What is Forex and How can I start trading on FXCM platforms? Table of Contents

- What is Forex?

- Forex Transaction at the basis

- Forex opportunities - What is your opinion?

- How to buy and sell FX currencies?

- Why trade Forex with FXCM?

- What is Forex? And why many investors trade it?

- Reasons many invest in Forex

- Pip, Profit, Leverage, and Loss

- Optimize Your Trading

- How to create a profitable trading strategy?

- Become an experienced Forex trader

What is Forex?

Forex, also known as foreign exchange (FX) is a decentralized global market where all global currencies are traded. The forex market is the largest and most liquid market in the world, with a daily trading volume in excess of $ 5 trillion. All the stock markets of the world put together do not even reach that equivalent in the slightest. What does this mean for you? If you take a closer look at forex trading, you may find interesting trading opportunities otherwise unavailable with other investments.

Forex Transaction at the basis

If you have traveled overseas, you will almost certainly have made a forex transaction. If a British citizen goes to France, he will convert the pounds into euros. The exchange rate between the two currencies, based on supply and demand, determines how many euros you receive for each pound. The exchange rate fluctuates all the time.

With a single pound you can get 1.19 euros on Monday and 1.20 euros on Tuesday. This small variation may seem irrelevant, but if you think big then it can make a difference. A large international company may need to pay its employees overseas. Imagine what the repercussions on earnings can be if, in the example above, the exchange makes you spend more based on when you make the trade. Even a few cents can have big repercussions. Either way, whether you are a traveler or an entrepreneur, you may want to wait for the change to become more favorable.

Forex opportunities – What is your opinion?

As with stocks, you can trade currencies based on what you think is their value or the direction they will take. However, one difference in forex is that it is possible to trade whether you think the price is going up or you think the price is going down. In the first case, you can choose to buy a currency, while in the second case, you will opt for a sale. With such a large market, finding a buyer when you want to sell and a seller when you want to buy is much easier than in other markets.

For example, you may have heard about China devaluing its currency to attract more foreign investment to the country. If you believe the trend will continue, you can trade forex by selling the Chinese currency for another currency, such as the US dollar. The more the Chinese currency devalues against the US dollar, the more you will earn. If the Chinese currency increases in value when you have an open sell position in your portfolio, your losses will increase and you may opt to close the trade.

How to open FXCM Forex and CFD Trading Account?

How to buy and sell FX currencies?

You have an opinion. And now? Open your free forex demo platform and trade based on your opinion.

All forex operations have two currencies as their object, as you bet on the value of one currency against another. Let’s take the EUR / USD as an example, which is the most traded currency pair in the world. The EUR, which is the first currency of the pair, is the base currency, while the USD is the secondary currency.

The price quoted on the platform indicates the value of 1 EUR in terms of USD. Two prices are always presented, as there is a buy price and a sell price. The difference between the two is the spread. By clicking on the Buy or Sell button, you will go to buy or sell the first currency of the pair.

Let’s admit that we believe the euro will appreciate against the dollar. Our pair is EUR / USD. Since the euro is the first currency and we believe it will grow, we are going to buy EUR / USD. If we believe the euro will drop in value against the US dollar, we will sell EUR / USD.

For example, if the buy price of the EUR / USD is 1.1500 and the sell price is 1.1504, the spread will be 0.4 pips. If the trade moves in your favor (or against you), once the spread is covered, you can generate a profit (or a loss) on the trade.

Why trade Forex with FXCM?

FXCM is a leading forex provider in the world and by trading with FXCM you can access several benefits that only a leading broker can offer. In particular:

- Award-winning customer service

- Get 24/7 service exactly when you need it, wherever you are.

- Free Premium Training

- With on-demand lectures, webinars and real-time training, you can improve your competitive edge in trading.

Additionally, you can trade on the Trading Station, one of the most innovative trading platforms on the market. Open a free demo account for forex and practice in the currency markets right away.

Every now and then a good trading idea can lead to a quick profit. However, professional traders know that continued success requires skill, rigorous risk and money management, and a solid trading plan.

What is Forex? And why many investors trade it?

You may not be aware of this but forex is actually one of the largest markets in the world, with over $ 4 trillion in daily trading volume.

By comparison, the opportunities offered by the stock exchange seem negligible. In fact, even if all the world’s stock exchanges were taken together, it would only be possible to reach an average of $ 84 billion per day.

But then, if the Forex market is so tempting, why have so few people heard of it?

The answer is simple and lies in the fact that most likely you, directly or indirectly, have already used Forex.

Whenever you go to another country and change money, you are effectively trading in currency; and in fact you trade in currencies even every time you buy a foreign-made object in a shop. You pay in your own currency while the producer has been paid in another.

People trade in currency at any time. But how can currency become an investment? Here is a clear example. Imagine that you made a trip from the United States to Europe in 2002. For that trip, you exchanged dollars for euros. At the end of the trip, as is natural, you changed the remaining euros into dollars. But what would have happened if you didn’t?

In 2002, one euro was worth around 90 US cents. ($ 0.90). Let’s imagine that you have decided to keep 500 euros and that you have stored them in a drawer for 5 years. Then in 2007 you take your euros to the bank and sell them for $ 1.40. Since you bought the euros for $ 0.90 and then resell them for $ 1.40, you made a profit of $ 0.50 per euro. In this way, you made $ 250 just for keeping those euros that you then resold at the right time. This made you a 55% profit in 5 years.

Basically the $ 4 trillion daily volume forex market revolves around the same criterion. Many large world banks, investment funds, and insurance companies operate in currencies to increase their profits. Since they carry out these operations on a very large scale, the profits and losses they record in this way on a daily basis are worth millions: it is sufficient for exchange rates to record minimal movements, even fractions of a cent.

Many people may not have heard of forex because, history in hand, that type of market has remained the exclusive domain of industry professionals. The average person could buy stocks but would not be able to trade in currency. And that is why this market has remained exclusive to the big speculators.

Things have changed.

The Internet, like what represented a revolution in the online trading of securities in the 1990s, has put the activity of currency trading within the reach of the average person sitting comfortably at home.

Thousands of people today, armed only with computers, an Internet connection, and a small account for trading operations, can safely operate in foreign currency from their living rooms.

You now have the ability to make your investment trading decisions, buy and sell at any time, day and night (Sunday to Friday), British pounds or Japanese yen. This short guide will show you how. Before you start trading, it is important to understand all the risks associated with trading on margin. Make sure you read and understand the Execution Risks before taking any further action.

See FXCM’s Real Execution Statistics for Real Traders

Reasons many invest in Forex

During the last decade, online forex trading has spread enormously due to the various advantages it offers

to investors.

- Forex never sleeps

- Trading continues all over the world in the working hours of the respective countries. And that’s why you can trade major currencies at any time, 24 hours a day. As there are no pre-established trading times, this means that there is always a significant volume of business, both day and night.

- Go long or short

- Unlike many other financial markets, where it can be difficult to sell short, there are no restrictions on shorting currencies. If you think a currency will go up, buy it. If you think it will go down, sell it. This means that there is no “bear market” in forex: you can make a profit but you can also lose money at any time.

- Low cost of spread

- Most forex accounts trade commission-free and there are no expensive exchange fees or licensing fees given. The cost to enter a trade is the spread between the buy price and the sell price, which is always displayed on the trading screen. Detailed information on charges and commissions are provided in FXCM’s Price List.

- Unmatched Liquidity

- Since forex is a $ 4 trillion a day market, with most trading focused on just a few currency pairs, there are always plenty of people trading. This makes it easier to enter and exit trades at any time, even a large one. However, be aware of the higher volatility as orders can be subject to Slippage.

- Available leverage

- You can trade Forex and CFDs with leverage. This can allow you to take advantage of even the smallest market movements. Of course, leverage is a double-edged sword, as it can significantly increase your losses as well as your profits. FXCM EU offers different leverage based on tradable instruments. Major currency pairs default to 30: 1, non-major currency pairs, gold and major indices default to 20: 1, commodities other than gold and equity indices non-major are set to default at 10: 1, 5: 1 for individual stocks and for other benchmarks and cryptocurrencies are set to 2: 1.

- International Exposure

- As the world becomes increasingly global, investors seek potential opportunities wherever they can. If you want to have a broad view and invest in another country (or short sell it), forex is an easy way to take a position.

Let’s start by defining what the basic Forex market represents.

What’s the condition of Margin/Leverage of FXCM UK?

Pip, Profit, Leverage, and Loss

Over the years, forex professionals have created a simplified mechanism to facilitate foreign exchange trading so that quick trading decisions can be made without having to use the calculator every time.

Currencies are traded on an open market, in the same way as stocks, bonds, computers, cars, and many other items and services. Just like any other asset, the value of a currency fluctuates according to supply and demand. If something causes the supply of a currency to rise, or lower the demand for it, that currency will fall. For example, when Greece threatened not to pay off its debts, it endangered the existence of the euro, so much so that investors around the world rushed to sell the euros.

Due to the sudden and exceptional growth in the number of euros on sale, and the concomitant reduction in demand, the euro fell precipitously against the US dollar and other currencies.

You can buy or sell at any time and according to your idea. So, if you think the eurozone will break, you can sell the euro and buy the dollar. If you think the Federal Reserve is printing too much money you can sell the dollar and buy the euro.

You should also be aware that trading on margin carries a high level of risk and may not be appropriate for all investors, so you should carefully consider your goals, financial situation, needs, and experience level before trading.

Optimize Your Trading

As previously mentioned, all trades are done using borrowed currency. This allows you to take advantage of the leverage effect. A leverage of 20: 1 allows you to trade the market for $ 10,000 for a balance of only $ 500 in your account. This means that you can take advantage of even the smallest currency movements by controlling more money in the market than you have in your account.

While it is true that in bargaining the leverage effect can be beneficial and increase profits, it is equally true that it can also significantly increase losses; therefore it must be used with great caution. Start small trades so you don’t take excessive risks.

Leverage is a double-edged sword.

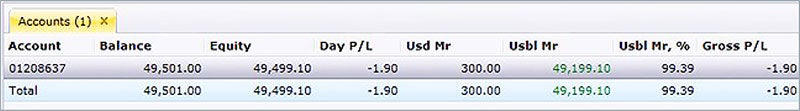

Used Margin (Usd Mr) means the amount of money that has been set aside to secure your open position. Usable Margin is the amount of money left in your account to open new trades or absorb any losses. Make sure you always have a good usable margin as otherwise you may receive a margin call order. If your usable margin drops you will be forced to close certain trades or deposit money into your account.

Learn How to Trade Forex on FXCM

How to create a profitable trading strategy?

So, now you know what forex traders do all day (and all night!). Sounds simple, right? Buy rising currencies and sell falling currencies.

And then?

You have already taken the first step by learning what forex is. Now is the time to try it out. Start with a demo account. This is a free simulation of a real trading account. It has all the functions of a real account (forex prices, pips, P / L, charts, etc.), only the money is not real. Think of this as if it were a driving license exam.

Open Forex trading account with FXCM

Become an experienced Forex trader

Once the demo is activated, you will begin to experience the feeling of how it works. You can start buying the currencies you think will go up and sell the ones you think will go down.

Remember that although demo accounts attempt to replicate real markets, they operate in a simulated market environment and there are key differences that distinguish them from real accounts, such as, for example, the lack of dependence on real-time market liquidity. , the delay in prices and the availability of some products, which may not be tradable on live accounts.

But how do you know which currencies will rise and which currencies will fall?

Over the years, forex traders have developed various methods to predict the trend of currency indices.

- Fundamental Analysis

- From the moment currencies are traded in a market, you will be able to look at supply and demand. This is called fundamental analysis. Interest rates, economic growth, employment, inflation and political risk are all factors capable of influencing supply and demand in terms of currency.

- Technical Analysis

- Price charts speak volumes and most forex traders depend on them to make operational decisions. When correctly interpreted, charts can indicate trends and important price levels at which traders can enter or exit the market.

- Risk Management

- It is an essential part of trading. Every trader needs to know how to measure potential risks and rewards and use them to judge entry, exit points and investment volume.

To become a professional forex trader you need to have some important skills. And like all skills, learning them takes some time and practice. In order to hone these skills, FXCM provides an interactive trading course. You will learn from expert instructors and traders how to analyze the market and how to conduct trading. Teaching takes place both through video lessons on request, and through hours spent directly in the office in order to acquire personal feedback, study at any time, and learn at your own pace.

And the best part is it’s free. All you need to do is show that you are serious about entering the largest market in the world and that you understand all the risks associated with trading. Open a live trading account with FXCM and you will become a true real money trader. You will have unlimited free access to the course, as well as tools such as charts, research and trading signals.

Please click "Introduction of FXCM", if you want to know the details and the company information of FXCM.