What is Forex basket of FXCM? How does it work? Table of Contents

Forex basket of FXCM

Trade indices on the Yen, USD, and emerging markets. Speculate on volatile instruments while reducing the risk of exposure to a single currency.

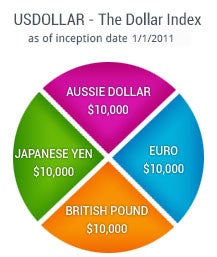

1. Dow Jones FXCM Dollar Index Basket

The Dow Jones FXCM Dollar Index Basket (USDOLLAR) was developed by traders for traders to allow you to take advantage of the appreciation or depreciation of the US Dollar with precise tracking and maximum liquidity.

The index basket is designed to be as easy to understand as it is to trade.

It reflects the change in the value of the US dollar measured against a basket of the most liquid currencies in the world:

The Dow Jones FXCM Dollar Index started on January 1, 2011, at a value of 10,000.

It represents an equivalent position of $ 10,000 in each of its component currencies.

It increases as the dollar rises against the euro, the British pound, and the Australian dollar and decreases as the dollar depreciate against these currencies.

Invest in Dow Jones FXCM Dollar Index Basket

2. JPYBasket – The Basket of the Yen

The JPYBasket (“Yen Index”) is a benchmark of the Japanese Yen and is designed to reflect the change in the value of the JPY against a basket of major world currencies.

The Index was developed by FXCM.

The JPYBasket started on January 2, 2019, with a value of 10,000.

It represents a position equivalent to ¥ 200,000 in each of the currencies that make up its components for an initial starting value of ¥ 1,000,000.

It rises as the Yen strengthens against the US dollar, euro, British pound, Canadian dollar and Australian dollar, and falls as the yen weakens against these currencies.

For the index to have an initial value of 10,000, the JPY basket uses the divisor of 100.

For example, if you buy 1 contract and then the yen strengthens and the index rises from 10,100 to 10,101, you earn exactly 100 JPY for every point change (or equivalent value in the account name).

3. EMBasket – The Basket of Emerging Markets

The EMBasket (“Emerging Markets Index”) is an emerging markets benchmark index and is designed to reflect the change in the value of the US dollar against a basket of smaller world currencies.

The Index was developed by FXCM.

The EMBasket started on January 2, 2019 with a value of 10,000.

It represents a position equivalent to $ 2,500 in each of its component currencies.

It increases as these currencies strengthen against the US dollar and decreases as they weaken.

EMBasket is a great way to speculate on often volatile instruments while reducing the risk of taking exposure to a single currency.

Please click "Introduction of FXCM", if you want to know the details and the company information of FXCM.