your order is definitely a platform with traders.

The broker, as the counterparty of the transaction (whether artificial or automatic), sets a delayed execution during the price change period, so that a requote occurs.

Therefore, he cannot execute your order and sends a message to notify you that the price has changed. This is a re-quote.

You will usually get a new price, which is obviously different from the price you requested (especially when the market is volatile).

In most cases, it is not good for traders and good for brokers.

OctaFX will not have any re-quotes, just because they do not have a trading background, whether artificial or automatic (a piece of software is usually called a virtual broker, automated trading, etc.).

News Time and Scalping are welcome on OctaFX

Unlike most brokers that directly prohibit or indirectly prevent scalping transactions, OctaFX welcomes scalping transactions.

On this point, you must be wondering why.

A trader platform is a counterparty to your transaction. That is, they expect that the market will move in the opposite direction and you will lose.

Scalper traders take advantage of short-term orders, which means that they only stay in the market for a short time, and during this period, the market trend has not changed direction.

Another problem with trader platforms is that scalping transactions generate a large number of transactions or simultaneous order requests (for example, when important news is released), which makes it difficult for the trading back office to process them.

OctaFX transfers all transactions to liquidity providers and only receives commissions from them.

Therefore, our interest is in high trading volume (the higher the trading volume, the more commission OctaFX gets), and this is usually driven by scalping transactions.

Try News Time Trading and Scalping with OctaFX

How to define a bad Forex broker?

There are some rules and regulations generally applicable to market maker platforms:

- Directly or indirectly prohibit scalping, trading news, other strategies;

- Fixed spread;

- The so-called “guaranteed” stop loss order;

- May re-quote.

If you encounter any of these situations, your broker will undoubtedly have a trader platform.

There are trader platforms (or, really called “market makers”) that actually create their own market for you with their own rules (as described above). Needless to say, these rules do not serve you; they are designed by their creators and serve the creators.

NDD (No Dealing Desk) brokers such as OctaFX, as an intermediary between the trader and the real market, accept strictly regulated and transparent commissions.

Find out more about OctaFX – STP and ECN broker

Why you shouldn’t trade with Market Makers?

Generally speaking, they do not trade on the market but conduct internal hedging.

What you see on the chart is the market maker’s quotes, which look real, but in fact, they are made by the market maker.

So in this case, if you buy at a certain price, say, the euro against the dollar, the trader opens your order, but does not hedge it, because he thinks the euro will fall.

If the euro falls, you will lose your deposit and the market maker will get it.

In addition, if you win, the market maker will pay you with its own money.

Of course, any market maker will make every effort to prevent you from winning.

Whether it is legal or illegal, they do everything when it comes to money.

At this time you will encounter requotes, slippage, etc.

OctaFX supports traders’ successes

Each transaction OctaFX will receive a certain commission from the liquidity provider.

OctaFX treats it as a profit and add it to the spread, which you can see on the chart (note that the commission is already included, regardless of your profit or loss).

Many liquidity providers around the world provide OctaFX with liquidity.

The system OctaFX designed can provide customers with the best quotation at all times.

When you place a new order, you get the best bid (or asking price) that includes OctaFX’s commission directly from the liquidity provider.

Therefore, OctaFX hopes you have more transactions.

To achieve this, the best way is to make a profit, not to lose. This means that OctaFX wants your trading to be as profitable as possible.

Open OctaFX’s Account for free

Why doesn’t OctaFX have Re-Quotes?

In short, OctaFX does not re-quote you because they have nothing to do with the quotation (that is, the price you see in your trading software).

One of OctaFX’s liquidity providers provides a price, and the order is filled.

It is important to understand that OctaFX cannot guarantee that your order will be traded at the price you requested; OctaFX’s system will automatically select another liquidity provider to provide a more favorable price to trade.

However, once again, your order will not be re-quoted, because OctaFX is more interested in your profitable transactions.

Why my orders are not executed at the market price?

This is a possible situation, and it usually occurs within a certain period of time due to a lack of liquidity.

For example, some customers placed short orders before the release of important news, with a total of 1,000 lots.

When the news was released, it raised the market by 50 points.

So the price on the chart has reached the price of these pending orders, and a total of 1000 lots need to be traded.

It is possible that at this moment, at this price, the liquidity provider may only have 200 lots of liquidity.

In this case, the first 200 of the 1,000 hands will be traded, while the remaining 800 hands will not be traded (no liquidity is available) and will continue to wait until the price reaches the pending order price again.

Fixed Spread or Floating Spread. Which is better?

The floating spread is better because it is real. There is no fixed spread in the interbank market.

When a bank or other financial institution wants to buy or sell currency, it sets the bid or ask price it needs.

In other words, the price is the price they want at the moment.

In the real world, the spread between the bid and the asking price cannot be fixed.

Therefore, every trading platform that provides fixed spreads manipulates prices to make the spreads fixed. In most cases, these manipulations are detrimental to traders.

For example, the EURUSD provided by your broker is a fixed spread of 2 points.

During the day, the spread is usually 1 or 1.2 pips.

This means that you lose 0.8 pips every time you trade, and your broker with a trader is happy.

On the other hand, before important news is released (such as non-agricultural employment (NFP)), the same euro-dollar spread may widen to 5-6 points.

If your broker wants to maintain 2 fixed spreads, it will either pay you 4 pips or re-quote you because it does not want to pay.

Requotes are the most likely to happen because there are traders’ platforms that don’t want to lose 4 points.

See more about OctaFX’s Account Types

What is Slippage and Why does it happen on OctaFX?

Slippage is a small deviation of the opening price due to a lack of liquidity (when it has been acquired by other traders’ orders).

It may also occur in gaps in the market.

It is important to understand that OctaFX cannot guarantee that your order will be traded at the price you requested; OctaFX’s system will automatically select another liquidity provider to provide a more favorable price to trade.

Therefore, during some news release periods, the price you requested may not be liquid.

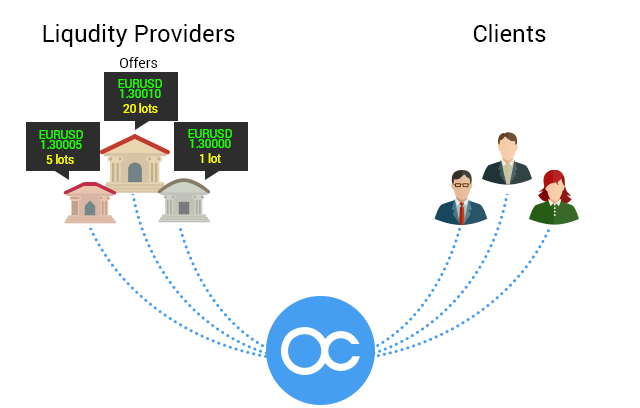

For example, you want to open a 5 lot EURUSD long position at 1.30000. Now, in this case, we can see the following liquidity:

Provider 1: Price 1.30010, 20 lots

Provider 2: Price 1.30005, 5 lots

Provider 3: Price 1.30000, 1 lot

In this case, your order will be traded with Provider 2, because he has the best price and sufficient liquidity to meet your requirements.

The transaction price is 1.30005, which is 0.5 pips away from the price you want.

However, once again, your order will not be re-quoted, because OctaFX is more interested in your profitable transactions.

Why Stop Loss Orders are not guaranteed on OctaFX?

To reiterate, there is no such thing as a “definite stop-loss” in the real market, it is only provided by a trader platform.

As mentioned above, market makers do not trade in the market but conduct internal hedging.

So when your “definite” stop loss is triggered, it means that your entire loss has fallen into the pocket of the market maker.

This leads to the practice of so-called “stop-loss hunting”. There are traders’ platforms that can see where your stop loss is, so they can easily manipulate the price to make it hit the stop loss.

In the real market, any stop-loss order is considered pending until its price is hit.

Afterward, the order is hedged with the liquidity provider (reiterate, slippage may or may not be involved, depending on the available liquidity).

Therefore, it is impossible to “ensure” or “hunt” your stop-loss order.

Open OctaFX’s STP and ECN account

Currency pairs and Exchange Rates

All currencies in foreign exchange transactions appear in pairs, with one currency corresponding to another.

Their names consist of a three-letter abbreviation, which is the well-known ISO code, where the first two letters represent the country and the third letter is the abbreviation of the currency name.

Based on how often they are traded, currencies can be divided into three categories:

The most actively traded currencies are often referred to as major currencies, including the US dollar, the euro, the British pound, the Japanese yen, the Canadian, the Swiss franc, the Australian dollar, and the New Zealand dollar.

Major currency pairs include the U.S. dollar and other currencies listed above, such as the euro against the dollar, the dollar against the yen, and the dollar against the Swiss franc.

The cross-currency pair includes two major currencies but neither of them is the U.S. dollar, such as the euro against the pound, the euro against the Swiss franc, the euro against the yen, the pound against the Canadian dollar, the pound against the Australian dollar and the Swiss franc against the yen.

Non-major currency pairs include a major currency and another currency that is traded in a small amount, such as the euro to the Turkish lira, the US dollar to Swedish krona, the US dollar to Danish kroner, the US dollar to Hong Kong dollar, and the US dollar to Sudanese pound.

Non-major currency pairs usually have less liquidity and larger spreads.

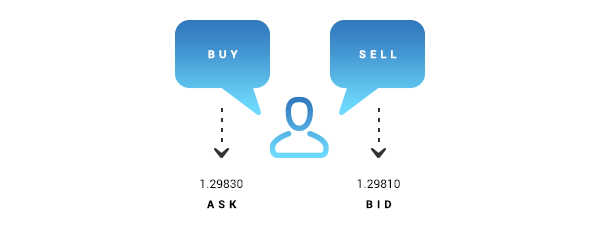

The exchange rate always means that the value of the basic (first) currency is represented by the quoted (second) currency.

Two prices are always given in foreign exchange-the buying price and the selling price-the former shows how much currency is needed to sell 1 unit of the base currency, and the latter represents how much currency is needed to buy the base currency.

The selling price is higher than the buying price.

The difference between the two prices is called the spread and is usually measured in points.

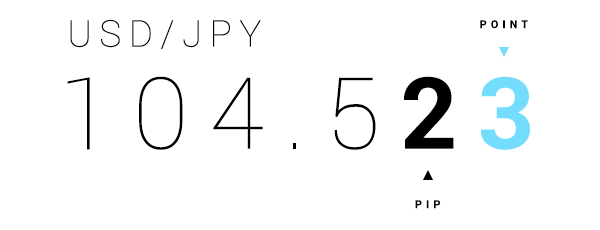

Previously, only 4-digit precision was available, and a spread, or percentage, was the smallest unit to measure price fluctuations.

After the introduction of a more precise 5-digit precise quotation, the minimum quotation unit changed and was called a point, but 1 spread is still calculated by the fourth digit.

For example, if the buying price is 1.11443 and the selling price is equal to 1.11449, the spread is 0.6 pips or 6 pips.

Learn How to Trade Forex with OctaFX

Type of transactions and how they work

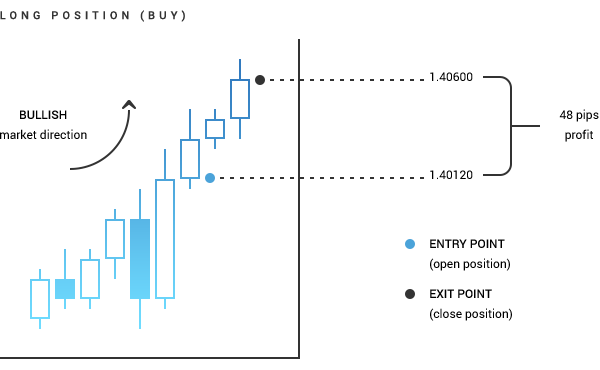

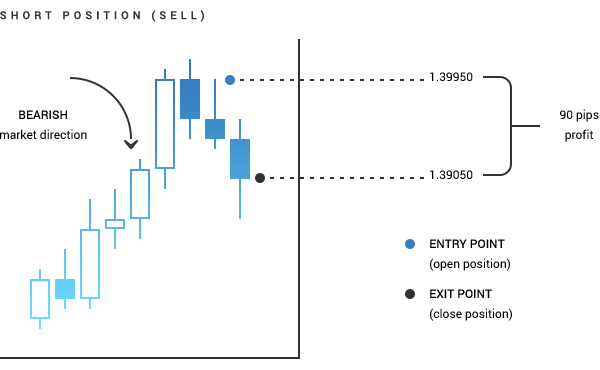

According to the direction of the order, transactions are divided into two types:

- A buy or long order is created by the selling price and closed by the buying price.

- A sell or short order is created by the buying price and closed by the selling price.

Any order can be executed by market price or created by pending order.

Closing an order is the opposite of creating an order, meaning that you sell the position you hold when closing a long (buy) order and vice versa.

When you close a short (sell) order, you buy the previously sold position.

A position can be closed manually according to the current market interest rate or when a certain price level is reached, through a stop loss and profit order.

- The purpose of the stop loss is to limit the loss. The stop-loss price in a sell order is higher than the opening price, and the stop-loss price in a buy order is lower than the opening price.

- Take profit allows you to close out a poly position when you get a certain profit. The take-profit level in a sell order is lower than the current selling price, and the take-profit level in a buy order is higher than the current buying price.

In order to make a profit, you need to close a long position when the price rises or close a short position when the price falls.

See OctaFX’s STP and ECN conditions

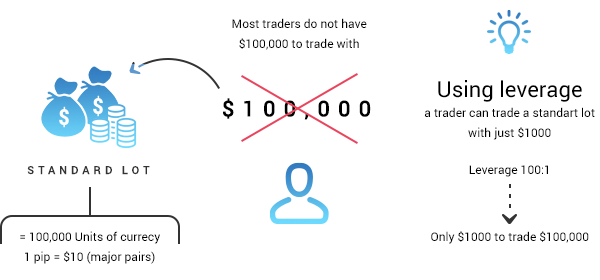

Leverage, trading volume, required margin.

To create a position, you need a certain amount of principal, which is commonly referred to as required margin or simply margin.

The amount of margin depends on the trading instrument, trading limit and leverage.

- A trading tool is any commodity that you can use to trade, such as currency pairs, metal spot, crude oil or indices.

- The trading volume is the amount you buy or sell in one lot. One standard lot is equal to 100,000 units of the base currency. Depending on your balance and account type, you can also trade mini lots (0.1) and micro-lots (0.01). The trading volume determines the point value, that is, the greater your trading volume, the more significant each price change will be. For example, the value of 1 lot in Europe and America is 10 dollars, and 0.5 lot in Europe and America is 5 dollars. You can use this tool to calculate the point value of any position.

- Leverage is a virtual credit provided by the company. The higher your leverage, the less margin required. For example, when you do not use leverage (the ratio is 1:1), you need 100,000 euros to open a position in Europe and the United States; if your account leverage is 1:200, you only need 500 euros as a margin. Using the maximum leverage provided by OctaFX 1:500, you only need 200 euros to open a position.

Please note that if you use a USD account, the required margin will be calculated as follows:

Current price*trading volume (hands)*100,000 units/leverage

For example, if your leverage is 1:200 and you open order for 0.5 lot of EURUSD at the price of 1.12931, you need a margin

1.12931* 0.5 lots *100 000 units/200 = 282.33 USD

The required margin is always calculated automatically by the platform.

To view the approximate margin required to open a certain position, you can use our

Find out more about OctaFX’s Leverage Condition

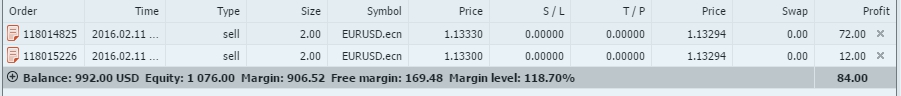

Balance, equity, available margin, and margin level

When you open a position, please note that your balance remains unchanged.

In fact, it only includes deposits, withdrawals and closed transactions.

The amount of required margin will be deducted from the “available margin”, which also includes floating profit, loss and deposit bonus (if you apply for it).

The available margin is the funds you have never opened a position.

Please note that when you create a hedging order with the opposite amount, there will be no margin requirement, but if your free margin is negative, you will not be able to open a reverse position.

Available margin = balance-required margin + floating profit/loss (+ bonus)

Another factor that affects your profit or loss is your net worth, which is calculated as follows:

Equity = balance + floating profit/loss (+ bonus)

Equity is important because it, together with the required margin, determines your margin ratio:

Margin ratio = net value / required margin * 100%

If your margin level is lower than 15%, your open positions will be closed from the trade with the highest floating loss.

Balance, equity, available margin and margin levels are automatically calculated by the platform at any time and displayed in the “transaction belt”.

How to start trading Forex and CFDs with OctaFX?

Basically, all you need to do is open an account and download and install the trading platform or log in to the MT4 or cTrader web terminal.

A demo account allows you to practice trading without risk, and a real account allows you to experience the real market with a minimum deposit of $25.

If you are not familiar with the trading platform, be sure to check OctaFX’s manual for detailed instructions.

Information about how the foreign exchange market works, what tools and techniques are used to predict price movements, and what strategies you should adopt, you can see in the article.

If you have any questions about the market, OctaFX website or trading conditions, you can check OctaFX’s elaborate and comprehensive FAQ.

Whenever you encounter an unfamiliar term, noun or market phenomenon, you can check its definition and description in the foreign exchange terminology compilation.

OctaFX’s award-winning customer service is happy to answer any questions for you 24 hours/5 days.

If you are not sure which account is right for you, you should choose or determine your level of knowledge of the foreign exchange market.

You can fill out OctaFX’s questionnaire to get helpful suggestions.

Open OctaFX’s STP and ECN account

Please check OctaFX official website or contact the customer support with regard to the latest information and more accurate details.

OctaFX official website is here.

Please click "Introduction of OctaFX", if you want to know the details and the company information of OctaFX.